Crypto Charts Moving Average

Many investors believe that crypto charts can help predict price movements. One popular tool is the moving average.

crypto charts and their moving averages

Cryptocurrencies are highly volatile and can experience large swings in their prices. This volatility is due to the fact that cryptocurrencies are not backed by any government or central bank, and are therefore not subject to the same rules and regulations as traditional currencies. Cryptocurrencies are also often traded on exchanges, which can lead to price spikes and sudden drops.

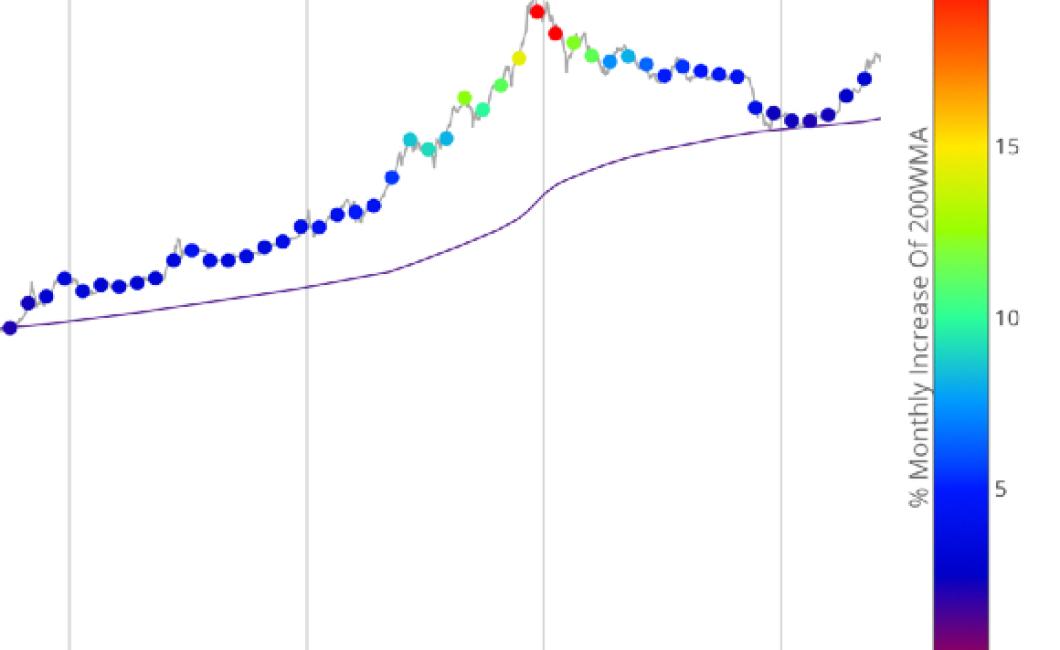

To help make sense of this volatility, many investors use moving averages to help smooth out the peaks and valleys in cryptocurrency prices. A moving average is a mathematical formula that predicts the future price movement of a security or commodity, based on past movements. The most common type of moving average is the simple moving average, which calculates the average price over a set period of time (e.g., 30 days).

The use of moving averages can help reduce the overall volatility of cryptocurrency prices, and can provide investors with a more accurate indication of where the market is headed. While moving averages are not a guaranteed strategy for predicting future prices, they can be a useful tool for those looking to gain an understanding of the cryptocurrency market.

how to read crypto charts with moving averages

To read crypto charts with moving averages, first identify the type of moving average you are using. You can use a simple moving average or a weighted moving average.

Once you have identified the type of moving average, you need to find the current value of the moving average. This can be found on the chart or in the accompanying data table.

Once you have the current value of the moving average, you need to find the value of the moving average at the previous period's closing price. This can be found on the chart or in the accompanying data table.

Finally, you need to find the value of the moving average at the current period's opening price. This can be found on the chart or in the accompanying data table.

the benefits of using moving averages on crypto charts

Moving averages are a technical analysis tool that can be used on cryptocurrency charts to identify trends. When used correctly, they can provide an investor with valuable insights into the market.

Some of the benefits of using moving averages on cryptocurrency charts include the following:

1. They can help you identify trends.

2. They can help you identify support and resistance levels.

3. They can help you identify price channels.

4. They can help you identify when a trend is over.

5. They can help you identify when a market is overvalued or undervalued.

6. They can help you identify when a market is about to undergo a major change.

the top 8 crypto moving averages you need to know

The 8 crypto moving averages you need to know

1. The 20-day moving average

2. The 50-day moving average

3. The 100-day moving average

4. The 200-day moving average

5. The 5-day moving average

6. The 10-day moving average

7. The 15-day moving average

why the 50-day moving average is critical for crypto traders

The 50-day moving average (50MA) is a technical indicator used in technical analysis. It is a simple average of the closing prices of a given period of 50 trading days. The idea is that if the current price is above the 50MA, this suggests that buyers are Strongly Interested in the asset, and vice versa if the price is below the 50MA.

The 50MA can be used to identify buying and selling pressure, and can help traders determine when it is safe to enter or exit a trade. By using the 50MA, traders can also avoid getting caught up in “ noise ” on the markets and focus on the most important indicators.

how to trade cryptos using moving averages

Cryptocurrencies can be traded using moving averages. This is a technical analysis tool that helps traders identify support and resistance levels.

To use moving averages, open a trading chart and find the 20-day and 50-day moving averages. The 20-day moving average is the average of the last 20 days’ prices. The 50-day moving average is the average of the last 50 days’ prices.

To trade cryptocurrencies using moving averages, find the price at which the moving averages intersect. The intersection point is where the two averages cross.

If the price is below the 20-day moving average, trade in the direction of the lower moving average. If the price is above the 50-day moving average, trade in the direction of the higher moving average.

the perils of trading cryptos without considering moving averages

There are a few reasons why moving averages can be an important part of your trading strategy when trading cryptocurrencies.

First, moving averages can help you identify trends in the market. By using a moving average, you can filter out noise and focus on the important trends.

Second, moving averages can help you identify support and resistance levels. When trading cryptocurrencies, it is important to know where the market is going. Moving averages can help you identify where the market is likely to stop or start moving.

Finally, moving averages can help you minimize losses. By using moving averages, you can identify when the market is about to go down. This can help you sell before the market goes down, which will minimize your losses.

why crypto investors need to pay attention to moving averages

Moving averages, or MA's, are a technical analysis tool used to identify trends and predict future price movements. When used in conjunction with other indicators such as the 50-day moving average (50-MA) and the 200-day moving average (200-MA), MA's can provide investors with an effective way to identify oversold and overbought markets.