Stock Charts For Crypto

This article discusses different types of stock charts that can be used to track the performance of cryptocurrencies. It also explains how to interpret these charts and what information they can provide about the market.

How to Read Crypto Stock Charts

To read crypto stock charts, follow these steps:

1. Look at the chart to see the current price and volume.

2. Compare the price and volume to see if there is a significant change.

3. Look for patterns in the price and volume to get an idea of what is happening.

4. If you want to buy or sell cryptocurrencies, look at the charts to see if there is a good time to do so.

3 Types of Crypto Charts You Should Know

Cryptocurrency charts are widely used to track the prices and movements of digital assets. There are a few different types of cryptocurrency charts you should know about if you want to track the prices of various digital assets.

The first type of cryptocurrency chart is a basic candle chart. This type of chart shows the price of a digital asset over a period of time using a candle symbol. The size of the candle corresponds to the value of the asset at that moment.

The second type of cryptocurrency chart is a candlestick chart. Candlestick charts are more detailed than basic candle charts and show the price of a digital asset over a period of time using a series of coloured candlesticks. The colour of the candlestick corresponds to the volume of trading activity for that asset at that moment.

The third type of cryptocurrency chart is a bar chart. This type of chart shows the price of a digital asset over a period of time using a horizontal bar. The height of the bar corresponds to the value of the asset at that moment.

The fourth type of cryptocurrency chart is a Venn diagram. This type of chart shows the overlap between different groups of users for a given digital asset. The different colours indicate the different types of users for that asset.

The fifth type of cryptocurrency chart is a Trello board. This type of chart shows the progress of a project for a given digital asset. The different colours indicate the different stages that project is in.

A Beginner's Guide to Crypto Stock Charting

Crypto trading can be a very exciting and profitable venture, but it can also be quite confusing. In this beginner's guide, we'll explain how to use crypto stock charts to make informed decisions about your investments.

Crypto stock charts are a great way to track the performance of individual cryptocurrencies. By looking at a chart, you can see how each coin is performing over time, and you can also see how the prices of different cryptocurrencies are related.

There are a few things you need to know before you start using crypto stock charts. First, you need to have a basic understanding of how cryptocurrency works. Second, you need to understand how to read a chart. Third, you need to have an understanding of how to use technical analysis to make investment decisions. Fourth, you need to be familiar with the different types of crypto charts.

Let's take a look at each of these points in more detail.

Cryptocurrency 101

Before you can use crypto stock charts, you need to understand some basics about cryptocurrency. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are created through a process called mining. Miners are rewarded with cryptocurrency for verifying and recording transactions on the blockchain. Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous person or group known as Satoshi Nakamoto.

How to Use Crypto Stock Charts

To use crypto stock charts, you first need to select a cryptocurrency you want to track. You can track any cryptocurrency on a variety of exchanges, including Binance, Coinbase, and Bittrex. Once you've selected a cryptocurrency, you can open a free account with one of the exchanges listed above.

Once you have an account with an exchange, you need to locate the coin's chart. The coin's chart will be located on the exchange's website, usually in the "Market" section. On the coin's chart, you will see different columns, including "Open," "High," "Low," and "Close."

Each column represents a different period of time. The "Open" column shows the price of the coin at the beginning of the period. The "High" column shows the highest price recorded during the period. The "Low" column shows the lowest price recorded during the period. The "Close" column shows the final price of the coin at the end of the period.

To use crypto stock charts, you first need to identify the period you're interested in. For example, if you're interested in bitcoin charting, you would look at the "Open," "High," "Low," and "Close" columns. If you're interested in Ethereum charting, you would look at the "Open," "High," "Mid," and "Close" columns.

Once you've identified the period you're interested in, you need to determine which currency is being tracked. To do this, you need to look at the "Market" tab on the coin's chart and find the currency name. For example, on the bitcoin chart, the currency name is "BTC."

Once you've determined which currency is being tracked, you need to look at the " candles ." A candle is a graphical representation of how much money has been exchanged between buyers and sellers during the period being tracked. On the bitcoin chart, for example, you would see candles for every hour from 0:00 AM to 11:59 PM.

