Patterns In Crypto Charts

Crypto charts can be a helpful tool for investors to use when trying to identify patterns in the market. By analyzing different chart patterns, investors may be able to predict future market movements and make more informed investment decisions. There are a few different types of chart patterns that investors should be aware of, which include head and shoulders, cup and handle, and double bottom. Each of these patterns can indicate different things about the market, so it is important to understand what each one means before making any investment decisions.

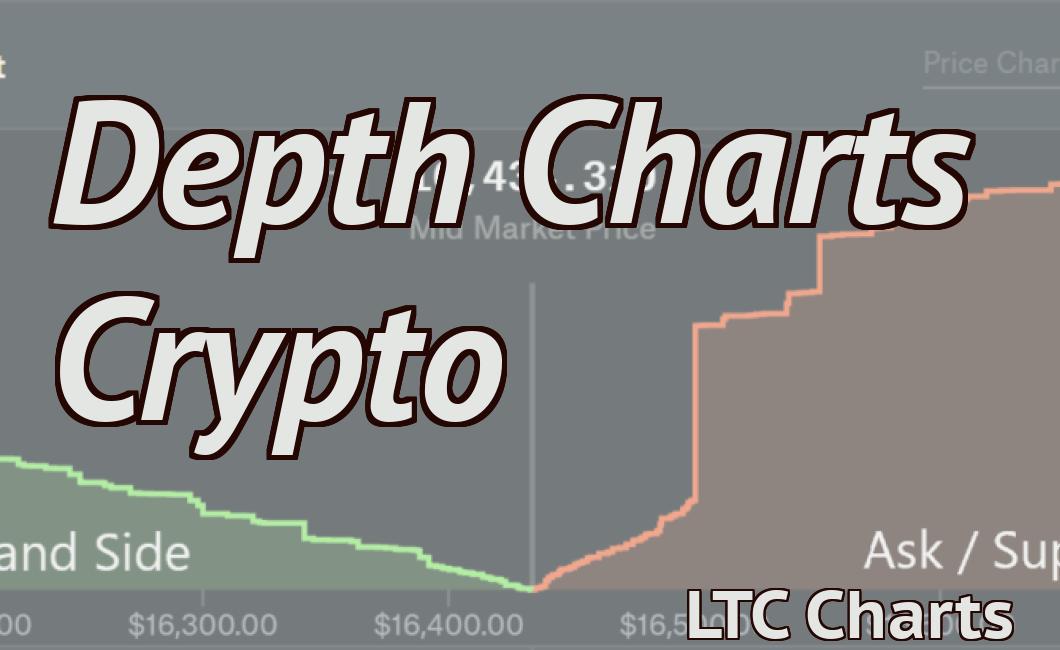

The Many Patterns of Cryptocurrency Charts

Cryptocurrency charts are an important tool for traders and investors. They can help you to understand the movements of a cryptocurrency and make informed investment decisions.

There are many different types of cryptocurrency charts, but they all have one common goal: to show you how a cryptocurrency is performing over time.

Here are some of the most common types of cryptocurrency charts:

