Crypto Rsi Charts

Crypto RSI charts are a great way to see how different cryptocurrencies are performing against each other. You can use them to compare the performance of different coins over time, or to see how different exchanges are faring.

A Beginner's Guide to Reading Crypto RSIs

Crypto RSIs (short for "resistant, tokenized securities") are a new type of security that use blockchain technology to create a tamper-proof record of ownership.

Crypto RSIs are a new type of security that use blockchain technology to create a tamper-proof record of ownership.

1. What is a Crypto RSI?

A Crypto RSI is a security that uses blockchain technology to create a tamper-proof record of ownership.

2. How do Crypto RSIs work?

Crypto RSIs work by using a blockchain to create a tamper-proof record of ownership. This means that investors can trust that the RSI will always remain accurate and up-to-date, regardless of whether or not the underlying security is traded on a public blockchain.

3. What are the benefits of using a Crypto RSI?

There are several benefits to using a Crypto RSI. Firstly, Crypto RSIs offer investors a unique way to invest in cryptographically-backed assets. This makes them a powerful tool for investors who want to diversify their portfolio and access new opportunities.

Secondly, Crypto RSIs provide investors with security and transparency benefits. This means that they can trust that the RSI will always remain accurate and up-to-date, regardless of whether or not the underlying security is traded on a public blockchain.

Lastly, Crypto RSIs offer investors the opportunity to make money from the growth of the underlying security. This is because Crypto RSIs are designed to be traded on public exchanges, just like traditional securities. As a result, investors can expect to make money from the appreciation of the security.

How to Use Crypto RSIs to Profit in Any Market

Crypto RSIs are a unique investment opportunity that allow you to profit in any market. You can use them to invest in digital assets, stocks, and other securities.

1. Choose a Crypto RSI to invest in.

There are a variety of Crypto RSIs to choose from. Some of the most popular include the Bitcoin RSI, Ethereum RSI, and Litecoin RSI.

2. Review the risks and rewards of the Crypto RSI.

Before investing in a Crypto RSI, you should review the risks and rewards. This will help you decide whether the investment is worth your time and money.

3. Buy the Crypto RSI.

After you have reviewed the risks and rewards of the Crypto RSI, you should buy it. This will allow you to profit from the investment.

3 Simple Tips for Trading with Crypto RSIs

When trading with crypto-assets, it is important to be familiar with the different types of exchanges available and their features. Here are some tips for trading with crypto-assets on exchanges:

1. Do your research. Before trading any assets, it is important to do your research. Examine the different exchanges available and their features.

2. Compare different exchanges. Compare different exchanges to find the best platform for you.

3. Register for an account with an exchange. Once you have decided which exchange to use, register for an account with that exchange. This will allow you to make trades and store your assets on the exchange.

4. Verify your account. Before you make any trades, it is important to verify your account with the exchange. This will ensure that you are dealing with a reputable platform.

5. Be prepared to lose money. When trading with crypto-assets, it is important to be prepared to lose money. Do not invest more than you are willing to lose.

The Ultimate Guide to Crypto RSIs

Crypto RSIs, or reverse stock splits, are a recent and popular way for crypto companies to raise money. They work like this: a crypto company announces that it plans to split its shares in half (or more), and then sells all of the new shares at a higher price than the old shares. This allows shareholders to make a lot of money while the company retains control of the same number of shares.

Here’s a guide to crypto RSIs:

1. What is a crypto RSI?

A crypto RSI is a technical indicator that measures the momentum of a cryptocurrency. It measures the rate of change of a cryptocurrency’s price over a period of time, and is used to predict future price movements.

2. How do I use a crypto RSI?

To use a crypto RSI, you first need to find a cryptocurrency that you want to track. Then, you will need to find a cryptocurrency tracking tool. The most popular tools for this are CoinMarketCap and Coinigy. Once you have found the tool, you will need to enter the relevant information for your chosen cryptocurrency. This will include the currency’s name, its trading volume, and its RSI.

3. What is the significance of a crypto RSI?

The significance of a crypto RSI depends on the specific cryptocurrency that you are tracking. However, most experts agree that a high RSI indicates strong investor interest in a cryptocurrency, and that a low RSI indicates weak investor interest.

4. What are the benefits of using a crypto RSI?

The benefits of using a crypto RSI include the ability to predict future price movements, and the ability to make money while a cryptocurrency retains control of the same number of shares.

How to Read Crypto RSIs Like a Pro

Crypto RSI indicators are one of the most popular tools used by traders to analyze cryptocurrency markets.

