Analyze crypto charts.

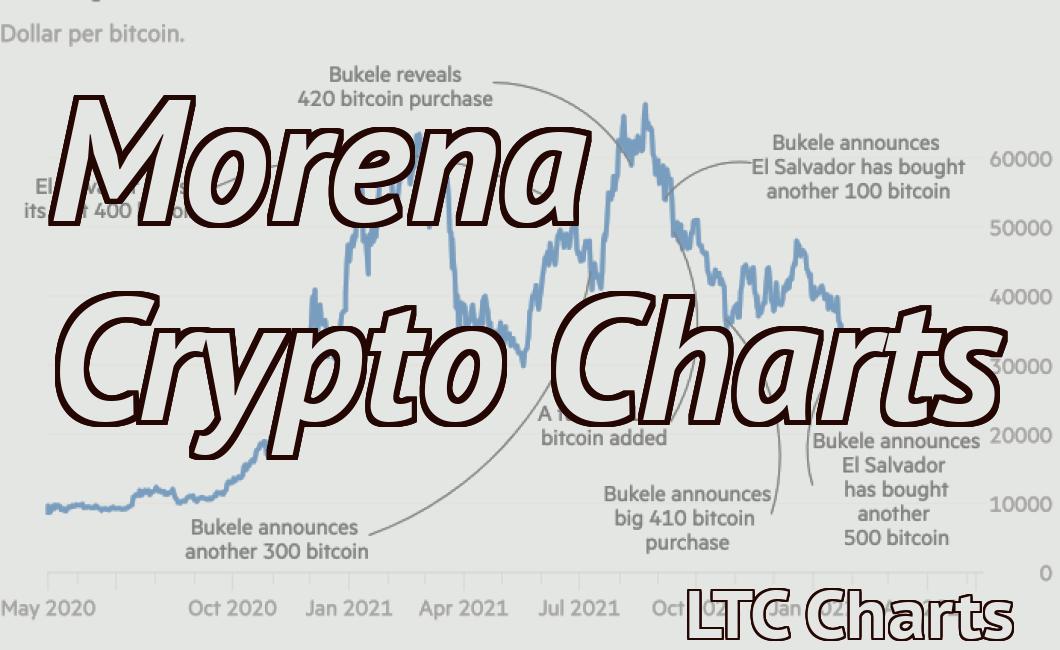

Crypto charts can be a helpful tool for investors to use when trying to determine which digital currencies to buy and sell. By analyzing the price movements of different digital assets over time, investors can get a better sense of which ones are likely to go up or down in value. Additionally, crypto charts can also be used to spot trends and patterns that can give clues as to where the market is headed.

How to read and understand cryptocurrency charts

Cryptocurrency charts are used to display the performance of a cryptocurrency over time. The chart will show you the value of the currency over a given period of time, and how it has changed relative to other currencies.

To read a cryptocurrency chart, you first need to understand what each column on the chart represents. The first column is the date, and the second column is the value of the currency in question. The third column shows the percentage change in value between the given date and the previous date. The fourth column is the total value of all coins in circulation. The fifth column shows the percentage change in value between the given date and the previous date, again divided by the total value of all coins in circulation.

To understand how a cryptocurrency is performing, you need to look at both the short-term and long-term charts. The short-term chart will show you how the value of a cryptocurrency has changed over the last few days, weeks, or months. The long-term chart will show you how the value of a cryptocurrency has changed over the last few years.

