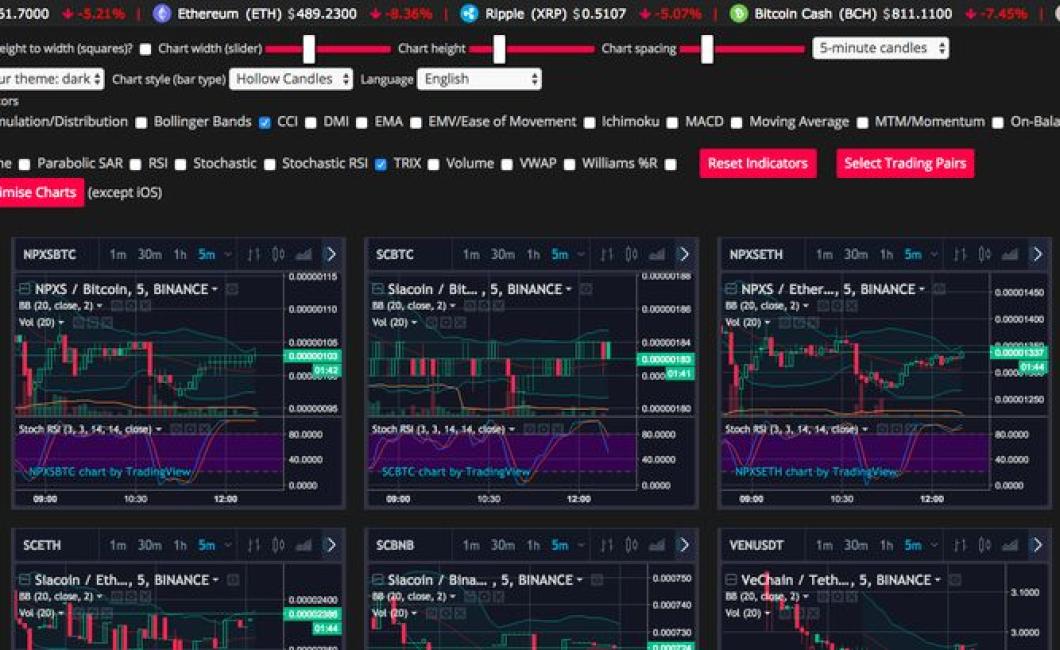

Live crypto charts with Bollinger Bands

Bollinger Bands are a technical analysis tool that is used to measure market volatility. They are calculated using a simple moving average and standard deviation. Bollinger Bands can be used to trade a variety of assets, including crypto currencies. The live crypto charts on our website show the Bollinger Bands for each currency pair. You can use these charts to help you make trading decisions.

How to Use Bollinger Bands to Trade Cryptocurrencies

Bollinger Bands are a technical analysis indicator used to measure the volatility of a security or currency. When applied to cryptocurrencies, Bollinger Bands can be used to gauge the likelihood of a price rally or fall.

To use Bollinger Bands on a cryptocurrency exchange, open a chart with the Bollinger Band indicator enabled. On the left side of the chart, locate the lower band and draw a horizontal line above it. On the right side of the chart, locate the upper band and draw a horizontal line below it. The two lines will indicate the current volatility levels for the cryptocurrency.

As the price of a cryptocurrency moves between the lower band and the upper band, it is likely that there will be a price rally. Conversely, if the price moves outside of the Bollinger Bands, it is likely that there will be a price fall.

Bollinger Bands can be used in conjunction with other technical analysis indicators to help traders make informed decisions about when to buy and sell cryptocurrencies.

Trading Cryptocurrencies with Bollinger Bands

Bollinger Bands are a technical analysis indicator that can be used to trade cryptocurrencies. When used in conjunction with other indicators, Bollinger Bands can help traders identify potential price trends and opportunities.

To use Bollinger Bands, open a chart for a cryptocurrency and locate the Bollinger Band indicator. To set the band width, adjust the indicator's upper and lower limits. The default values are .8 and 2.0, which indicate that the band width will be 8% and 20% of the daily candle's range, respectively.

