Fred charts bubble crypto.

This article discusses Fred's experience with investing in cryptocurrencies, specifically bubbles within the market. He charts out his findings and provides analysis on when he believes is the best time to buy or sell.

fred charts bubble crypto: the rise and fall of a digital currency

Cryptocurrencies are digital or virtual coins or tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

fred charts bubble crypto: what went wrong?

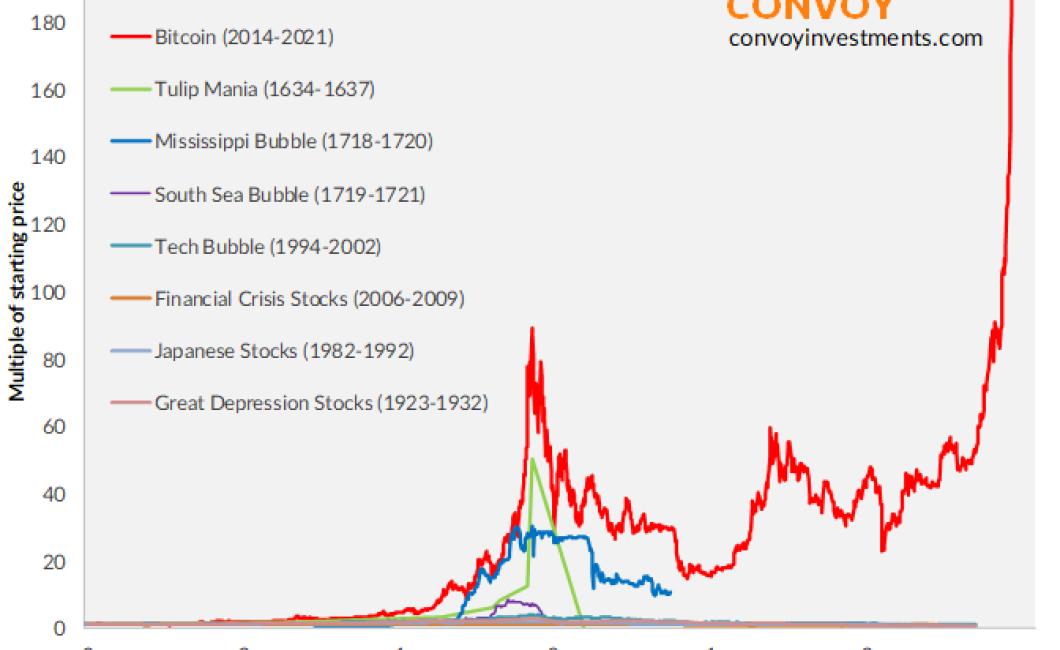

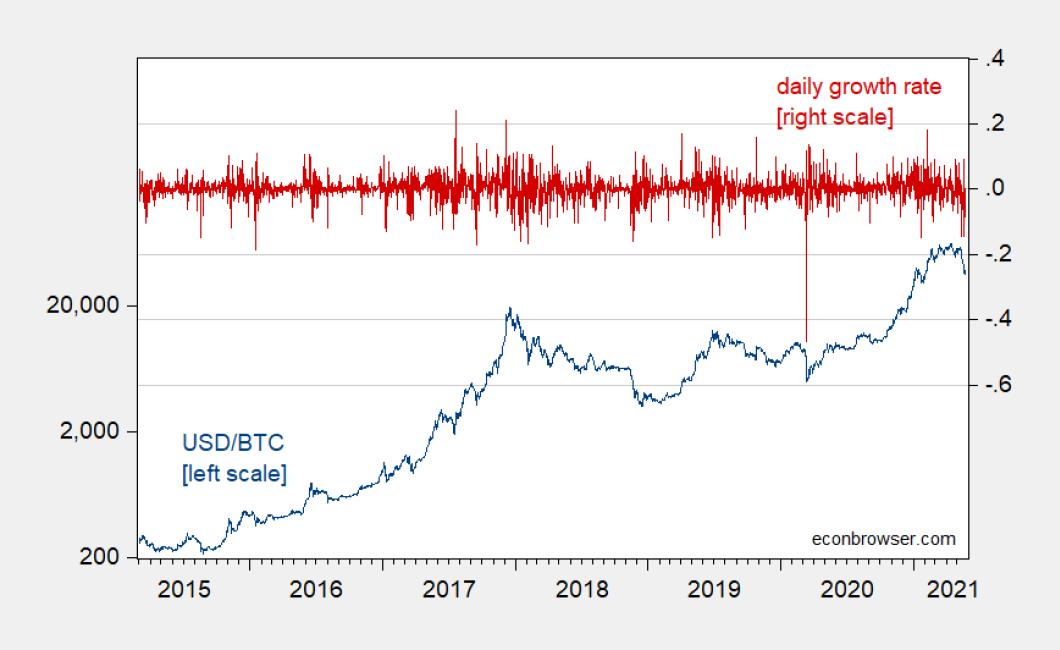

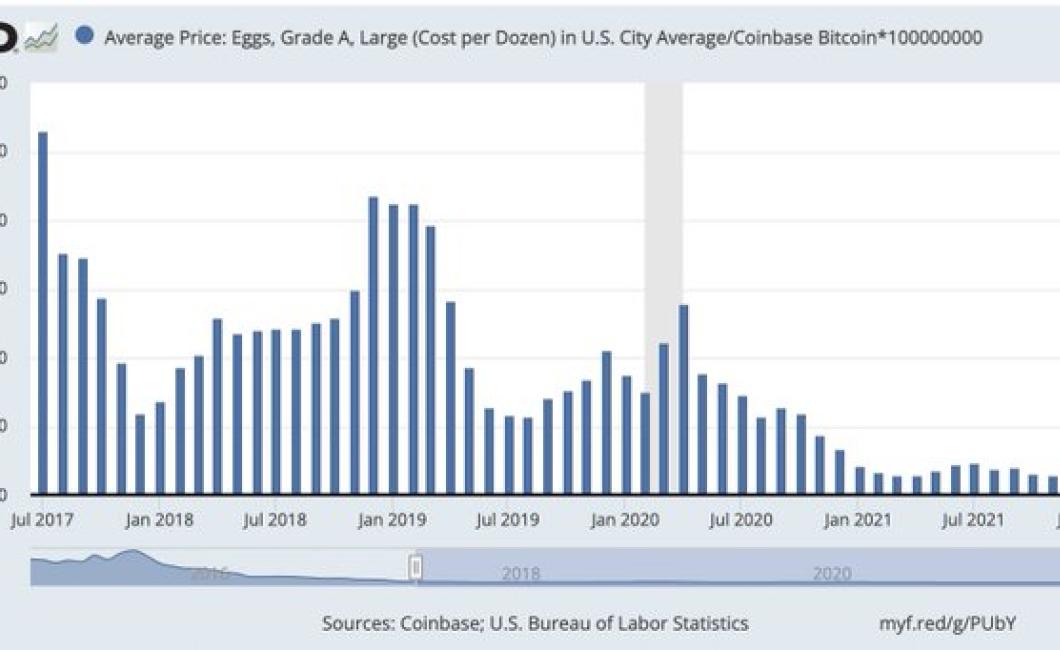

First, let's look at the chart:

The red line is the Bitcoin price, and the blue line is the Ethereum price.

What went wrong?

There are a few things that could have gone wrong with this chart.

1) The price of Ethereum could have gone down, which would have affected the Bitcoin price.

2) The price of Bitcoin could have gone up, which would have affected the Ethereum price.

3) The two prices could have stayed the same.

4) The two prices could have gone different directions.

5) There could have been a technical issue with the chart.

fred charts bubble crypto: how a once-popular currency fell from grace

According to data from CoinMarketCap, at its peak, bitcoin was worth more than $19,000 per unit. However, since then, the cryptocurrency has lost a significant amount of value, and is currently worth around $6,000 per unit.

Bitcoin was once considered to be a safe investment, but this is no longer the case. In recent months, there have been a number of high-profile scandals involving bitcoin and other cryptocurrencies. For example, the Mt. Gox exchange hack, which caused the loss of millions of dollars worth of bitcoin, and the Silk Road drug marketplace, which used bitcoin as its main currency.

These events have led to a decline in the popularity of bitcoin and other cryptocurrencies. This is likely to continue, as there are still a number of risks associated with these investments.

fred charts bubble crypto: a cautionary tale

In early 2017, a new digital asset called “bitcoin” emerged on the market. Bitcoin was unlike any other currency on the market – it was not backed by any government or institution, and it was not subject to the same regulations.

Many people saw bitcoin as a way to make money quickly. But before long, people began to realize that bitcoin was also a very risky investment. In just a few months, the price of bitcoin went from $1,000 to $20,000 – an incredible increase. But then, just as quickly as it had risen, the price of bitcoin plummeted, eventually reaching a low of $6,000.