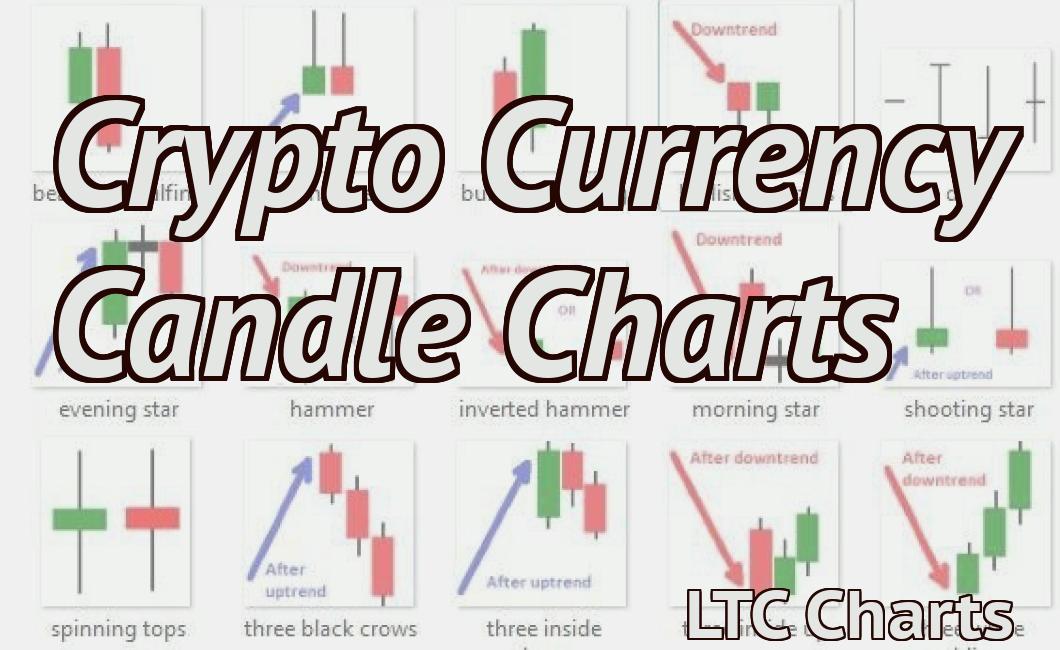

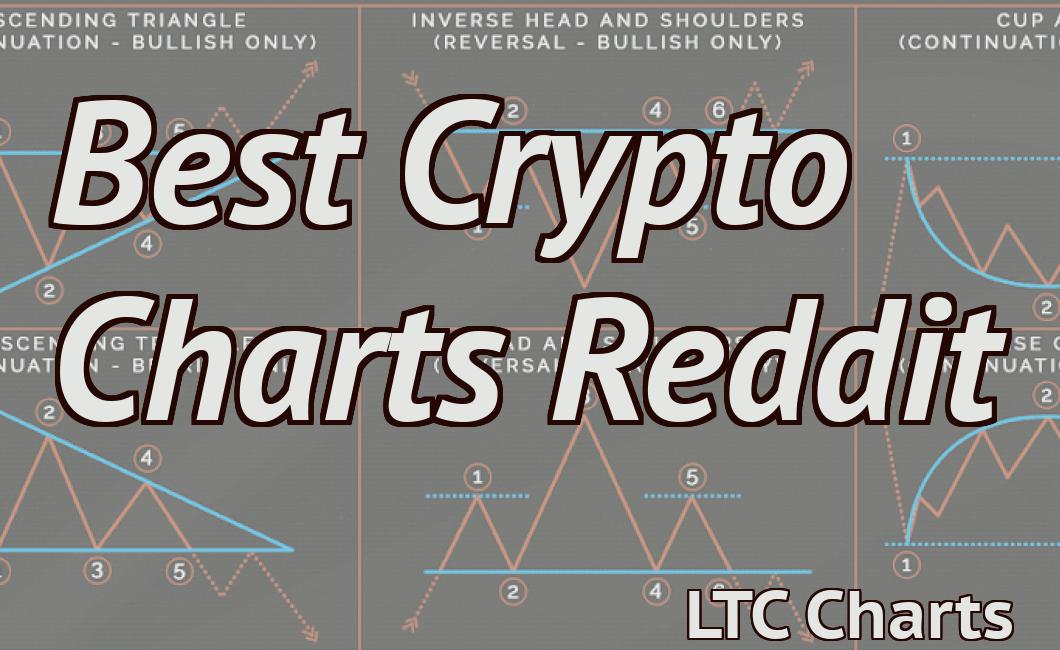

The most common crypto chart patterns and what they mean

A “band” is a technical term used to describe a range of prices that are tightly clustered together. When a band is formed, it often indicates that there is strong buying or selling pressure present and that prices are likely to move up or down within the band.

