How do I read crypto charts?

This article provides a basic overview of how to read cryptocurrency charts. It covers the basics of chart types, indicators, and signals.

How to Read Crypto Charts for Beginners

Cryptocurrency charts are designed to help investors and traders better understand the movement of digital currencies.

The first step is to understand what a “cryptocurrency” is. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Next, you need to understand how to read a cryptocurrency chart. A cryptocurrency chart is divided into two sections: the upper section shows the total value of a cryptocurrency over time, and the lower section shows the price of a particular cryptocurrency at specific points in time.

To begin, look at the upper section of the chart. This section will show you the total value of a cryptocurrency over time. The value of a cryptocurrency can go up or down, but it will always move up and down over time.

Next, look at the lower section of the chart. This section will show you the price of a particular cryptocurrency at specific points in time. The price of a cryptocurrency will go up or down, but it will not always move in a straight line.

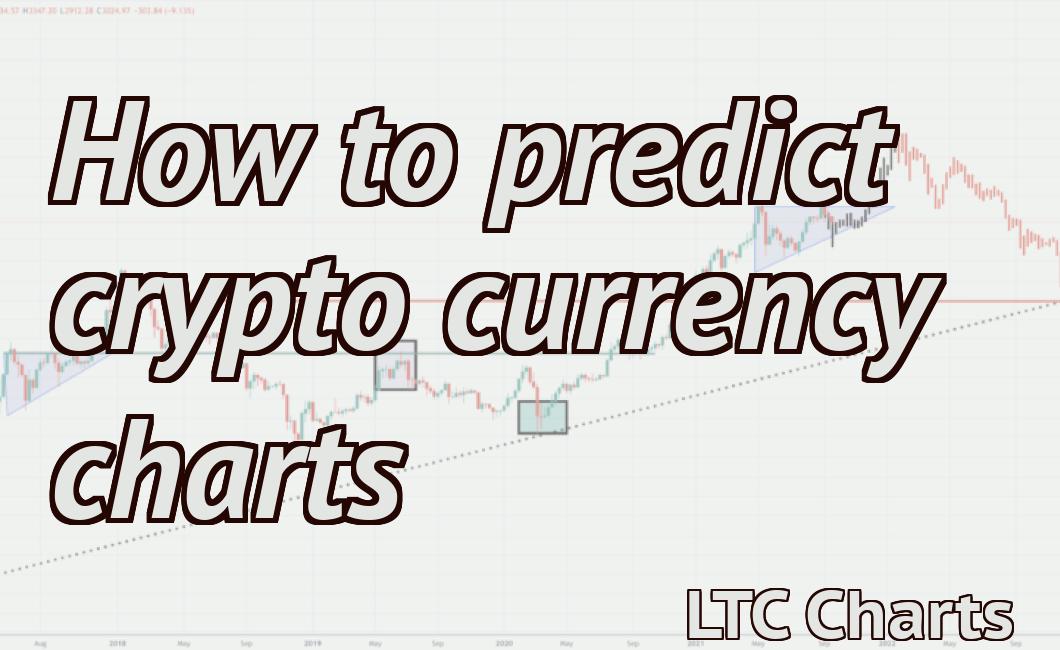

Finally, use your understanding of the chart to make predictions about the future movement of a cryptocurrency. If you think the value of a cryptocurrency is going to go up, then you should buy it. If you think the value of a cryptocurrency is going to go down, then you should sell it.

A Guide to Reading Crypto Charts

When you are looking at crypto charts, it is important to understand the different types of charts that are available and how they can be used.

candlestick charts

A candlestick chart is one of the most basic types of charts and shows the price of a security over a given time period. The shape of the candlestick indicates the market's sentiment at the time the candle was formed. For example, a bullish candlestick indicates that the market is optimistic about the future price of the security, while a bearish candlestick indicates that the market is pessimistic about the future price of the security.

bar charts

A bar chart shows the price of a security over a given time period as a series of bars. The length of the bar indicates the volume of the security traded over the given time period. The color of the bar indicates the market's sentiment at the time the bar was formed. For example, a green bar indicates that the market is bullish about the future price of the security, while a red bar indicates that the market is bearish about the future price of the security.

line charts

A line chart shows the price of a security over a given time period as a series of lines. The color of the line indicates the market's sentiment at the time the line was formed. For example, a green line indicates that the market is bullish about the future price of the security, while a red line indicates that the market is bearish about the future price of the security.

area charts

An area chart shows the price of a security over a given time period as a series of squares. The size of the square indicates the volume of the security traded over the given time period. The color of the square indicates the market's sentiment at the time the square was formed. For example, a green square indicates that the market is bullish about the future price of the security, while a red square indicates that the market is bearish about the future price of the security.

How to Interpret Crypto Charts

Crypto charts are used to help investors and traders keep track of the price movements of different cryptocurrencies.

Cryptocurrencies are often traded on exchanges, and the prices of these digital assets can be highly volatile. Crypto charts can help investors and traders monitor these movements and make informed decisions about when and how to buy or sell cryptocurrencies.

Cryptocurrency charts are typically displayed as a series of horizontal lines. The colors of the lines indicate the current value of the cryptocurrency. The height of the line indicates how much the cryptocurrency has changed in price since the last update.

