Crypto Charts Inflation

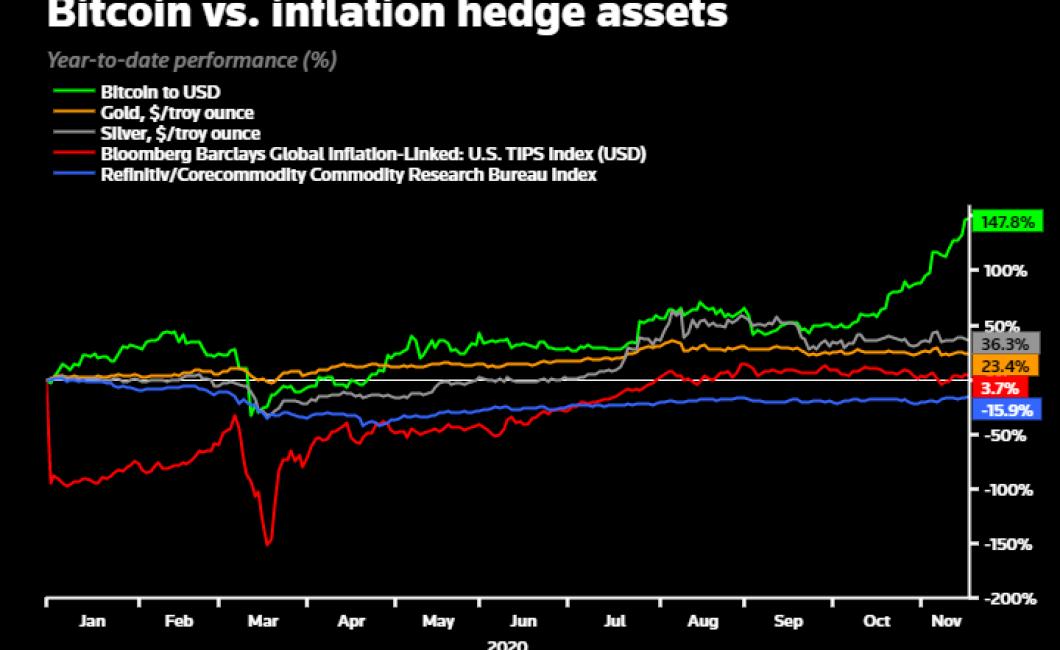

The inflation of crypto charts is a visual representation of the increase in the prices of cryptocurrencies. It can be used to compare the relative value of different cryptocurrencies, or to examine the overall trend of the cryptocurrency market.

The top 5 crypto charts measuring inflation

1. CoinMarketCap - This is probably the most well-known and trafficked crypto charts measuring inflation. It displays a variety of metrics such as market cap, 24-hour volume, and price index.

2. CoinMarketCap - This is probably the most well-known and trafficked crypto charts measuring inflation. It displays a variety of metrics such as market cap, 24-hour volume, and price index.

3. CoinMarketCap - This is probably the most well-known and trafficked crypto charts measuring inflation. It displays a variety of metrics such as market cap, 24-hour volume, and price index.

4. CoinMarketCap - This is probably the most well-known and trafficked crypto charts measuring inflation. It displays a variety of metrics such as market cap, 24-hour volume, and price index.

5. CoinMarketCap - This is probably the most well-known and trafficked crypto charts measuring inflation. It displays a variety of metrics such as market cap, 24-hour volume, and price index.

How to read crypto charts measuring inflation

Crypto charts measuring inflation usually have a Y-axis measuring inflation rates, and a X-axis measuring time. The Y-axis will typically start at 0%, and go up as inflation rates increase. The X-axis will typically start at 0 days, and go up as time progresses.

3 key indicators of inflation in the crypto market

1. Inflation in the crypto market is typically higher when there is an increase in the number of new coins and tokens being created.

2. Inflation in the crypto market is also typically higher when there is an increase in the price of cryptocurrencies.

3. Inflation in the crypto market is also typically higher when there is a decrease in the number of circulating coins and tokens.

The most important crypto charts for inflation analysis

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are not legal tender and are not backed by any government or central bank. Their value is based on how much people are willing to pay for them.

