Comparison Of Crypto Charts

In the cryptocurrency world, there are many different ways to track the movements of digital assets. In this article, we will compare some of the most popular crypto charts so that you can make an informed decision about which one is right for you.

How to read a crypto chart

Cryptocurrencies are traded on decentralized exchanges and can be bought and sold with a variety of currencies. Each cryptocurrency has its own unique chart that shows the price and volume over time.

The difference between line and candlestick charts

A line chart is a graphical representation of price movements over time, while a candlestick chart is a graphical representation of price movements over time with the use of candle sticks.

The most popular crypto charting tools

There are many crypto charting tools available on the internet. Here we present some of the most popular ones.

CoinMarketCap

CoinMarketCap is one of the most popular crypto charting tools. It provides real-time market data for over 2000 cryptocurrencies. CoinMarketCap also provides price analysis and historical charts.

CryptoCurrency Explorer

CryptoCurrency Explorer is a free crypto charting tool. It provides real-time market data for over 1800 cryptocurrencies. CryptoCurrency Explorer also provides price analysis and historical charts.

Cryptocompare

Cryptocompare is a premium crypto charting tool. It provides real-time market data for over 1600 cryptocurrencies. CryptoCompare also provides price analysis and historical charts.

The benefits of using crypto charts

Cryptocurrencies are decentralized, meaning they are not subject to government control. This makes them attractive to investors who believe in the future of a free and open society. Cryptocurrencies also offer privacy, as no personal information is required to purchase or trade them.

Cryptocurrencies are also unique in that their value is based on supply and demand. This means that their prices can go up or down based on the interest of investors. Cryptocurrencies are not subject to the whims of a central bank, which gives them an edge over traditional financial instruments.

The top 5 crypto charting tools

1. CoinMarketCap

CoinMarketCap is the most popular crypto charting tool. It offers real-time and historical data for over 1,500 cryptocurrencies.

2. Coinigy

Coinigy is another popular crypto charting tool. It offers real-time and historical data for over 1600 cryptocurrencies.

3. TradingView

TradingView is a popular crypto charting tool that offers real-time and historical data for over 1000 cryptocurrencies.

4. CoinCharts

CoinCharts is a popular crypto charting tool that offers real-time and historical data for over 500 cryptocurrencies.

5. CoinMarketCap (Android)

CoinMarketCap (Android) is a popular crypto charting tool that offers real-time and historical data for over 100 cryptocurrencies.