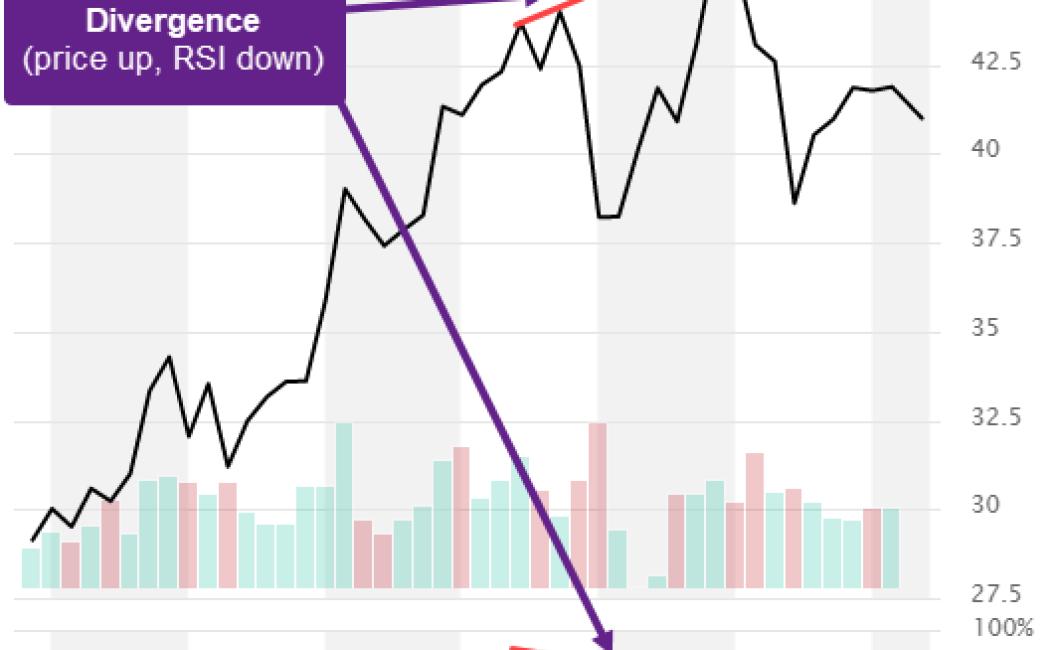

RSI is a technical indicator that is used to identify overbought and oversold conditions in a market.

When the RSI is above 70, it indicates that the market is overbought.

When the RSI is below 30, it indicates that the market is oversold.

The main use of the RSI is to help traders identify when a market is about to go in either a positive or negative direction.

When the RSI is near the 70 level, it is often a sign that the market is about to go up.

When the RSI is near the 30 level, it is often a sign that the market is about to go down.

The Ins and Outs of Crypto RSIs

A crypto RSI is a technical indicator that measures the relative strength of a cryptocurrency’s price against the rest of the market. It is calculated by taking the average price of a cryptocurrency over a given period of time, and dividing it by the average price over the same period of time for all cryptocurrencies.

The purpose of a crypto RSI is to help traders determine when a cryptocurrency is overvalued or undervalued. When a crypto RSI is above 70, it is generally considered to be in an “overvalued” state. Conversely, when a crypto RSI is below 30, it is generally considered to be in an “undervalued” state.

What Do Crypto RSIs Mean for Traders?

Crypto RSIs are a new type of security that are traded on the cryptocurrency exchanges. They are similar to regular RSIs, but they have a different value. Crypto RSIs have a higher value than regular RSIs because they are backed by cryptocurrency. This means that the trader can trust that the value of the RSI will remain stable.

How to Use Crypto RSIs to Your Advantage

Crypto RSIs offer investors a way to gain exposure to a variety of digital assets without having to trade cryptocurrencies. By investing in a Crypto RSI, investors can gain exposure to a variety of digital assets while also benefiting from the technical indicators that are commonly used to measure a digital asset’s value.

One way to use a Crypto RSI to your advantage is to invest in a digital asset that is exhibiting strong technical indicators. By doing this, you can gain access to the potential profits that are associated with the asset’s growth. Additionally, by investing in a digital asset that is exhibiting strong technical indicators, you can also reduce the risk associated with the investment.

Another way to use a Crypto RSI to your advantage is to invest in a digital asset that is experiencing price volatility. By doing this, you can gain access to the potential profits that are associated with the asset’s growth and the asset’s potential for volatility. Additionally, by investing in a digital asset that is experiencing price volatility, you can also reduce the risk associated with the investment.

Getting the Most Out of Crypto RSIs

Cryptocurrencies are quickly gaining in popularity, and rightfully so. They offer a unique way to transfer value between two parties without the need for a third party.

However, not all crypto investments are created equal. Some cryptocurrencies offer a higher potential return on investment (ROI) than others.

Here are four tips for maximizing your crypto RSIs:

1. Do Your Homework

Before investing in any cryptocurrency, it is important to do your research. Read reviews, analysis, and compare different cryptocurrencies.

This will help you identify which cryptocurrencies offer the best potential return on investment.

2. Diversify Your Portfolio

One of the key benefits of crypto investing is that it allows you to diversify your portfolio. This means that you can invest in a variety of different cryptocurrencies in order to minimize your risk.

By diversifying your portfolio, you will increase your chances of earning a positive return on investment.

3. Do Not Overinvest

When investing in cryptocurrencies, it is important to be cautious not to overinvest. This means that you should only invest what you are able to lose.

If you overinvest, you could end up losing all of your money. Instead, aim to invest a small amount of money into each cryptocurrency in order to maximize your return.

4. Stay Vigilant

As with any investment, it is important to stay vigilant and monitor your portfolio regularly. This will help you identify any potential risks early on and take appropriate action.

How to Make Money Trading with Crypto RSIs

Crypto RSIs are a way to make money trading cryptocurrencies.

1. Choose a Crypto RSI indicator. There are many to choose from, so find one that is reliable and accurate.

2. Set up a trading account with a cryptocurrency exchange.

3. Trade cryptocurrency pairs according to the Crypto RSI indicator.

4. Profit from trading gains and losses.