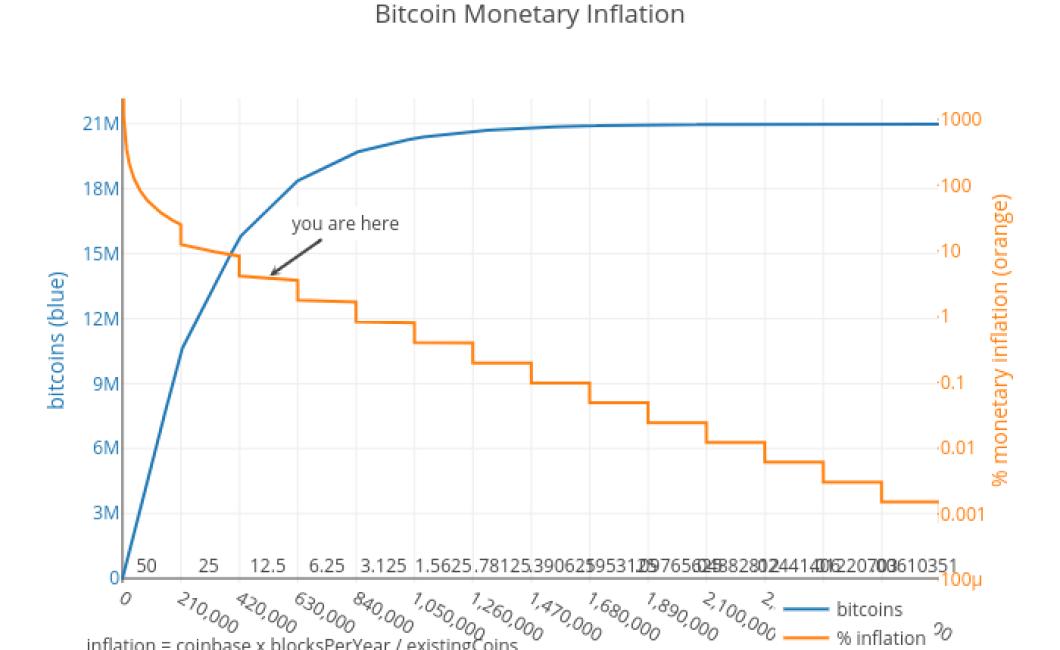

Cryptocurrency charts can be used to track the price of a cryptocurrency over time, as well as to monitor changes in the number of coins in circulation. Inflation analysis can also be performed on cryptocurrency charts to determine whether a currency is losing value or not.

What do crypto charts measuring inflation tell us?

Cryptocurrencies are decentralized, digital, and often deflationary in nature. This means that there is a limited number of coins in circulation and that each new coin is worth less than the previous coin. As a result, cryptocurrency investors are constantly monitoring inflation rates to make sure that their holdings are growing in value over time.

Cryptocurrency inflation rates can provide important insights into the health of the digital currency ecosystem. When inflation rates are high, it suggests that new coins are being created at a faster rate than they are being lost or destroyed. This means that the network is growing and that there is demand for cryptocurrencies. Inflation rates that are low, on the other hand, can indicate that the network is struggling and that there is a risk of a crash.

How accurate are crypto charts at measuring inflation?

Cryptocurrencies are not typically used to measure inflation, as they are not backed by any government or central bank. Cryptocurrencies are instead based on a digital code that allows users to exchange goods and services. While cryptocurrencies can track inflation, it is not a perfect measure, as there are many factors that can influence the value of a digital currency.

What can we learn from crypto charts about inflation?

Cryptocurrencies are often associated with high levels of inflation. This is because the creation of new cryptocurrencies is done through a process known as "mining." Miners are rewarded with new cryptocurrencies for verifying and confirming transactions on the blockchain. As a result, new cryptocurrencies are created at a rapid pace, which can lead to high levels of inflation.

What do experts say about crypto charts and inflation?

Cryptocurrencies are not backed by anything, which means that their value is entirely based on demand and supply. As a result, there is a lot of speculation around the price of cryptocurrencies, and therefore their inflation rate. Some experts believe that cryptocurrencies are susceptible to inflation, while others believe that they are not. Ultimately, it is impossible to say for certain whether or not cryptocurrencies will experience inflation in the future.

Do crypto charts help us predict inflation?

Crypto charts can help us predict inflation, as they show how much bitcoin and other digital currencies are worth over time. However, predicting inflation is a difficult task, and there is no guaranteed way to do so.

How do changes in the crypto market affect inflation?

Cryptocurrencies are not technically inflationary, but the rapid price fluctuations can cause some people to think they are. Inflation is when prices increase over time. When prices rise quickly and then level off, some people might think that there is inflation going on. But in reality, there may be little or no inflation happening.

What role do crypto charts play in inflationary periods?

Crypto charts play an important role in inflationary periods. When people are buying and selling cryptocurrencies, they are driving up the prices of cryptocurrencies. This can cause the value of a cryptocurrency to increase faster than the rate at which the economy is growing. If the value of a cryptocurrency continues to increase faster than the rate at which the economy is growing, it can lead to an inflationary period.

What can we learn from past inflations as measured by crypto charts?

There are a few key takeaways from past inflations that can be applicable to crypto markets.

First, it is important to keep in mind that inflations are not always a good thing for the overall economy. Inflation can lead to an increase in debt levels, which can ultimately lead to a financial crisis. Additionally, inflations can cause people to lose money as the value of their assets decreases.

Second, it is important to remain vigilant when it comes to crypto markets. Many people may become complacent during periods of stable prices, but this is not always a safe strategy. If the price of a cryptocurrency falls below a certain threshold, it may be time to take some action. For example, if you own Bitcoin and the price falls below $6,000, it may be time to sell your holdings.

Finally, it is important to remember that the crypto markets are highly volatile. This means that the price of a cryptocurrency can change rapidly and without warning. It is important to always do your own research before making any investment decisions.