When to buy and sell crypto charts?

If you're thinking about buying or selling cryptocurrency, it's important to understand how to read crypto charts. Charts can help you identify trends and make informed decisions about when to buy and sell. Here's a guide to reading crypto charts and using them to your advantage.

The Benefits of Using Crypto Charts

Cryptocurrencies are becoming increasingly popular, with a market capitalization of over $1 trillion as of January 2019. Crypto charts can provide investors with a visual representation of the latest trends and movements in the cryptocurrency markets.

Cryptocurrency charts can also be used to identify potential buying and selling opportunities. By following the movements of specific cryptocurrencies, investors can determine whether they are undervalued or overvalued.

Cryptocurrencies are also unique in that they are not subject to government or financial institution control. As a result, they may be more volatile than traditional assets. However, crypto charts can provide an accurate snapshot of the current market conditions.

Finally, crypto charts can be helpful in understanding the complex nature of the cryptocurrency markets. By analyzing the various indicators, investors can better understand the dynamics of the market.

How to Read Crypto Charts

Cryptocurrency charts are a great way to monitor the market and see how prices are moving. When you first start looking at charts, it can be a bit overwhelming. However, once you get the hang of it, you'll be able to read crypto charts like a pro.

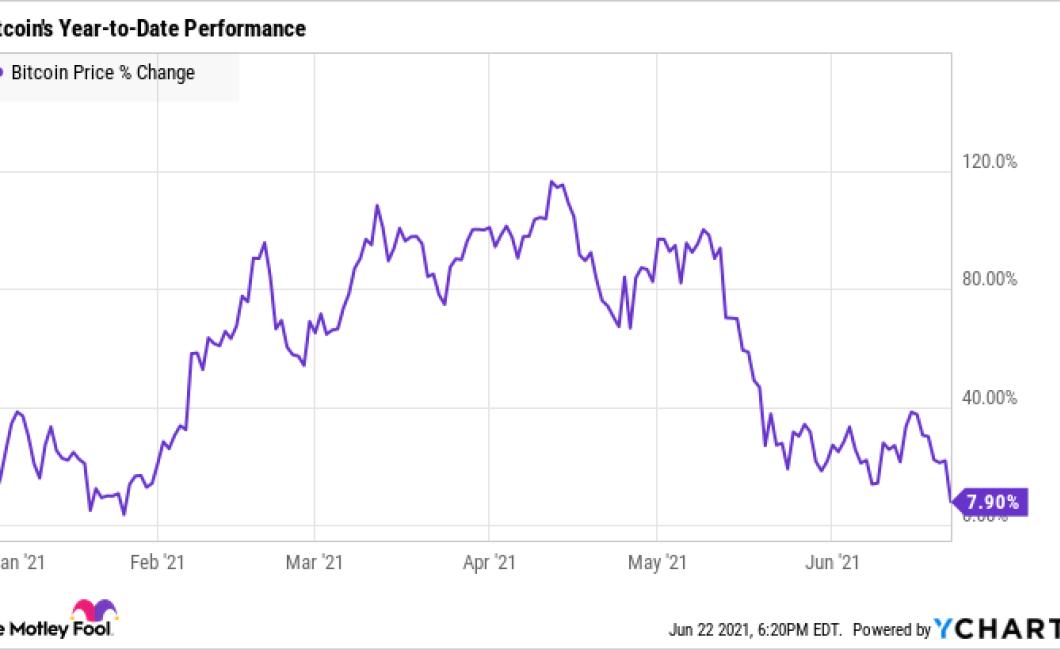

The first thing you need to do is find the currency you're interested in. For example, if you're looking at Bitcoin charts, you would look for "Bitcoin."

Once you've found the currency you're interested in, you'll need to find the chart. There are a few different ways to find a crypto chart:

1. Use a search engine. Just type in "cryptocurrency chart" into a search engine and you'll be presented with a variety of options.

2. Go to a website that specializes in cryptocurrency charts. Some of the more popular websites include CoinMarketCap and TradingView.

3. Use a mobile app. Several cryptocurrency charting apps are available on both Android and iOS devices.

Once you've found the chart, the next step is to understand how to read it. Here are a few tips:

1. Look at the overall market trend. This is the most important thing to look at when reading crypto charts. Make sure to pay attention to how prices are moving overall and whether there are any major changes happening.

2. Watch for breakout prices. When prices start to move significantly higher or lower than the rest of the market, this is often a sign of a potential breakout. Keep an eye on these prices to see if they reach their targets.

3. Watch for indicators. Many cryptocurrencies have specific indicators that can help you predict how the market is likely to move. These indicators can include MACD, RSI, and Bollinger Bands.

4. Try different timeframes. Some investors prefer to focus on short-term charts while others prefer longer-term charts. Experiment to see what works best for you.

5. Use charts as a guide, not a gospel. Don't let the charts dictate all of your investment decisions. Instead, use them as a tool to help you make informed decisions.

