How to predict crypto charts?

This article discusses how to predict crypto charts using technical analysis. It covers the basics of technical analysis and provides a step-by-step guide on how to use it to predict crypto chart movements.

How to Use Technical Analysis to Predict Crypto Charts

Technical analysis is a method of analyzing financial charts in order to predict future price movements. Technical analysts use indicators like moving averages, volume, and RSI to identify potential buying and selling opportunities.

When trading cryptocurrencies, it is important to follow a consistent technical analysis strategy in order to make informed decisions. There are many different methods of technical analysis, so it is important to find one that works best for you. Some popular methods of technical analysis include:

Moving Averages

A moving average is a technical indicator that is used to identify potential trend changes. The most common moving averages are the 50-day moving average and the 200-day moving average.

The 50-day moving average is used to identify short-term trends, and the 200-day moving average is used to identify long-term trends. When using moving averages, it is important to keep in mind that they are not always reliable indicators of future price movements.

Volume

Volume is a measure of how active the market is. When volume is high, it indicates that there are a lot of buyers and sellers active in the market. Volume can be used to identify potential buying and selling opportunities.

RSI

RSI is an oscillator that is used to identify potential oversold and overbought conditions in the market. When RSI is high, it indicates that the market is oversold, and when RSI is low, it indicates that the market is overbought.

When using technical analysis to predict cryptocurrency charts, it is important to keep in mind the following tips:

1. Follow a Consistent Strategy

It is important to follow a consistent technical analysis strategy in order to make informed decisions. There are many different methods of technical analysis, so it is important to find one that works best for you.

2. Use Moving Averages and Volume Indicators

Moving averages and volume indicators are two common indicators that are used to predict future price movements. When using these indicators, it is important to keep in mind that they are not always reliable indicators of future price movements.

3. Be Alert for Oversold and Overbought Conditions

When using technical analysis to predict cryptocurrency charts, it is important to be alert for oversold and overbought conditions. When oversold conditions are detected, it is often a good time to buy cryptocurrencies, and when overbought conditions are detected, it is often a good time to sell cryptocurrencies.

4. Follow the Trends

When using technical analysis to predict cryptocurrency charts, it is important to follow the trends. When trends are detected, it is often a good time to buy or sell cryptocurrencies.

How to Use Fundamental Analysis to Predict Crypto Charts

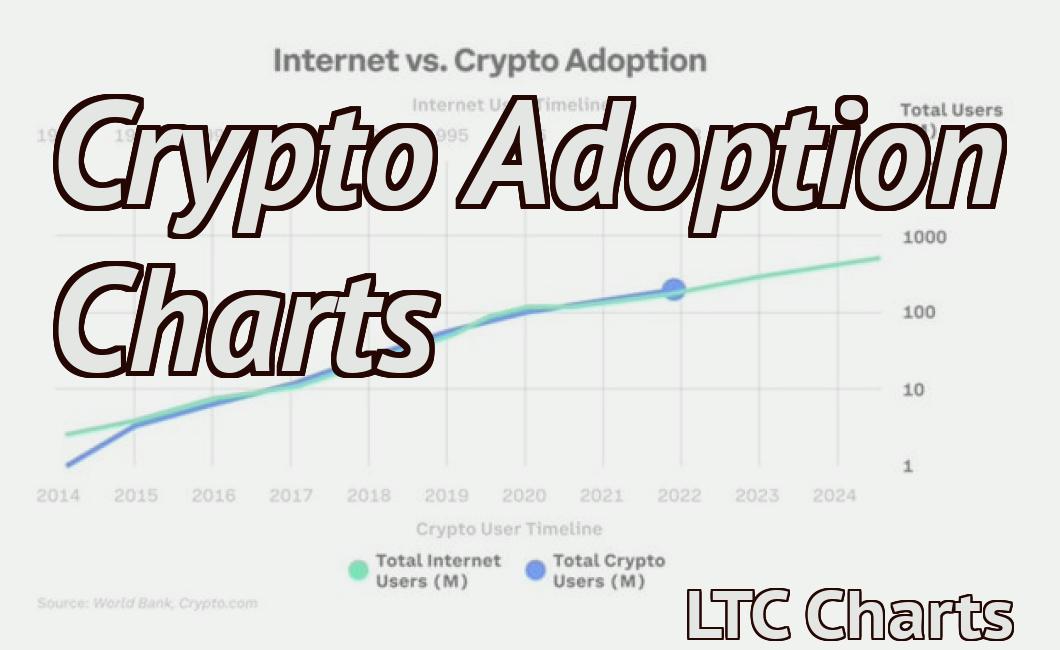

Cryptocurrencies are a new and exciting investment opportunity, but there is still a lot of uncertainty about how to use fundamental analysis to predict their future prices.

