Crypto Charts Pattern

Crypto charts are used to predict future price movements of cryptocurrencies. They are created by analyzing past price data and finding patterns that may repeat in the future.

How to read crypto charts patterns

Crypto charts patterns are visual clues that can help you to predict future price movements.

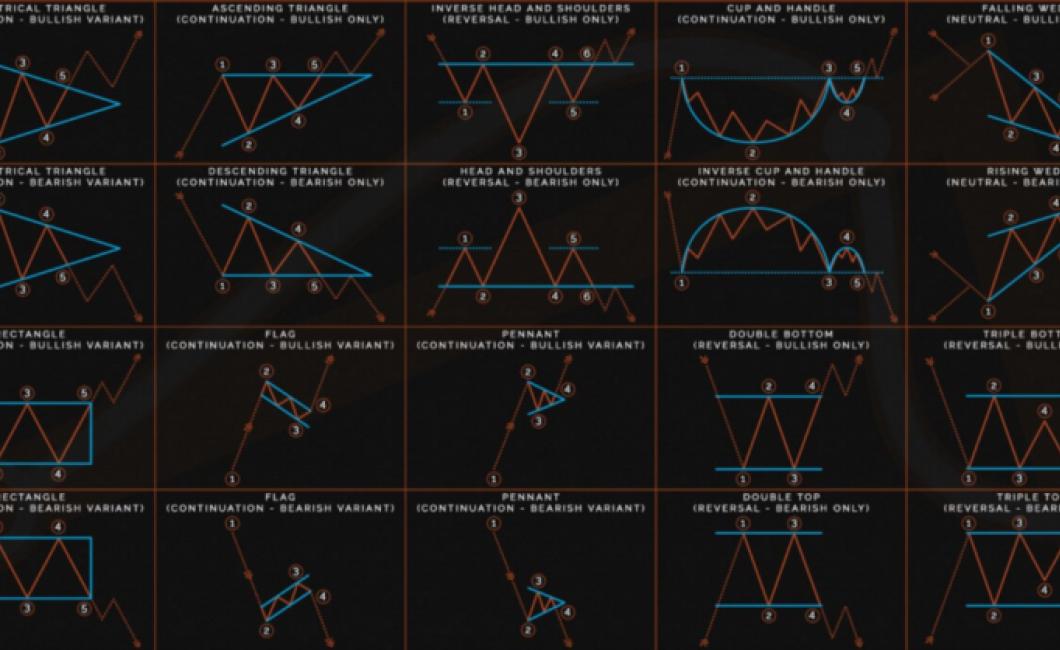

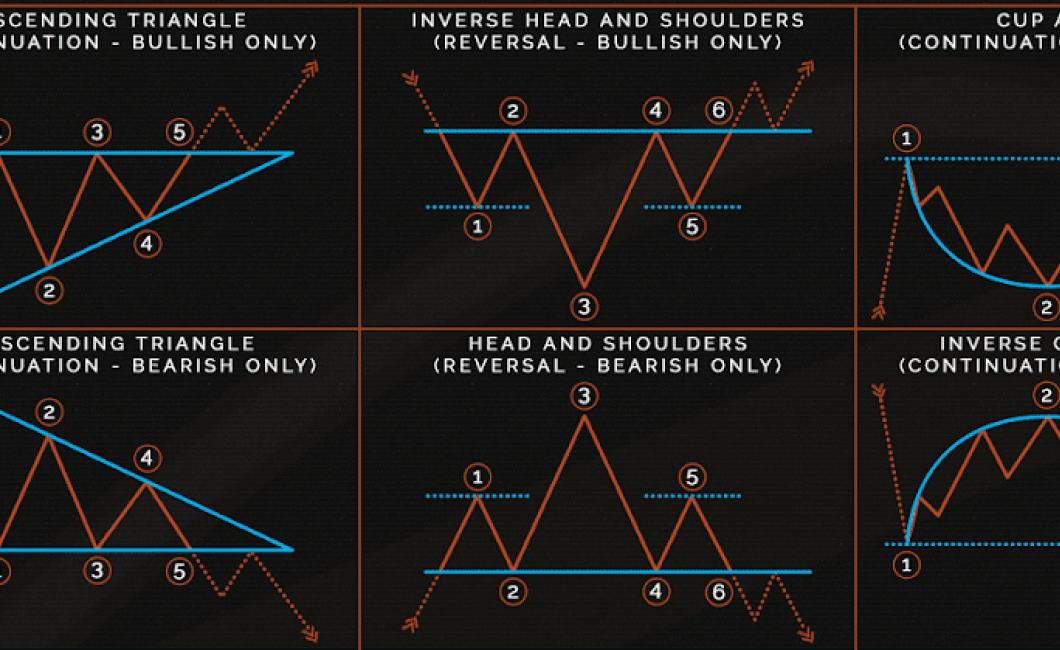

There are a number of different patterns that can be found on crypto charts, and all of them can provide you with valuable information about the market.

