Charts For Crypto Trading

If you're serious about crypto trading, then you need to be using charts to guide your decisions. In this article, we outline the different types of charts you can use and how to interpret them. With this knowledge in hand, you'll be able to make more informed and profitable trades.

How to Use Charts for Crypto Trading

There are a few ways to use charts for crypto trading.

1. Use Charts to Gauge Price Movement

Charts can be used to gauge price movement and determine whether a cryptocurrency is over or undervalued. When looking at a chart, it is important to keep in mind the following:

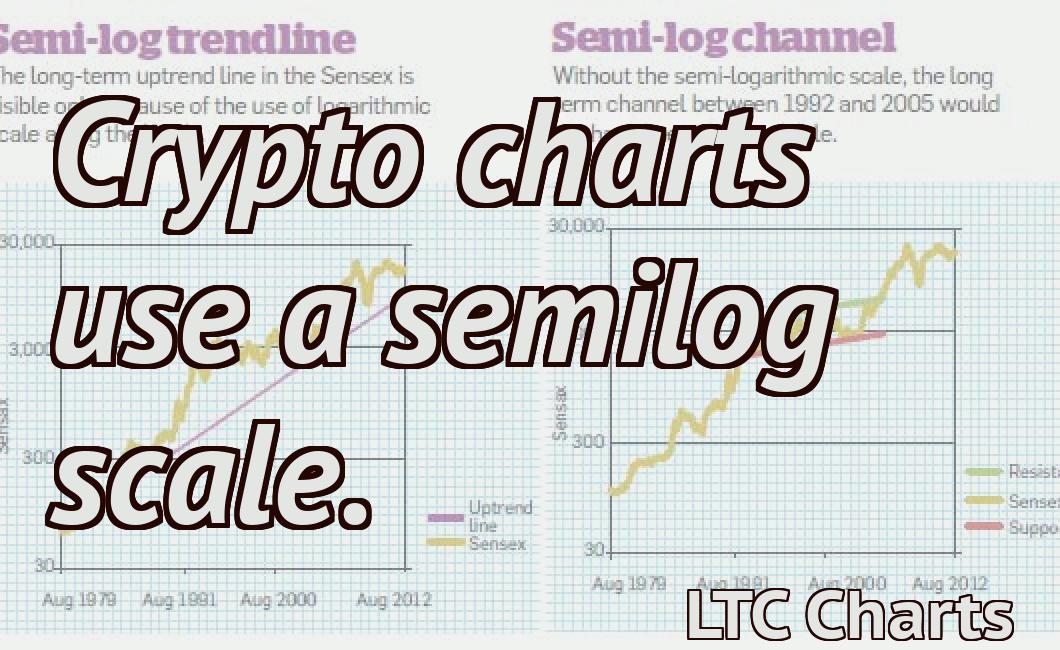

-The timeframe you are using (hourly, daily, weekly, etc.).

-The type of chart (lines, candlesticks, etc.).

-The colors used on the chart (red, green, blue).

-The indicators (moving averages, MACD, RSI, etc.).

-The location of the buy/sell points.

When looking at a chart, it is important to have an idea of what you are looking for. Some common things to look for when gauging price movement are:

-If the cryptocurrency is moving up or down.

-If there is a clear trend.

-If the cryptocurrency is overvalued or undervalued.

-If the cryptocurrency is in a strong or weak position.

-If there is a big volume spike or drop.

2. Use Charts to Forecast Price Movement

Charts can also be used to predict future price movement. When looking at a chart, it is important to have an idea of what you are looking for. Some common things to look for when forecasting future price movement are:

-If the cryptocurrency is moving in a certain direction.

-If there is a clear trend.

-If the cryptocurrency is overvalued or undervalued.

-If the cryptocurrency is in a strong or weak position.

-If there is a big volume spike or drop.

-If the cryptocurrency is about to enter a new market cycle (bull or bear).

3. Use Charts as Support and Resistance Levels

Charts can also be used as support and resistance levels. When looking at a chart, it is important to have an idea of what you are looking for. Some common things to look for when using charts as support and resistance levels are:

-If the cryptocurrency is moving below a certain support level.

-If the cryptocurrency is moving above a certain resistance level.

-If there is a clear trend.

-If the cryptocurrency is overvalued or undervalued.

-If the cryptocurrency is in a strong or weak position.

-If there is a big volume spike or drop.

The Benefits of Using Charts for Crypto Trading

There are many benefits to using charts for crypto trading. For starters, charts allow you to see how prices have reacted over time. This can help you to make informed decisions about when to buy or sell cryptocurrencies.

