What determines cryptocurrency prices?

The prices of cryptocurrencies are determined by a variety of factors, including the supply and demand of the currency, the stability of the underlying blockchain technology, and the overall market conditions.

How Cryptocurrency Prices Are Determined

Cryptocurrency prices are determined by supply and demand. The more people want a particular cryptocurrency, the higher its price will be. Conversely, if there is a shortage of a particular cryptocurrency, its price will be lower.

The Factors That Influence Cryptocurrency Prices

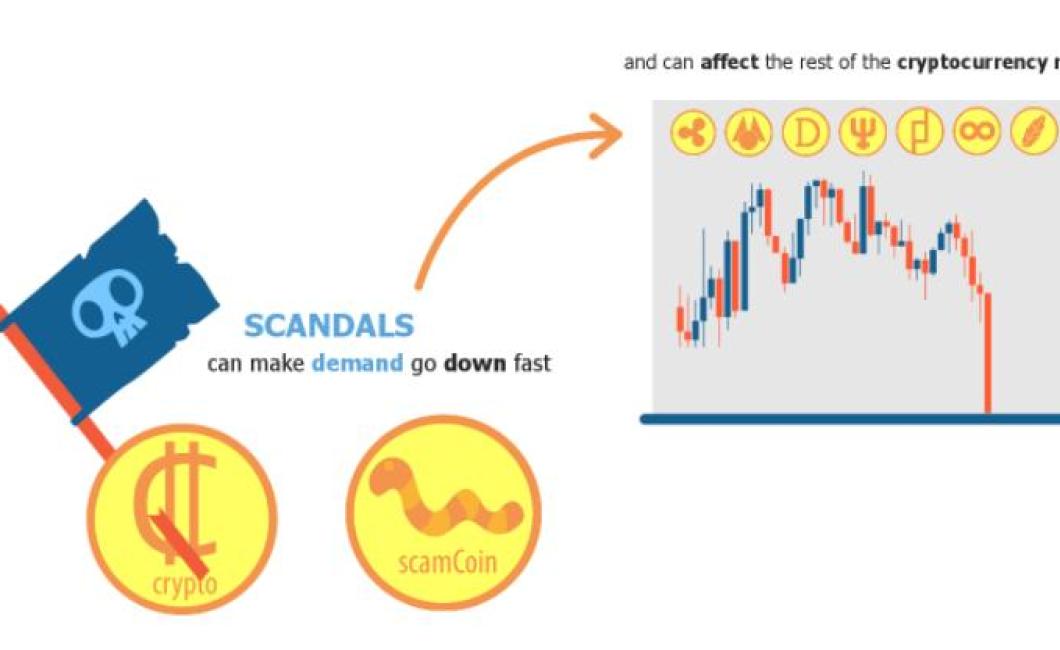

There are a number of factors that influence the prices of cryptocurrencies. These factors include global economic conditions, news events, and fluctuations in the value of other currencies. Additionally, the popularity of particular cryptocurrencies and the demand for them from buyers and sellers can also affect their prices.

The Relationship Between Supply and Demand for Cryptocurrencies

When it comes to Bitcoin, supply and demand are two of the most important factors that affect its price.

Supply: The total number of Bitcoin that will ever be created.

Demand: The number of people who are willing to buy Bitcoin.

How Economic Factors Affect Cryptocurrency Prices

There is no one-size-fits-all answer to this question, as the price of cryptocurrency depends on a variety of factors specific to each individual coin and market. However, some key factors that can influence cryptocurrency prices include:

Supply and Demand

Cryptocurrency prices are generally determined by the supply and demand of a particular coin. When new coins are created, they are released into the market at a set rate, and as demand for these coins increases, the price of these coins will rise. Conversely, when there is a decrease in demand for a particular coin, the price of that coin will also decrease.

Governance and Regulations

Another important factor that can affect cryptocurrency prices is government and regulatory oversight. For example, if the government decides to crackdown on digital currencies, this could lead to a decrease in demand and price for these coins. Conversely, if the government decides to support digital currencies and provide them with favorable regulation, this could lead to an increase in demand and price for these coins.

Market Sentiment

Finally, market sentiment can also play a significant role in determining the price of cryptocurrency. For example, if investors are bullish on a particular coin, this might lead to an increase in demand and price for that coin. Conversely, if investors are bearish on a particular coin, this might lead to a decrease in demand and price for that coin.