Some of the most common patterns include:

Bull and bear markets: These patterns indicate that the market is either in a positive or negative trend, and that it is likely to stay that way for a certain period of time.

These patterns indicate that the market is either in a positive or negative trend, and that it is likely to stay that way for a certain period of time. Support and resistance levels: These are the points at which the market seems to be resisting or supporting further price rises or falls.

These are the points at which the market seems to be resisting or supporting further price rises or falls. Fibonacci retracements: This is a pattern that is often used to predict future price movements. It involves tracing the movement of prices back to Fibonacci numbers, which are ratios that are based on the Golden Ratio.

This is a pattern that is often used to predict future price movements. It involves tracing the movement of prices back to Fibonacci numbers, which are ratios that are based on the Golden Ratio. Candlesticks: These are graphical representations of market activity, and they can be used to show whether the market is going up or down.

These are graphical representations of market activity, and they can be used to show whether the market is going up or down. Volumes: This is another indicator that can be used to predict future price movements. When there is a lot of buying and selling activity going on, this usually indicates that the market is healthy and likely to continue moving in a positive direction.

3 most common crypto chart patterns

1. Head and Shoulders

2. Double Top

3. Triangle

4. Flag

5. Cup and Handle

6. Hammer

7. Hanging Man

8. Kite

9. Parabolic SAR

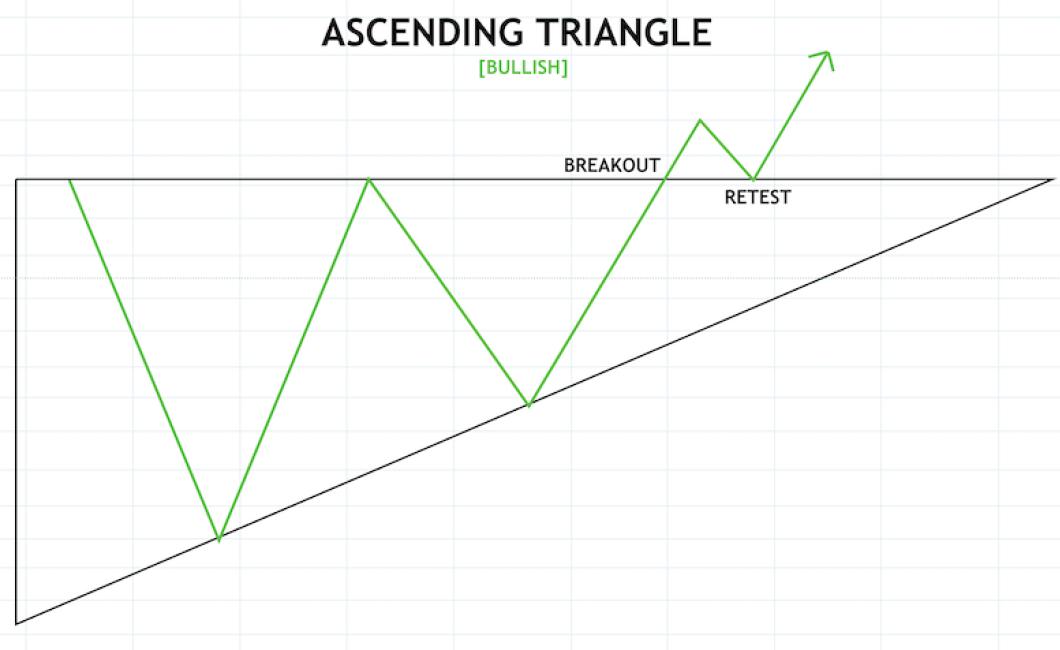

10. Ascending triangle

Top 10 crypto chart patterns

1. Bullish candles

2. Bullish triangles

3. Bullish flags

4. Bearish candles

5. Bearish triangles

6. Bearish flags

7. Inverted triangle

8. Inverted flag

9. Three black candles

10. Death cross

How to trade based on crypto chart patterns

Crypto trading is a highly technical and complex activity. Before you can trade based on crypto chart patterns, you need to have a good understanding of how these patterns work.

Crypto chart patterns are visual representations of financial trends. They can be used to predict future price movements.

When you see a crypto chart pattern, it’s important to understand the underlying trend. This will help you determine whether to buy or sell.

There are four types of crypto chart patterns: continuation patterns, reversal patterns, consolidation patterns, and trend lines.

Continuation patterns indicate that the underlying trend is continuing. They appear as horizontal lines on the chart.

Reversal patterns indicate that the underlying trend has changed. They appear as vertical lines on the chart.

Consolidation patterns indicate that the underlying trend is weak. They appear as clusters of small dots on the chart.

Trend lines indicate the direction of the underlying trend. They appear as thin lines on the chart.