Once the band is set, hover your mouse over the indicator's line to view the current price and volatility. To find potential price trends, use the band's width as a guide. For example, if the band is wide and the price is moving higher, look for other cryptocurrencies that are trading within the same Bollinger Band range. If the band is narrow and the price is moving lower, consider selling the cryptocurrency and buying another within the band's range.

Bollinger Bands and Cryptocurrency Trading

Bollinger Bands are a technical indicator used in price analysis. They are named after John Bollinger, the creator of the indicator. Bollinger Bands are a simple moving average used to indicate the current price range of a security or commodity.

Cryptocurrencies are often traded on exchanges using digital currencies such as Bitcoin, Ethereum, and Litecoin. When trading cryptocurrencies, it is important to understand how Bollinger Bands work and how they can be used to improve your trading strategy.

Bollinger Bands use a simple moving average to help predict price movements. The bands are based on the average price of a specific period over a number of previous periods. When the price of a security or commodity moves outside of the Bollinger Bands, it is generally considered to be a buy signal. When the price moves within the Bollinger Bands, it is considered to be a sell signal.

When using Bollinger Bands as part of your cryptocurrency trading strategy, it is important to keep in mind that they are not infallible. They are simply a tool that can be used to help improve your trading strategy.

Using Bollinger Bands to trade Bitcoin

Bollinger Bands are a technical indicator used to identify the price range of a security. They are also used to make trading decisions.

To use Bollinger Bands in trading, first find the appropriate time frame for your trading strategy. For example, you may use Bollinger Bands to trade stocks over the course of a day.

The Bollinger Bands indicator consists of two bands: the upper band indicates the current price range, and the lower band indicates the lower limit of that range. The bands will widen or contract as the price moves within the range.

To set up the Bollinger Bands indicator, open a chart with prices of a security you want to trade. Click on the indicator box in the lower left corner of the chart window and select "Bollinger Bands."

Enter two values into the "Lower" and "Upper" fields. The "Width" field determines the width of the bands. The narrower the bands, the more volatile the price is. The "Length" field sets the number of periods for the bands.

Click on the "Settings" button and set the "Refresh Rate" to "daily." Click on the "Close" button to finish setting up the Bollinger Bands indicator.

Now you're ready to start trading. To use the Bollinger Bands indicator, right-click on the security's price and select "With Bollinger Bands." The Bollinger Bands window will appear.

To use the Bollinger Bands indicator, first find the appropriate time frame for your trading strategy.

The Bollinger Bands indicator consists of two bands: the upper band indicates the current price range, and the lower band indicates the lower limit of that range. The bands will widen or contract as the price moves within the range.

To set up the Bollinger Bands indicator, open a chart with prices of a security you want to trade. Click on the indicator box in the lower left corner of the chart window and select "Bollinger Bands."

Enter two values into the "Lower" and "Upper" fields. The "Width" field determines the width of the bands. The narrower the bands, the more volatile the price is. The "Length" field sets the number of periods for the bands.

Click on the "Settings" button and set the "Refresh Rate" to "daily." Click on the "Close" button to finish setting up the Bollinger Bands indicator.

Now you're ready to start trading. To use the Bollinger Bands indicator, right-click on the security's price and select "With Bollinger Bands." The Bollinger Bands window will appear.

To use the Bollinger Bands indicator, first find the appropriate time frame for your trading strategy.

How to trade Ethereum using Bollinger Bands

There is no single answer to this question as the best way to trade Ethereum using Bollinger Bands depends on your individual trading strategy. However, one approach that many traders use is to use a Bollinger Bandwidth indicator to help them identify potential opportunities to buy or sell Ethereum.

To use a Bollinger Bandwidth indicator, first open up your trading platform of choice and create a new trade. Once you have created your trade, input the price of Ethereum you would like to buy or sell and select the Bollinger Bandwidth indicator type.

