How to manipulate crypto charts?

The article covers the basic of chart manipulation and how to read crypto charts. It also includes a few tips on how to make the most out of your charting experience.

How to use crypto charts to your advantage

Crypto charts can be a powerful tool for analyzing the price of cryptocurrencies. By understanding how the prices of different coins are related, you can make informed investment decisions.

To use crypto charts to your advantage, first identify the types of charts that are most relevant to your analysis. There are several different types of crypto charts, including:

1. Price chart

A price chart shows the price of a cryptocurrency over time. You can use a price chart to track the price of a single coin, or the market share of a group of coins.

2. Volume chart

A volume chart shows the amount of cryptocurrency that has been traded over time. You can use a volume chart to track the price of a single coin, or the market share of a group of coins.

3. Circular chart

A circular chart is a type of chart that shows the relative prices of two cryptocurrencies. You can use a circular chart to track the price of a single coin, or the market share of a group of coins.

4. Charts with multiple timeframes

Some crypto charts include multiple timeframes. This allows you to track the price of a cryptocurrency over a longer period of time, or the market share of a group of coins over a shorter period of time.

Once you have identified the type of crypto chart that is most relevant to your analysis, you can start to use it to your advantage.

1. Use a price chart to track the price of a cryptocurrency over time.

A price chart can be a helpful tool for tracking the price of a cryptocurrency over time. By understanding how the prices of different coins are related, you can make informed investment decisions.

For example, if you are interested in the price of Ethereum, you can use a price chart to track the price of Ethereum over time. You can also use a price chart to track the market share of Ethereum relative to other coins.

2. Use a volume chart to track the amount of cryptocurrency that has been traded over time.

A volume chart can be a helpful tool for tracking the price of a cryptocurrency over time. By understanding how the prices of different coins are related, you can make informed investment decisions.

For example, if you are interested in the price of Ethereum, you can use a volume chart to track the amount of Ethereum that has been traded over time. You can also use a volume chart to track the market share of Ethereum relative to other coins.

3. Use a circular chart to track the relative prices of two cryptocurrencies.

A circular chart is a type of chart that shows the relative prices of two cryptocurrencies. You can use a circular chart to track the price of a single coin, or the market share of a group of coins.

4. Use charts with multiple timeframes to track the price of a cryptocurrency over a longer period of time, or the market share of a group of coins over a shorter period of time.

How to read crypto charts like a pro

Cryptocurrency charts can be a confusing and daunting task for first time investors. To make things a little bit easier, we’ve put together a few tips that will help you read crypto charts like a pro.

1. Understand the basics

Before you start reading crypto charts, it’s important to understand the basics. This includes understanding what a cryptocurrency is, what a blockchain is, and what a digital asset is.

2. Look for trends

One of the most important things to do when reading crypto charts is to look for trends. This includes looking for patterns such as uptrends and downtrends, and tracking the price over time.

3. Analyse the data

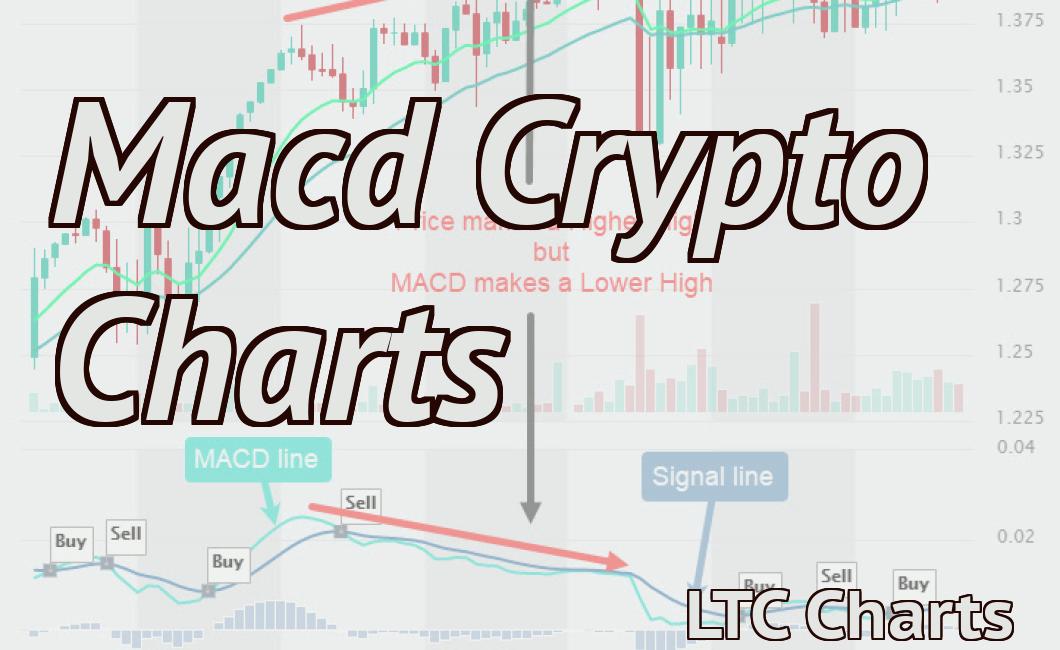

Once you have a basic understanding of what’s going on in the market, you can start to analyse the data. This includes looking at the technical indicators such as the MACD and RSI, and the financial indicators such as the volume and price.

