How do you read cryptocurrency charts?

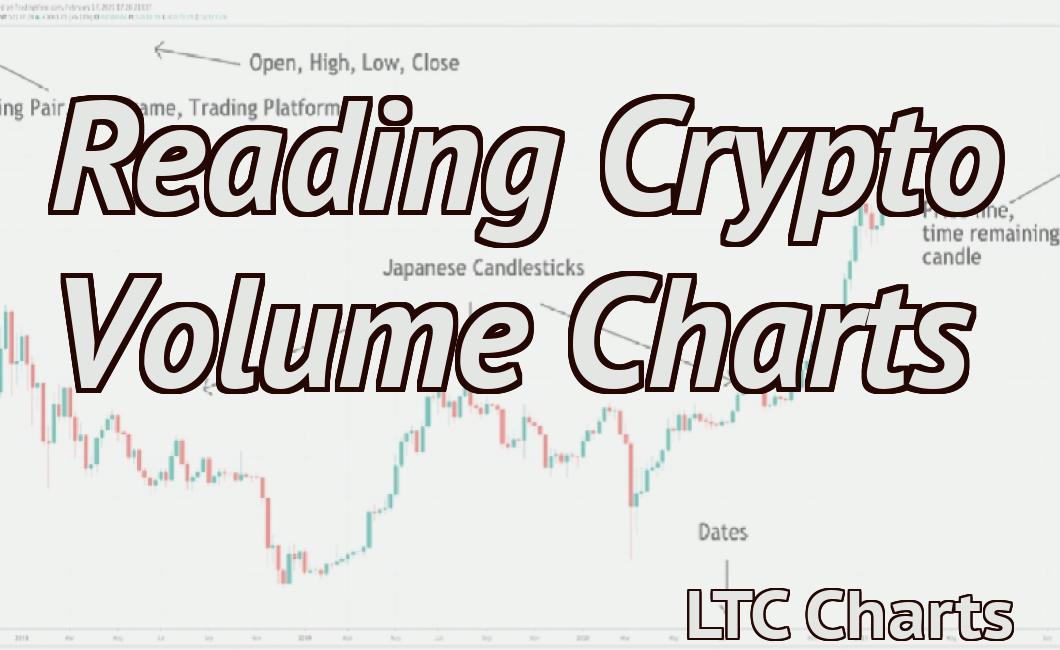

Cryptocurrency charts can be a little confusing at first, but they're actually not too difficult to read once you know what you're looking at. The most important thing to remember is that cryptocurrency prices are highly volatile, so don't put too much money into any one coin unless you're prepared to lose it all. With that said, here's a quick guide to reading cryptocurrency charts: The first thing you'll notice on a cryptocurrency chart is the price history. This is represented by a line going up and down over time. The vertical axis shows the price in US dollars, while the horizontal axis shows the time period. You can use this to see how the price has changed over time. Next, you'll see something called the order book. This shows all the buy and sell orders for a particular coin at different prices. The order book can be a little confusing, but basically, the higher the price that someone is willing to pay for a coin, the more "buy" orders there will be. Similarly, the lower the price that someone is willing to sell a coin for, the more "sell" orders there will be. Finally, you may also see something called candlestick charts. These are used to show price changes over time, but they give you a bit more information than just the price history. Each "candle" on the chart represents a certain time period, and the size of the candle represents how much the price changed during that time period. For example, a tall candle means that the price went up a lot during that time period, while a short candle means that the price didn't change much. With these three things in mind, you should be able to read most cryptocurrency charts without too much trouble. Just remember that prices can change very rapidly in this market, so don't invest more than you can afford to lose.

How to read crypto currency charts for beginners

There are a few different ways to read crypto currency charts for beginners.

The most basic way to read crypto currency charts is to look at the price over time. This will show you how much the coin has changed in value over a specific period of time.

Another way to read crypto currency charts is to look at the trend. This will tell you whether the coin is increasing or decreasing in value over a specific period of time.

Finally, you can also look at the market capitalization to see how valuable the coin is overall.

A guide to reading crypto currency charts

Cryptocurrency charts can be difficult to understand, but with a little practice, you'll be able to read them like a pro.