The Impact of Geopolitical Events on Cryptocurrency Prices

Geopolitical events can have a significant impact on cryptocurrency prices. For example, when the US Securities and Exchange Commission (SEC) announced that it would review whether digital tokens are securities, this caused the price of many cryptocurrencies to fall. Similarly, news of a financial crisis in a country such as Venezuela can lead to a decrease in the value of cryptocurrencies in that country.

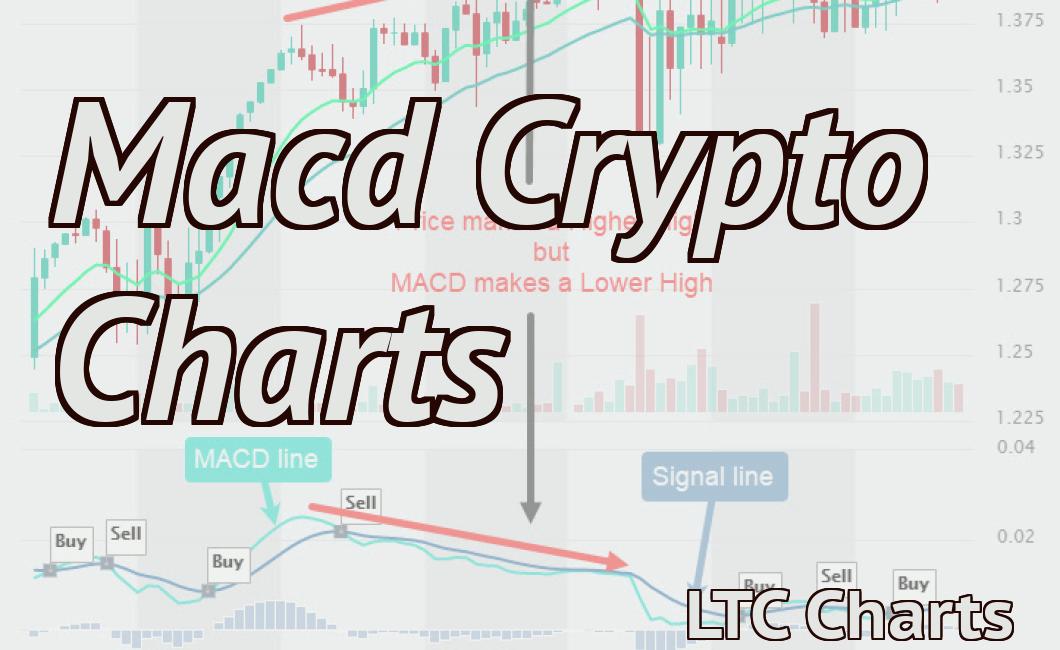

Technical Analysis and Predictions for Cryptocurrency Prices

Cryptocurrency prices are always volatile and can go up or down a lot. It is important to do your own research before investing in any cryptocurrency.

Here are some predictions for the cryptocurrency prices over the next few months:

Bitcoin prices will continue to rise.

Ethereum prices will continue to rise.

Bitcoin Cash prices will continue to rise.

Litecoin prices will continue to decline.

The Psychology of Investing in Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

The first cryptocurrency, bitcoin, was created in 2009 by an anonymous person or group of people under the name Satoshi Nakamoto. Bitcoin is a digital currency that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin is decentralized, meaning it is not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Some cryptocurrencies, such as bitcoin, are also used as investment vehicles. Cryptocurrencies are volatile, which means their value can fluctuate rapidly.

The Risks and Rewards of Investing in Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Despite their potential benefits, investing in cryptocurrencies carries a number of risks. These risks may include price volatility, security vulnerabilities, and lack of liquidity. Price volatility refers to the tendency of cryptocurrencies to experience large swings in price, which can make it difficult for investors to make consistent profits. Security vulnerabilities can allow hackers to steal cryptocurrencies or use them to finance illegal activities. Lack of liquidity can make it difficult for investors to sell cryptocurrencies, which can lead to losses.

While cryptocurrencies carry risks, they also offer potential benefits, including reduced transaction fees, greater privacy, and the ability to bypass government censorship. Investors should carefully consider the risks and rewards before making any investment decisions.

10 Tips for Trading Cryptocurrencies Successfully

1. Do your research. Before you start trading cryptocurrencies, it is important to do your due diligence. There are a lot of scams out there, and you don’t want to get caught up in one. Pay attention to news, forums, and social media for information.

2. Set realistic goals. Trading cryptocurrencies is a high-risk, high-reward activity. Make sure your goals are realistic and that you are prepared to lose money if you don’t succeed.