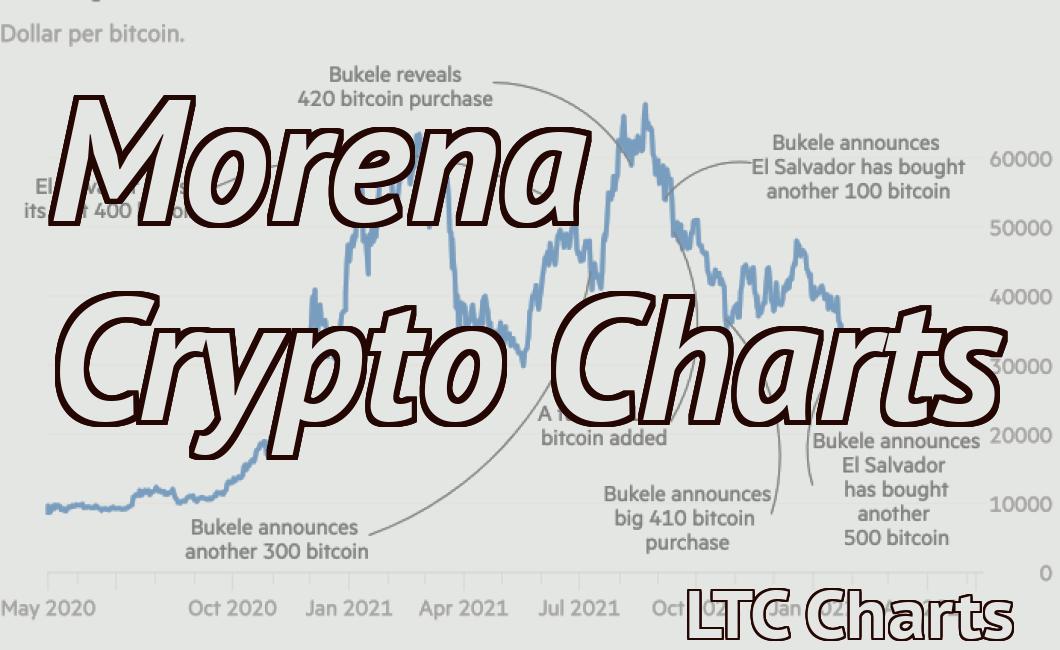

The difference between BTC and ETH charts

Bitcoin and Ethereum are two of the most popular cryptocurrencies in the world. Both cryptocurrencies are built on blockchain technology, which allows them to operate without a central authority.

While Bitcoin is the more valuable cryptocurrency, Ethereum has seen significant growth in recent months.

Bitcoin vs Ethereum charts

The following charts compare the price performance of Bitcoin and Ethereum over the past few months.

Bitcoin vs Ethereum price chart (BTC vs ETH)

Bitcoin and Ethereum have both seen significant price growth over the past few months. However, Ethereum has seen much higher growth than Bitcoin.

Ethereum is currently trading at around $320, while Bitcoin is trading at around $6,500. Ethereum is expected to see even greater growth in the future, while Bitcoin is expected to see less growth.

Bitcoin vs Ethereum market capitalization chart

Bitcoin and Ethereum are both very popular cryptocurrencies. They have a large market capitalization, which means that they are worth a lot of money.

Bitcoin currently has a market capitalization of around $115 billion, while Ethereum has a market capitalization of around $81 billion. Bitcoin is expected to see less growth in the future, while Ethereum is expected to see even greater growth.

A beginner's guide to reading crypto charts

Cryptocurrencies are a type of digital asset that uses cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on virtual exchanges and can also be used to purchase goods and services. The value of a cryptocurrency is based on supply and demand, and can fluctuate rapidly. It's important to do your research before investing in cryptocurrencies.

How to read a crypto chart

To understand how a crypto chart works, you first need to understand how a currency is traded. Currency is traded between buyers and sellers on an exchange. When buyers want to buy a currency, they exchange cash for the currency. When sellers want to sell a currency, they exchange the currency for cash.

Cryptocurrencies are different because they are not traded on an exchange. Instead, they are traded on virtual exchanges. A virtual exchange is like a digital market where users can buy and sell cryptocurrencies.

When you look at a crypto chart, you're looking at a visual representation of how many bitcoins or other cryptocurrencies are being traded at any given time. The horizontal axis shows the number of bitcoins being traded, while the vertical axis shows the price of bitcoins.

A crypto chart is like a graph of a stock market. The X-axis shows the time, while the Y-axis shows the price of the stock. The same thing happens with cryptocurrencies – the X-axis shows the time, while the Y-axis shows the price of the cryptocurrency.

The color of a cryptocurrency's line corresponds to its popularity. For example, if there are more buyers than sellers, the cryptocurrency's line will be blue. If there are more sellers than buyers, the cryptocurrency's line will be red.

How to use crypto charts to your advantage

Crypto charts can be used to help you make informed decisions about your investments.

When looking at crypto charts, be sure to pay attention to the following:

1. Volume

One of the most important factors to consider when examining crypto charts is volume. The more volume there is in a given cryptocurrency, the more likely it is that buyers and sellers are active. This is a good indicator of market sentiment.

2. Price

Another important factor to consider when examining crypto charts is the price of a cryptocurrency. The price of a cryptocurrency will generally reflect the sentiment of the market. If the price of a cryptocurrency is rising, it's likely that the market is bullish and expects the value of the currency to continue to increase. Conversely, if the price of a cryptocurrency is falling, it's likely that the market is bearish and expects the value of the currency to decrease.

3. Supply and Demand

When looking at crypto charts, be sure to also pay attention to the supply and demand figures. These figures indicate how much cryptographic currency is available on the market and how much demand there is for that currency. If the supply figure is high, it's likely that there is a lot of currency available for purchase. Conversely, if the demand figure is high, it's likely that there is a lot of interest in acquiring that currency.