Each candle shows the amount of money exchanged between buyers and sellers during that hour. You can use this information to determine which direction the market is moving. For example, if you see a candle that has been traded a lot of volume in one direction, that likely means that the market is trending in that direction.

If you want to track multiple cryptocurrencies, you can toggle between them by clicking on the "Time Frame" dropdown menu at the top of the chart. This will show you charts for each currency in different time periods.

Technical Analysis

Technical analysis is a method used to make investment decisions by analyzing the behavior of markets and financial instruments. Technical analysis can be used to predict future trends, and it can be used to make decisions about where to buy and sell cryptocurrencies.

Technical analysis is based on four main principles: supply and demand, trendlines, support and resistance levels, and Fibonacci ratios. Each of these principles can be used to make predictions about where the market is headed.

Supply and demand is based on the idea that there will always be a certain amount of supply and demand for a particular good or service. When there is increased demand for a good, suppliers will rush to meet that demand, resulting in increased prices. When there is decreased demand for a good, suppliers will pull back, resulting in decreased prices.

Trendlines are lines that show how prices have trended over time. When prices move along a trendline, it often indicates that there is a strong trend present in the market.

Support and resistance levels are areas where prices have been stuck for a long period of time. When prices reach a resistance level, buyers tend to pull back, and when prices reach a support level, buyers tend to enter the market.

Fibonacci ratios are ratios that were developed by Italian mathematician Leonardo Fibonacci in 1202 AD. These ratios are used to predict how prices are likely to move in future periods. For example, if you see Fibonacci ratios that are close to each other, that often indicates that prices are likely to move in the same direction.

Technical analysis is not 100% accurate, but it can help you make informed decisions about your investments.

Crypto Stock Charts 101

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. These tokens are decentralized, meaning they are not subject to government or financial institution control. Cryptocurrencies are created through a process called mining. Miners are rewarded with cryptocurrency for verifying and recording transactions on the blockchain. Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous person or group known as Satoshi Nakamoto

The Different Ways to Chart Cryptocurrencies

There are a few different ways to chart cryptocurrencies. Each has its own advantages and disadvantages.