1. Look at the overall trend.

The first thing you need to look for is the overall trend of the chart. This will tell you whether the price is going up or down.

If the price is going up, the trend will be upwards. If the price is going down, the trend will be downwards.

2. Look at the price action.

Next, you need to look at the price action on the chart. This will tell you what is happening right now.

If the price is going up, look for a series of higher highs and higher lows. If the price is going down, look for a series of lower lows and lower highs.

3. Look at the volume.

Volume is also important when it comes to cryptocurrency charts. Look for patterns in the volume of the market.

If the volume is high, it means that there are a lot of people trading the cryptocurrency. This is good news for buyers because it means that the price is likely to go up.

If the volume is low, it means that there are a lot of people selling the cryptocurrency. This is bad news for buyers because it means that the price is likely to go down.

How to understand and interpret crypto currency charts

Cryptocurrencies are complex and volatile investments. It is important to understand the terminology and how to read cryptocurrency charts before investing.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrency prices are determined by supply and demand. They are often quoted in U.S. dollars, but can also be in other currencies.

Cryptocurrency prices are often highly volatile and can be very sensitive to news events. It is important to do your own research before investing in cryptocurrencies.

Tips for reading crypto currency charts

Cryptocurrency charts are often used to determine the price trends of a certain digital asset. However, there are a few things that you should keep in mind when reading a crypto currency chart.

1. The appearance of a crypto currency chart can be deceiving. For example, if the price of a digital asset is dropping, it may seem like the trend is reversing. However, this could be due to temporary factors such as a market correction or news event. So, it is important to monitor the chart closely in order to make informed investment decisions.

2. It is important to understand how to read a crypto currency chart. For example, if the price of a digital asset is dropping, it may be due to a decline in demand or a decrease in supply. So, it is important to understand the underlying mechanics of the cryptomarket in order to make informed investment decisions.

3. It is also important to monitor the volatility of the digital asset. For example, if the price of a digital asset is dropping rapidly, it is likely that there is significant volatility associated with the asset. This means that it may be difficult to make informed investment decisions. So, it is important to monitor the volatility of the digital asset closely in order to make informed investment decisions.

The essentials of reading crypto currency charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Decoding the secrets of crypto currency charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrency charts are used to track the price of a cryptocurrency over time. They can be used to identify patterns in price movement and to identify opportunities for market entry or exit.

Cryptocurrency charts are often displayed on cryptocurrency exchanges, and they can also be found on websites that provide information about cryptocurrencies.

Cryptocurrency charts are based on a candlestick diagram, which is a type of chart that shows the price of a security over time. Candlestick charts are divided into two main sections: the body and the shadows. The body shows the actual price of a security over time, while the shadows show the percentage change in price from one candlestick to the next.

The main components of a cryptocurrency chart are the price axis, the time axis, and the candlestick symbols. The price axis shows the value of a cryptocurrency over time, while the time axis shows the date and time of each chart update. The candlestick symbols show the actual price of a security at specific points in time.

Cryptocurrency charts can be divided into two main types: technical analysis and fundamental analysis. Technical analysis uses chart patterns to identify potential market trends and to make predictions about future prices. Fundamental analysis examines a cryptocurrency's underlying technical and economic fundamentals to determine if it is worth investing in.

How to make sense of crypto currency charts

Cryptocurrency charts are designed to help you make sense of the current prices of cryptocurrencies.

Cryptocurrencies are often traded on virtual exchanges and can experience large price swings. So it's important to understand how these charts work in order to make informed investment decisions.

Cryptocurrency charts show the price of a cryptocurrency over time. The price of a cryptocurrency is displayed on the vertical axis and the time period is displayed on the horizontal axis.

The green line on a cryptocurrency chart is known as the "support level". This is the price level at which the majority of buyers are willing to buy a cryptocurrency. If the price of a cryptocurrency falls below this level, it is said to be in a "downtrend". If the price of a cryptocurrency rises above this level, it is said to be in a "upward trend".

The red line on a cryptocurrency chart is known as the "resistance level". This is the price level at which the majority of sellers are willing to sell a cryptocurrency. If the price of a cryptocurrency falls below this level, it is said to be in a "downtrend". If the price of a cryptocurrency rises above this level, it is said to be in an "upward trend".