4. Take action

Finally, remember that charts are only a tool – don’t get too carried away with them. Instead, use them to help you take action in the market. This could include trading based on the data that you’ve analysed, or investing in cryptos that you believe will be successful in the long term.

How to make sense of crypto charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on a variety of exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

How to interpret crypto charts

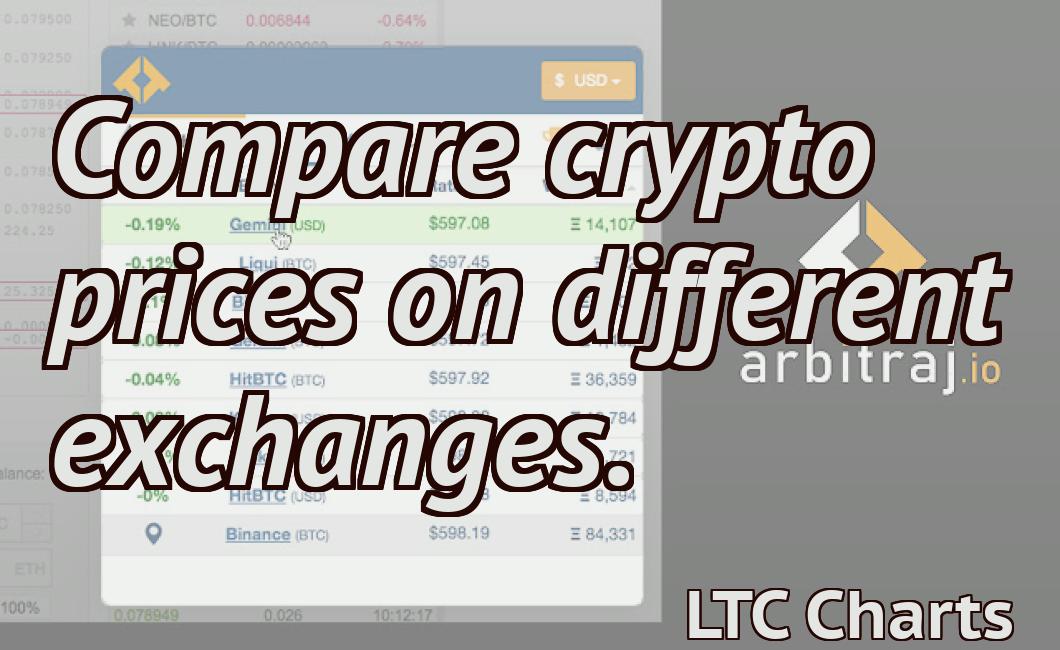

Cryptocurrencies are traded on various exchanges and can be bought and sold at different prices. Cryptocurrencies are also often used to purchase goods and services.

Cryptocurrencies are often traded on decentralized exchanges, which are not subject to government or financial institution control. Cryptocurrencies are also traded on centralized exchanges, which are subject to government or financial institution control.

Cryptocurrencies are often volatile and can be affected by a variety of factors including news, political events, and market conditions.

Cryptocurrencies are not legal tender and cannot be used to purchase goods or services.

How to get the most out of crypto charts

Crypto charts can be a great way to monitor your portfolio and track your progress over time. Here are some tips to get the most out of crypto charts:

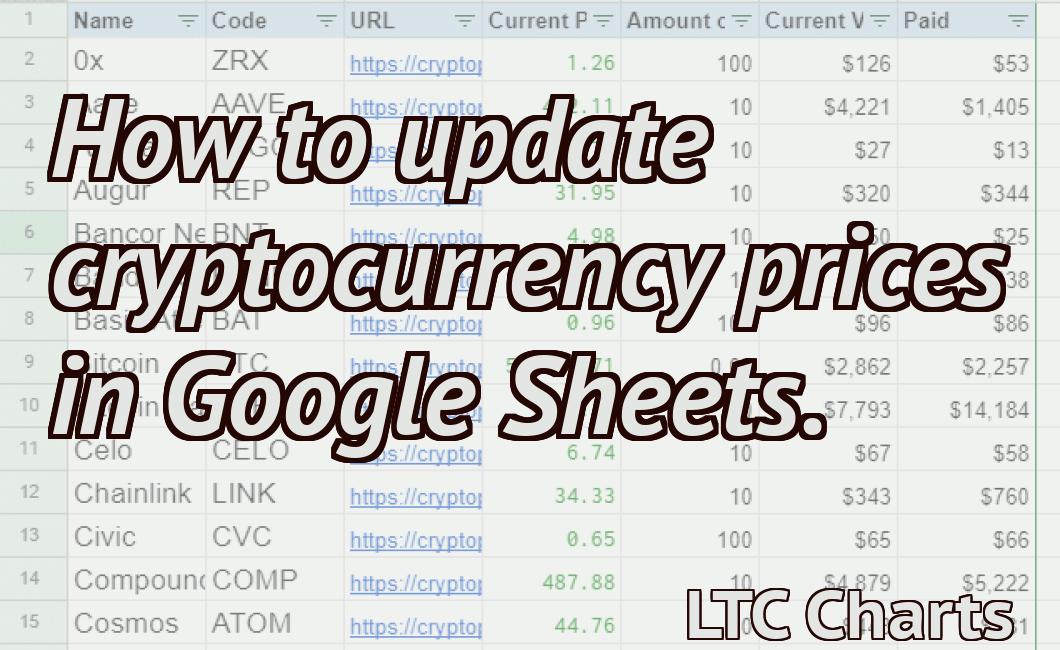

1. Use a crypto charting platform. There are a number of different crypto charting platforms available, and each has its own features and advantages. Some popular options include CoinMarketCap, CoinGecko, and CoinDesk.

2. Use different time periods. It's important to use different time periods when monitoring your portfolio. For example, you might want to track your crypto portfolio over the course of a month, week, or day.

3. Use a variety of indicators. Many crypto charting platforms offer a variety of indicators, including technical indicators (such as the MACD and RSI) and fundamental indicators (such as the market capitalization). Use these indicators to help you track your portfolio's progress.

4. Compare your results with others. Compare your results with those of other users of the same crypto charting platform. This can help you identify trends and patterns in your portfolio.

5. Use alerts. Many crypto charting platforms offer alerts, which can help you track important events in your portfolio. For example, you can set up an alert to notify you when your portfolio falls below a certain threshold.

How to take advantage of crypto charts

Cryptocurrencies are volatile and can be difficult to invest in without the help of a financial advisor. Cryptocurrency charts can provide an easy way to track your investment and see how it is performing over time.

To use a cryptocurrency chart, first find the appropriate website. There are many to choose from, but some of the most popular include CoinMarketCap and CoinGecko. Once you have found an appropriate website, open it up in a new tab or window.

Next, find the cryptocurrency you would like to track. For example, if you are invested in Bitcoin, you would search for “Bitcoin” on CoinMarketCap.

Once you have found Bitcoin, you will need to find its price history. To do this, you will need to search for the “price” column and find the date that the Bitcoin was priced at. For example, if Bitcoin was priced at $10,000 on January 1, 2018, its price history would be listed as “$10,000” on January 1, 2018 and “$11,000” on January 2, 2018.

Now you will need to find the “volume” column. This column shows how many Bitcoin were traded during that time period. For example, if there were 5,000 Bitcoin traded during the time period listed in the “price” column and the “volume” column, then the chart would show a line with an arrow pointing up (indicating an increase in value). Conversely, if there were only 1,000 Bitcoin traded during the time period listed in the “price” column and the “volume” column, then the chart would show a line with an arrow pointing down (indicating a decrease in value).

Finally, you will need to find the “percentage” column. This column shows the percentage change in value from the previous day. For example, if Bitcoin was priced at $10,000 on January 1, 2018 and its percentage change was +50%, then its percentage on January 2, 2018 would be $11,250.

How to make money from crypto charts

Cryptocurrency charts are a great way to make money from cryptocurrency trading.

There are a number of ways to make money from cryptocurrency charts:

1. Trading cryptocurrency with a CFD broker

Some brokers offer cryptocurrency trading as a service. This means you can trade cryptocurrencies with them without actually owning any cryptocurrency. This is a good way to make money from cryptocurrency charts, as the prices of cryptocurrencies can often be volatile and go up and down a lot.

2. Trading cryptocurrency with a traditional stockbroker

If you want to trade cryptocurrencies with a traditional stockbroker, you will need to buy them outright. This can be a bit tricky, as cryptocurrency prices are often quite volatile. However, this is still a good way to make money from cryptocurrency charts, as the prices of cryptocurrencies tend to go up over time.

3. Trading cryptocurrency with a crypto hedge fund

A crypto hedge fund is a type of investment company that invests in cryptocurrencies and other digital assets. They can be a great way to make money from cryptocurrency charts, as they are usually able to trade cryptocurrencies at a much higher rate than traditional stockbrokers.

How to beat the markets with crypto charts

Crypto charts can be a powerful tool for understanding the market, and can be used to beat the market.

The first step is to identify the charts that are most relevant to your investment strategy. For example, if you are focusing on short-term price fluctuations, you may want to focus on charts that show 24-hour price movements.

Once you have identified the charts that are most relevant to your investment strategy, you need to understand how to use them. For example, if you are focused on short-term price fluctuations, you may want to use candlestick charts to analyze the market. Candlestick charts provide a visual representation of the market, and allow you to see the ebbs and flows of the market.

Finally, you need to be prepared to act on the information that you glean from the charts. For example, if you see that the market is about to decline, you may want to sell your assets before they fall further.