Many people who had invested in bitcoin lost a lot of money. Is bitcoin a safe investment? That is a question that still remains unanswered.

fred charts bubble crypto: lessons learned

There are a few things to keep in mind when investing in cryptocurrencies:

1. Don't over-invest. Cryptocurrencies are highly volatile and can go up and down a lot in price. If you invest too much money, you could lose all your money.

2. Use a good mix of digital and traditional assets. Cryptocurrencies are digital assets, so you need to keep some in digital form and some in traditional form. This is important because if the value of cryptocurrencies goes down, your traditional assets will still be worth something.

3. Don't forget about taxes. Cryptocurrencies are not taxed like regular investments, so you may have to pay taxes on them when you sell them.

fred charts bubble crypto: what could have been done differently?

There are many things that could have been done differently with regard to the charting of the Bitcoin (BTC) bubble. One possibility is that more attention could have been paid to technical analysis indicators, such as the Ichimoku Cloud or the Relative Strength Index (RSI), in order to help identify when the market was about to hit a bottom or peak. Additionally, it would have been beneficial to publish more frequent and more detailed market analysis reports, in order to provide investors with more timely information about what was happening in the market. Finally, it would have been beneficial to establish a more consistent and transparent communication strategy, in order to ensure that all stakeholders were kept up to date on the latest developments.

fred charts bubble crypto: where does it go from here?

There is no one definitive answer to this question, as the future of cryptocurrencies is still largely up in the air. However, some analysts believe that the current market conditions may eventually lead to a major bubble burst. If this occurs, then the value of many cryptocurrencies could plummet, making them less attractive for investors.

fred charts bubble crypto: is there a future for digital currencies?

Digital currencies, such as bitcoin, have been in the news a lot lately. Some people are predicting that they will become a mainstream form of payment, while others are saying that they are a bubble that will eventually burst.

There is no one definitive answer to this question. It largely depends on the future development of the digital currency sector. If it continues to grow, then there is a future for digital currencies. However, if they are prone to crashes and are not used by many people, then their future may be less rosy.

fred charts bubble crypto: what does this mean for the future of money?

If you're wondering what the big deal is with the Bitcoin charts bubble, it basically means that there is a lot of speculation about the future price of Bitcoin and other cryptocurrencies. This can be a dangerous game to play, as it's possible that the prices of these assets could skyrocket or crash suddenly, causing a lot of damage to those who invest too heavily in them.

fred charts bubble crypto: a case study in financial speculation

In this article, we will explore how a company called BitShares (BTS) became popular among cryptocurrency investors. We will also look at the factors that contributed to its subsequent price collapse.

BitShares was founded in 2013 by Daniel Larimer. The company's goal is to create a blockchain-based platform that can be used to manage transactions and investments. BTS is based on the Bitcoin blockchain platform.

The BitShares platform has been met with mixed reviews. Some people see it as a promising new platform, while others view it as overcomplicated and difficult to use.

Nevertheless, BTS saw a surge in popularity in late 2017. This was likely due to two factors. First, the price of Bitcoin had reached an all-time high of nearly $20,000. Second, many investors were looking for alternative ways to invest their money in the wake of the 2017 cryptocurrency market crash.

As the price of BTS grew, so did the amount of speculation surrounding the coin. Many people began buying BTS hoping to make a quick profit. However, as the price of BTS began to fall, many investors lost their money. By mid-December 2017, the price of BTS had plummeted to just over $0.30 per coin.

In conclusion, BitShares is an example of a financial bubble crypto. Its popularity was based on the fact that the price of Bitcoin had reached an all-time high and many investors were looking for alternative ways to invest their money. When the price of Bitcoin began to fall, many investors lost their money.

fred charts bubble crypto: the rise and fall of an economic experiment

Bitcoin and other digital currencies have seen a dramatic increase in value in recent years. However, this has not been without its challenges - notably the 2017 bubble and subsequent crash. In this article, we explore the rise and fall of bitcoin and other digital currencies, and their potential future.

fred charts bubble crypto: what can we learn from this?

It's difficult to say anything definitive about the Fidelity charts bubble crypto, since the bubble is still unfolding. However, there are a few lessons that we can learn from it.

First, it's important to be aware of the potential for bubbles. It's easy to get caught up in the excitement of a new investment opportunity, and it can be hard to resist the temptation to buy in when prices are rising rapidly.

Second, it's important to do your research before investing in any new cryptocurrency or blockchain-based project. It's easy to get caught up in the hype and forget to do your research, which can lead you to invest in a scam coin or project.

Finally, it's important to be patient when it comes to investing in cryptocurrencies and blockchain-based projects. It can take a while for these types of investments to pay off, so it's important to be patient and not overreact to short-term price fluctuations.