Cryptocurrencies are often traded on exchanges, and the prices of these digital assets can be highly volatile. Crypto charts can help investors and traders monitor these movements and make informed decisions about when and how to buy or sell cryptocurrencies.

How to Analyze Crypto Charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrency exchanges allow you to buy and sell cryptocurrencies and sometimes offer trading pairs between different cryptocurrencies.

Cryptocurrency charts are a way to track the performance of a cryptocurrency over time. Crypto charts can be used to see how a cryptocurrency is performing against its peers, to identify trends, and to predict future prices.

To analyze cryptocurrency charts, you need to have a basic understanding of how cryptocurrencies work. You also need to be familiar with the different types of cryptocurrency charts and how to use them.

Cryptocurrency Charts

Cryptocurrency charts are often divided into three categories: technical, fundamental, and market.

Technical charts are designed to show how a cryptocurrency is performing technically. They may include indicators such as Bollinger bands and moving averages.

Fundamental charts are designed to show how a cryptocurrency is performing based on its fundamentals. These include measures of demand (such as daily trading volume) and supply (such as total number of coins in circulation).

Market charts are designed to show how a cryptocurrency is performing relative to the rest of the market. They may include measures of price volatility and market capitalization.

How to Use Crypto Charts

The first step in using crypto charts is to gather the relevant data. This can be done by scanning a list of exchanges, looking at historical prices, or mining various coins to get a sense of market trends.

Once the data is collected, the next step is to create a chart. This can be done by opening a charting program, such as Excel or Google Sheets, and entering the data into the appropriate cells.

Next, it is necessary to create a plot. This can be done by selecting the data that is relevant to the plot and clicking on the plot button. This will open a plot window which will allow you to customize the plot.

Finally, it is necessary to publish the chart. This can be done by clicking on the publish button and filling in the appropriate information.

A Tutorial on Reading Crypto Charts

Crypto charts are a great way to get an overview of the current prices of cryptocurrencies. By reading crypto charts, you can quickly and easily gain an understanding of the current state of the cryptocurrency market.

There are a few things that you will need in order to read crypto charts:

1. A cryptocurrency wallet

2. A digital currency exchange

3. A cryptocurrency charting platform

Once you have these items, you can begin reading crypto charts.

The first step is to open your cryptocurrency wallet. This is where you will store your digital currency. You will also need to have an account with a digital currency exchange. Once you have both of these items, you can begin reading crypto charts.

To read a cryptocurrency chart, you will first need to find a digital currency charting platform. There are a number of these platforms available online, so it is important to find one that is compatible with your cryptocurrency wallet. Once you have found a compatible platform, you can begin reading the charts.

When you are reading a cryptocurrency chart, it is important to understand the different types of charts that are available. There are three main types of cryptocurrency charts: daily, weekly, and monthly. Each of these charts provides a different type of information.

Daily crypto charts show the prices of cryptocurrencies over a 24-hour period. Weekly crypto charts show the prices of cryptocurrencies over a 7-day period. Monthly crypto charts show the prices of cryptocurrencies over a 30-day period.

Each of these charts has its own advantages and disadvantages. Daily crypto charts are the most popular because they provide the most detailed information. Weekly crypto charts are less detailed but are more popular because they allow users to see trends over a longer period of time. Monthly crypto charts are the least detailed but are the most popular because they provide the most insight into the current state of the cryptocurrency market.

Once you have begun reading crypto charts, it is important to stay up to date with the latest news and events. This will help you to make better decisions when trading cryptocurrencies.

How to Read Crypto Chart Patterns

Cryptocurrencies are often traded on digital exchanges and can be highly volatile. As such, it can be difficult to determine the direction of the market and make informed investment decisions.

One way to make informed investment decisions is to look for patterns in the price of cryptocurrencies. Patterns can indicate whether the market is headed in a certain direction, and can help you make better investment decisions.

There are a number of different crypto chart patterns, but the most common are candlesticks, triangles, and flags.

Candlesticks

A candlestick is a visual representation of a cryptocurrency's price movement. Candlesticks are typically filled with either green or red, indicating whether the price was higher or lower than the previous candlestick.

When looking for candlestick patterns, it's important to focus on the length and direction of the candles. When the candles are long and moving in the same direction, this is called a bullish pattern. When the candles are short and moving in opposite directions, this is called a bearish pattern.

Triangles

A triangle is a graphical pattern that indicates a trend reversal. When identifying a triangle, it's important to look for the three points that make up the triangle. These points indicate when the price of the cryptocurrency began to rise, when it peaked, and when it began to decline.

If you see a triangle forming, it's important to wait until the trend has been confirmed before making any investment decisions.

Flags

A flag is a graphic pattern that indicates an impending trend change. Flags are typically represented by a flagpole with two flags hanging from it. The first flag indicates when the trend began, and the second flag indicates when the trend is likely to end.

When looking for a flag pattern, it's important to watch for how the flags are moving. If the flags are moving in opposite directions, this is indicative of a trend reversal. If the flags are moving in the same direction, this is indicative of a trend continuation.