Reading Crypto Volume Charts

If you want to get into cryptocurrency trading, one of the first things you need to understand are crypto volume charts. In this article, we'll explain what they are and how to read them. Crypto volume charts show the amount of a cryptocurrency that has been traded over a certain period of time. They usually have a line going across the chart that shows the price of the cryptocurrency, and the volume is represented by bars underneath. The height of the bars shows how much of the cryptocurrency has been traded at that price. So if there is a tall bar, it means that a lot of the cryptocurrency has been traded at that price. You can use volume charts to help you make decisions about when to buy or sell a cryptocurrency. If there is a sudden spike in the volume, it could be an indication that there is about to be a big move in the price. Understanding crypto volume charts is an important part of becoming a successful cryptocurrency trader.

Why Crypto Volume Charts Matter

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrency volume charts are used to track the value and activity of cryptocurrencies. Volume is measured in terms of units transacted over a certain period of time. This information can be used to determine the popularity and potential demand for a particular cryptocurrency.

Cryptocurrency volume charts can also be used to identify potential price trends. When a cryptocurrency sees increased activity and volume, this may signal an upcoming price increase. Conversely, if volume and activity decrease, this may signal a potential price decline.

How to Read Crypto Volume Charts

To read crypto volume charts, you will need to understand what a cryptocurrency is, how it works, and what a volume chart is.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Volume charts show the value of a cryptocurrency over time. The higher the volume, the more valuable the cryptocurrency. Volume is measured in digital or virtual currency units (dollars, bitcoins, etc.), and is typically represented as a line on a chart.

To use a volume chart, first understand what it is measuring. For example, a volume chart for bitcoin might show the number of bitcoins traded over a certain period of time. Next, look at the chart and identify trends. For example, if you see that the volume is increasing, that might be an indication that the value of bitcoin is also increasing.

What do Crypto Volume Charts Tell Us?

Crypto volume charts are used to track the movement of cryptocurrencies. Volume measures the number of transactions that have taken place on a particular cryptocurrency exchange over a certain time period.

The Significance of Crypto Volume Charts

Cryptocurrencies are a new and interesting investment option, and there is a lot of interest in them. Volume charts are a useful way to track the popularity of cryptocurrencies and to see how they are performing.

Volume charts can be used to find trends in cryptocurrency prices and to see how popular different cryptocurrencies are. They can also be used to identify potential investments.

Cryptocurrencies are volatile, so volume charts should not be used as the only indicator of how a cryptocurrency is performing. However, volume charts can be a useful tool for investors.

Why You Should Check Crypto Volume Charts

Cryptocurrencies are speculative, and their prices are highly volatile. As such, it's important to monitor their volume charts to stay informed about the trends of their prices.

Volume charts show you how much cryptocurrency is being traded in a given period of time. This information can help you determine whether the price of a cryptocurrency is stable or volatile.

Volume charts also give you an idea of how popular a cryptocurrency is. If a cryptocurrency is experiencing high volumes, this may suggest that its price is stable or rising. Conversely, low volume may suggest that the cryptocurrency is experiencing volatility or a decline in its value.

How to Use Crypto Volume Charts

Crypto Volume Charts are a very popular tool for traders and investors to use. They allow you to visualize the flow of cryptocurrency transactions over time and identify trends.

To use a Crypto Volume Chart, first find the exchanges where you want to track cryptocurrency transactions. Once you have found the exchanges, open a new tab in your browser and visit their respective websites.

On the exchanges’ pages, look for the “Volume (24h)” and “Volume (7d)” columns. The Volume (24h) column will show you the total volume of cryptocurrency transactions that took place over the past 24 hours. The Volume (7d) column will show you the total volume of cryptocurrency transactions that took place over the past 7 days.

Now, on the Crypto Volume Chart, click on the “Data” tab. This will open the Crypto Volume Chart in a new tab.

On the Crypto Volume Chart, you will see the following information:

The Y-axis shows the value of cryptocurrency transactions over time.

The X-axis shows the date.

The chart will show the following trend lines:

The green line is the 24-hour trend line. This line shows the general trend of cryptocurrency transactions over the past 24 hours.

The blue line is the 7-day trend line. This line shows the general trend of cryptocurrency transactions over the past 7 days.

The red line is the 24-hour moving average trend line. This line is a smoothed version of the 24-hour trend line. It shows the average trend of cryptocurrency transactions over the past 24 hours.

The purple line is the 7-day moving average trend line. This line is a smoothed version of the 7-day trend line. It shows the average trend of cryptocurrency transactions over the past 7 days.

The yellow line is the day’s low point. This line shows the lowest point of cryptocurrency transactions over the past day.

The yellow line is the day’s high point. This line shows the highest point of cryptocurrency transactions over the past day.

The green dotted line is the 12-hour moving average trend line. This line is a smoothed version of the 24-hour moving average trend line. It shows the average trend of cryptocurrency transactions over the past 12 hours.

The red dotted line is the 12-hour moving average trend line. This line is a smoothed version of the 7-day moving average trend line. It shows the average trend of cryptocurrency transactions over the past 12 hours.

The purple dotted line is the 24-hour exponential moving average trend line. This line is a smoothed version of the 24-hour moving average trend line. It shows the average trend of cryptocurrency transactions over the past 24 hours, weighted by how recent these transactions are.

The blue dotted line is the 7-day exponential moving average trend line. This line is a smoothed version of the 7-day moving average trend line. It shows the average trend of cryptocurrency transactions over the past 7 days, weighted by how recent these transactions are.

