How to read candlestick charts for crypto currencies.

Candlestick charts are one of the most popular ways to visualize data for crypto currencies. They provide a clear and easy-to-understand way to see price action over time. In this article, we will explain how to read candlestick charts for crypto currencies.

How to Read Candlestick Charts for Crypto Currencies

When looking at candlestick charts for cryptocurrencies, it is important to understand the different types of formations that can occur.

The first type of formation is called a "hollow." This occurs when there is a large sell-off in the market and no new buying has started to fill the gap. This indicates that the market is weak and could potentially be ready to reverse its current trend.

The next type of formation is called a "hammer." This occurs when the market is going up rapidly and there is a lot of buying activity. This indicates that the market is strong and could potentially continue to rise.

The final type of formation is called a "top." This occurs when the market is going down rapidly and there is a lot of selling activity. This indicates that the market is weak and could potentially fall.

The Ins and Outs of Reading Candlestick Charts for Crypto Currencies

Candlestick charts are a popular way to visually display the performance of a cryptocurrency over time. Candlestick charts are divided into two parts: the body and the tail. The body is the section of the chart which shows the prices of the cryptocurrencies over time. The tail is the section of the chart which shows the changes in prices over time.

What are the benefits of candlestick charts?

One of the benefits of candlestick charts is that they are easy to understand. Candlestick charts are divided into two parts: the body and the tail. The body is the section of the chart which shows the prices of the cryptocurrencies over time. The tail is the section of the chart which shows the changes in prices over time. Candlestick charts help to convey information quickly and easily. They are also effective in helping to identify trends. Candlestick charts are a good way to monitor the performance of a cryptocurrency over time.

A Beginner's Guide to Reading Candlestick Charts for Crypto Currencies

Candlestick charts are a great way to see how the price of a cryptocurrency is moving over time. This guide will teach you how to read candlestick charts and use them to invest in cryptocurrencies.

What is a Candlestick Chart?

A candlestick chart is a visual representation of how the price of a cryptocurrency is moving over time. Each candlestick is composed of three pieces of information: the open, high, and low prices for that day.

The open price is the lowest price at which a cryptocurrency was sold on that day. The high price is the highest price at which a cryptocurrency was sold on that day. The low price is the lowest price at which a cryptocurrency was sold on that day.

The middle column is the volume for that day. This column shows how many coins were traded at each price. The last column is the percentage change from the open price. This column shows how much the price of a cryptocurrency has changed from the open price.

How to Read Candlestick Charts

To read a candlestick chart, you first need to understand what each column represents.

The open, high, and low prices represent how much money was spent on a cryptocurrency on that day. The volume represents how many coins were traded at each price. The percentage change column shows how much the price of a cryptocurrency has changed from the open price.

Here are some tips for reading candlestick charts:

1. Look for patterns. If you see a pattern in the data, it can help you predict future prices. For example, if you see that the open, high, and low prices always move up or down together, that might be a sign that the price of a cryptocurrency is about to change.

2. Pay attention to the volume. If the volume is low, that might be a sign that there is not much interest in the cryptocurrency. On the other hand, if the volume is high, that might mean there is a lot of interest in the cryptocurrency.

3. Don't get stuck on one candlestick. If one candlestick looks particularly important, don't focus on it exclusively. Instead, look at several different candlesticks to get a fuller picture of how the price of a cryptocurrency is moving.

4. Use a trading platform. A trading platform will help you track your investments and make informed bids and offers on cryptocurrencies.

