Charts crypto technical analysis.

Charts crypto technical analysis is a process of using charts and other technical indicators to identify trading opportunities in the cryptocurrency market. Technical analysis can be used to identify trends, Support and Resistance levels, and potential entry and exit points for trades.

charts crypto technical analysis: what you need to know

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin is the first and most well-known cryptocurrency. Bitcoin is traded on cryptocurrency exchanges and can also be used to purchase goods and services. Ethereum is another popular cryptocurrency. Ethereum is used to build decentralized applications. Litecoin is a cryptocurrency that is similar to Bitcoin. Litecoin is also traded on cryptocurrency exchanges and can be used to purchase goods and services.

Cryptocurrencies are volatile and can fluctuate in value. Before investing in cryptocurrencies, you should understand the risks involved.

charts crypto technical analysis: the basics

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

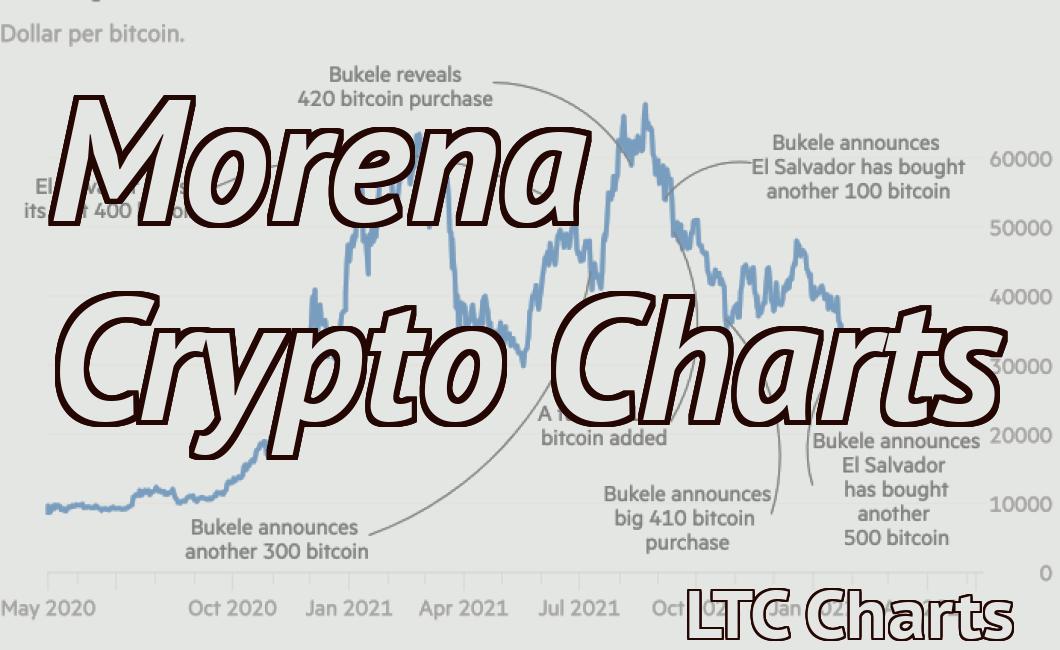

Bitcoin is the first and most well-known cryptocurrency. Bitcoin is created as a reward for a process known as mining. Each block of Bitcoin transactions is verified by miners before it can be added to the blockchain. Bitcoin has been increasing in value since its inception in 2009.

Ethereum is a second most popular cryptocurrency. Ethereum is based on the blockchain technology and allows developers to create smart contracts. Ethereum also allows for payments to be made without revealing personal information. Ethereum has been increasing in value since its inception in 2015.

charts crypto technical analysis: how to read them

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are unique in that they use a distributed ledger called a blockchain to record transactions. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are often traded on exchanges and can also be used to purchase goods and services. Bitcoin has been relatively stable in value over the past few years, but the prices of other cryptocurrencies have fluctuated wildly.

Cryptocurrencies are not regulated by the government, but some governments are beginning to recognize their potential and are exploring ways to regulate or even tax them.

charts crypto technical analysis: what do they mean?

Cryptocurrency technical analysis can be used to help investors make informed decisions about the potential value and future of a particular cryptocurrency.

Some common measures used in crypto technical analysis include:

1. Price Index

This measures the average price of a cryptocurrency over a particular period of time, typically 24 or 48 hours. An increase in the price index indicates that demand for the cryptocurrency is increasing, and may signal that a rally is in progress.

2. Volume Index

The volume index measures the total value of a cryptocurrency’s transactions over a given period of time. An increase in the volume index may indicate increased interest in the cryptocurrency, and may signal that a rally is in progress.

3. RSI

The RSI indicator is designed to measure the strength of a buying or selling trend. When the RSI is above the 70 level, this indicates that buyers are in control, and when the RSI is below the 30 level, this indicates that sellers are in control.

4. MACD

The MACD indicator is designed to help predict the direction of a cryptocurrency’s price. When the MACD is in the bearish zone, this signals that the price of the cryptocurrency is likely to decline, and when the MACD is in the bullish zone, this signals that the price of the cryptocurrency is likely to rise.