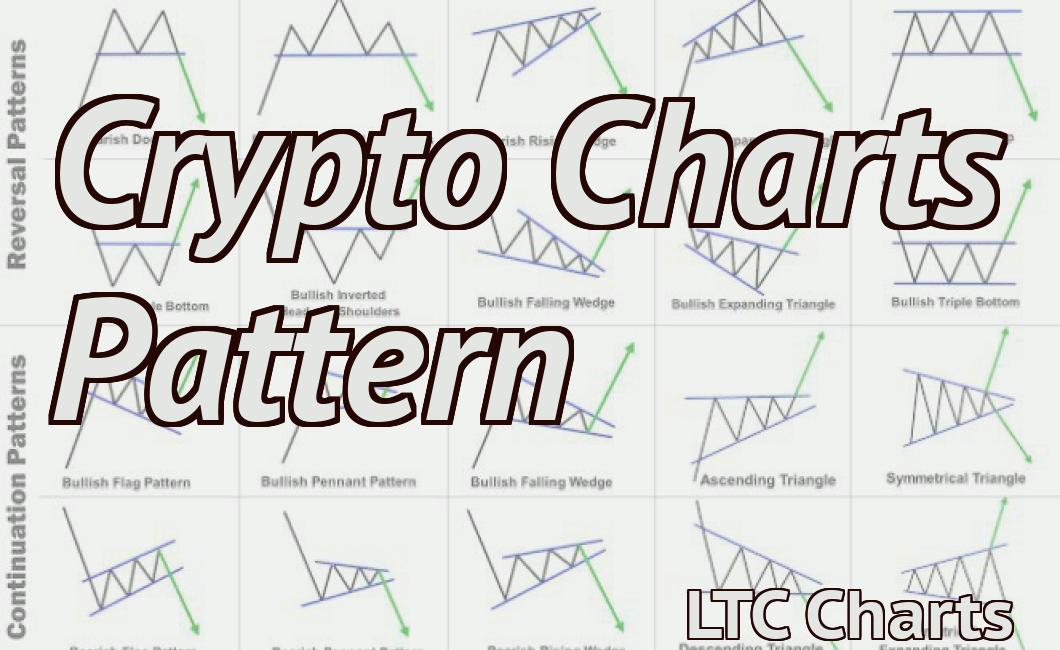

Charts can also help you to identify patterns in market activity. By doing this, you can better understand how the market is reacting to specific events. This can help you to make more informed investment decisions.

Finally, charts can help you to measure your performance over time. This can help you to improve your trading skills.

The Different Types of Charts for Crypto Trading

There are many types of charts that can be used to track the performance of a cryptocurrency.

The most common type of chart is a candlestick chart. Candlestick charts show the price of a cryptocurrency over time, as well as the volume of trade for that period.

Another common type of chart is a histogram. Histograms show the number of buy and sell orders over time. This can help traders determine when the market is about to change direction.

A bar chart also shows the price of a cryptocurrency over time. However, instead of showing the volume of trade, it shows the amount of change in price over time.

Finally, a line chart shows the price of a cryptocurrency over time, but it does not show the volume of trade.

The Most Popular Charting Tools for Crypto Trading

1. CoinMarketCap

CoinMarketCap is a popular cryptocurrency market analysis tool that provides real-time prices for all digital currencies and their associated markets. The site provides comprehensive information on all digital currencies, including their market capitalization, circulating supply, and price history. CoinMarketCap also offers real-time price alerts and an API that allows developers to create their own applications using the data it offers.

2. Coinigy

Coinigy is another popular cryptocurrency market analysis tool that provides real-time prices for all digital currencies and their associated markets. The site offers comprehensive information on all digital currencies, including their market capitalization, circulating supply, and price history. Coinigy also offers real-time price alerts and an API that allows developers to create their own applications using the data it offers.

3. Cryptocompare

Cryptocompare is a popular cryptocurrency trading platform that provides real-time prices for all digital currencies and their associated markets. The site offers comprehensive information on all digital currencies, including their market capitalization, circulating supply, and price history. Cryptocompare also offers live charts and historical data for each currency, as well as a variety of other features.

4. CoinMarketCalculator

CoinMarketCalculator is a simple but powerful cryptocurrency calculator that provides real-time prices for all digital currencies and their associated markets. The site offers comprehensive information on all digital currencies, including their market capitalization, circulating supply, and price history. CoinMarketCalculator also offers live charts and historical data for each currency, as well as a variety of other features.