To trade based on crypto chart patterns, you need to understand the following:

1. The trend – To determine whether to buy or sell, you need to understand the underlying trend. This will help you determine whether to buy or sell near the pattern’s breakout point.

2. The breakout point – The breakout point is the point at which the pattern is confirmed. This is usually indicated by a change in direction of the price movement.

3. The price action – After the breakout point is reached, the price action will determine whether to buy or sell. This will depend on the momentum of the underlying trend.

4. Trade setups – To make successful trades, you need to find trade setups that correspond to the pattern. These setups will depend on the momentum of the underlying trend and the breakout point.

5 simple crypto chart patterns for beginners

1. Price correlation

When two cryptocurrencies exhibit a strong correlation with each other, this indicates that they are likely to move in tandem. This can be a useful indicator for predicting future price movements, as it suggests that demand for one cryptocurrency is likely to result in rising demand for the other.

2. Volatility clustering

When several cryptocurrencies exhibit high levels of volatility, this can indicate that they are likely to move in tandem. This can make them difficult to trade, but can also lead to profitable short-term trading opportunities.

3. Rebounding trends

When a cryptocurrency experiences a sustained period of growth, this can often be followed by a period of increased volatility. This is known as a rebound trend, and can indicate that the price is about to experience a significant increase.

4. Head-and-shoulders patterns

When a cryptocurrency experiences a sustained period of growth followed by a period of decline, this can often be identified by the appearance of a head-and-shoulders pattern. This indicates that the price is likely to experience a further decline before reaching a new equilibrium.

5. Fibonacci retracements

Fibonacci retracements are another common pattern that can be used to identify potential price movements. They are based on the Fibonacci sequence, which describes the relationship between successive prices in a given market. When used in conjunction with other indicators, they can provide an effective way to identify potential buy and sell opportunities.

3 advanced crypto chart patterns

1. Price consolidation

When a cryptocurrency price begins to consolidate, it typically means that there is a lack of buyers and sellers and that the price is likely to stay within a certain range for a longer period of time. This can often lead to a potential buying opportunity, as buyers may be more willing to purchase a cryptocurrency at a lower price than they would if the price were to continue to rise.

2. Triangle patterns

Triangle patterns are one of the most popular advanced crypto chart patterns and involve a consolidation phase followed by a breakout phase. During the consolidation phase, the price may stay within a narrow range for a period of time, before eventually breaking out and reaching new highs or lows. The breakout phase usually marks the beginning of a new uptrend or downtrend in the market, respectively.

3. Head-and-shoulders patterns

Head-and-shoulders patterns are another popular advanced crypto chart pattern and involve a consolidation phase followed by a breakout phase. During the consolidation phase, the price may stay within a narrow range for a period of time, before eventually breaking out and reaching new highs or lows. The breakout phase usually marks the beginning of a new uptrend or downtrend in the market, respectively.

The best crypto chart patterns for day trading

There is no one definitive answer to this question, as the best cryptocurrency chart patterns will vary depending on your trading strategy and goals. However, some commonly used chart patterns that can be used for day trading include:

The Ichimoku Cloud

The Ichimoku Cloud is a popular chart pattern that can be used to identify potential trend changes. When viewed in conjunction with other indicators, it can provide early warning signs of a potential trend reversal.

The Hammer

The Hammer is a bullish chart pattern that forms when the price of a cryptocurrency begins to rise rapidly and then falls sharply. The pattern is often used to indicate a potential bull market trend, and can be used to make profitable trades.

The Golden Cross

The Golden Cross is a bullish chart pattern that forms when the price of a cryptocurrency crosses above the 50-day moving average and then falls below the 200-day moving average. The pattern is often used to indicate a potential bull market trend, and can be used to make profitable trades.

How to find crypto chart patterns

There are a few ways to find crypto chart patterns. One way is to use a trading platform that allows you to see historical data for a particular cryptocurrency, and look for patterns that may have occurred in the past. For example, if you're interested in Bitcoin, you could look for patterns in price movement that correspond with specific news events or political movements.

Another way to find crypto chart patterns is to use a technical analysis tool, such as TradingView, which allows you to see how price movement is related to various technical indicators. You can look for patterns that may indicate potential price trends or support and resistance levels.

The difference between bullish and bearish crypto chart patterns

Bullish patterns indicate that the price of a cryptocurrency is rising, while bearish patterns indicate that the price of a cryptocurrency is falling. The following are examples of bullish and bearish crypto chart patterns:

Bullish crypto chart patterns

• A symmetrical triangle.

• A Star pattern.

• A doji.

Bearish crypto chart patterns

• A bearish flag.

• A descending triangle.

• A symmetrical descending triangle.

How to use Fibonacci retracements in crypto chart patterns

To use Fibonacci retracements in crypto chart patterns, you first need to identify a trend. Once you've identified the trend, you can then use Fibonacci retracements to identify possible support and resistance levels.