The top 3 benefits of using crypto charts

1. Transparency: With crypto charts, you can see all the important details of a cryptocurrency at a glance. This is useful for tracking prices, volume, and other important data.

2. Immutability: Cryptocurrencies are immutable, meaning that they are not subject to government or financial institution control. This makes them an attractive option for investors who want to be sure that their investment is safe.

3. Security: Cryptocurrencies are secure, meaning that they are not susceptible to fraud or theft. This makes them a safe investment option for those who are worried about the safety of their money.

Why every crypto trader needs a charting tool

A charting tool can be a very valuable tool for any crypto trader. It can help you to keep track of your holdings, identify trends, and make better trading decisions.

There are a number of different charting tools available, and each has its own strengths and weaknesses. You'll need to find one that is suitable for your trading style and needs.

Some common charting tools include:

1. Tradingview - One of the most popular charting tools, Tradingview offers a wide range of features including support for multiple exchanges and currencies, and detailed technical analysis.

2. Coinigy - Coinigy offers a wide range of features including support for multiple exchanges, cryptocurrencies, and commodities. It also offers real-time charts, order books, and market data.

3. Tradingview - Another popular charting tool, Tradingview offers a wide range of features including support for multiple exchanges and currencies, and detailed technical analysis.

4. Kraken - Kraken is a well-known trading platform that offers a wide range of features including support for multiple exchanges, cryptocurrencies, and commodities. It also offers real-time charts, order books, and market data.

5. MetaTrader 4 - One of the most popular trading platforms, MetaTrader 4 offers a wide range of features including support for multiple exchanges, cryptocurrencies, and commodities. It also offers real-time charts, order books, and market data.

The ultimate guide to reading crypto charts

Now that you know how to read crypto charts, it’s time to learn how to use them to make better investment decisions.

Crypto charts are a great way to track the overall trend of a cryptocurrency, and can be used to identify areas of potential investment.

When looking at crypto charts, it’s important to keep in mind the following tips:

1. Look at the long-term trend

It’s important to look at the long-term trend of a cryptocurrency, and pay attention to how it’s fluctuating over time. This will give you a better understanding of how the cryptocurrency is performing overall, and whether there are any potential areas of investment.

2. Check the current market conditions

It’s also important to check the current market conditions when looking at crypto charts. This will help you to understand how the market is feeling, and what kind of opportunities (or risks) there are currently available.

3. Pay attention to price fluctuations

One of the key things to remember when looking at crypto charts is that price fluctuations are normal and should be expected. This means that you should always keep an eye on the price of a cryptocurrency, and adjust your investment accordingly.

4. Be cautious with high-risk investments

When looking at crypto charts, it’s important to be cautious with high-risk investments. This means that you should only invest money that you can afford to lose, and shouldn’t invest more than you’re comfortable with risking.

5. Always consult a financial advisor

Finally, always consult a financial advisor before making any investment decisions. This will help you to understand the risks involved in each cryptocurrency, and make sure that you’re making the right decision for your specific situation.

How to make the most out of crypto charts

Cryptocurrencies are notoriously volatile and can be difficult to predict. However, there are a few things you can do to make the most out of crypto charts.

1. Follow a strategy.

Before investing in any cryptocurrency, it is important to have a strategy. Some people invest in cryptocurrencies as a way to make quick, short-term profits. Others believe that cryptocurrencies are a long-term investment and will appreciate in value over time. Regardless of your strategy, following a consistent plan will help you make the most out of your investments.

2. Diversify your holdings.

One of the biggest mistakes that people make when investing in cryptocurrencies is concentrating their holdings in a single currency or asset. By spreading your investments across multiple cryptocurrencies and assets, you reduce the risk of losing everything if one of them fails. This is especially important to remember when the value of a certain cryptocurrency is falling – if you have a large percentage of your portfolio in that currency, it will be more difficult to lose money on that investment.

3. Monitor prices regularly.

Cryptocurrencies are notorious for volatility, which means that the prices of individual cryptocurrencies can change rapidly. It is important to monitor prices regularly and make changes to your investment strategy as needed in order to account for these fluctuations.