A “cup and handle” pattern is a technical term used to describe a range of prices that are tightly clustered together, with the bottom of the handle representing a lower price point and the top of the cup representing a higher price point. When a cup and handle pattern is formed, it often indicates that there is strong buying or selling pressure present and that prices are likely to move up or down within the band.

A “bullish flag” pattern is a technical term used to describe a range of prices that are tightly clustered together, with the middle of the flag representing a market area where prices are relatively stable. When a bullish flag is formed, it often indicates that there is strong buying or selling pressure present and that prices are likely to move up or down within the band.

3 essential tips for reading cryptocurrency charts

1. Always use a trading platform that provides comprehensive charting features.

2. Compare different exchanges and find one that offers the best price and liquidity.

3. Watch for important support and resistance levels to identify potential areas of buying or selling.

4. Make sure to keep an eye on your total investment, as well as the percentage of gain or loss achieved, in order to stay disciplined.

5. Always consult a financial advisor before making any investment decisions.

How to spot trends and make predictions using crypto charts

Cryptocurrency charts can be used for a variety of purposes, including trendspotting and predicting future events.

When analyzing cryptocurrency charts, it is important to keep in mind the following tips:

1. Look at the overall trend.

2. Compare the current price with previous prices.

3. Look at the volume of trade.

4. Check for any unusual activity on the chart.

5. Make predictions based on the trends and information found on the chart.

The basics of reading cryptocurrency charts

Cryptocurrency charts are a useful way to track the performance of a cryptocurrency over time. They show the price and volume of a cryptocurrency over a specific period of time.

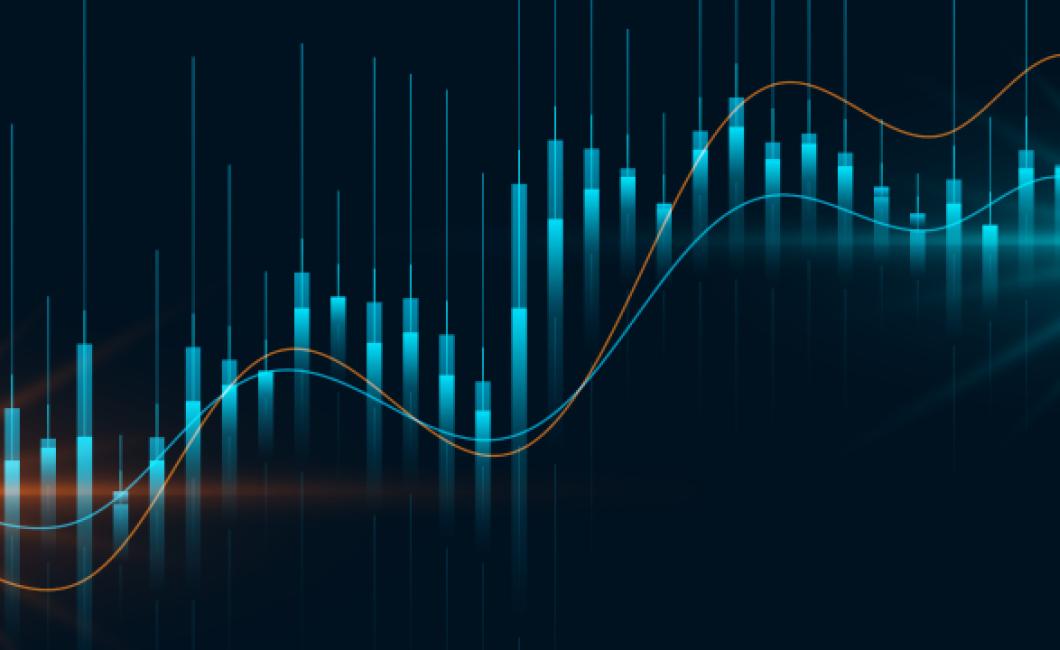

Charting tools allow you to view a cryptocurrency’s performance in different ways, including:

1. As a graph showing the price over time

2. As a histogram showing the distribution of prices over time

3. As a candlestick chart showing the price and volume over time

4. As a line chart showing the price over time

5. As a bar chart showing the price and volume over time

6. As a pie chart showing the distribution of prices over time

7. As a Venn diagram showing the overlap between different types of charts

It’s important to note that not all charting tools are available for every cryptocurrency. Some may only be available for certain exchanges or platforms. You should consult the charting tool’s documentation to find out more.