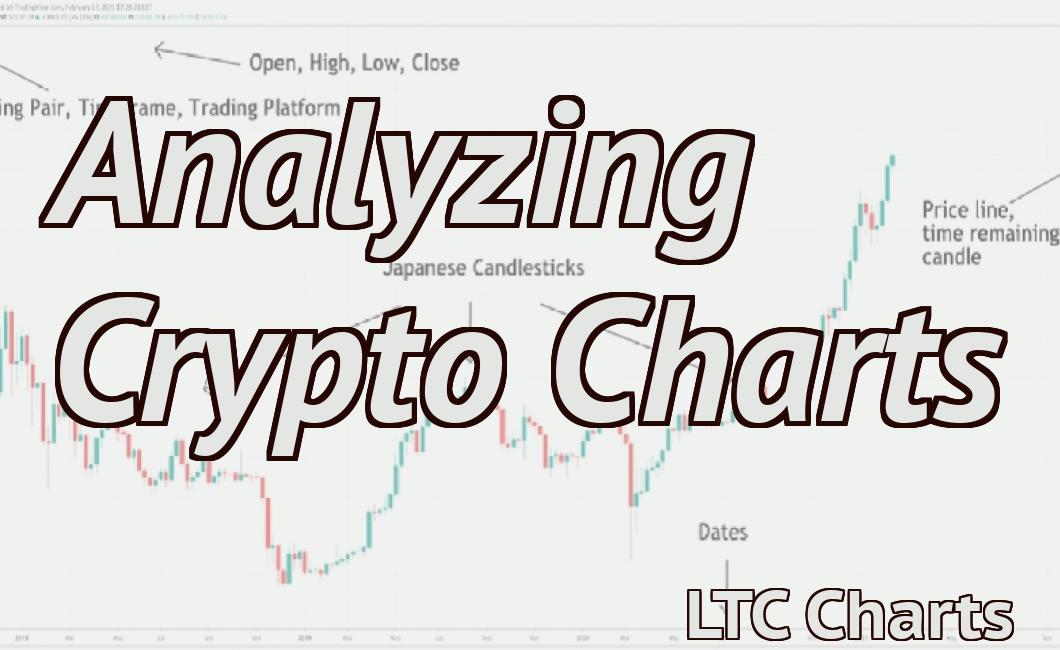

1. Candle Chart

A candle chart is a simple way to visualize the movement of a cryptocurrency over time. It shows the price of a cryptocurrency over a period of 24 hours, divided into candles.

Each candle shows the price of a cryptocurrency at a specific time. The size of a candle corresponds to the volume of trade that took place at that specific time.

2. OHLC Charts

An OHLC chart is a popular way to visualize the movement of a cryptocurrency over time. It shows the price of a cryptocurrency over a period of 1, 3, 5, and 7 days, divided into bars.

Each bar shows the price of a cryptocurrency at a specific time. The color of a bar indicates the sentiment of the market at that moment: green indicates a bullish sentiment, and red indicates a bearish sentiment.

3. Volume Charts

A volume chart is a popular way to visualize the movement of a cryptocurrency over time. It shows the traded volume of a cryptocurrency over a period of 24 hours, divided into circles.

Each circle shows the volume of trade that took place at that specific time. The size of a circle corresponds to the value of the trade that took place at that specific time.

4. Moving Averages

A moving average is a technical indicator that helps you to understand the trend of a cryptocurrency over time. It shows the average price of a cryptocurrency over a period of N periods, divided into bars.

The longer the bar, the more recent the data in it is. The moving average helps you to identify whether the current price is above or below the average price of the past N periods.

The Most Common Patterns in Cryptocurrency Charts

There are a few common patterns in cryptocurrency charts that investors and traders should be aware of.

1. Price Peaks and Troughs

Cryptocurrency prices tend to experience pronounced price peaks and troughs over time. These peaks and troughs can be related to a variety of factors, including news events, regulatory changes, or market sentiment.

2. Volatility

Cryptocurrency prices are notoriously volatile. This means that prices can often change rapidly and unpredictably.

3. Geographical Distribution

Cryptocurrency prices tend to be more volatile in some regions of the world than others. This is likely due to a variety of factors, including regulatory uncertainty and overall investor appetite.

The Most Important Patterns in Cryptocurrency Charts

Bitcoin

Bitcoin is by far the most important cryptocurrency in the world. It is the first and most well-known cryptocurrency, and it is responsible for a large majority of the overall market cap.

Bitcoin has been the top performer in the cryptocurrency market for the past several years, and it remains one of the more stable cryptocurrencies.

Ethereum

Ethereum is second only to Bitcoin in terms of market cap. It is a popular choice for cryptocurrency investors because of its potential to grow significantly in the future.

Ethereum is unique in that it allows developers to create blockchain applications. This makes it a powerful tool for other cryptocurrencies to compete against Bitcoin.

Litecoin

Litecoin is a popular choice for those looking for a more affordable alternative to Bitcoin. It has a lower market cap than Bitcoin, but it is growing rapidly.

Monero

Monero is a relatively new cryptocurrency that focuses on privacy. This makes it a good choice for those looking to hide their transactions from authorities.

