Crypto Technical Charts

Crypto Technical Charts is a website that provides users with access to technical charts for various cryptocurrencies. The website also offers an online forum where users can discuss cryptocurrencies and their technical aspects.

How to read crypto technical charts

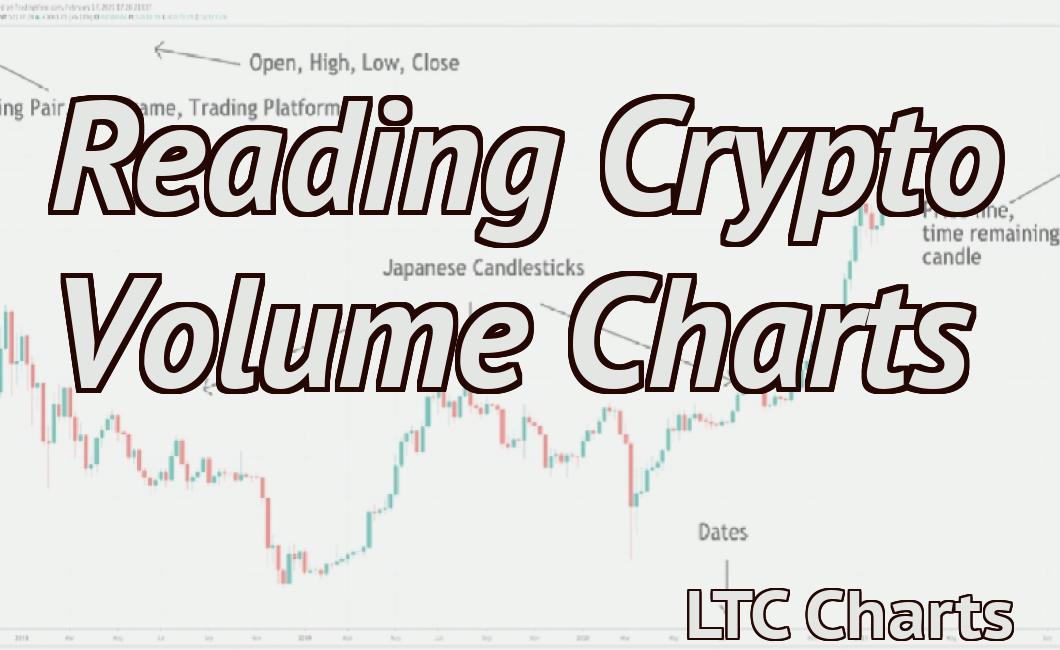

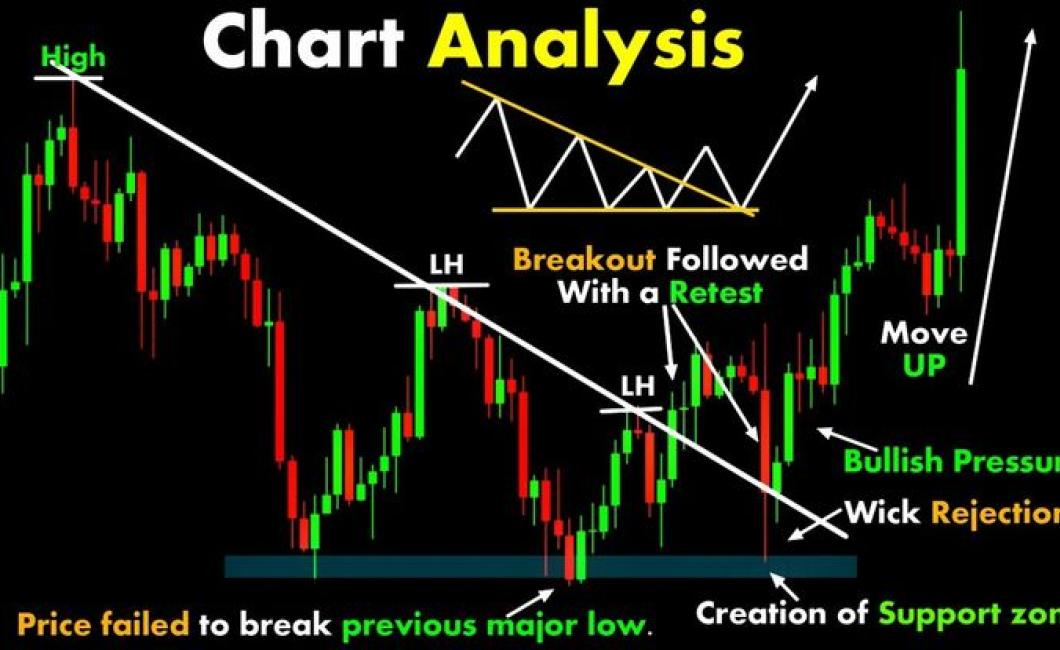

Cryptocurrencies are traded on a variety of exchanges and can be accessed through a variety of digital wallets. Cryptocurrency prices are displayed on various technical indicators, such as the candlestick chart.

