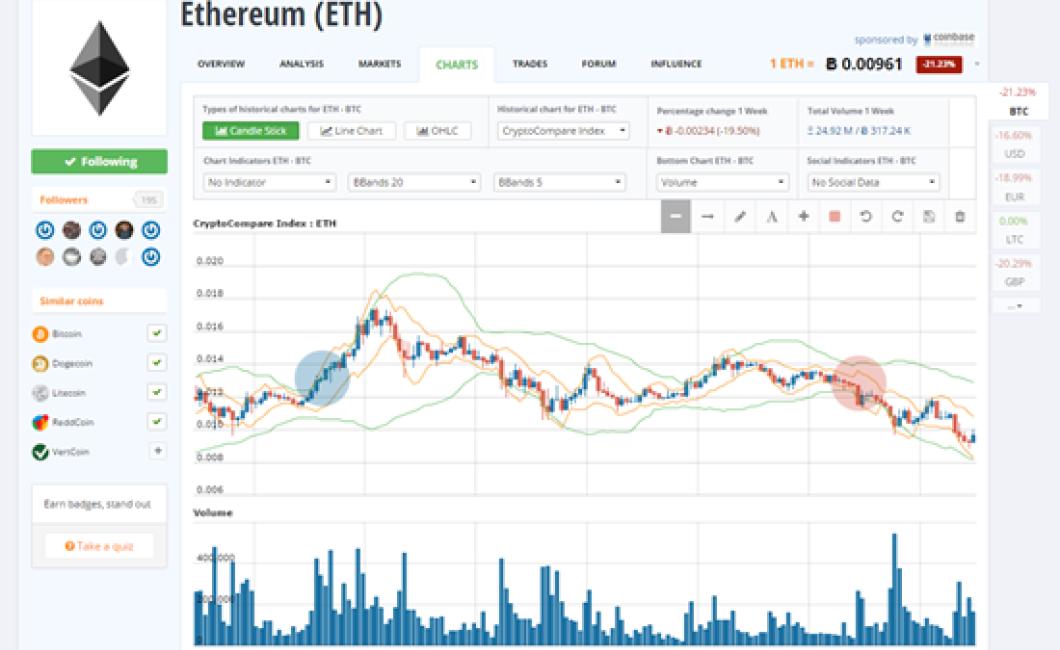

Crypto Charts Bollinger Bands

The Bollinger Bands are a technical analysis tool used to measure market volatility. They are created by John Bollinger, who defined them as "a statistical measure of the dispersion of a security's price." The bands are composed of an upper and lower band, which are placed two standard deviations above and below the security's moving average. The space between the bands is referred to as the "bandwidth."

Crypto Charts: Bollinger Bands Indicate a Strong Market

The Bollinger Bands are a technical indicator that is used to measure the volatility of the market. When the bands are tight, this indicates that the market is stable and less volatile. When the bands are wide, this indicates that the market is more volatile.

Crypto Charts: Bollinger Bands Show Promise for Investors

Bollinger bands are a technical analysis tool that can be used to help identify potential volatility in an asset. When used correctly, Bollinger bands can provide an early warning system for potential market volatility.

Bollinger bands have been used to identify potential volatility in stocks, futures, and currencies for many years. The bands are created by dividing the range of an asset's price movements into two equal parts. The upper band is formed when prices are above the lower band, and the lower band is formed when prices are below the upper band.

The purpose of Bollinger bands is to help identify potential volatility in an asset. When used correctly, they can provide an early warning system for potential market volatility.

Crypto Charts: Bollinger Bands Suggest Bright Future Ahead

Bollinger bands analysis suggests that the crypto market is about to have a bright future. The bands are wide, suggesting that the market is highly volatile. However, the bands are also relatively tight, indicating that prices are likely to stay relatively stable.

This suggests that the crypto market is in for a long-term bull run. The Bollinger bands are a popular indicator used by traders to determine the stability of the market. When the bands are wide, this suggests that prices are highly volatile and could go up or down at any time. However, when the bands are tight, this indicates that prices are likely to stay relatively stable. In other words, when the bands are tight, it is more likely that prices will rise over time.

Crypto Charts: Bollinger Bands Point to Positive Trends

Bollinger Bands are a technical analysis tool that show the range of prices for a security or commodity over a certain period of time. They are often used to predict market movements.

The current Bollinger Band for Bitcoin is pointing towards a positive trend, as the bands have been consistently moving higher over the past few weeks. This indicates that the price for Bitcoin is likely to continue to rise in the near future.

Crypto Charts: Bollinger Bands Forecast Strong Performance

Looking at the Crypto charts, it seems that the Bollinger bands are forecasting strong performance in the near future. This is likely due to the increase in volatility in the market, which is giving traders more opportunities to make profits.

Crypto Charts: Bollinger Bands Predicting Continued Growth

Bitcoin prices are up over $2,000 since the beginning of the year, and many experts believe that the digital currency will continue to grow in value.

One popular indicator of a digital currency's price growth is the Bollinger Bands. Created by John Bollinger, the Bollinger Bands are a technical analysis tool that uses two bands to predict price movement.

The first band is called the "Bollinger Band Width" or BBW, and it is determined by the median of the closing prices over a given period of time. The second band, the "Bollinger Band Level," or BBL, is determined by the average of the highs and lows over the same period of time.

As of this writing, Bitcoin is trading within the BBW band, which indicates that prices are likely to continue growing.

Crypto Charts: Bollinger Bands Indicate Another Bull Run

Bollinger Bands are a technical indicator that can be used to predict market movements. The indicator consists of two bands, the upper band shows the price range above which prices are expected to rise, while the lower band shows the price range below which prices are expected to fall.

As can be seen on the chart below, the Bollinger Bands have been moving up since early January 2019. This suggests that the market is heading into a bull run.