In this article, we will outline a simple approach that you can use to predict the future prices of cryptocurrencies using fundamental analysis.

1. Identify the key drivers of cryptocurrency prices

The first step in using fundamental analysis to predict cryptocurrency prices is to identify the key drivers of prices. These drivers can be anything that influences the demand for or supply of cryptocurrencies, including:

Government regulations

Economic conditions

The popularity of cryptocurrencies among individual investors

News events that impact the value of cryptocurrencies

These key drivers can be studied and tracked over time to get a better understanding of how they impact prices.

2. Analyze historical trends and patterns

After identifying the key drivers of cryptocurrency prices, the next step is to analyze historical trends and patterns. This analysis can help you understand how prices have behaved in the past and which factors have had the most impact.

Some common methods for analyzing historical trends and patterns include:

Frequency analysis – This approach looks at how often a particular event or trend has occurred over time. For example, you might look at how often a government regulation has been imposed on cryptocurrencies in the past.

Event-based analysis – This technique looks at specific events that have affected the price of cryptocurrencies over time. For example, you might study how the value of cryptocurrencies has changed after major news events have occurred.

Relationship analysis – This approach looks at how different factors are related to each other and how that affects the price of cryptocurrencies. For example, you might study how the value of cryptocurrencies has changed after major news events have occurred and see if there is a correlation between them.

3. Make predictions based on historical data

After analyzing historical trends and patterns, you can make predictions about how prices will behave in the future. You can do this by using one or more of the following methods:

Projection analysis – This approach uses past data to make predictions about future prices. For example, you might use projection analysis to predict how the value of a cryptocurrency will change in the future based on current trends and conditions.

Modeling – This technique uses mathematical models to make predictions about future prices. Models can take a variety of different forms, including regression models, survival models, and Bayesian networks.

4. Take into account potential risks when making predictions

When making predictions about cryptocurrency prices, it is important to consider potential risks. These risks can include:

Volatility – Cryptocurrencies are highly volatile, meaning that their prices can fluctuate a lot over short periods of time. This volatility can be a risk when predicting prices in the future.

Inflation – Cryptocurrencies are designed as digital assets, which means that their value is based on their ability to retain value over time. If inflation rates rise significantly, the value of cryptocurrencies could decrease over time.

Pump and dump schemes – Pump and dump schemes are illegal practices used to artificially inflate the price of a cryptocurrency by selling it to an unsuspecting public and then buying it back at a higher price later. If this practice is repeated over a period of time, it could lead to the price of a cryptocurrency dropping.

5. Take into account potential risks when making predictions about cryptocurrency prices

When making predictions about cryptocurrency prices, it is important to consider potential risks. These risks can include:

How to Use Sentiment Analysis to Predict Crypto Charts

When you’re looking to predict the future behavior of a digital asset or cryptocurrency, sentiment analysis is an important tool to consider.

Sentiment analysis is the process of analyzing the tone of a piece of text in order to derive information about the emotions expressed within it.

There are a number of different ways to measure sentiment, but the most common methods are:

Positive/Negative: This measures the percentage of words that are either positive or negative.

This measures the percentage of words that are either positive or negative. Positive/Neutral: This measures the percentage of words that are neither positive nor negative.

This measures the percentage of words that are neither positive nor negative. Positive/Negative/Unhappy: This measures the percentage of words that are all positive, all negative, or both unhappy.

Once you have measured sentiment, you can use that information to predict future trends in digital asset prices.

For example, if you see that the sentiment in a digital asset is consistently negative, that may be a sign that the price of that asset is going to drop in the near future. Conversely, if the sentiment in a digital asset is consistently positive, that may be a sign that the price of that asset is going to rise in the near future.

Sentiment analysis is an important tool for traders and investors, so be sure to keep it in mind when analyzing digital assets and cryptocurrencies.

