Trade Charts Crypto

The article "Trade Charts Crypto" provides an overview of the different types of charts that are available to traders when trading cryptocurrencies. It discusses the pros and cons of each type of chart and provides examples of how they can be used to trade cryptocurrencies.

How to Trade Crypto Charts

Cryptocurrency charts are a great way to get a snapshot of the market conditions of a specific digital asset.

There are a variety of different cryptocurrency charts that can be used to track market conditions. Some popular cryptocurrency charts include the 24-hour, 7-day, and 1-month charts.

To use a cryptocurrency chart, first find the symbol of the digital asset you wish to track. You can do this by searching for the symbol on an online search engine or by visiting a cryptocurrency exchange and looking at the list of digital assets.

Once you have found the symbol, open a cryptocurrency charting platform, such as CoinMarketCap.com.

Next, find the “cryptocurrency charts” section and click on the desired chart.

On the cryptocurrency chart, you will see a list of currencies and their corresponding prices. The 24-hour chart will display the price of the asset over a 24-hour period, while the 7-day chart will show the price over a 7-day period. The 1-month chart will show the price over a 1-month period.

To view the history of a specific currency, hover your cursor over the price bar and click on the “history” button. This will display the price history for that currency.

To change the time period for a cryptocurrency chart, click on the “time period” button and select the desired period from the list.

You can also use cryptocurrency charts to find trends in the market. For example, you can look for patterns in the prices of different currencies over time. Or, you can track how the prices of different digital assets are related to one another.

Trading Crypto Charts for Beginners

Cryptocurrencies are a type of digital asset. A digital asset is a representation of value that exists in the form of encrypted data or digital signatures. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are created through a process called mining. Miners are rewarded with cryptocurrency for verifying and committing transactions to the blockchain. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

The Different Types of Crypto Charts

Crypto charts are used to visualize various aspects of the cryptocurrency market. There are three main types of crypto charts:

1. Price chart

A price chart shows the price of a cryptocurrency over time. It can be used to track the price of a cryptocurrency, to identify trends, and to measure the performance of a cryptocurrency.

2. Volume chart

A volume chart shows the amount of cryptocurrency that has been traded over time. It can be used to track the market activity of a cryptocurrency, to identify trends, and to measure the performance of a cryptocurrency.

3. Supply chart

A supply chart shows the number of cryptocurrency that is currently in circulation. It can be used to track the market activity of a cryptocurrency, to identify trends, and to measure the performance of a cryptocurrency.

How to Read Crypto Charts

Crypto charts are unique in that they allow users to see the performance of cryptocurrencies on a specific day or over a period of time.

To read a crypto chart, first find the cryptocurrency you are interested in. On some exchanges, this will be listed as the top right corner of the chart. You can also find cryptocurrencies by using their ticker symbol.

Once you have found the cryptocurrency, you will need to find the date or time frame you are interested in. The time frame can be found on the far right side of the chart.

To view the performance of a cryptocurrency on a specific day, select the date from the calendar on the left side of the chart. To view the performance of a cryptocurrency over a period of time, select the time frame from the calendar on the left side of the chart and click on the day you would like to view.

What Do Candlestick Charts Mean in Crypto Trading?

Candlestick charts are a popular way to visualize data in the cryptocurrency market. They show the price of a cryptocurrency over a period of time, typically 24 hours. Candlestick charts are easy to read and can help you identify patterns in the price of a cryptocurrency.

What is a Cryptocurrency Chart?

A cryptocurrency chart is a graphical representation of the price of a cryptocurrency over time. It can be used to identify trends and track prices.

How to Use Charts when Trading Cryptocurrencies

Cryptocurrencies are a relatively new asset class and there is still much to learn about them. One way to learn more is to use charts to help you make better trading decisions.

When trading cryptocurrencies, it’s important to keep in mind that digital assets are not guaranteed to maintain their value. There is a high risk of loss in trading cryptocurrencies.

Before you start trading cryptocurrencies, make sure you have a solid understanding of the following:

What are cryptocurrencies?

How do they work?

What are their risks?

What are the benefits of using them?

What are the different types of charts available?

What are the best cryptocurrencies to trade?

What are the best strategies for trading cryptocurrencies?

What are the risks of not trading cryptocurrencies?

What are the risks of trading cryptocurrencies?

Before you start trading cryptocurrencies, make sure you understand what they are, how they work, and the risks involved. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. There are hundreds of different cryptocurrencies, and new ones are being created all the time. Before you start trading cryptocurrencies, it’s important to understand their risks and benefits. Here are some things to keep in mind when trading cryptocurrencies: Risk factors When trading cryptocurrencies, there are a number of risks involved. These include the risks of losing your investment, of not being able to sell your cryptocurrency at a desired price, and of being hacked.