Ripple

Ripple is a popular choice for those looking to move money quickly and easily. It has been growing rapidly in popularity, and it is expected to become the next big thing in the cryptocurrency market.

The Lesser-Known Patterns in Cryptocurrency Charts

While there are a number of well-known patterns in cryptocurrency charts, there are also a number of less-known patterns that can be useful for understanding the dynamics of the market.

1. The Power Law

One of the most well-known patterns in cryptocurrency charts is the power law. This is a graphical representation of how often a given event occurs relative to the total number of events.

The power law can be used to identify different patterns in the market, such as when a trend is beginning or ending. Additionally, it can be used to predict future movements in the market.

2. The V-Shape

Another well-known pattern in cryptocurrency charts is the V-shape. This is a graphical representation of how prices have fluctuated over time.

The V-shape is often used to identify a trend in the market, and it can also be used to predict future movement in the market.

3. The Fibonacci Retracement

Another well-known pattern in cryptocurrency charts is the Fibonacci retracement. This is a graphical representation of how prices have recovered after falling in price.

The Fibonacci retracement is often used to identify a trend in the market, and it can also be used to predict future movement in the market.

The Most Popular Patterns in Cryptocurrency Charts

There are a number of popular cryptocurrency charts that are used by investors and traders. Some of the most popular charts include:

1) 24-hour candlestick charts

2) Line charts

3) Candlestick charts with timeframes

4) Candlestick charts with indicators

5) Technical analysis charts

24-Hour Candlestick Charts

24-hour candlestick charts are a popular way to track price movements over a period of time. These charts show the closing prices for a given day, as well as the opening and closing prices for the previous day.

Line Charts

Line charts are another popular type of chart that shows the price movement of a cryptocurrency over time. These charts typically use either a linear or logarithmic scale to display data.

Candlestick Charts with Timeframes

Candlestick charts with timeframes show the price movement of a cryptocurrency over a specific period of time. These charts typically use a 24-hour, 7-day, or 1-month timeframe.

Candlestick Charts with Indicators

Candlestick charts with indicators show the price movement of a cryptocurrency over a specific period of time using different indicators. These charts typically use indicators such as moving averages, Bollinger bands, and RSI.

Technical Analysis Charts

Technical analysis charts are used to identify patterns in the price movement of a cryptocurrency. These charts can be used to identify trends, signals, and reversals.

The Most Significant Patterns in Cryptocurrency Charts

Bitcoin is the most popular cryptocurrency and has been dominant in the market since its inception. Bitcoin’s share of the cryptocurrency market has remained relatively consistent over the years, hovering around 50-60% over the past few years.

Ethereum has been the second most popular cryptocurrency for a while now and has seen significant growth in recent years. Ethereum’s share of the cryptocurrency market has increased significantly in recent months and it now accounts for around 25-30% of the total market cap.

Other popular cryptocurrencies include Bitcoin Cash, Ripple, and Litecoin. These cryptocurrencies are all experiencing growth in the market, but Bitcoin Cash and Ripple are leading the way.

There are a number of important patterns that can be seen in cryptocurrency charts. The first is that Bitcoin is the dominant cryptocurrency and has been so for a long time. Ethereum has seen significant growth in recent months, but it is still a relatively small player in the market.

Another important pattern is that there is a lot of volatility in the cryptocurrency market. This means that prices can change rapidly and often unpredictably. This is something that investors should be aware of and prepared for.

The Most Unique Patterns in Cryptocurrency Charts

There are a lot of unique patterns in cryptocurrency charts, which can be really confusing for new investors.

In this article, we will try to list some of the most common and unique cryptocurrency chart patterns that you should be aware of.

1. The Head-and-Shoulders Pattern

The head-and-shoulders pattern is one of the most common patterns in cryptocurrency charts. It is usually seen when a cryptocurrency is experiencing a period of stability and growth, followed by a period of volatility and growth.

To identify the head-and-shoulders pattern, you need to identify two peaks in the price chart. The first peak should be higher than the second peak, and the prices should be moving in a upward direction. The head-and-shoulders pattern usually lasts for about three to six months.