The Pros and Cons of Using Charts for Crypto Trading

There are pros and cons to using charts for crypto trading. The pros of charts include that they can help you understand your investment better and make more informed trading decisions. They can also help you stay calm in volatile markets.

However, charts can also be a source of stress for traders. If you are not experienced with charting, they can be difficult to understand and can be overwhelming. Charts can also be a distraction from other important tasks, such as monitoring the market conditions and making trades.

How to Interpret Charts for Crypto Trading

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges. In order to make informed trading decisions, traders need to understand the charts used to plot prices.

There are a number of different charts used to plot prices for cryptocurrencies. These charts can be used to identify opportunities and to assess risks.

The following are three types of charts used to plot cryptocurrency prices:

1. Price Chart

A price chart is a graphical representation of price movement over time. It can be used to identify trends, measure market sentiment, and identify support and resistance levels.

2. Volume Chart

A volume chart is a graphical representation of the number of transactions conducted over a given period of time. It is used to measure market sentiment, identify trends, and identify support and resistance levels.

3. Crypto Chart

A crypto chart is a graphical representation of the price movements of a specific cryptocurrency. It can be used to assess risks and identify opportunities.

Guidelines for Using Charts for Crypto Trading

1. Understand the technical indicators:

A chart is a tool that can be used to help you understand the behavior of a security or commodity over time. Technical indicators are mathematical formulas that can be used to measure price action, volume, and other factors.

2. Use technical indicators to help you make trading decisions:

When using technical indicators, always remember to use them in conjunction with your own analysis and personal beliefs. Use them to help you make informed decisions about when to buy or sell a security or commodity.

3. Watch for important news events:

If you are trading a security or commodity, it is important to keep an eye on important news events that could impact the price of the security or commodity. For example, if there is a regulatory change that could impact the price of a security, you should watch for news stories that will provide more information about the change.

4. Use charts to track your progress:

Using charts can be helpful in tracking your progress as a trader. By tracking your progress, you can learn what strategies work best for you and how to improve your trading skills.

Tips for Getting the Most Out of Charts for Crypto Trading

Cryptocurrency charts are a powerful tool for crypto traders. However, like any other tool, they can be used effectively or not at all if used incorrectly. Here are five tips for getting the most out of charts for crypto trading:

1. Understand the Basics

Before even looking at charts, it is important to have a basic understanding of cryptocurrency and blockchain technology. This will help you to understand the basics of how a chart works and what information is displayed.

2. Use Charts to Help Make Investment Decisions

Charts can help you make informed investment decisions by showing you how the price of a cryptocurrency is related to other cryptocurrencies and fiat currencies. This can help you to decide whether or not to buy or sell a cryptocurrency.

3. Use Charts to Stay Up-to-Date on Crypto Trends

By monitoring the trends shown on charts, you can stay up-to-date on the latest changes in the cryptocurrency market. This can help you to make better investment decisions and to maximize your returns.

4. Use Charts to Diagnose Problems

If you are having problems with your cryptocurrency investment, charts can help you to diagnose the problem and to find a solution. By monitoring the charts, you can quickly detect any changes in the price that may indicate a problem.

5. Use Charts to Learn about Cryptocurrency Trading

Charts can also be helpful in learning about cryptocurrency trading. By studying the charts, you can learn about how to make profitable trades and about the different strategies that are available.

How to Avoid Common Mistakes When Using Charts for Crypto Trading

Before you start trading cryptocurrencies, it is important to be aware of the common mistakes that people make when using charts for crypto trading.

1. Misunderstanding Technical Analysis

Many people use technical analysis to try and predict the future price of cryptocurrencies. However, technical analysis is not always accurate, and can often be misleading.

2. Focusing on the Wrong Factors

When trading cryptocurrencies, it is important to focus on the factors that are most important to you. Do not focus on factors that are irrelevant to your trading strategy.

3. Making Too Many Changes

When trading cryptocurrencies, it is important to make only a few changes to your trading strategy. If you make too many changes, your chances of success are greatly reduced.

4. Focusing on the Wrong Timeframe

When trading cryptocurrencies, it is important to focus on the correct timeframe. Do not try to trade on a timeframe that is inappropriate for your trading strategy.

5. Not Keeping Track of Your Progress

When trading cryptocurrencies, it is important to keep track of your progress. This will help you to avoid making mistakes and to stay on track with your trading strategy.