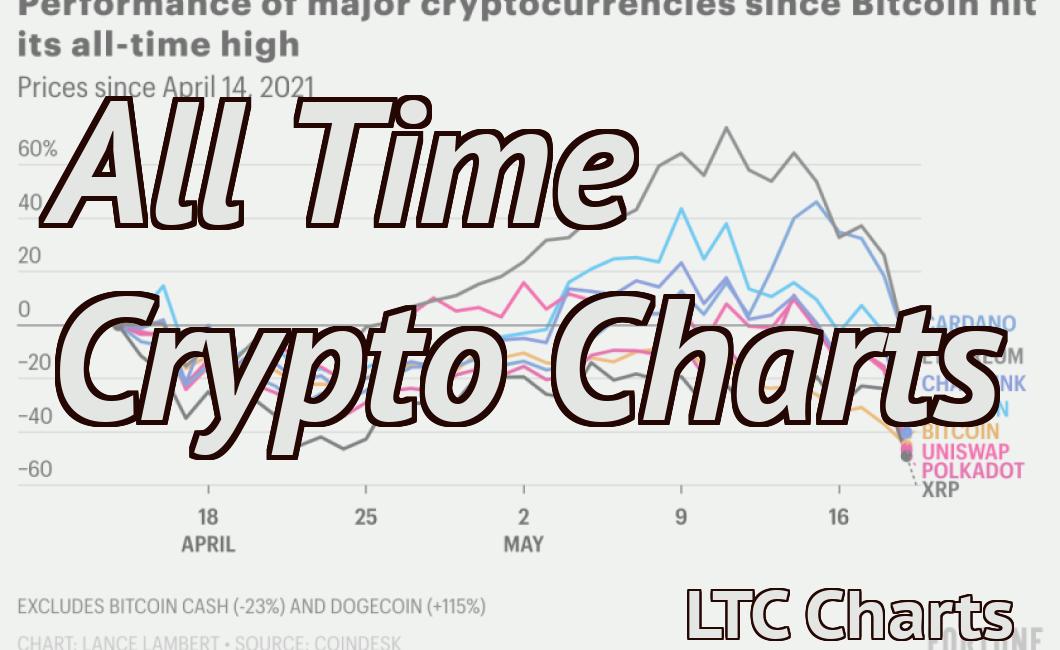

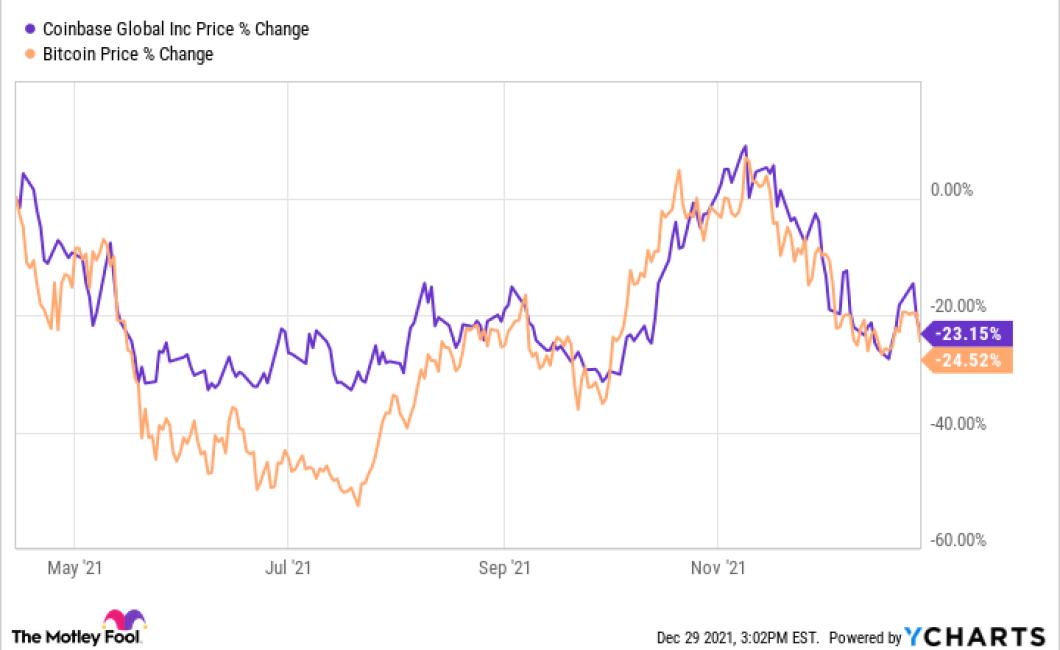

The first way is to simply plot the price of a cryptocurrency against time. This can be done using a chart like this:

This chart shows the price of Bitcoin over the past year. The price is plotted against time, with the green line representing the current price and the red line representing the price one year ago.

The second way to chart cryptocurrencies is to use a candlestick chart. This type of chart shows the price of a cryptocurrency over a period of time, typically day by day. Candlestick charts are popular for their simplicity and easy to read format.

The following candlestick chart shows the price of Bitcoin over the past week:

The third way to chart cryptocurrencies is to use a technical analysis tool like TradingView. This type of tool allows you to analyse the market trends and make predictions about future prices.

The following TradingView chart shows the price of Bitcoin over the past month:

The fourth way to chart cryptocurrencies is to use a volume-based indicator. This type of indicator measures the amount of cryptocurrency being traded on a given day. Volume-based indicators are useful for measuring the overall health of the cryptocurrency market.

The following volume-based indicator shows the daily trading volume of Bitcoin over the past month:

Finally, another way to chart cryptocurrencies is to use a graph like this:

This graph shows the total number of cryptocurrency wallets on different platforms. It is useful for seeing how popular cryptocurrencies are overall.

Why Use Charts When Trading Cryptocurrency Stocks?

