How to predict crypto currency charts

If you're interested in trying your hand at predicting crypto currency charts, there are a few things you should know. First, it's important to understand the market and the factors that can affect prices. Then, you need to identify patterns and trends in the data. Finally, you need to use your knowledge and intuition to come up with predictions. In this article, we'll walk you through the process of predicting crypto currency charts step-by-step. We'll also provide some helpful tips and resources along the way.

How to predict crypto currency charts: The ultimate guide

Cryptocurrencies are all over the news, and it can be hard to keep track of them all. This guide will teach you how to predict the crypto currency charts, so that you can stay up to date with the latest prices and trends.

1. Understand how crypto currency works

Before you can predict the prices of cryptocurrencies, you need to understand how they work. Cryptocurrencies are based on blockchain technology, which is a distributed ledger of all cryptocurrency transactions. Each node in the blockchain is responsible for verifying and recording transactions. This makes it difficult for anyone to tamper with the data.

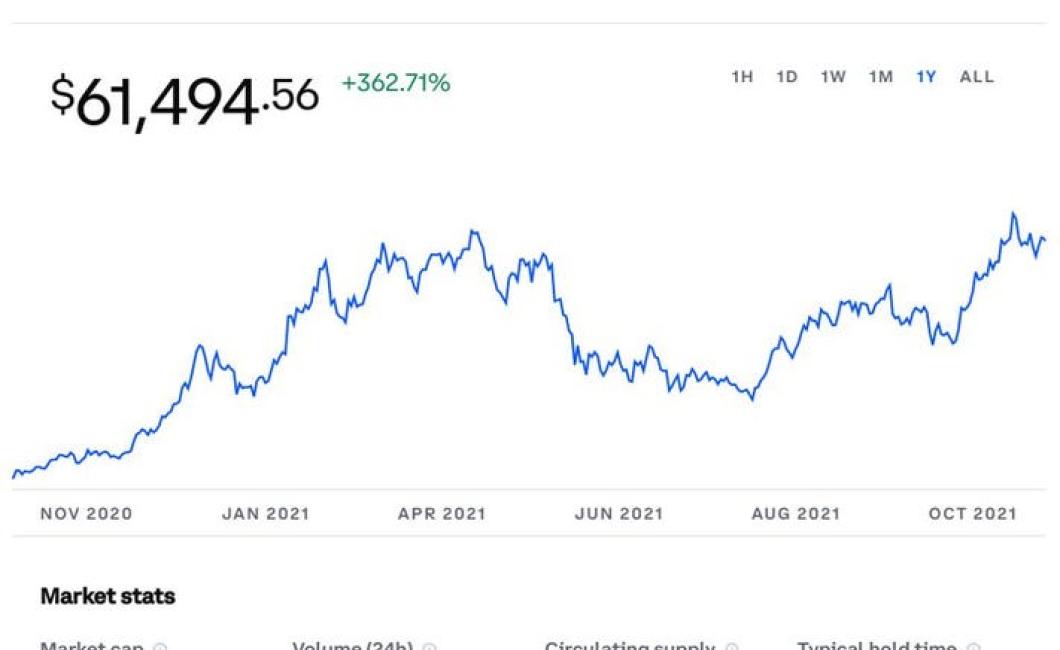

2. Look at the historical prices

One of the best ways to predict the prices of cryptocurrencies is to look at the historical prices. This will give you an idea of how volatile the prices can be, and how long trends can last.

3. Analyse the news

Another way to predict the prices of cryptocurrencies is to analyse the news. This will give you an idea of how the market is reacting to certain events, and what might be driving the prices.

4.look at technical indicators

Finally, you can use technical indicators to help you predict the prices of cryptocurrencies. These indicators can help you identify patterns in the data, and predict future prices.

How to use technical analysis to predict crypto currency charts

Technical analysis is the use of technical indicators to predict the behavior of stock, commodity, and cryptocurrency markets. Technical indicators are mathematical formulas that are used to analyze historical data in order to identify patterns and predict future trends.

There are a number of technical indicators that can be used to predict the behavior of crypto currencies, including the moving average, Bollinger Bands, and the Relative Strength Index (RSI).

The Moving Average

The moving average is a technical indicator that is used to predict the trend of a security or market. The moving average is calculated by taking the average price of a security or market over a certain period of time and dividing that average price by the number of transactions that took place during that same period.

The Moving Average can be used to identify whether the market is trending up or down. If the Moving Average is above the 20-day moving average, then the market is likely trending up. If the Moving Average is below the 20-day moving average, then the market is likely trending down.

The Bollinger Bands

The Bollinger Bands are a technical indicator that is used to identify volatility in a security or market. The Bollinger Bands are two bands that are used to measure price volatility. The bands are set at two different levels, and the width of the bands reflects the amount of volatility in the market.