What do Crypto Charts Mean?

Crypto charts are used to visually represent the movement of a cryptocurrency’s price over time. Crypto charts can be used to track price movements, identify trends, and forecast future prices.

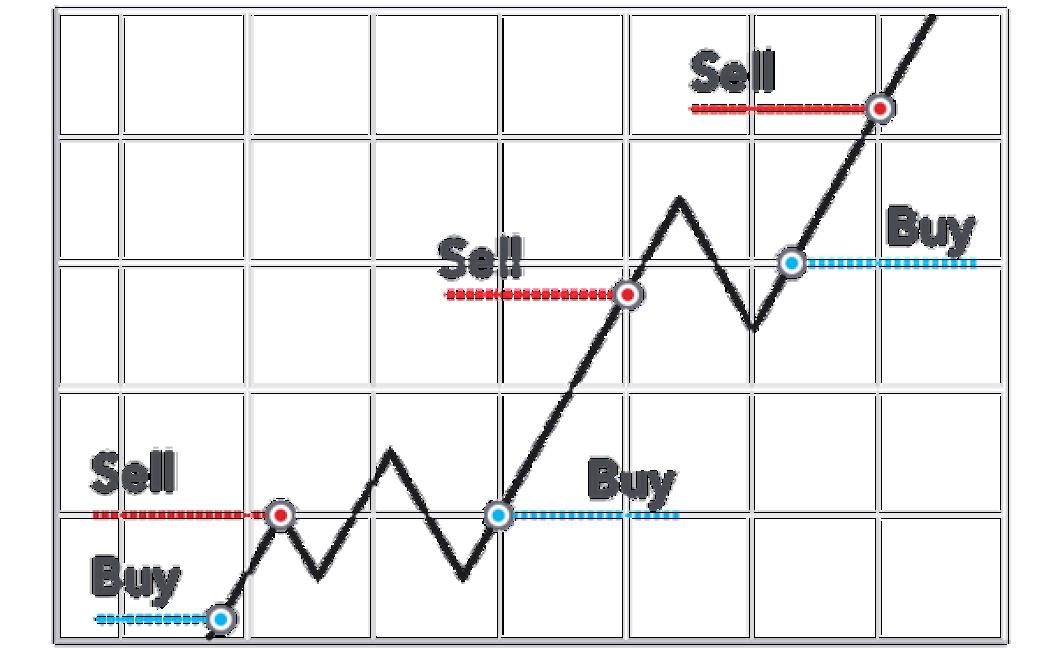

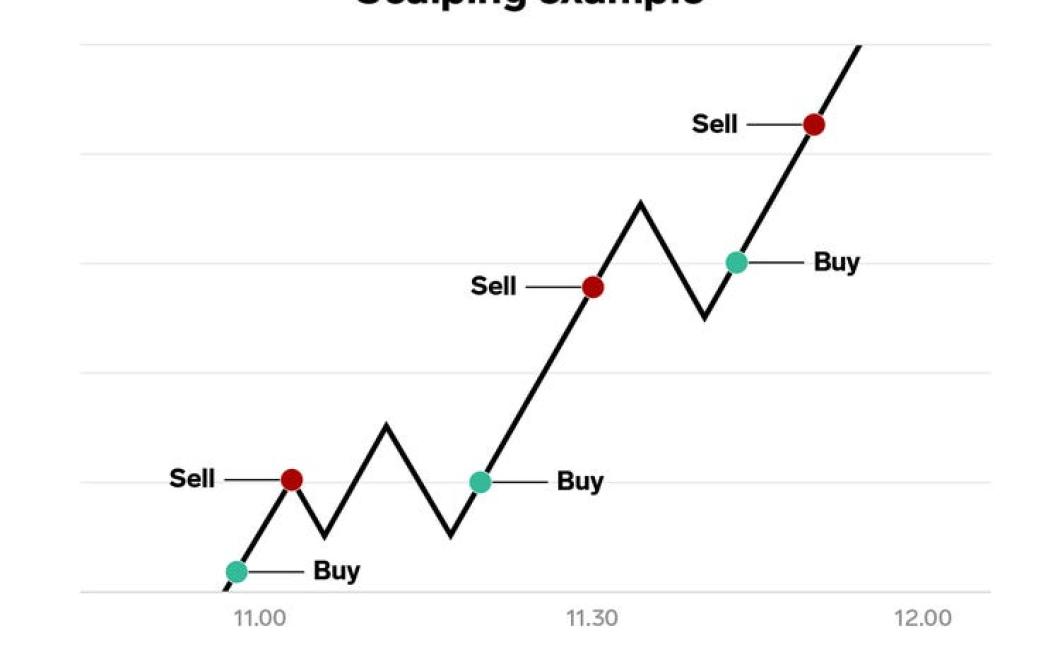

When to Buy and Sell Based on Crypto Charts

You should always do your own research when it comes to cryptocurrency trading, but there are some general rules you can follow in order to make better decisions.