3. Be patient. It can take a long time to make money trading cryptocurrencies. Don’t get discouraged if you don’t make a lot of money right away. Over time, you will probably make some money, but it may not be as much as you expect.

4. Don’t overtrade. Don’t trade too much of a particular cryptocurrency or else you could lose your investment. Try to stick to a few coins that you are interested in.

5. Use a trading strategy. Some people find it helpful to use a trading strategy. This will help them make more informed decisions about where to buy and sell cryptocurrencies.

6. Don’t invest more than you can afford to lose. Trading cryptocurrencies is a high-risk activity, and if you lose your money you could lose a lot of it. Make sure you are comfortable with the risk before you invest any money.

7. Stick to a budget. It is important not to overspend on cryptocurrencies. Make sure you have a budgeted amount for trading expenses, and stick to it.

8. Stay safe. Bitcoin and other cryptocurrencies are high-risk investments. Make sure you know how to stay safe when trading them. Always use a secure wallet and practice safe trading practices.

9. Don’t overthink it. Sometimes it is easy to get overwhelmed by the complexities of cryptocurrency trading. Don’t try to do too much at once. Take things slow and make sensible decisions.

10. Have fun. Trading cryptocurrencies can be fun, and it is an interesting way to make money. If you are having fun, you are likely doing something right.

How to Build a Diversified Portfolio of Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

To build a diversified cryptocurrency portfolio, you should invest in a range of cryptocurrencies, each with its own unique features and benefits. Consider investing in cryptocurrencies that:

Have high liquidity – cryptocurrencies with high liquidity are easier to trade and can be purchased by larger amounts of investors.

– cryptocurrencies with high liquidity are easier to trade and can be purchased by larger amounts of investors. Have strong fundamentals – cryptocurrencies with strong fundamentals, such as a strong community and good technical performance, are more likely to maintain their value over time.

– cryptocurrencies with strong fundamentals, such as a strong community and good technical performance, are more likely to maintain their value over time. Have low volatility – cryptocurrencies with low volatility are less likely to experience large swings in their value.

– cryptocurrencies with low volatility are less likely to experience large swings in their value. Have a solid governance and development team – well-governed and developed cryptocurrencies have a stronger foundation for long-term success.

– well-governed and developed cryptocurrencies have a stronger foundation for long-term success. Are accepted by a broad range of users – cryptocurrencies that are widely accepted by users and merchants are more likely to maintain their value over time.

Here are five examples of cryptocurrencies that may be a good fit for your portfolio:

Bitcoin

Bitcoin is the first and most well-known cryptocurrency, and it has been the most dominant cryptocurrency for many years. Bitcoin is a decentralized currency that uses blockchain technology to secure its transactions. Bitcoin has strong fundamentals, is widely accepted by users and merchants, and has low volatility.

Ethereum

Ethereum is a decentralized platform that uses blockchain technology to secure its transactions. Ethereum is more complex than Bitcoin, and it has more features and applications than most cryptocurrencies. Ethereum has strong fundamentals, is widely accepted by users and merchants, and has low volatility.

Litecoin

Litecoin is a decentralized cryptocurrency that uses blockchain technology to secure its transactions. Litecoin has lower transaction fees than Bitcoin and Ethereum, and it has a larger block size limit than Bitcoin. Litecoin has strong fundamentals, is widely accepted by users and merchants, and has low volatility.

Bitcoin Cash

Bitcoin Cash is a decentralized cryptocurrency that was created as a result of the SegWit2x hard fork of Bitcoin. Bitcoin Cash has stronger fundamentals than Bitcoin and Ethereum, and it has lower transaction fees than Bitcoin. Bitcoin Cash is not widely accepted by users and merchants, but it has a larger block size limit than Bitcoin.

5 Must-Read Books on Cryptocurrencies

1. Bitcoin: A Peer-to-Peer Electronic Cash System by Satoshi Nakamoto

2. Cryptocurrencies: A Comprehensive Guide to Bitcoin, Ethereum, and More by Matthew Slater

3. Bitcoin for Beginners: How to Buy, Invest, and Use Digital Currencies by Nicolas Cary

4. The Bitcoin Bible: A Comprehensive Guide to Understanding, Mining, and Trading Bitcoin by Andreas Antonopoulos

5. Mastering Bitcoin: Unlocking Digital Cryptocurrency's Greatest Potential by Andreas Antonopoulos