How to Make Sense of Candlestick Charts for Crypto Currencies

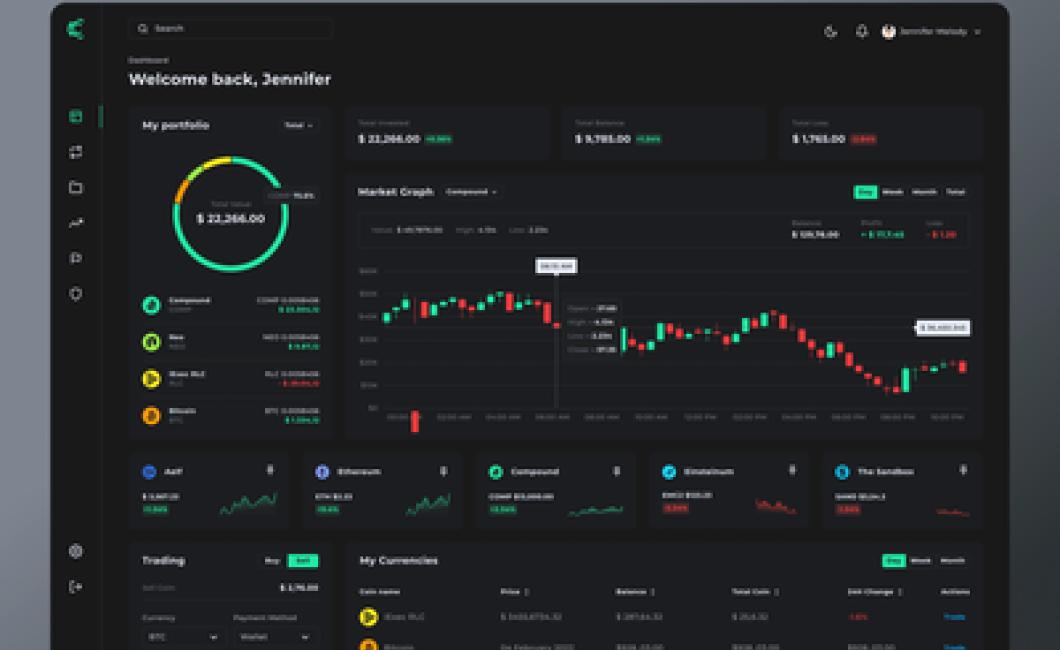

When you are looking to trade cryptocurrencies like Bitcoin, Ethereum, and Litecoin, you will need to use candlestick charts. Candlestick charts are a type of technical analysis chart that can help you to make sense of the movement of these digital assets.

Candlestick charts are made up of two types of data: the open and the close. The open is the first day's value, and the close is the last day's value. Candlestick charts also include a color code to indicate whether the price is rising, falling, or staying the same.

When you are looking to trade cryptocurrencies, it is important to understand how these assets move. Candlestick charts can help you to make sense of this movement and to determine when it is safe to buy or sell.

How to Use Candlestick Charts to Trade Crypto Currencies

Candlestick charts are a type of technical analysis used to trade cryptocurrencies. Candlestick charts are made up of two types of bars: the open and close bars.

The open bar shows the price of a cryptocurrency at the start of the bar. The close bar shows the price of a cryptocurrency at the end of the bar.

You can use candlestick charts to identify patterns in the prices of different cryptocurrencies. For example, you might look for patterns that suggest a cryptocurrency is about to go up or down.

Candlestick charts are useful for timing trades, as well. You can use them to determine when it is best to buy or sell a cryptocurrency.

Trading Crypto Currencies with Candlestick Charts

Candlestick charts are a popular way to visualize trading activity in crypto currencies.

To create a candlestick chart, first open a chart in your favorite trading software.

Next, select the "candlestick" option from the charting menu.

A candlestick chart will now be displayed.

Each candlestick corresponds to a single trade. The height of the candlestick indicates the amount of trade volume that occurred during that particular timeframe.

To view the underlying data for a given candlestick, right-click on the candlestick and select "View Data." This will open the data table for that particular candlestick.

How to Profit from Candlestick Charts in the Crypto Currency Market

Candlestick charts are a popular way to track the performance of individual cryptocurrencies and other assets.

To use candlestick charts, you'll first need to find a cryptocurrency or other asset you wish to track. You can find a list of all the available cryptocurrencies and other assets on CoinMarketCap.com.

Once you've found the cryptocurrency or other asset you wish to track, you'll need to open a trading account with a brokerage firm that offers candlestick charts. You can find a list of all the available brokerage firms on TradingView.com.

Once you've opened an account with a brokerage firm and logged in, you'll need to find the candlestick chart for the cryptocurrency or other asset you wish to track. To do this, you'll first need to find the "time frame" for the chart. This can be found under the "data" tab on the chart.

The time frame for the candlestick chart will be either "1 day," "7 days," "14 days," or "30 days." Once you've found the time frame, you'll need to find the "candlestick pattern." This can be found under the "patterns" tab on the chart.

The candlestick pattern for the cryptocurrency or other asset you wish to track will be either "bullish," "neutral," or "bearish." Once you've found the candlestick pattern, you'll need to find the "high," "low," and "close" for the candle. These can be found under the "historical data" tab on the chart.

Once you've found the high, low, and close for the candle, you'll need to find the "profit/loss" for the candle. This can be found under the "performance" tab on the chart.

If you'd like to sell the cryptocurrency or other asset you're tracking, you'll need to find the "sell" candle for the chart. The sell candle will be located under the "historical data" tab, and will have a "sell" price next to it.

If you'd like to buy the cryptocurrency or other asset you're tracking, you'll need to find the "buy" candle for the chart. The buy candle will be located under the "historical data" tab, and will have a "buy" price next to it.