The red dashed line is the 30-day exponential moving average trend line. This line is a smoothed version of the 7-day moving average trend line. It shows the average trend of cryptocurrency transactions over the past 30 days.

The purple dashed line is the 365-day exponential moving average trend line. This line is a smoothed version of the 7-day moving average trend line. It shows the average trend of cryptocurrency transactions over the past 365 days.

What Crypto Volume Charts Mean for You

Cryptocurrency volume charts are a great way to track the overall health and performance of the cryptocurrency markets. Volume charts can provide valuable insights into the current prices and volumes of various cryptocurrencies.

When interpreting cryptocurrency volume charts, it is important to remember that the data is not always accurate or reliable. Many factors can influence the volume of a particular cryptocurrency, including market conditions, news events, and regulatory changes.

Overall, cryptocurrency volume charts can be helpful in understanding the current state of the cryptocurrency markets.

Why Crypto Traders Must Study Volume

Cryptocurrency traders must study volume to understand the market conditions. Volume can indicate the strength of a demand for a particular cryptocurrency. For example, if there is high volume for a cryptocurrency, it may be indicative that the market is strong and demand is high. Conversely, if there is low volume for a cryptocurrency, it may be indicative that the market is weak and demand is low.

How to Analyze Cryptocurrency Volumes

There are a few different ways to analyze cryptocurrency volumes. The first way is to look at the total market cap of all cryptocurrencies. This can be found on CoinMarketCap.com. The second way is to look at the total number of transactions that have taken place on various exchanges. This can be found on CryptocurrencyExchanges.com. The third way is to look at the number of new cryptocurrencies that are being created each day. This can be found on CoinMarketCap.com.

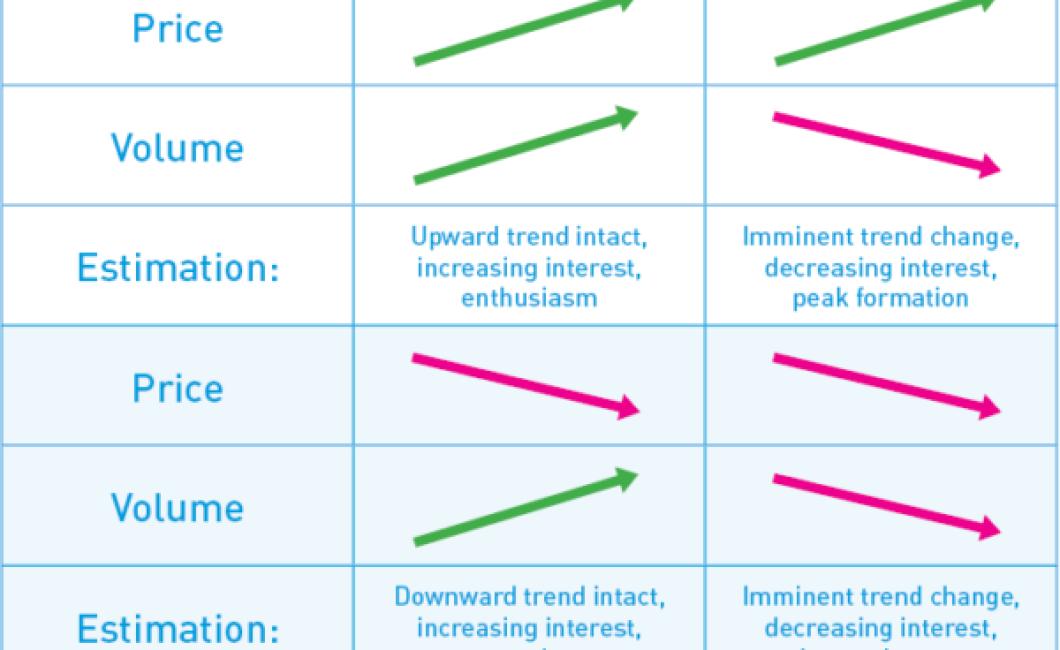

What Do Increasing or Decreasing Cryptocurrency Volumes Mean?

Cryptocurrency volumes are a metric that shows how much money is being traded in cryptocurrency markets. When volumes are high, this suggests that there is a lot of interest in cryptocurrencies, and that people are buying and selling them. When volumes are low, this suggests that there is less interest in cryptocurrencies, and that people are trading them less.

How to Use Trading Volume to Predict Price Movements

When you are looking to predict the price movements of a security, it is important to understand how trading volume impacts price. Trading volume is a measure of the number of contracts that are traded in a given period of time. The higher the trading volume, the more active the market is and the more likely it is that the price of a security will move in response to changing demand.

When analyzing price movements, traders often look at the average price over a given period of time and use that as a reference point. If the average price is moving higher or lower than what was seen in previous periods, it is likely that there is strong demand for or supply of the underlying security and that therefore, the price will move in that direction.

While trading volume is an important factor to consider when predicting price movements, it is not the only factor at play. Other factors such as news events, economic conditions, and technical indicators can also impact prices.

Why Volume is the Most Important Indicator in Crypto Trading

Volume is the most important indicator in crypto trading. When the volume of a particular cryptocurrency is high, it indicates that there is a lot of interest in that particular cryptocurrency. This means that the price of that cryptocurrency is likely to go up. Conversely, when the volume of a particular cryptocurrency is low, it indicates that there is a lot of selling happening, which means that the price of that cryptocurrency is likely to go down.