How to read candlestick charts for crypto

Candlestick charts are one of the most popular ways to visualize cryptocurrency price data. They offer a clear and concise way to see price action, and can be used to spot trends and make predictions about future price movements. In this article, we'll show you how to read candlestick charts for crypto, and explain some of the most important features to look for.

-How to read candlestick charts for crypto

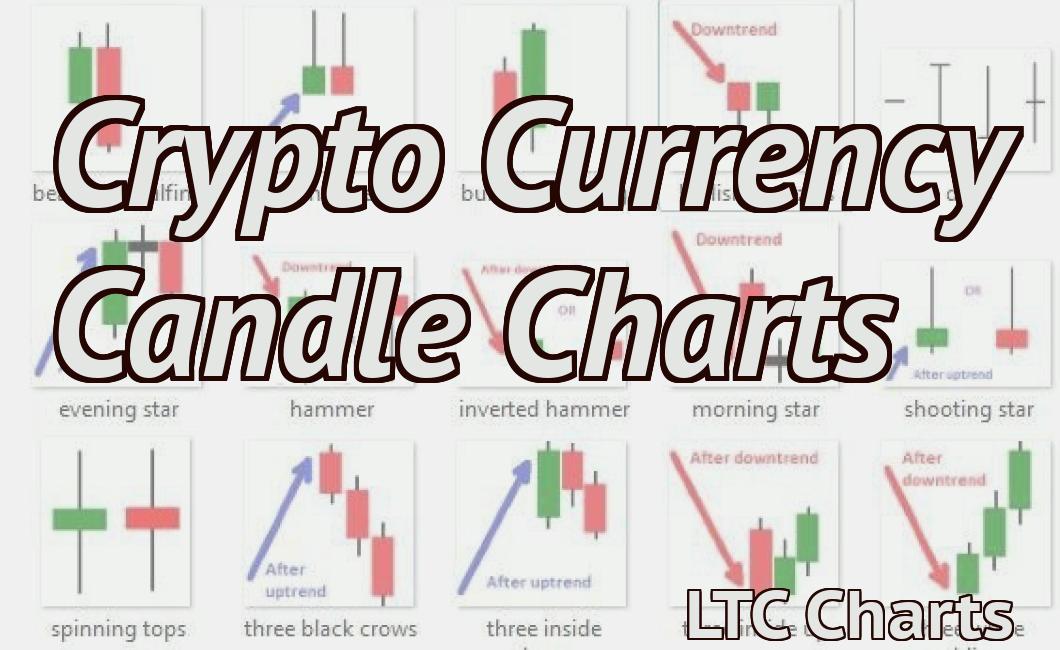

When looking at candlestick charts for cryptocurrency, it is important to understand the different types of candles.

There are four main types of candles:

1) Bullish candles: These are candlesticks with highs near the top and lows near the bottom. This indicates that the price is rising, and is often a sign that the price is about to reach a new high.

2) Bearish candles: These are candlesticks with lows near the bottom and highs near the top. This indicates that the price is falling, and is often a sign that the price is about to reach a new low.

3) Range candles: These are candlesticks with two different highs and lows. This indicates that the price is moving between two different levels.

4) Doji candles: These are candlesticks with a small opening and a small closing price. This indicates that there is no clear trend, and that the price is likely to move in either direction.

-How to read candlestick charts for cryptocurrency

To read candlestick charts for cryptocurrency, you will need to understand how to read candlestick charts. Candlestick charts are a visual representation of the price movement of a cryptocurrency over time.

To begin, you will need to identify the open, high, low, and close prices for each day. You will also need to identify the volume for each day. Volume is the amount of currency that was exchanged during that day.

Next, you will need to determine the direction of the price movement for each day. You can do this by looking at the open, high, low, and close prices and then determining whether the price moved up, down, or remained unchanged.

If the price moved up, then you can determine whether the trend is up or down by looking at the volume data and determining whether the volume was higher on days when the price moved up or lower on days when the price moved down.

If the price moved down, then you can determine whether the trend is up or down by looking at the volume data and determining whether the volume was higher on days when the price moved up or lower on days when the price moved down.

If the price remained unchanged, then you can determine whether the trend is up or down by looking at the volume data and determining whether the volume was higher on days when the price moved up or lower on days when the price moved down.

-How to read candlestick charts for Bitcoin

To read a candlestick chart for Bitcoin, one must understand the basics of candlestick charting. A candlestick chart is a graphical representation of price movements over a given period of time. The main elements of a candlestick chart are the open, high, low, and close prices for each day. Candlestick charts are most useful for analyzing short-term price movements.

-How to read candlestick charts for Ethereum

To read Ethereum candlestick charts, first identify the open, high, low and close prices for each day. Next, find the corresponding candle's height, and then find the corresponding price at the candle's closing. Finally, find the percentage change from the open to the closing price, and multiply that by 100 to get the percentage gain or loss for that day.

-How to read candlestick charts for Litecoin

To read candlestick charts for Litecoin, first identify the open, high and low prices for Litecoin during the given time period. Next, identify the number of candles that have been drawn since the open price. The closer two candles are in price, the more recent they are. Finally, look for patterns in the candle patterns and use that information to predict future prices.

-How to read candlestick charts for Ripple

To read candlestick charts for Ripple, first find the open, high, low and close prices for the day. Next, find the average price for the day. Finally, find the candlestick pattern that matches the average price.

-How to read candlestick charts for Bitcoin Cash

To read a candlestick chart for Bitcoin Cash, first find the open, high, and low prices for the session. Next, find the area that the candlestick chart covers and look for patterns. If there is a clear trend, follow that trend. If there are multiple trends, choose the one that is most important to you.

-How to read candlestick charts for Stellar

To read Stellar candlestick charts, first identify the open, high, low and close prices for the day. Next, look for patterns that may have occurred during the day. Finally, use those patterns to make trading decisions.

-How to read candlestick charts for NEO

When looking at NEO candlestick charts, it is important to understand the different types of signals that can be found. The three main signals that can be found on NEO charts are:

1. The opening or "high" of the candle. This is the point where the price of the NEO went up the most and is generally a good sign that the market is buying into the asset.

2. The "low" of the candle. This is the point where the price of the NEO went down the most and is generally a bad sign that the market is selling into the asset.

3. The "close" of the candle. This is the point where the price of the NEO went back to where it started (or close to it).