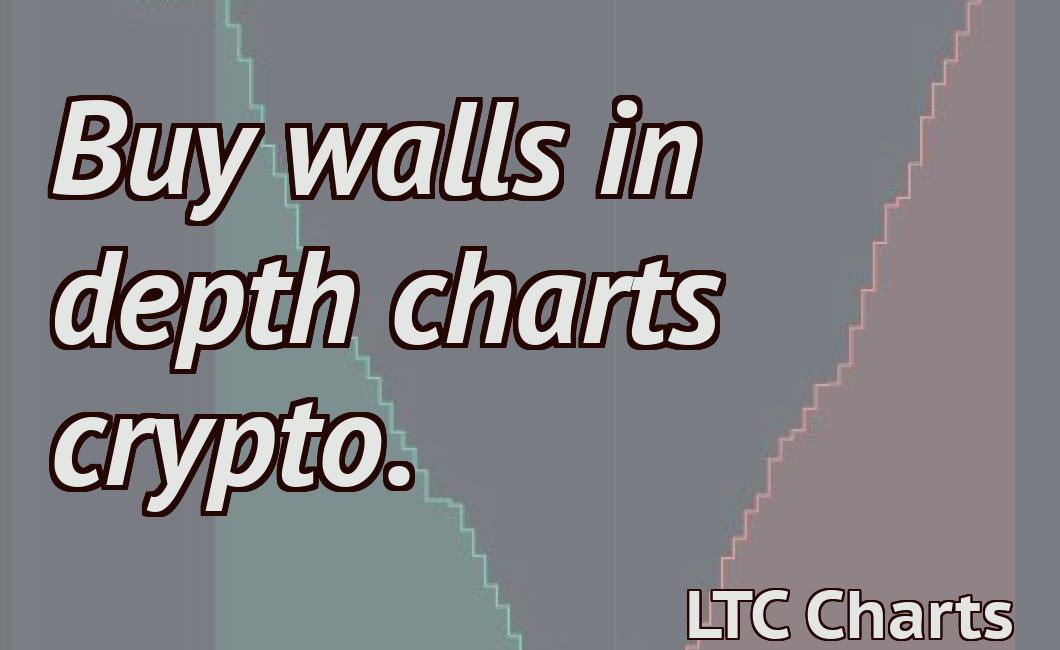

charts crypto technical analysis: finding trends

Cryptocurrencies are notoriously volatile and can experience large swings in price. This makes it difficult to make informed investment decisions.

One way to try to make sense of the volatility is to look for patterns in the price movements. This can help you identify trends that might indicate where the price is headed.

One common trend to watch is the movement of the overall market cap. This metric reflects the total value of all cryptocurrencies in circulation.

As seen in the chart below, the overall market cap has been on a steady rise since the beginning of the year. This suggests that there is growing interest in cryptocurrencies overall, and that prices are likely to continue to rise.

Another common trend to watch is the movement of the prices of individual cryptocurrencies. This can give you an idea of which ones are likely to be more volatile.

As seen in the chart below, some of the more popular cryptocurrencies have seen large fluctuations in price. This suggests that they are likely to be more volatile than others.

Overall, these are just two examples of patterns that can be used to help you make informed cryptocurrency technical analysis decisions. Use them as a starting point, and feel free to explore other ways to stay ahead of the curve.