One of the most popular ways to trade cryptocurrency stocks is to use charts. Charts allow investors to see a visual representation of their portfolio, and can help them make better investment decisions. They can also help traders see patterns in price movements, which can help them identify opportunities and avoid potential pitfalls.

How to Analyze Crypto Stock Charts

Crypto stock charts are essential for anyone interested in the cryptocurrency market. They can provide insights into the price movements of specific cryptocurrencies, as well as the overall market performance.

There are several different ways to analyze crypto stock charts. Here are a few tips:

1. Look at the overall trend.

If you are looking for an overview of the current market conditions, it is important to look at the overall trend. This will help you determine whether the prices are going up or down, and whether there is any significant news affecting the market.

2. Compare the prices of different cryptocurrencies.

One of the most important things to do when analyzing crypto stock charts is to compare the prices of different cryptocurrencies. This will help you identify which ones are doing well and which ones are struggling.

3. Watch for patterns.

When looking at crypto stock charts, it is important to watch for patterns. This includes noticing how the prices are moving over time, and identifying any specific occasions when the prices spiked or dropped. This can help you determine whether there is any underlying trend, and whether you should make any investments based on that trend.

Technical Analysis of Crypto Charts

Crypto charts are used to track the performance of cryptocurrencies and other digital assets. The data shown on the charts is gathered from a variety of sources, including exchanges, global news, and social media.

Cryptocurrencies are often traded on digital exchanges, and the prices of these assets are often volatile. This means that the data shown on crypto charts can be highly volatile.

Cryptocurrencies are also often used as an investment vehicle, and their prices are affected by a number of factors, including political events, market sentiment, and technical analysis.

Cryptocurrencies are often traded on digital exchanges, and the prices of these assets are often volatile. This means that the data shown on crypto charts can be highly volatile.

Using Candlestick Charts for Crypto Stock Trading

Candlestick charts are a popular way to view cryptocurrency prices. They are easy to understand and can be used to make quick, informed decisions about whether to buy or sell.

To use candlestick charts for crypto stock trading, first identify the opening and closing prices for the day. Make a note of the high and low values for each candle. Next, plot the candles on a chart. The horizontal axis should be labeled "time." The vertical axis should be labeled "price."

When looking at a candlestick chart, it is important to focus on the "tick" marks on the horizontal axis. These represent the periods during which the price changed by a fixed amount. For example, the "tick" mark at the bottom of the chart might represent a change in price of 0.10%.

When looking at a candlestick chart, it is also important to focus on the "candles." These represent the volume of transactions that took place during that particular period. For example, if there were four candles, then the volume for that period would be 4x.

Comparing Crypto Stock Charts

Looking at crypto stock charts, it is easy to see that there is a lot of volatility and price movement. This can be a bit confusing for some people, as it can be hard to know what to do with this information.

For those unfamiliar with stock charts, volatility is simply the amount of change in price over a given period of time. This can be measured in percentages, and can range from very low levels (less than 1%) to very high levels (more than 100%).

Price movement is simply the amount of change in price over a given period of time. This can be measured in percentages, and can range from very low levels (less than 1%) to very high levels (more than 100%).

Reading Volume in Crypto Charts

Volume is one of the most important metrics when it comes to understanding the health of a cryptocurrency market. Volume reflects the number of trades that have taken place over a particular period of time. This metric can be used to indicate the strength of demand for a particular cryptocurrency.

Interpreting Price Action in Crypto Charts

Price action in crypto charts is often used to identify support and resistance levels, as well as trend lines. Price action can also be used to forecast future price movements.

When studying price action in crypto charts, it is important to keep in mind the following key points:

1. Price action is not always reliable.

2. Price action can be misleading.

3. Price action is often temporary.

4. Price action is often chaotic.

5. Price action is often intermittent.

6. Price action can be easily manipulated.

7. Price action can be used to identify trends.

8. Price action can be used to identify support and resistance levels.

9. Price action can be used to identify trend lines.

10. Price action can be used to forecast future price movements.