Reading Candle Charts Crypto

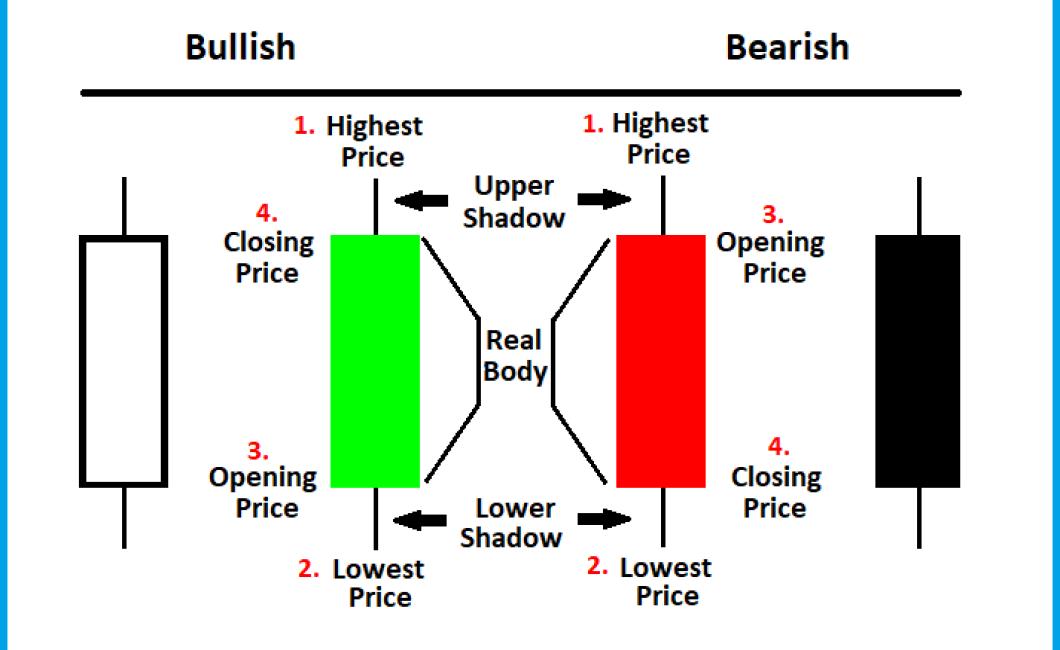

If you're interested in trading cryptocurrencies, one tool you may want to consider using is candle charts. In this article, we'll take a look at what candle charts are and how they can be used to help you trade digital currencies. Candle charts are a graphical way of displaying price data over a period of time. Each candlestick on the chart represents the price action for a specific time period, typically one day. The candlesticks are plotted on a price chart, with the price axis typically being the y-axis and the time axis being the x-axis. The four main elements of a candlestick are the open, high, low, and close. The open is the price at which the period started, while the close is the price at which it ended. The high and low prices are the highest and lowest prices traded during the period. There are two main types of candle charts - line charts and bar charts. Line charts simply connect the dots between the open and close prices for each time period, while bar charts also include the high and low prices for each period. Candle charts can be used to identify trends, support and resistance levels, and potential reversals. When used in conjunction with other technical indicators, they can provide valuable insights into where the market may be headed next.

How to read candle charts for cryptocurrency trading

There are a few different ways to read candle charts for cryptocurrency trading. One way is to look at the candles as a guide to where the price is headed. For example, if the candle is close to the bottom of the chart, that might mean that the price is heading downwards. If the candle is close to the top of the chart, that might mean the price is heading upwards.

Another way to read candle charts is to look at the trend. For example, if the candle is moving slowly and consistently in one direction, that might be a sign that the trend is continuing. If the candle is moving quickly and erratically, that might be a sign that the trend is changing.

3 things you need to know about reading candle charts for crypto

1. candle charts are a visual representation of a cryptocurrency's price over time.

2. They can be used to help investors make informed decisions about when to buy or sell a cryptocurrency.

3. Candle charts can be used to identify trends in a cryptocurrency's price.

A beginner's guide to reading candle charts for cryptocurrency

candles are a popular way to track the performance of a cryptocurrency. Candle charts are a graphical representation of how much the price of a cryptocurrency has changed over a given period of time.

The following guide will explain the basics of candle charts and how to use them to analyze the performance of a cryptocurrency.

What is a candle chart?

A candle chart is a graphical representation of how much the price of a cryptocurrency has changed over a given period of time. Candle charts are typically displayed as a series of circles, with each circle representing a certain amount of time. The size of the circles corresponds to the percentage change in price over that period of time.

For example, if you were to look at the candle chart for Bitcoin, you would see that the price of Bitcoin has fluctuated between $6,000 and $8,000 over the past six months. The size of the circles on the candle chart corresponds to the percentage change in price over that period of time.

How to use candle charts

Candle charts can be used to analyze the performance of a cryptocurrency over a given period of time. Simply look at the candle chart and try to figure out what happened in terms of price changes.

For example, if you were to look at the candle chart for Bitcoin, you would see that the price of Bitcoin has fluctuated between $6,000 and $8,000 over the past six months. The size of the circles on the candle chart corresponds to the percentage change in price over that period of time.

This means that if the size of the circle is big (large percentage change), then the price of Bitcoin went up a lot during that period of time. Conversely, if the size of the circle is small (small percentage change), then the price of Bitcoin went down a lot during that period of time.

How to interpret candle charts when trading cryptocurrency

When trading cryptocurrencies, candle charts are an important tool to use. Candle charts plot the price of a cryptocurrency over time, and can be used to identify trends and patterns.

When looking at a candle chart, it is important to focus on the length of the candles. The longer the candles, the more liquid the market is. When the market is more liquid, it is easier to buy and sell cryptocurrencies, and prices will move more quickly.

Another thing to watch for on a candle chart is the supply and demand balance. If the supply is higher than the demand, prices will be lower, and vice versa. This information can help you determine when to buy and sell cryptocurrencies.

What do candlesticks mean in cryptocurrency trading?

Candlesticks are used in technical analysis to show the trend of a cryptocurrency's price over time. They can be used to identify support and resistance levels, as well as to predict when a cryptocurrency is likely to make a move.

How to use candlestick charts to trade cryptocurrency

Candlestick charts are a popular way to trade cryptocurrencies because they provide a visual representation of the price action over a set period of time.

To use candlestick charts, first find the open, high, low, and close prices for the given period of time. Next, plot the candles using a simple moving average or Bollinger Bands. Finally, look for patterns in the candle movements and use that information to make trading decisions.

For example, if you see that the candle on the leftmost column is closing higher than the candle on the rightmost column, that might be an indication that the price is about to go up. If you see that the candles are consistently closing lower than the moving average or Bollinger Bands, that might be an indication that the price is about to go down.

A guide to understanding and reading candle charts for crypto

A candle chart is a graphical representation of price movements over time. Candles on a chart are represented by a series of lines that move up and down in price.

The height of a candle is the amount of money that was spent on that particular security at that point in time. The length of a candle is the time it took for the candle to reach that height.

A candlestick is a type of chart that shows the price movement of a security over time. Each candlestick is made up of three segments: the open, the high, and the low. The open is the first point at which the security's price is available for trading. The high is the point at which the security's price reached its highest point during the period under examination. The low is the point at which the security's price reached its lowest point during the period under examination.