2. The Double Top Pattern

The double top pattern is another common cryptocurrency chart pattern. It is usually seen when a cryptocurrency experiences a period of stability and growth, followed by a period of volatility and growth.

To identify the double top pattern, you need to identify two peaks in the price chart. The first peak should be higher than the second peak, and the prices should be moving in opposite directions. The double top pattern usually lasts for about three to six months.

3. The Bullish Flag Pattern

The bullish flag pattern is another common cryptocurrency chart pattern. It is usually seen when a cryptocurrency is experiencing a period of stability and growth, followed by a period of volatility and growth.

To identify the bullish flag pattern, you need to identify a flag in the price chart. The flag should be moving in an upward direction, and the prices should be moving higher. The bullish flag pattern usually lasts for about three to six months.

The Most Mysterious Patterns in Cryptocurrency Charts

It's hard not to be struck by the mystery of cryptocurrency charts. They seem to defy logical explanation, and they've inspired a cottage industry of amateur analysts and fortune-tellers.

At their heart, cryptocurrency charts are just graphical representations of the prices of digital tokens. But they display an amazing range of patterns that can be difficult to interpret.

Here are four of the most mysterious patterns in cryptocurrency charts:

1. The Engulfing Pattern

This is one of the most common patterns on cryptocurrency charts. It shows a token's price rising dramatically over a period of time, reaching a high point before falling back down again.

The reason for this pattern is unclear, but it may be related to speculative buying or fear of missing out (FOMO). Whatever the reason, it's a common sight on cryptocurrency charts.

2. The Exponential Growth Pattern

This pattern is similar to the engulfing pattern, but it shows a token's price rising exponentially over a period of time.

The reason for this pattern is also unclear, but it may be related to the increasing popularity of cryptocurrencies. Whatever the reason, this pattern is also common on cryptocurrency charts.