How to Use Trend Analysis to Predict Crypto Charts

Cryptocurrencies are notoriously volatile, with prices swinging wildly in short periods of time. This makes trend analysis an essential part of any cryptocurrency investment strategy.

To use trend analysis to predict cryptocurrency charts, you first need to identify the overall trend. This can be done by looking at historical data, analyzing news and events, or using a technical analysis tool.

Once you have identified the trend, you can then use that information to make predictions about future prices.

For example, if you think the overall trend is headed up, you might predict that the price of a cryptocurrency will increase in the future. Alternatively, if you think the trend is headed down, you might predict that the price of a cryptocurrency will decrease in the future.

As with any investment decision, always consult a financial advisor before making any predictions about cryptocurrency charts.

How to Use Volume Analysis to Predict Crypto Charts

Volume analysis can be used to predict the future movements of cryptocurrency prices. Volume is a metric that measures the amount of shares or contracts traded in a given period of time.

When analyzing volume, it is important to take into account the following factors:

1) The Overall Volume of All Cryptocurrencies

2) The Volume of Top Cryptocurrencies

3) The Volume of Active Cryptocurrencies

4) The Volume of Altcoins

5) The Time of Day

Overall Volume of All Cryptocurrencies

The overall volume of all cryptocurrencies should be taken into consideration when analyzing volume. This includes both the overall market cap as well as the number of active cryptocurrencies. The overall market cap is the total value of all cryptocurrencies in circulation. The number of active cryptocurrencies is the number of cryptocurrencies that are currently being traded on a given exchange.

Volume of Top Cryptocurrencies

The volume of the top cryptocurrencies should also be taken into consideration when analyzing volume. This includes the currencies with the highest market caps as well as the most active cryptocurrencies. The more active a cryptocurrency is, the more likely it is to experience significant price movement.

Volume of Active Cryptocurrencies

The volume of active cryptocurrencies should also be taken into consideration when analyzing volume. This includes the currencies with the highest trading volumes on a given exchange. Trading volumes reflect how much money is being exchanged for a cryptocurrency.

Volume of Altcoins

The volume of altcoins should also be taken into consideration when analyzing volume. This includes all cryptocurrencies other than the top five cryptocurrencies by market cap. These currencies may experience significant price movement, but they will not typically have a larger market cap than the top five cryptocurrencies.

Time of Day

The time of day should also be taken into consideration when analyzing volume. This includes the morning and evening hours as well as the weekend. The morning and evening hours tend to see more volume because people are more likely to be active during these hours. The weekend generally sees less volume because there are fewer people active in the marketplace.

How to Use Price Action to Predict Crypto Charts

Cryptocurrencies are often traded on digital exchanges and can be volatile. Therefore, it is important to use price action to predict where the price of a cryptocurrency will go.

The most important thing to remember when using price action is to stay disciplined. Do not invest more than you are willing to lose. Also, do not get caught up in the hype. Instead, focus on the underlying fundamentals of the cryptocurrency and how the price is behaving.

There are a few basic principles that you should follow when using price action to predict cryptocurrency charts.

1. Look at the Price Action

The first step is to look at the price action. This includes studying the peaks and valleys in the price of the cryptocurrency. You should also watch for trends, as this can provide valuable information about where the price is headed.

2. Use Support and Resistance

After you have studied the price action, you should use support and resistance levels to predict where the price of the cryptocurrency will go. Support and resistance levels are points where the price of the cryptocurrency has failed to move beyond a certain number of times.

3. Use Fibonacci Retracements

Fibonacci retracements are another tool that you can use to predict where the price of the cryptocurrency will go. Fibonacci retracements are based on the Fibonacci sequence, which is a series of numbers that describe how prices move up and down over time.

4. Use Technical Indicators

Technical indicators can also be used to predict where the price of the cryptocurrency will go. These indicators include moving averages, Bollinger bands, and RSI (Relative Strength Index).

How to Use Inter-Market Analysis to Predict Crypto Charts

Inter-market analysis can be used to predict crypto charts. Inter-market analysis looks at the relationships between different markets, and can be used to make predictions about how those markets will behave.

For example, if you think that the cryptocurrency market is about to undergo a major correction, you can use inter-market analysis to predict which other markets are likely to fall along with it. By understanding the relationships between the different markets, you can make better predictions about where the market is likely to go.

Inter-market analysis is a powerful tool for traders and investors, and can help you make better predictions about the future of the crypto market.