Best Charts For Day Trading Crypto

This article provides a list of the best charts for day trading crypto, as well as some tips on how to use them.

The 8 Best Charts for Day Trading Crypto

Cryptocurrency trading can be a very lucrative activity, but it is also a high-risk one. Therefore, it is important to use the right charts to make informed decisions. Here are the 8 best cryptocurrency charts for day trading.

1. candlestick chart

A candlestick chart is one of the most popular types of charts used in day trading. It is simple to understand and can help you to identify patterns and trends.

2. volume chart

A volume chart is another useful tool for day trading. It helps you to track the amount of activity happening on the market and can help you to identify potential buy and sell signals.

3. relative strength index

The relative strength index (RSI) is a popular technical indicator that can be used to identify oversold or overbought conditions. When the RSI is close to 50, this indicates that the market is likely to make a strong move in the opposite direction.

4. moving average convergence divergence

Moving average convergence divergence (MACD) is a technical indicator that can help you to identify potential buy and sell signals. When the MACD is positive, this indicates that the market is likely to make a strong move in the opposite direction, while when the MACD is negative, this indicates that the market is likely to remain stable.

5. stochastic oscillator

The stochastic oscillator (STO) is a technical indicator that can help you to identify oversold or overbought conditions. When the STO is above 50, this indicates that the market is likely to make a strong move in the opposite direction, while when the STO is below 50, this indicates that the market is likely to remain stable.

6. Fibonacci retracement

A Fibonacci retracement is a technical indicator that can help you to identify potential buy and sell signals. When the Fibonacci retracement is close to the price point that you are interested in, this indicates that the market is likely to make a strong move in the opposite direction.

7. RSI divergence

RSI divergence (RSID) is a technical indicator that can help you to identify potential buy and sell signals. When the RSI is above 70, this indicates that the market is likely to make a strong move in the opposite direction, while when the RSI is below 70, this indicates that the market is likely to remain stable.

8. Ichimoku cloud

The Ichimoku cloud is a technical indicator that can help you to identify potential buy and sell signals. The Ichimoku cloud consists of five levels: red, orange, yellow, green, and blue. The closer the levels are to each other, the stronger the signal.

The Best Cryptocurrency Day Trading Charts

Cryptocurrency charts are a great way to get an overview of the market. By looking at a chart, you can see the price of a cryptocurrency over time, as well as how much volume is being traded.

There are a number of different cryptocurrency charts available, so it is important to select the one that is most relevant to your investment. The charts below are some of the best cryptocurrency day trading charts.

1. CoinMarketCap Cryptocurrency Chart

CoinMarketCap is one of the most popular cryptocurrency day trading charts. It displays information such as the price, volume, and market capitalization of cryptocurrencies.

2. CoinMarketCap 24-Hour Cryptocurrency Chart

The CoinMarketCap 24-Hour Cryptocurrency Chart is a visual representation of the price, volume, and market capitalization of cryptocurrencies over a 24-hour period.

3. CoinMarketCap USD Cryptocurrency Chart

The CoinMarketCap USD Cryptocurrency Chart shows the price and volume of cryptocurrencies in US dollars. This chart is useful for investors who want to track the performance of cryptocurrencies in US dollars.

4. CoinMarketCap EUR Cryptocurrency Chart

The CoinMarketCap EUR Cryptocurrency Chart shows the price and volume of cryptocurrencies in euros. This chart is useful for investors who want to track the performance of cryptocurrencies in euros.

5. CoinMarketCap GBP Cryptocurrency Chart

The CoinMarketCap GBP Cryptocurrency Chart shows the price and volume of cryptocurrencies in British pounds. This chart is useful for investors who want to track the performance of cryptocurrencies in British pounds.

The Most Important Charts for Day Trading Crypto

Cryptocurrency charts can be a very important part of day trading. They can help you to see how the price of a cryptocurrency is moving, and what factors are influencing it.

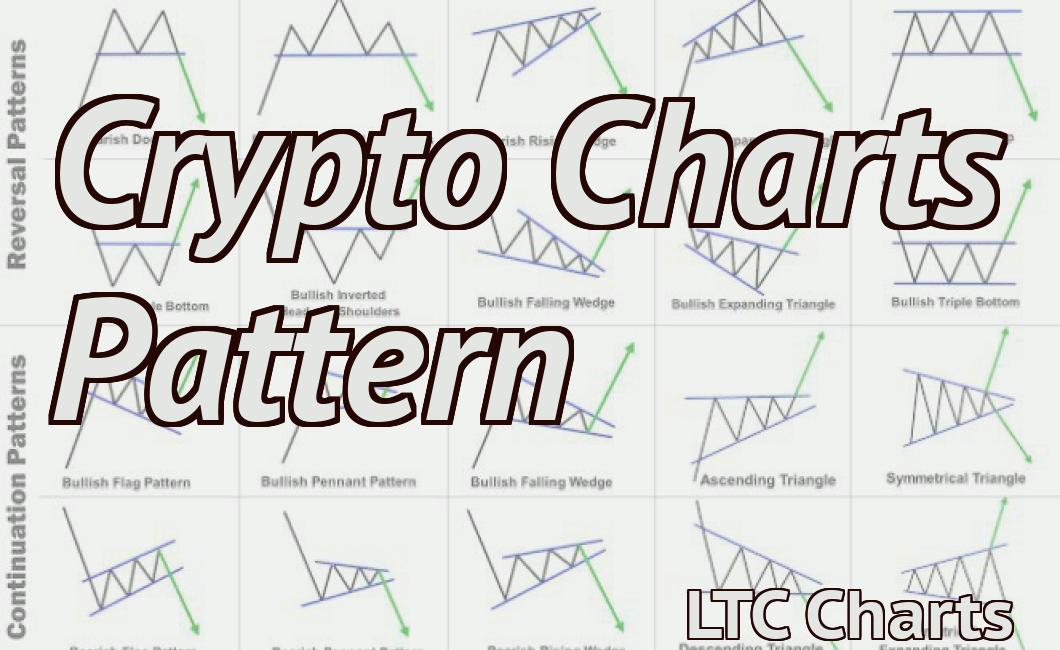

There are a number of different types of cryptocurrency charts, and each one can be useful in different ways.

