Crypto Currency Trading Charts

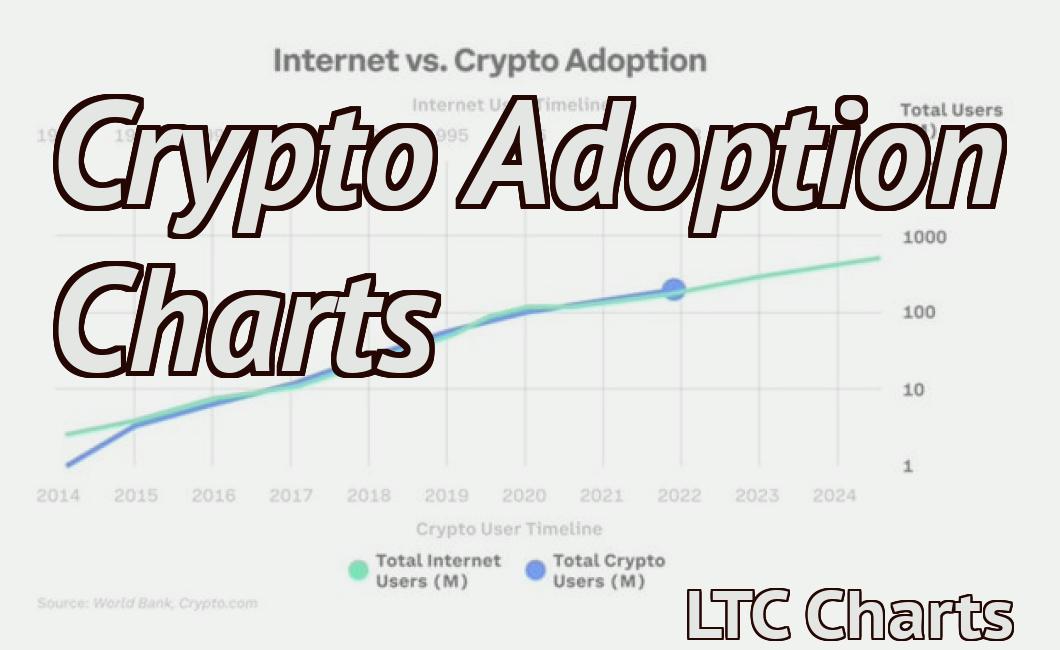

Crypto currency trading charts are a visual representation of the movements in the value of a particular crypto currency. They can be used by traders to track the performance of a currency, and to make predictions about future movements.

How to read crypto currency trading charts

Crypto currency charts are a great way to track the performance of a digital currency. They show the price of a cryptocurrency over time and can be used to determine when a digital currency is overvalued or undervalued.

To read a crypto currency chart, first find the currency you're interested in. Then, find the specific chart you want to view. For example, the Bitcoin chart can be found here.

Once you've found the chart, you'll need to find the time period you're interested in. This can be done by clicking on the "time period" tab at the top of the chart. You can then choose from a variety of time periods, such as "day," "week," "month," or "year."

Once you've chosen your time period, you'll need to find the "data point" you're interested in. This is the point in the chart where the value of the cryptocurrency was at. For example, if you're looking at the Bitcoin chart, the data point for Bitcoin would be at the bottom of the chart.

Finally, you'll need to find the "line graph" tab and click on it. This will open up a new window that will show the cryptocurrency's performance over time. You can see the value of the cryptocurrency change over time, as well as the percentage change.

3 most important crypto currency trading chart patterns

1) Bull Trap: A bullish pattern where the price of a coin increases rapidly and then falls, often resulting in a loss.

2) Bear Trap: A bearish pattern where the price of a coin decreases rapidly and then falls, often resulting in a gain.

3) Triangle: A pattern that occurs when the price of a coin moves between two boundaries that are close to each other but not exactly the same.

Beginner's guide to crypto currency trading charts

Cryptocurrency trading is a highly volatile and complex activity. Before you start trading, you should carefully consider whether trading is for you. This guide is for those who are interested in getting started trading cryptocurrency.

Cryptocurrency trading is not for everyone. Before you start, you need to understand the risks. You also need to be comfortable with using an exchange, reading charts, and making decisions. If you are not confident in these areas, please do not start trading.

This beginner’s guide will teach you the basics of cryptocurrency trading. We will cover:

What is cryptocurrency?

How to trade cryptocurrency

What are cryptocurrency charts?

What are risk factors?

Before you start trading, you need to understand what cryptocurrency is. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

There are two main types of cryptocurrencies: digital and traditional. Digital currencies use encryption to secure transactions and control the creation of new units. They are often traded on decentralized exchanges and can be used to purchase goods and services. Traditional currencies are printed and backed by governments. They are often traded on centralized exchanges and can be used to purchase goods and services.

How to trade cryptocurrency

To trade cryptocurrency, you need an exchange. Exchanges are where you buy and sell cryptocurrencies. There are many exchanges available, but some of the most popular include Binance, Bitfinex, Bittrex, and Coinbase.

Before you start trading, you need to set up an account with an exchange. You will need to provide your name, email address, and a password. You will also need to provide your nationality and a photo ID. After you have set up your account, you will need to deposit some money into your account. You can either use a bank transfer or a cryptocurrency. Popular cryptocurrencies to trade include Bitcoin, Ethereum, and Litecoin.

