Institutional Investment In Crypto Charts

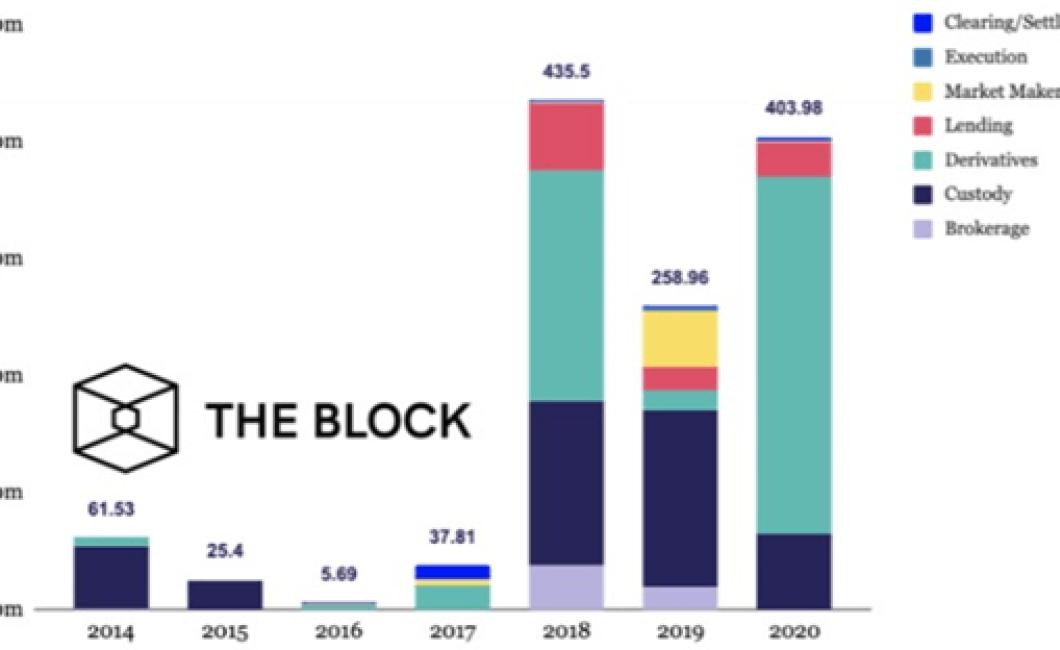

Institutional investment in cryptocurrency is growing despite the bear market. In 2018, there was an influx of institutional investors into the space, and that trend is continuing in 2019. The institutional investors are coming from traditional financial institutions, such as hedge funds, venture capitalists, and family offices. They are also coming from the tech sector and the online retail sector. The institutional investors are attracted to the potential of cryptocurrency and blockchain technology. They are also attracted to the volatility of the market.

How institutional investors are charting the course for cryptocurrency growth

Cryptocurrency investors are split into two camps: those who believe that cryptocurrencies will become a mainstream investment option and those who are more cautious.

Institutional investors are generally more cautious about cryptocurrencies, as they are still not well understood by most investors. However, some large institutional investors have started to invest in cryptocurrencies, as they see potential in the technology and the potential for growth.

Some institutional investors are also exploring the possibility of using cryptocurrencies as a way to reduce their exposure to traditional financial institutions.