When to Buy

Cryptocurrency prices are always in a state of flux, which means that it can be difficult to predict the future movements of a given coin. However, there are certain coins that are more likely to increase in value over time, and you should aim to buy these coins when they are relatively cheap.

For example, if you believe that Bitcoin will continue to grow in value, you should buy Bitcoin when its price is low. Conversely, if you think that Bitcoin is headed for a decline, you should wait until its price is higher before investing.

When to Sell

Similarly, you should sell your coins when their prices rise. This means that you should wait for a coin’s price to reach a certain level before selling it. For example, if you believe that Ethereum will reach $1,000 by the end of the year, you should wait until Ethereum’s price reaches $900 before selling.

Remember that cryptocurrency prices are constantly in flux, so don’t be afraid to adjust your strategy as needed.

How to Use Crypto Charts to Maximize Profit

Crypto charts are one of the most popular tools used by traders and investors. By using a crypto chart, you can analyze the price of a cryptocurrency over time and make informed investment decisions.

To use a crypto chart effectively, you first need to understand the different types of charts. There are three main types of charts:

1. Candle Chart

A candle chart is used to display the movement of a cryptocurrency over time. On a candle chart, each candle shows the price movement of a specific currency over a specific time period.

2. Line Chart

A line chart is used to display the trend of a cryptocurrency over time. On a line chart, each line shows the price movement of a specific currency over a specific time period.

3. Volume Chart

A volume chart is used to show how much cryptocurrency is being traded over time. On a volume chart, each bar shows the amount of cryptocurrency traded over a specific time period.

Once you understand the different types of charts, you can use them to maximize your profit.

1. Use a Candle Chart to Track Price Movement

A candle chart is perfect for tracking the price movement of a cryptocurrency over time. On a candle chart, each candle shows the price movement of a specific currency over a specific time period.

To use a candle chart to track the price movement of a cryptocurrency, first find the timeframe that you want to track. For example, you can track the price movement of a cryptocurrency over the course of one day.

Next, find the candles that you want to track. For example, you can track the price movement of Bitcoin over the course of a day.

Finally, use the candles to track the price movement of the cryptocurrency. For example, if the value of Bitcoin rises from $6,000 to $6,500 over the course of a day, you would place a $6,500 candle at the bottom of the candle chart and a $6,000 candle at the top of the candle chart.

2. Use a Line Chart to Track Trend

A line chart is perfect for tracking the trend of a cryptocurrency over time. On a line chart, each line shows the price movement of a specific currency over a specific time period.

To use a line chart to track the trend of a cryptocurrency, first find the timeframe that you want to track. For example, you can track the trend of Bitcoin over the course of one week.

Next, find the lines that you want to track. For example, you can track the trend of Bitcoin over the course of one day.

Finally, use the lines to track the trend of the cryptocurrency. For example, if the value of Bitcoin rises from $6,000 to $6,500 over the course of one day, you would place a $6,500 line at the bottom of the line chart and a $6,000 line at the top of the line chart.

Tips for Trading Using Crypto Charts

1. Always do your own research. Don’t trust anyone blindly when it comes to trading or investing in cryptocurrencies.

2. Understand the charts. Charting is an important part of trading, and understanding different types of charts can help you make better decisions.

3. Know your indicators. Different types of indicators can help you predict price movements.

4. Use a stop loss. A stop loss is a set limit on your losses, and it’s important to use one if you’re trading cryptocurrencies.

5. Don’t overtrade. Over trading can lead to losses, so be careful not to trade too much or too fast.

Understanding the Risks of Trading Based on Crypto Charts

There are a few key things to keep in mind when trading based on cryptocurrency charts. First, it’s important to remember that cryptocurrency charts are not always accurate. This means that you may not be able to make accurate trades based on them.

Second, cryptocurrency charts can be volatile. This means that prices of cryptocurrencies can change rapidly, which can lead to losses if you aren’t careful.

Finally, cryptocurrency trading is a high-risk activity. This means that you may lose a significant amount of money if you don’t make smart trades.

What are the Most Commonly Used Crypto Charts?

Cryptocurrency charts are used to track the performance of digital currencies such as bitcoin and Ethereum. They can be used to find trends, identify market moves and help investors make informed decisions.

How to Create a Crypto Chart

There are a few ways to create a crypto chart. You can use a cryptocurrency exchange's API to generate a chart of the prices over time, or you can use a cryptocurrency trading platform's built-in charting tools.

If you're using an exchange's API, you'll need to provide the exchange's API key and secret. Then, you can use the API to generate a chart of the prices over time.

If you're using a trading platform's built-in charting tools, you'll need to first find the currency you're interested in charting. Once you've found the currency, you'll need to find the trading platform's API key and secret. Then, you can use the API to generate a chart of the prices over time.