How to read crypto currency charts like a pro

Crypto currency charts are a great way to learn about the market and find opportunities in the crypto space.

When you first start trading, it can be difficult to know what to look for on a crypto currency chart. However, with a few simple tips, you can become a pro at reading crypto currency charts.

1. Look for trends

One of the most important things to look for on a crypto currency chart is trends. Trends can tell you a lot about the market and what is happening.

For example, if you see a pattern of price increasing then decreasing, this could be a sign that the market is unstable and may not be a good investment.

2. Follow the trend

Once you have identified a trend, it is important to follow it. This means buying when the price is going up and selling when the price is going down.

3. Look at the charts in detail

When looking at crypto currency charts, it is important to take the time to look at them in detail. This means tracking the prices, the volumes, and the indicators.

4. Stay patient

It can be difficult to trade the crypto market, but with a little patience and practice, you will be able to become a pro.

How to become a master of reading crypto currency charts

There is no one-size-fits-all answer to this question, as the best way to become a master of reading crypto currency charts depends on your individual skills and preferences. However, some tips on how to become a better crypto currency trader include studying charts and indicators, learning how to read price action, and keeping a close eye on market conditions.

The art of reading crypto currency charts

Cryptocurrency charts are essential for anyone who wants to invest in cryptocurrencies. They can help you identify potential investments, track prices, and make informed decisions.

Cryptocurrency charts are usually represented as a series of graphs with different colors and symbols. The most important thing to remember is that the graphs are always changing, so it’s important to pay attention to the direction and magnitude of changes.

If you want to be a successful crypto investor, you need to be able to read charts like a pro. Here are some tips to help you become a better chart reader:

1. Pay attention to the trend

The first thing you need to do is pay attention to the overall trend. Charts are always changing, but if the trend is positive then the price is likely going up. Conversely, if the trend is negative then the price is likely going down.

2. Monitor the price action

Once you have a grasp on the trend, you need to monitor the price action. This means watching the movement of the prices over time and noting any changes in direction or magnitude.

3. Look for signals

Signals are important clues that can help you make informed decisions about your investments. Look for patterns in the data that signal a change in direction or magnitude.

4. Use indicators

Some charts also include indicators, which can help you make more informed decisions. For example, the RSI (relative strength index) can help you identify oversold or overbought conditions.

How to read crypto currency charts like an expert

Cryptocurrency charts are a great way to see how the market is performing and to understand which coins are doing well.

To read a cryptocurrency chart like an expert, you first need to understand what the different types of charts are and how they are used.

There are three main types of cryptocurrency charts:

1. Price charts

Price charts show you the price of a cryptocurrency over time. They are useful for understanding how the market is performing and for identifying which coins are doing well.

2. Volume charts

Volume charts show you the number of coins that have been traded over time. They are useful for understanding how active the market is and for spotting trends.

3. Circulation charts

Circulation charts show you the total number of coins that are in circulation. They are useful for understanding how much demand there is for a cryptocurrency.

How to read crypto currency charts like a boss

The first step to understanding crypto currency charts is to understand what they are supposed to show.

Cryptocurrencies are typically traded on decentralized exchanges, which means that the prices of digital assets are not necessarily reflective of the underlying market.

Cryptocurrency charts are designed to provide a snapshot of the current and historical prices of a given digital asset.

The primary indicators that are used to measure the health of a cryptocurrency market are the supply and demand curves.

The supply curve shows the number of tokens that will be created in the future and is determined by the total supply of coins that are in circulation.

The demand curve shows the amount of tokens that are currently being traded and is based on the amount of buyers and sellers.

When the supply and demand curves are in equilibrium, the price of a digital asset will be stable.

When the supply curve is higher than the demand curve, more tokens will be created and the price of the asset will be lower.

When the demand curve is higher than the supply curve, more tokens will be sold and the price of the asset will be higher.

When the supply curve is lower than the demand curve, more tokens will be created and the price of the asset will be lower.

When the demand curve is lower than the supply curve, more tokens will be sold and the price of the asset will be higher.