Here are the most important cryptocurrency charts for day trading:

1. Price Charts

Price charts are probably the most important type of cryptocurrency chart. They show you the current price of a cryptocurrency, as well as the price movement over the past few minutes, hours, or days.

Price charts can help you to see how the price is moving, and which factors are influencing it. They can also help you to make decisions about whether to buy or sell a cryptocurrency.

2. Volume Charts

Volume charts show you the amount of a cryptocurrency that has been traded over the past few minutes, hours, or days.

Volume charts can help you to see how active the market is, and which cryptocurrencies are being traded the most. They can also help you to make decisions about whether to buy or sell a cryptocurrency.

3. Supply and Demand Charts

Supply and demand charts show you how much of a cryptocurrency is available on the market, and how much demand there is for it.

They can help you to see how the price of a cryptocurrency is likely to move, and which cryptocurrencies are likely to be most popular.

4. Technical Indicators

Technical indicators are indicators that are used to measure the performance of a cryptocurrency.

They can include things like the Bollinger Bands, the RSI, and the MACD.

Technical indicators can help you to make decisions about whether to buy or sell a cryptocurrency.

The Best Technical Indicators for Day Trading Crypto

Technical indicators are a valuable tool for day trading cryptocurrencies. They can help you identify potential trends and opportunities in the market.

Some of the best technical indicators for day trading cryptocurrencies include the Relative Strength Index (RSI), the Commodity Channel Index (CCI), and the MACD.

1. Relative Strength Index (RSI)

The RSI is an indicator that measures the strength of a cryptocurrency’s movement over time. It is typically used to identify oversold and overbought conditions.

When the RSI is above 50, it is considered bullish, and when it is below 50, it is considered bearish.

2. Commodity Channel Index (CCI)

The CCI measures the trend of a cryptocurrency’s price over a period of time. It is used to identify potential turning points in the market.

The CCI ranges from 0 to 100, with a higher number indicating a stronger trend.

3. MACD

The MACD is an indicator that shows the difference between a cryptocurrency’s two most recent prices. It is used to identify potential trends and to predict future prices.

The MACD is typically composed of two lines, each of which represents a different type of security. The first line is called the histogram, and the second line is called the signal line.

If the histogram is above the signal line, it indicates that the market is bullish, and if the histogram is below the signal line, it indicates that the market is bearish.

The Best Candlestick Patterns for Day Trading Crypto

There are a few candlestick patterns that are commonly used by day traders to make informed decisions about whether or not to buy or sell cryptocurrencies.

The hammer

The hammer is a bullish candlestick pattern that indicates that the price of a cryptocurrency is about to rise. The pattern is created when the price of a cryptocurrency falls sharply and then rebounds. The hammer is usually followed by a sustained uptrend in the price of the cryptocurrency.

The Hanging Man

The Hanging Man is a bearish candlestick pattern that indicates that the price of a cryptocurrency is about to fall. The pattern is created when the price of a cryptocurrency rises sharply and then declines. The Hanging Man is usually followed by a sustained downtrend in the price of the cryptocurrency.

How to Use Volume to Trade Crypto

Volume is one of the most important factors in cryptocurrency trading. Volume measures the amount of buying and selling activity on a given cryptocurrency exchange.

The higher the volume, the more liquidity there is on the exchange and the more likely you are to find a good price for your cryptocurrency.

To use volume to trade cryptocurrencies, first find an exchange with a high volume. Then, find a cryptocurrency that is trading at a price you want to buy. Compare the price of the cryptocurrency on the exchange to the price you found online. If the cryptocurrency is trading at a lower price on the exchange, you can buy it there and sell it on the exchange at a higher price. If the cryptocurrency is trading at a higher price on the exchange, you can sell it on the exchange at a lower price and then buy it on the exchange at a higher price.

How to Use Price Action to Trade Crypto

Cryptocurrencies are a relatively new investment opportunity and the market is still very volatile. Price action is a technique that can help traders make informed decisions about when to buy or sell a cryptocurrency.

When price action is used to trade cryptocurrencies, traders should look for trends in the price of the cryptocurrency. For example, if the price of a cryptocurrency is increasing over time, then it may be a good time to buy the cryptocurrency. If the price of a cryptocurrency is decreasing over time, then it may be a good time to sell the cryptocurrency.

Price action can also help traders identify support and resistance levels for the cryptocurrency. For example, if the price of a cryptocurrency is below its support level, then it may be a good time to buy the cryptocurrency. If the price of a cryptocurrency is above its resistance level, then it may be a good time to sell the cryptocurrency.

Using Support and Resistance to Trade Crypto

Support:

People who believe in and support cryptocurrencies generally believe that they hold great potential for future growth. They see them as a way to make financial transactions more secure and efficient, and believe that the technology behind them has the potential to revolutionize the way we do business.

Resistance:

People who oppose cryptocurrencies generally believe that they are a risky investment and that they are not backed by any real world currency. They see them as a way for criminals to launder money and for terrorists to fund their activities. They also believe that cryptocurrencies are not regulated enough and that their value is highly volatile.