charts crypto technical analysis: support and resistance

1. Support is found at $7,820 on the 4-hour chart.

2. Resistance is found at $8,950 on the 4-hour chart.

3. The price is currently trading above the support level and the 100 hourly simple moving average.

4. The MACD is in the positive zone, indicating that the price is likely to continue rising.

5. The RSI is currently near the 50 level, indicating that the market is in a bullish trend.

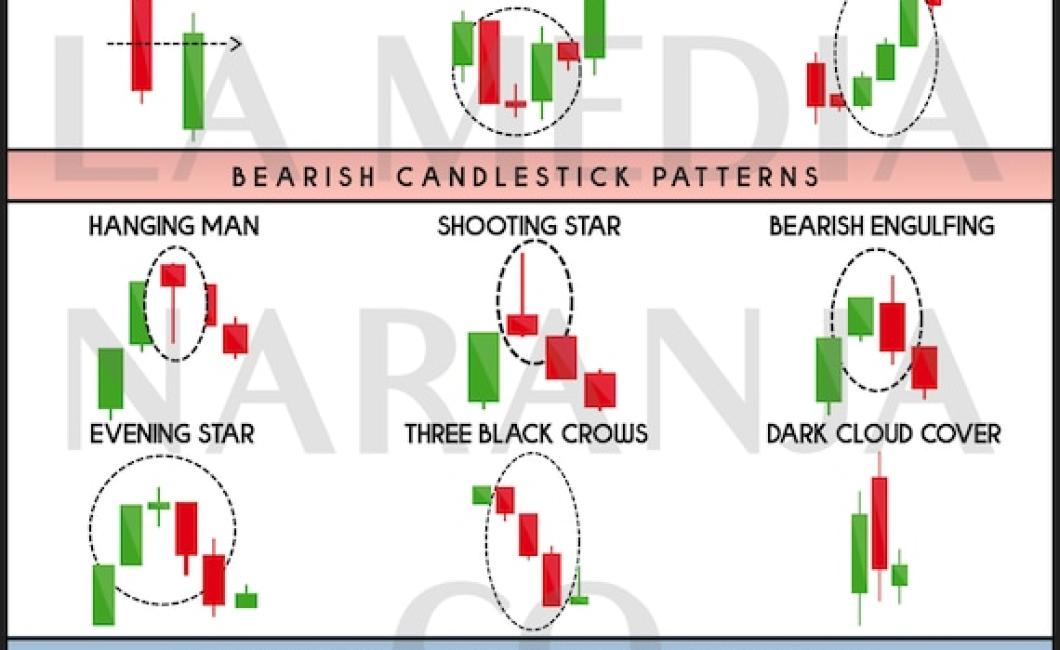

charts crypto technical analysis: chart patterns

There are a number of chart patterns that can be used to predict future movement in cryptocurrencies. A few of the more common patterns include head and shoulders, bull and bear markets, and double tops and bottoms.

Head and shoulders

This is a pattern that is typically seen in stocks, and is characterized by a rise in price followed by a decline. The pattern is said to be completed when the price reaches a higher point and then declines again.

Bull and bear markets

Bull markets are periods of rising prices, and bear markets are periods of falling prices. They can last for a short period of time or for a long period of time, and can be identified by the number of rallies and declines.

Double tops and bottoms

This is a pattern that is typically seen in markets that are volatile, and is characterized by two peaks that are followed by a decline. The peaks may be close to each other or far apart, and the decline may be gradual or sudden.

charts crypto technical analysis: indicators

-Bitcoin price

-Ethereum price

- Ripple price

- Litecoin price

- Bitcoin cash price

- Cardano price

- IOTA price

- NEO price

- Tron price

charts crypto technical analysis: trading signals

Cryptocurrency technical analysis is the study of patterns in price movements and technical indicators to predict future price behavior.

There are many different technical indicators that can be used to analyze crypto markets, and each has its own strengths and weaknesses. Some popular technical indicators include the Bollinger Bands, the RSI, and the MACD.

The Bollinger Bands are a popular tool for analyzing price movement and volatility. They show the range of prices over a given period of time, and can be used to identify potentially overvalued or oversold markets.

The RSI is a popular tool for measuring market momentum. It shows the rate of change of a security's prices over a given period of time, and can be used to identify whether the market is moving quickly or slowly.

The MACD is a popular tool for analyzing trend direction. It shows the difference between the two most recent closing prices, and can be used to identify whether the market is moving up or down.

charts crypto technical analysis: backtesting

Cryptocurrency technical analysis can be used to determine the potential price movements of a digital asset. It can be used to predict future trends and to identify opportunities in the market.

Cryptocurrency technical analysis can be broken down into two main categories: backtesting and charting.

Backtesting is the practice of testing a digital asset’s price predictions against historical data. This allows traders to identify which indicators and patterns work best for predicting future prices.

Charting is the use of graphical representations of cryptocurrency technical analysis data. This allows traders to see patterns and trends more easily.

Backtesting is the most important aspect of cryptocurrency technical analysis. It allows traders to identify which indicators and patterns work best for predicting future prices.

Some common backtesting methods include:

1. Fibonacci retracements: This is a popular method for identifying support and resistance levels. It uses the Fibonacci sequence to identify areas where prices have previously bounced off of the ground.

2. Elliott waves: Elliott waves is a popular technical analysis indicator that uses five waves to identify patterns in the market.

3. MACD: The MACD is a popular technical analysis indicator that usesMoving Average Convergence Divergence to identify trends in the market.

4. RSI: The RSI is a popular technical analysis indicator that uses Relative Strength Index to identify oversold and overbought conditions in the market.

5. STOCHastics: The STOCHastics indicator uses a stochastic oscillator to identify short-term trends in the market.

Charting is the use of graphical representations of cryptocurrency technical analysis data.

Some common charting methods include:

1. Candlestick charts: Candlestick charts are one of the oldest types of charts used in technical analysis. They show the price of a digital asset over time as represented by a series of colourful candlesticks.

2. Bollinger Bands: Bollinger Bands are a type of Bollinger Banding indicator that uses three bands to identify patterns in the market.

3. Gann Fan Charts: Gann Fan Charts are a type of technical analysis chart that uses a fan-shaped graph to show price movements over time.

4. Ichimoku Charts: Ichimoku Charts are a type of technical analysis chart that uses five colors to identify trends in the market.

5. OHLC Charts: OHLC charts are one of the most popular types of charts used in cryptocurrency technical analysis. They show the price of a digital asset over time as represented by lines on a graph.

charts crypto technical analysis: resources

cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.