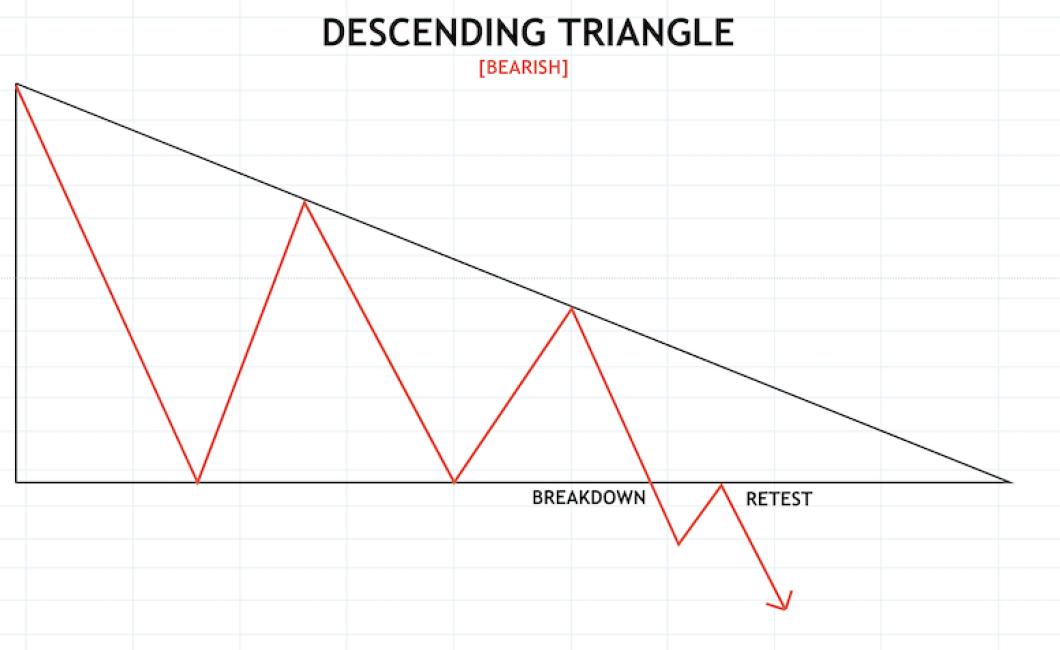

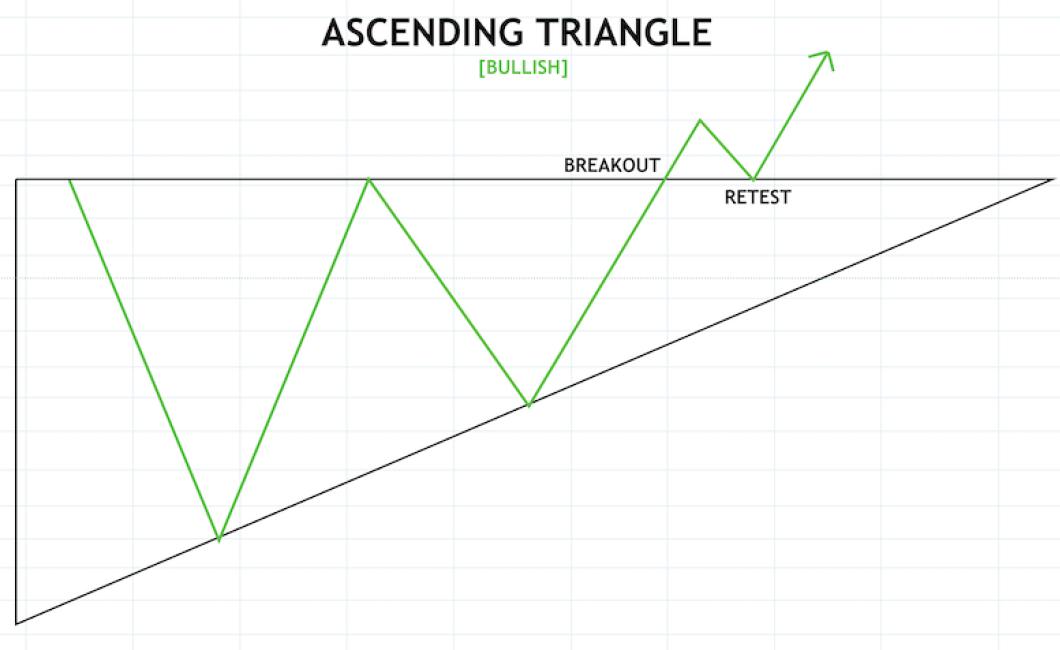

3. The Triangle Pattern

This pattern is often seen on cryptocurrency charts when a token's price is going up and down between two specific points.

The triangle pattern usually indicates that there's a lot of volatility and uncertainty surrounding the token's price. It can be difficult to predict what will happen next, which can lead to some profitable trading opportunities.

4. The Chaotic Volatility Pattern

This pattern is often seen on cryptocurrency charts when the prices of tokens are going up and down rapidly and unpredictably.

The chaotic volatility pattern can be very frustrating for amateur traders, as it's hard to predict which direction the prices will go next. If you're trying to make a long-term investment in cryptocurrencies, this pattern might not be the best way to go about it.

The Most Controversial Patterns in Cryptocurrency Charts

There are a lot of patterns that people find controversial in cryptocurrency charts. Some of these patterns are more controversial than others, but they all have one thing in common: they can be difficult to interpret.

1. Wild swings in price

One of the most controversial patterns in cryptocurrency charts is wild swings in price. This means that the price of a cryptocurrency can go up or down a lot, without any real reason. This can be confusing for people who are not familiar with cryptocurrency, and it can also be dangerous for people who are investing money in cryptocurrencies.

2. Fake signals

Another controversial pattern in cryptocurrency charts is fake signals. This means that a cryptocurrency chart is showing signs that suggest that the price of a cryptocurrency is about to go up, but actually the price of the cryptocurrency is going to go down instead. This can be very confusing for people who are trying to invest in cryptocurrencies, and it can also be dangerous for people who are investing money in cryptocurrencies.