The Bollinger Bands can be used to identify whether the market is over or undervalued. If the Bollinger Bands are wide, then the market is overvalued. If the Bollinger Bands are narrow, then the market is undervalued.

The Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a technical indicator that is used to identify whether a security or market is oversold or overvalued. The RSI measures the speed and change of a security or market over a period of time. The RSI is divided into two ranges, low and high, and is based on a 10-day moving average.

If the RSI is below the 30-day moving average, then the market is oversold. If the RSI is above the 30-day moving average, then the market is overvalued.

How to predict crypto currency charts with machine learning

There is no one definitive answer to this question. There are a variety of methods that can be used to predict crypto currency charts with machine learning, and the most effective approach depends on the specific needs of the project.

Some common methods include using historical data to predict future prices, using trends in user activity to predict price movements, and using machine learning algorithms to predict future prices.

Each method has its own advantages and disadvantages, so it is important to choose the approach that is best suited for the project.

One approach that is often used is to use historical data to predict future prices. This method is based on the assumption that past prices are a good predictor of future prices.

This approach is useful for projects that have a long history of data. It is also useful for projects that have a stable price history.

However, this approach is not as effective for projects that have a history of volatile prices.

Another approach that is often used is to use trends in user activity to predict price movements. This method is based on the assumption that users tend to make buy or sell decisions based on recent trends.

This approach is useful for projects that have a high level of user activity. It is also useful for projects that have a volatile price history.

However, this approach is not as effective for projects that have a stable price history.

Another approach that is often used is to use machine learning algorithms to predict future prices. This method is based on the assumption that machine learning algorithms can learn how to predict prices.

This approach is useful for projects that have a limited number of historical data points. It is also useful for projects that have a volatile price history.

However, this approach is not as effective for projects that have a stable price history.

How to predict crypto currency charts with fundamental analysis

Cryptocurrency charts are notoriously difficult to predict, especially when considering fundamental analysis. However, there are a few general trends that can be observed when analyzing cryptocurrency charts.

For example, it is often possible to identify when a cryptocurrency is in a bull or bear market. By understanding when these markets are in remission and when they are heating up, it is possible to make better predictions about when a coin will reach new highs or lows.

Additionally, it is important to monitor the overall trend of the market. If a particular coin is consistently outperforming the rest of the market, it may be worth investing in that currency. Conversely, if a particular coin is consistently underperforming the rest of the market, it may be worth avoiding that currency.

Overall, fundamental analysis is a valuable tool for predicting cryptocurrency charts. By understanding the general trends that are driving the market, it is possible to make smarter investment decisions.

How to predict crypto currency charts with sentiment analysis

Sentiment analysis is a technique that can be used to predict the future price movements of cryptocurrencies.

There are a number of ways to do sentiment analysis, but the most common approach is to look at the historical sentiment of a given cryptocurrency using a variety of indicators.

One popular sentiment indicator is the relative strength index (RSI), which measures the speed and magnitude of price changes over a given period of time.

Other popular sentiment indicators include the moving average (MA) and the Bollinger Bands.

Once you have determined the sentiment of a given cryptocurrency, you can use that information to predict its future price movements.

For example, if you believe that the sentiment of a cryptocurrency is bullish, you could expect its price to rise in the future. Conversely, if you believe that the sentiment of a cryptocurrency is bearish, you could expect its price to decline in the future.

How to predict crypto currency charts with news events

Cryptocurrencies are often correlated with news events. For example, when Bitcoin hit $10,000 for the first time, there was a lot of media coverage surrounding the event. This increased interest in Bitcoin and other cryptocurrencies, which helped to drive their prices up.

How to predict crypto currency charts with social media Sentiment

There is no one definitive way to predict the price of cryptocurrency charts with social media sentiment. However, looking at factors like overall volume and the sentiment of recent tweets or posts can provide a good indication of where the market is heading.

How to predict crypto currency charts with technical indicators

There are a number of technical indicators that can be used to predict the future performance of digital currency charts. Some of the most popular indicators include the RSI, MACD, and SMA.

The RSI is a technical indicator that measures the relative strength of a market. The RSI can be used to identify oversold or overbought conditions in the market. When the RSI is oversold, this indicates that the market is likely to experience a decrease in prices. Conversely, when the RSI is overbought, this indicates that the market is likely to experience an increase in prices.

The MACD is a technical indicator that helps to identify the overall trend of a market. The MACD can help to identify whether the market is moving up or down. The MACD also helps to identify whether the market is in a bullish or bearish trend.

The SMA is a technical indicator that helps to identify the trend of a market over time. The SMA can help to identify whether the market is moving up or down. The SMA also helps to identify whether the market is in a bullish or bearish trend.