After you have deposited money into your account, you will need to open an account with a charting platform. A charting platform is where you will track the prices of cryptocurrencies. Some popular charting platforms include Trading View, Coinigy, and CoinMarketCap. After you have opened an account with a charting platform, you will need to set up an account with a trading bot. A trading bot is a computer program that automates your trades. Some popular trading bots include botcoin, Cryptohopper, and CryptoTraderPro.

What are cryptocurrency charts?

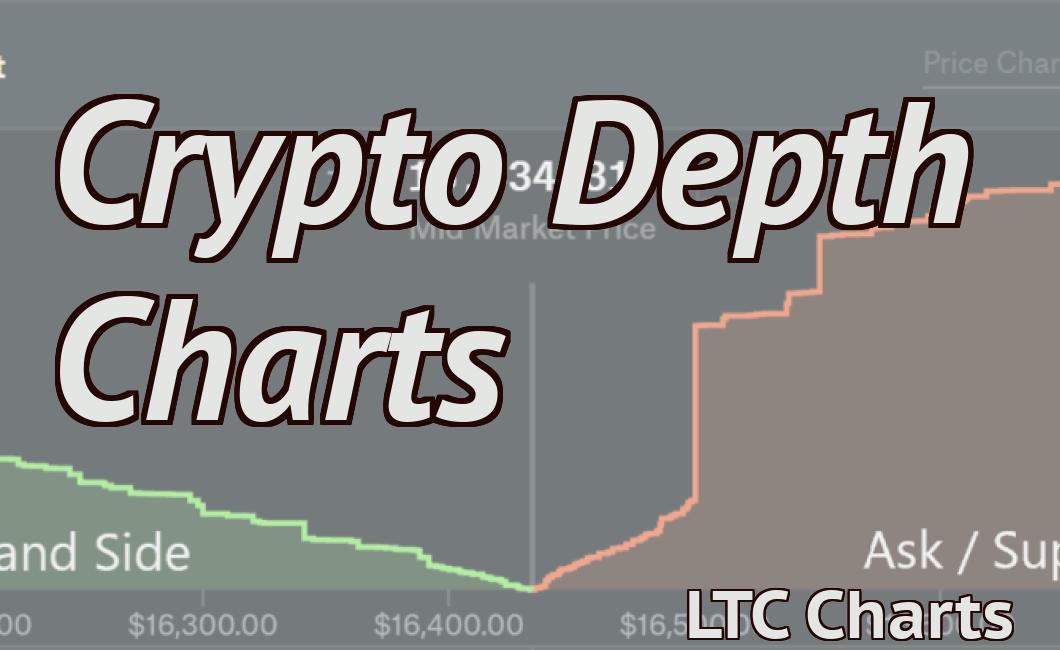

Cryptocurrency charts are visual representations of the prices of cryptocurrencies. They show the price of a cryptocurrency over time and can be used to predict future prices.

Cryptocurrency charts are often divided into two categories: technical analysis and fundamental analysis. Technical analysis is the use of charts to predict future prices. It is based on the theory that markets are driven by supply and demand. Technical analysts look for patterns in the data to forecast future prices. Fundamental analysis is the use of charts to analyze the fundamentals of a cryptocurrency. It is based on the theory that markets are driven by facts and information. Fundamental analysts look at factors such as the price of a cryptocurrency, the number of transactions, and the market capitalization of a cryptocurrency to predict future prices.

What are risk factors?

Before you start trading cryptocurrency, you need to understand the risks associated with the activity. The risks associated with cryptocurrency trading include:

The risks associated with investing in cryptocurrencies include the risk of losing your investment.

The risks associated with trading cryptocurrencies include the risk of losing your money.

The risks associated with using an exchange include the risk of being hacked.

The risks associated with using a charting platform include the risk of losing your money.

The risks associated with using a trading bot include the risk of losing your money.

How to use crypto currency trading charts to make profits

Cryptocurrency trading charts can be used to help traders make profits. When analyzing charts, it is important to look for trends and signals that can provide valuable information about the market conditions. By using these signals, traders can make informed decisions about when to trade and how to trade in order to maximize their profits.

When looking at cryptocurrency trading charts, it is important to pay attention to the following indicators:

1) The price of the cryptocurrency

2) The volume of the cryptocurrency

3) The trend of the cryptocurrency

By analyzing these indicators, traders can identify patterns that can help them make informed trading decisions. For example, if the price of a cryptocurrency is trending upward, it is likely that there are opportunities to make profits by trading in this direction. In contrast, if the price of a cryptocurrency is trending downward, it is likely that there are opportunities to make profits by trading in the opposite direction.

By using these trading signals, traders can make informed decisions about when to trade and how to trade in order to maximize their profits.

The secrets of successful crypto currency traders

Crypto currency trading is a high-risk, high-return investment opportunity. The following are some secrets of successful crypto currency traders:

1. Do your research.

Before you start trading crypto currencies, do your research and understand the risks. Know what coins you are investing in and understand the mechanics of the coin and the blockchain technology.

2. Stay disciplined.

When you start trading, be disciplined and stick to your plan. Don’t overreact to the market conditions. Instead, stick to your investment strategy and hold on to your coins.

3. Have a plan for when the market goes down.

When the market goes down, have a plan for how you will deal with it. Do not panic and instead, stay disciplined and stick to your plan.

4. Have a plan for when the market goes up.

When the market goes up, have a plan for how you will deal with it. Do not panic and instead, stick to your investment strategy and hold on to your coins.

What do crypto currency trading charts really mean?

Cryptocurrency trading charts are a way to track the price of cryptocurrencies over time. They can be used to determine when a cryptocurrency is over or undervalued, and can also be used to predict future price movements.