3. Pump and dump schemes

Pump and dump schemes are another controversial pattern in cryptocurrency charts. This means that a group of people (usually traders) will try to drive up the price of a cryptocurrency by buying it, and then selling it immediately afterwards. This can be very deceiving, and it can also be dangerous for people who are trying to invest in cryptocurrencies.

4. Fake volumes

Another controversial pattern in cryptocurrency charts is fake volumes. This means that a cryptocurrency chart is showing signs that suggest that a lot of people are buying or selling a cryptocurrency, when in fact there is actually very little activity happening on the market. This can be confusing for people who are trying to invest in cryptocurrencies, and it can also be dangerous for people who are investing money in cryptocurrencies.

The Most Misunderstood Patterns in Cryptocurrency Charts

There are a few patterns that are often misunderstood in cryptocurrency charts. One of these patterns is the head-and-shoulders pattern.

The head-and-shoulders pattern is a technical indicator that is used to identify oversold and overbought conditions in markets. When the price of a cryptocurrency is moving up and down in a repetitive pattern, it is often considered to be in an oversold or overbought condition.

When the price of a cryptocurrency is moving up and down in a repetitive pattern, it is often considered to be in an oversold or overbought condition.

The most common way to identify a head-and-shoulders pattern is to look for a price point that is consistently above or below the previous price point. If the price of a cryptocurrency is moving up and down but never settles at either of the two aforementioned prices, it is likely that the market is in a head-and-shoulders pattern.

Other patterns that can be confusing for cryptocurrency investors include the double top and double bottom patterns. These patterns are often used to identify when a market is about to experience a significant change.

When identifying a double top or double bottom pattern, be sure to look for two consecutive price points that are significantly different from each other. If the market experiences a sudden change after these two points have been reached, it may be an indication that the market is about to experience a significant change.

The most Forgotten Patterns in Cryptocurrency Charts

There are a number of patterns that are often forgotten when it comes to cryptocurrency charts, and unfortunately, these patterns can lead to significant losses for investors.

1. Oversold Conditions

One of the most common mistakes made when trading cryptocurrencies is investing in coins or tokens when the market is in an oversold condition. This occurs when the price of a security has fallen below its previous support level and is likely to continue falling.

When this occurs, it is easy for investors to panic and sell their holdings, which in turn can lead to further price declines. If you see a coin or token appearing oversold on a chart, it is important to wait until the market has regained some momentum before making a purchase.

2. Focusing on Price instead of Volume

Another common mistake made when trading cryptocurrencies is focusing too much on the price of a coin or token. While price is important, it is not the only factor that should be considered when making a decision about whether or not to buy or sell a security.

Volume is also important, as it provides insight into how active the market is and how popular a coin or token is. When volume is high, it suggests that investors are buying and selling the asset, which is a positive sign. However, volume can also be misleading, and it is important to take other factors into account before making a purchase or sale.

3. Trading without proper research

Another common mistake made when trading cryptocurrencies is not doing enough research before making a purchase. Before investing in any cryptocurrency, it is important to do your own research and understand the risks involved.

If you do not have any understanding of the technology behind a coin or token, you could end up making a costly mistake. It is important to do your research before making any investment decisions, so that you can avoid common cryptocurrency chart mistakes.

The Patterns that will shape the Future of Cryptocurrencies

Cryptocurrencies are a new form of currency that uses cryptography to secure transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin was the first cryptocurrency and remains the most well-known. Bitcoin is a digital asset that uses cryptography to secure transactions and to control the creation of new units. Bitcoin is decentralized, meaning it is not subject to government or financial institution control.

Bitcoin has been widely accepted as a form of payment and has been used to purchase goods and services. However, there is no guarantee that Bitcoin will continue to be the most widely accepted cryptocurrency or that its use will be limited to purchasing goods and services.

Other cryptocurrencies have been created since Bitcoin was introduced, and there is likely to be continued innovation in this area. It is possible that new cryptocurrencies will become more widely accepted than Bitcoin and may even replace it as the most well-known cryptocurrency.

It is also possible that cryptocurrencies will become less popular and may eventually be discontinued. There is no guarantee that any particular cryptocurrency or group of cryptocurrencies will remain in use for long periods of time or become widely accepted.