A beginner's guide to reading cryptocurrency charts

Cryptocurrencies are complex and there is a lot of information to be understood when looking at their charts. In this article, we will provide an overview of how to read cryptocurrency charts and help you understand what is happening on the market.

What is a cryptocurrency chart?

A cryptocurrency chart is a visual representation of the prices of cryptocurrencies over time. The chart will show you the prices of cryptocurrencies at different exchanges, the volume of transactions, and the average price of a cryptocurrency.

How to read a cryptocurrency chart

When looking at a cryptocurrency chart, the first thing to understand is the layout. The chart will usually have two sections: the top section will show the prices at different exchanges, while the bottom section will show the volume of transactions and the average price.

The first thing to look for on a cryptocurrency chart is the price. This is where you will find out how much value a cryptocurrency has been trading for over the past few hours, days, or weeks.

To understand how valuable a cryptocurrency is, you need to look at its volume. Volume is a measure of how much money is being traded in a cryptocurrency over a given period of time. High volume indicates that there is a lot of interest in the cryptocurrency and that it is likely to rise in value.

Finally, you need to look at the average price. This is where you will find out what the cryptocurrency has been trading for on average over the past few hours, days, or weeks. This is an important statistic because it can help you determine whether a cryptocurrency is over or undervalued.

How to use cryptocurrency charts to inform your trading decisions

Cryptocurrency charts are a great way to inform your trading decisions. When looking at a cryptocurrency chart, you want to focus on the following:

1. Price action: The price of a cryptocurrency should be moving up and down. If the price is not moving, then there is likely a lack of demand for the cryptocurrency and you should avoid buying it.

2. Technical indicators: There are many technical indicators that can help you determine if a cryptocurrency is over or undervalued. Some of the most important technical indicators to watch include the Relative Strength Index (RSI), the MACD, and the Bollinger Bands.

3. Volume: When looking at cryptocurrency charts, you want to focus on the amount of volume that is traded. High volume indicates that there is a lot of interest in the cryptocurrency and you should consider buying it. Low volume indicates that there is not a lot of interest in the cryptocurrency and you should avoid buying it.

The different types of cryptocurrency charts and what they show

Cryptocurrency charts are used to track the price of a cryptocurrency over time. There are a variety of different types of cryptocurrency charts, each with its own purpose.

The most common type of cryptocurrency chart is a chart that shows the price of a cryptocurrency over time. This type of chart can be used to track the price of a cryptocurrency over a set period of time, such as a day, week, or month.

Another type of cryptocurrency chart is a chart that shows the price of a cryptocurrency over a set period of time, but it also includes information about the number of coins that are in circulation. This type of chart is known as a volume chart.

A third type of cryptocurrency chart is a chart that shows the price of a cryptocurrency over a set period of time, but it also includes information about the market capitalization of the cryptocurrency. This type of chart is known as a market cap chart.

Finally, a fourth type of cryptocurrency chart is a chart that shows the price of a cryptocurrency over a set period of time, but it also includes information about the number of transactions that have been made with the cryptocurrency. This type of chart is known as a transaction chart.

An introduction to technical analysis for cryptocurrency trading

Technical analysis is used to forecast future price movements for a security or commodity. By studying past trends and analyzing current conditions, traders can make informed decisions about where to put their money.

There are a few core concepts to technical analysis:

1. Price Movement

Traders use price movement to determine whether a security or commodity is oversold or overbought. Oversold securities or commodities are usually trading at prices below their fundamental value, while overbought securities or commodities are trading at prices above their fundamental value. When a security or commodity is oversold, it is typically time to sell, and when it is overbought, it is typically time to buy.

2. Supply and Demand

Supply and demand are two important factors that determine the price of a security or commodity. When there is more demand for a security or commodity than there is available supply, the price will rise. Conversely, when there is more supply than demand, the price will fall.

3. Technical Analysis Indicators

Technical analysis indicators are used to identify patterns in price movements that can suggest future price outcomes. Some common technical analysis indicators include the MACD (Moving Average Convergence Divergence), ADX (Advanced Degree X), and RSI (Relative Strength Index).