When trading cryptocurrencies, there are a number of risks involved. These include the risks of losing your investment, of not being able to sell your cryptocurrency at a desired price, and of being hacked. Benefits of trading cryptocurrencies Trading cryptocurrencies can offer a number of benefits. These include the ability to trade quickly and easily between different platforms and currencies, the ability to earn a return on investment, and the lack of government or financial institution control over them.

Trading cryptocurrencies can offer a number of benefits. These include the ability to trade quickly and easily between different platforms and currencies, the ability to earn a return on investment, and the lack of government or financial institution control over them. Trading strategies There are a number of different trading strategies that can be used when trading cryptocurrencies. These include buying and selling at fixed prices, buying and selling based on supply and demand, and trading based on technical indicators. It’s important to choose the right trading strategy for your own circumstances.

The Benefits of Using Charts when Trading Cryptocurrencies

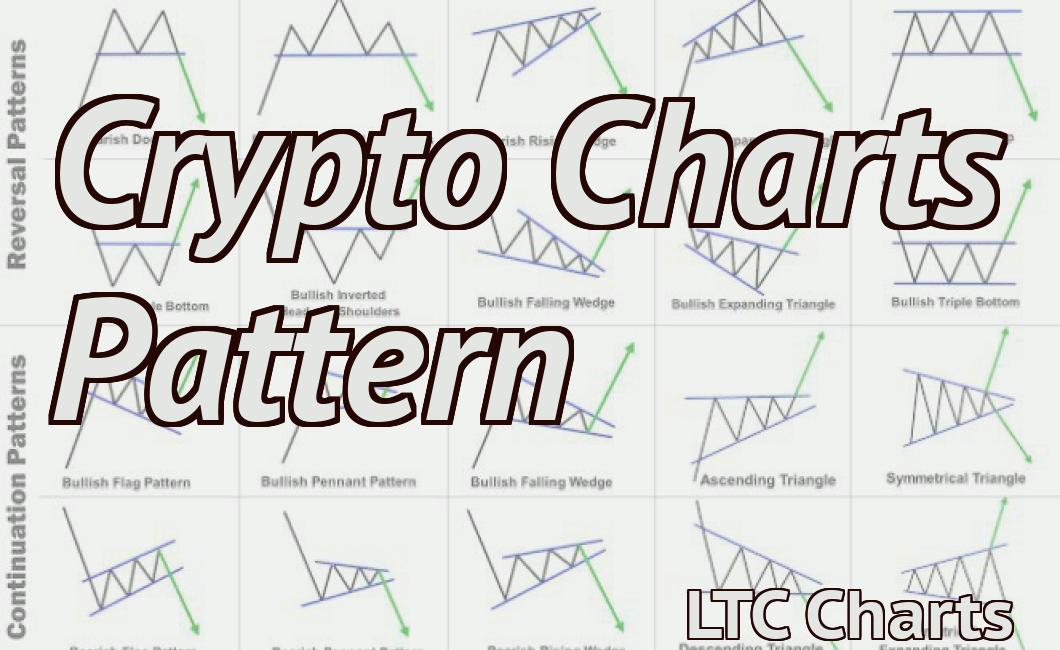

There are a number of benefits to using charts when trading cryptocurrencies. Charting can help traders identify trends, spot support and resistance levels, and make more informed decisions about when to buy or sell.

1. Trend Analysis

One of the most important benefits of using charts is trend analysis. By studying the charts, traders can identify whether a cryptocurrency is going up, down, or staying the same. This information can help traders make more informed decisions about when to buy or sell.

2. Spotting Support and Resistance Levels

Another benefit of charting is spotting support and resistance levels. When a cryptocurrency is near a support level, it may be worth buying. Conversely, if a cryptocurrency is near a resistance level, it may be worth selling. By understanding where these levels are, traders can make more informed decisions about their investments.

3. Making Informed Decisions

Charting can also help traders make informed decisions about when to buy or sell. By understanding where the price is currently located, traders can make more informed decisions about their investments. This information can help them avoid making mistakes and increase their chances of success.