Once you have selected the Bollinger Bandwidth indicator, the indicator will display two sets of bands. The first set of bands will show you the current price range for Ethereum while the second set of bands will show you the potential price range for Ethereum.

To enter into a buy or sell order, simply move the cursor over the lower band of the Bollinger Bandwidth indicator and click on the buy or sell button.

Trading Litecoin with Bollinger Bands

When trading Litecoin with Bollinger Bands, it is important to understand the Bollinger Band Width. The Bollinger Band Width is a technical indicator used to measure price fluctuations.

The Bollinger Band Width is calculated by taking the standard deviation of the Bollinger Band and dividing it by 2. For example, if the standard deviation of the Bollinger Band is .25, the Bollinger Band Width would be .5.

The narrower the Bollinger Band Width, the more volatile the price movements are. When the Bollinger Band Width is wide, the price movements are relatively stable.

What are Bollinger Bands and how can they help you trade better?

Bollinger Bands are a technical analysis tool that can help traders identify price patterns and determine when to buy or sell. When used in conjunction with other technical analysis tools, Bollinger Bands can provide a more complete picture of market conditions and help you make better trading decisions.

How to read crypto charts with Bollinger Bands

To read crypto charts with Bollinger Bands, first find the appropriate time frame for the chart. For example, if you are looking at a weekly crypto chart, you would need to find the week number. Once you have identified the week number, you can find the beginning and end of the week on the chart. Once you have located these points, you can find the open and close prices for that week.

Next, you will need to find the Bollinger Band width for that particular time frame. The Bollinger Band width is the distance between the open and close prices. For example, if the Bollinger Band width is .5, then the price range for that time frame is between the open price and the close price.

Once you have located the Bollinger Band width, you can start to plot the prices on the chart. You will want to plot the prices close to the Bollinger Band width, but not too close. If the price is plotted too close to the Bollinger Band width, it will be difficult to see the movement of the price. Instead, you want to plot the prices a little bit outside of the Bollinger Band width. This will allow you to see the movement of the price more easily.

What do Bollinger Bands tell you about a cryptocurrency?

Bollinger Bands are a technical indicator used to measure the volatility of a cryptocurrency. When the bands are tight, this indicates that the market is more volatile and may be less likely to experience large price swings. When the bands are wider, this indicates that the market is less volatile and is more likely to experience large price swings.

Bollinger Bands and what they mean for your trading

Bollinger Bands are technical indicators that can be used to help traders identify potential market trends.

Generally, a Bollinger Band is a two-dimensional chart that shows the range of prices over a certain period of time. The width of the band indicates how tightly prices are clustered around a certain price point, and the height of the band indicates how far prices vary from that point.

Bollinger Bands can be used to identify conditions that might lead to a trend reversal, such as when prices are moving too quickly or slowly for the band to remain stable. By watching the band and reacting accordingly, traders can avoid unnecessary losses or gains.

How to use Bollinger Bands to make better trades

There is no one-size-fits-all answer to this question, as the use of Bollinger Bands will vary depending on the trading strategy that you are using. However, some tips on how to use Bollinger Bands in your trading strategy include:

Using Bollinger Bands to trade cryptocurrencies like a pro

Bollinger Bands are a technical analysis tool that can be used to trade cryptocurrencies like a pro.

When using Bollinger Bands, traders should consider the following factors:

1) The band width – This is the range of prices that the Bollinger Bands will encompass. It is important to remember that the wider the band, the more volatile the market will be.

2) The upper and lower bands – These are the limits of price movement within the band. If the price falls below the lower band, it is considered to be in a bear market, while if it rises above the upper band, it is considered to be in a bull market.

3) The bands’ height – This tells traders how wide the bands are and how active the market is. The height of the bands is also indicative of how much pressure is currently being exerted on the price.

4) The volatility – This tells traders how often the price moves between the upper and lower bands. Volatility is also indicative of how risky the market is.