How are market prices determined in crypto?

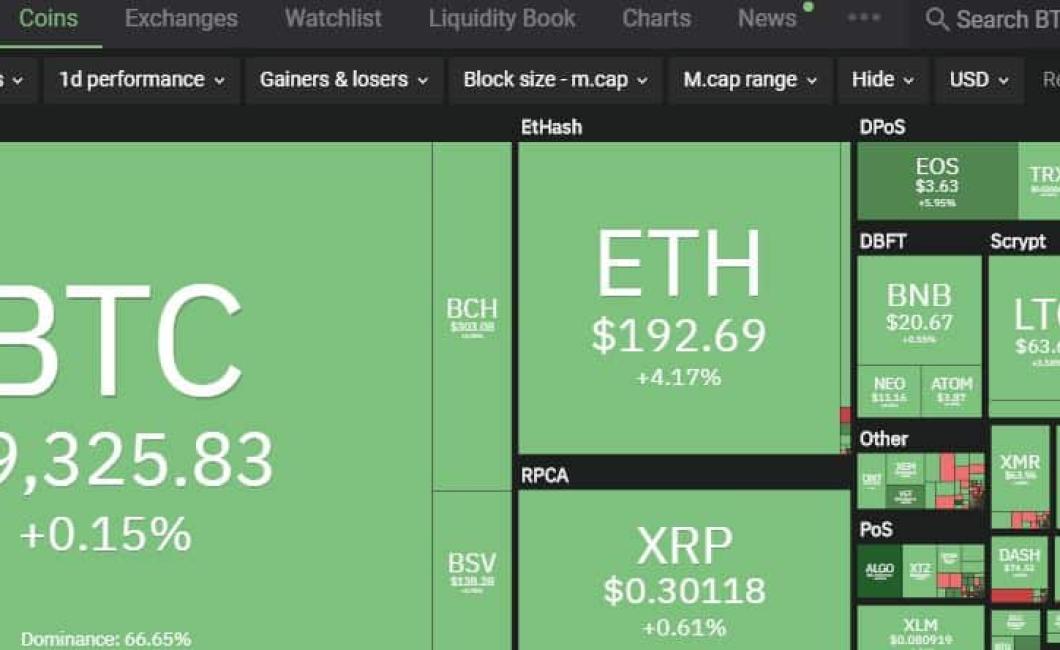

In the world of cryptocurrency, market prices are determined by a number of factors. The most important factor is supply and demand. When there is more demand for a particular coin than there is available supply, the price will go up. Conversely, when there is more supply than demand, the price will go down. Other factors that can influence price include news events, platform updates, and overall market sentiment.

How Market Prices Are Determined In Crypto

Crypto markets are determined by supply and demand. Supply is determined by the total number of coins that have been created, and demand is determined by the number of people who are willing to buy a certain crypto asset.

The price of a cryptocurrency is affected by a number of factors, including the supply and demand of the underlying crypto asset, global economic conditions, and news events.

The Factors That Affect Crypto Market Prices

Cryptocurrency prices are highly influenced by a number of factors, including global trends, regulatory changes, technical analysis indicators, and news events.

Global Trends

Cryptocurrencies are often considered to be volatile and speculative investments, and their prices are often sensitive to global trends. The popularity of cryptocurrencies has been rising globally, and this has caused their prices to rise and fall.

Regulatory Changes

Regulatory changes can have a significant impact on the prices of cryptocurrencies. For example, if the government decides to crackdown on cryptocurrencies, this could cause their prices to drop.

Technical Analysis Indicators

Technical analysis indicators are used to predict the future price movements of cryptocurrencies. These indicators can be used to determine whether the cryptocurrency is in a bullish or bearish phase.

News Events

News events can also have a significant impact on the prices of cryptocurrencies. For example, if a major financial institution begins to accept cryptocurrencies as a form of payment, this could cause their prices to increase.

How Volatility Affects Crypto Prices

Volatility is a measure of how much price movement there is in the cryptocurrency market. The greater the volatility, the more price swings there will be.

Bitcoin, for example, has a very high level of volatility. This means that its price can swing a great deal in a short period of time. This makes it a risky investment, and it’s important to do your homework before investing in any cryptocurrency.

If you’re looking to buy cryptocurrency, it’s important to understand how volatility affects prices. If you’re interested in selling cryptocurrency, understanding volatility can help you set the right asking price.

The Relationship Between Supply & Demand In Crypto Markets

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

How Fear & Greed Drive Crypto Prices

Cryptocurrencies are built on a blockchain technology that allows for secure, transparent and tamper-proof transactions. Cryptocurrencies are also built on the idea that digital scarcity and demand will drive their prices up.

Cryptocurrencies are often associated with greed and fear. Greed is when someone desires something more than they need, and fear is when someone is afraid of something. When people are greedy, they may invest in cryptocurrencies in order to make money. When people are fearful, they may sell their cryptocurrencies in order to avoid losing money.

The Psychology Of Crypto Pricing

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. The value of a cryptocurrency is based on supply and demand. Crypto prices can fluctuate rapidly due to a variety of factors, including political, economic, and social events.