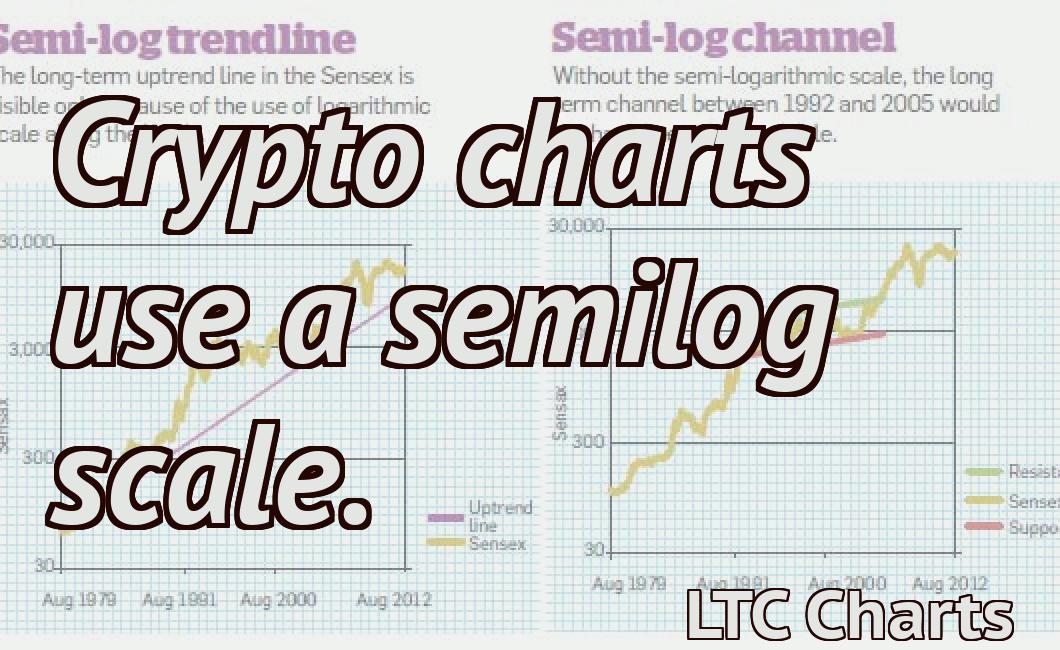

How to Analyze Cryptocurrency Charts

Cryptocurrency charts are a great way to get a snapshot of the current market conditions for a given coin. They can also be helpful in gauging the trends of a coin over time.

To analyze a cryptocurrency chart, you first need to understand the basics of how to read a chart. In general, you want to look at the following elements when examining a cryptocurrency chart:

The price of the coin over time The direction of the price movement The volume of the coin over time

Once you have a basic understanding of how to read a cryptocurrency chart, you can start analyzing it to see how it is performing.

One of the most important things to look for on a cryptocurrency chart is the price. This is the amount of money that a coin is worth on the open market. The price can be measured in a variety of ways, but the most common way is to use a fiat currency value.

The direction of the price movement is also important to pay attention to. This tells you whether the price is going up or down. The volume of a coin can also be an indicator of how popular the coin is. This is because higher volumes usually mean more people are buying and selling the coin.

What Technical Indicators to Use for Cryptocurrency Trading

Cryptocurrency trading can be a very profitable venture, but it is important to use Technical Indicators (TI) to help make informed decisions. Here are some of the most popular TI's to use for cryptocurrency trading:

1. Bollinger Bands

Bollinger Bands are a simple but powerful indicator that can help you identify opportunities and resist risks. When the bands aretighten, this indicates that the price is about to go up, and when they'relooser, this indicates that the price is about to go down.

2. MACD

The MACD is a technical indicator that can help you identify trends in the market. The MACD indicator shows two lines, the MACD histogram and the MACD signal line. The MACD histogram plots the MACD values over time, while the MACD signal line indicates whether the price is going up or down.

3. RSI

The RSI is another technical indicator that can help you identify trends in the market. The RSI indicator shows the rate of change of the closing price over time, and is usually used to indicate whether the market is oversold or overbought.

How to Find the Best Crypto Charts

Cryptocurrencies are a relatively new and volatile investment, so it can be difficult to know which ones are worth investing in. To make things easier, we've put together a list of the best crypto charts to help you make an informed decision.

CoinMarketCap

CoinMarketCap is one of the most popular sources for cryptocurrency information. It provides real-time prices for all active and listed cryptocurrencies, as well as market capitalization and circulation data.

CoinMarketCap also offers a variety of tools for investors, including a ranking of the top coins by market cap, a price history graph, and a list of the top 10 cryptocurrencies by market cap.

CoinMarketCap is free to use.

CoinGecko

CoinGecko is another popular source for cryptocurrency information. It provides real-time prices for all active and listed cryptocurrencies, as well as market capitalization and circulation data.

CoinGecko also offers a variety of tools for investors, including a ranking of the top coins by market cap, a price history graph, and a list of the top 10 cryptocurrencies by market cap.

CoinGecko is free to use.

Cryptocompare

Cryptocompare is another popular source for cryptocurrency information. It provides real-time prices for all active and listed cryptocurrencies, as well as market capitalization and circulation data.

Cryptocompare also offers a variety of tools for investors, including a ranking of the top coins by market cap, a price history graph, and a list of the top 10 cryptocurrencies by market cap.

Cryptocompare is free to use.

Bitcoin.com

Bitcoin.com is another popular source for cryptocurrency information. It provides real-time prices for all active and listed cryptocurrencies, as well as market capitalization and circulation data.

Bitcoin.com also offers a variety of tools for investors, including a ranking of the top coins by market cap, a price history graph, and a list of the top 10 cryptocurrencies by market cap.

Bitcoin.com is free to use.