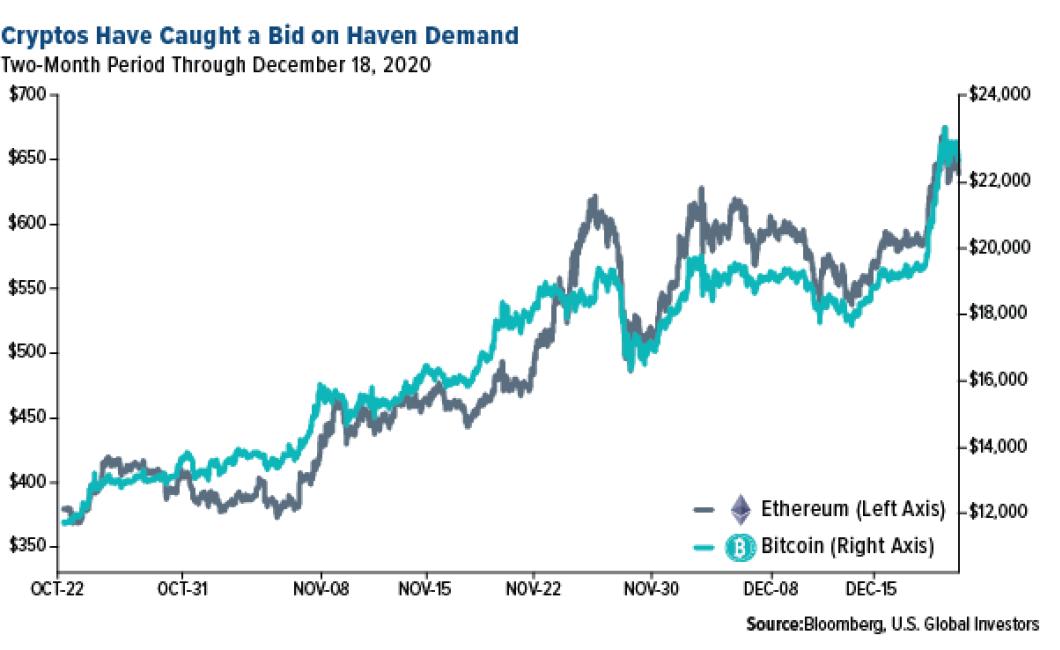

Why big money is turning to cryptocurrency investments

There are a few reasons why big money is turning to cryptocurrency investments. One reason is that cryptocurrency is a new and untested investment medium. This means that there is potential for big returns if the cryptocurrency does well. Another reason is that cryptocurrencies are decentralized, meaning that they are not subject to government or financial institution control. This means that they are not subject to the same regulations and restrictions as traditional investments. Finally, cryptocurrencies are not subject to the same financial institutions and taxation systems as other investments. This makes them attractive to investors who want to avoid government interference and taxation.

How institutional investors are driving the cryptocurrency market

There are a variety of institutional investors driving the cryptocurrency market. Large financial institutions, such as Goldman Sachs, JPMorgan Chase, and Citigroup, have been major players in the market. These institutions see the potential for cryptocurrencies to become a mainstream investment vehicle. They see cryptocurrencies as an opportunity to gain an edge over their competition.

Other institutional investors include hedge funds and investment banks. These entities invest in a variety of assets, including cryptocurrencies. They see the potential for cryptocurrencies to become a major financial instrument. They believe that the market has the potential to grow significantly in the future.

Individual investors also play a role in the cryptocurrency market. These individuals are attracted to the potential for high returns on investment. They see cryptocurrencies as a way to diversify their portfolio. They believe that the market has the potential to become very large.

The rise of institutional investment in cryptocurrency

Institutional investors are starting to take an interest in cryptocurrency and blockchain technology. This is likely to increase the value and adoption of cryptocurrencies and blockchain technology.

Some of the biggest institutional investors that are investing in cryptocurrency and blockchain technology include Fidelity Investments, Goldman Sachs Group, JP Morgan Chase, and Citigroup. These companies see the potential in these technologies and believe that they have the potential to revolutionize many industries.

Some of the reasons why these companies are investing in cryptocurrency and blockchain technology include the following:

1. They see the potential for cryptocurrencies and blockchain to revolutionize many industries.

2. They believe that cryptocurrencies and blockchain have the potential to reduce corruption and fraud.

3. They believe that cryptocurrencies and blockchain can help to improve financial transparency.

4. They believe that cryptocurrencies and blockchain can help to reduce the cost of financial transactions.

What institutional investors are doing to drive cryptocurrency growth

There are a few institutional investors that are driving the growth of cryptocurrency. These investors are typically large financial institutions that are looking to get involved in the cryptocurrency market. These institutions are investing in cryptocurrencies because they see potential in the technology and the potential for growth.

How institutional investors are changing the cryptocurrency landscape

There are a few major institutional investors who are starting to get interested in the cryptocurrency market. This includes firms such as Goldman Sachs, Morgan Stanley, and JPMorgan Chase. These firms are starting to invest in various cryptocurrencies and blockchain projects. They hope to find new opportunities in this area and make a profit.

Another group of institutional investors is studying the potential of cryptocurrencies and blockchain technology. They believe that this technology has the potential to change the way the world works. some of these companies include Accenture, IBM, and Microsoft. They are working on various projects to see how this technology can be used.

Overall, the institutional investors are changing the landscape of the cryptocurrency market. They are investing in various projects and hope to make a profit. This is a major shift in the industry and will help to bring more stability to the market.