To read crypto technical charts, you'll need to understand how those indicators work. Candlestick charts are used to display the price of a cryptocurrency over a given period of time, typically 24 hours. The size of the candlestick indicates the volume of trade that occurred during that time period.

The first thing to look for on a candlestick chart is the open, or green, candlestick. This represents the price at which the cryptocurrency was traded at the beginning of the period. The next thing to look for is the close, or red, candlestick. This represents the price at which the cryptocurrency was traded at the end of the period.

If the open and close candlesticks are close together, this indicates that the volume of trade was high during that time period. If the open and close candlesticks are far apart, this indicates that the volume of trade was low during that time period.

Other indicators that can be used to analyze crypto technical charts include the Bollinger Bands, the moving averages, and the RSI. Bollinger Bands indicate whether prices are overbought or oversold. Moving averages indicate how fast prices are moving and can be used to identify patterns. The RSI is a Relative Strength Index, which measures how much demand there is for a cryptocurrency and can be used to identify if the market is overvalued or undervalued.

The most important crypto technical indicators

The following are the most important crypto technical indicators.

1) Price index

This is a measure of the price of a cryptocurrency over a certain period of time. It shows how the price of the cryptocurrency is changing over time. The price index can be used to identify changes in the market conditions.

2) Trading volume

This is a measure of how many transactions were made with a cryptocurrency over a certain period of time. It shows how active the market is and how investors are trading the cryptocurrency.

3 simple crypto technical analysis strategies for beginners

1. Do your research

Before you start trading or investing in cryptocurrencies, it’s important to do your own research. This means understanding how cryptocurrencies work, what markets they’re traded on, and what risks are involved.

2. Stick to well-known coins

Cryptocurrencies are volatile, which means that the price of a coin can change quickly. It’s therefore important to stick to coins that are well-known and have a stable value.

3. Don’t invest more than you can afford to lose

While cryptocurrencies can be an exciting investment opportunity, remember that they’re also risky. If you’re not prepared to lose all of your money, don’t invest in cryptocurrencies.

A step-by-step guide to reading crypto technical charts

1. Look for a crypto’s price and volume over the course of a given day or week.

2. Compare prices and volumes between different exchanges.

3. Look for patterns in price and volume over time.

4. Evaluate the crypto’s technical indicators to get an idea of its overall trend.

How to use crypto technical charts to predict price movements

Crypto technical charts are a valuable tool for predicting price movements. Technical analysis is the study of the behavior of financial markets and the underlying factors that influence price movements.

When analyzing crypto technical charts, it is important to look at a variety of indicators to get an overall understanding of the market. Some of the most important indicators to watch for include the following:

1) The price trend

2) The supply and demand curves

3) The volume trend

4) The MACD (Moving Average Convergence/Divergence) indicator

5) The RSI (Relative Strength Index) indicator

6) The Bollinger Bands indicator

7) The Fibonacci retracement levels

8) The Ichimoku Cloud indicator

Each of these indicators can provide important information about the current state of the market. When combined, they can provide a comprehensive view of the current trends and dynamics of the crypto market.

It is important to keep in mind that technical analysis is not infallible. Even the best indicators can be wrong from time to time, and there is no guarantee that any specific pattern will continue to hold true over long periods of time. However, using technical analysis as a tool for trading can help you make informed decisions about your investments, and can give you a better understanding of how the market is behaving.

The most popular crypto technical indicators and what they mean

1. MACD

The MACD is a momentum indicator that helps to identify if a crypto is overbought or oversold. When the MACD line is above the MACD histogram, it is considered bullish, and when the MACD line is below the MACD histogram, it is considered bearish.

A beginner's guide to interpreting crypto technical charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are not regulated by the government, but some governments have issued warnings about their risks.

Cryptocurrency charts are used to monitor the price of a cryptocurrency and to identify trends. Technical analysis is the use of charts and other technical indicators to predict the future price movements of a security.

Cryptocurrency charts are divided into two main categories: daily and weekly. Daily charts show the price of a cryptocurrency over a fixed period of time, such as a day, week, or month. Weekly charts show the price of a cryptocurrency over a fixed period of time, but with updates every day.