How to read crypto trading charts.

This article will teach you how to read crypto trading charts so that you can make better-informed decisions when trading cryptocurrencies. You will learn how to identify different types of chart patterns, and how to use technical indicators to spot trading opportunities. By the end of this article, you will have a better understanding of how to read crypto charts and be able to make more informed trading decisions.

How to Read Crypto Trading Charts

Crypto trading charts are a great way to stay up-to-date on the latest prices and movements in the cryptocurrency market.

There are a few things to keep in mind when reading crypto trading charts:

1. Don’t get too attached to any specific price or movement, as the market can move quickly and unpredictably.

2. Keep in mind that crypto trading charts are not always accurate, and should not be relied on for investment decisions.

3. Always consult a financial advisor before making any investments.

How to Understand the Information in a Crypto Trading Chart

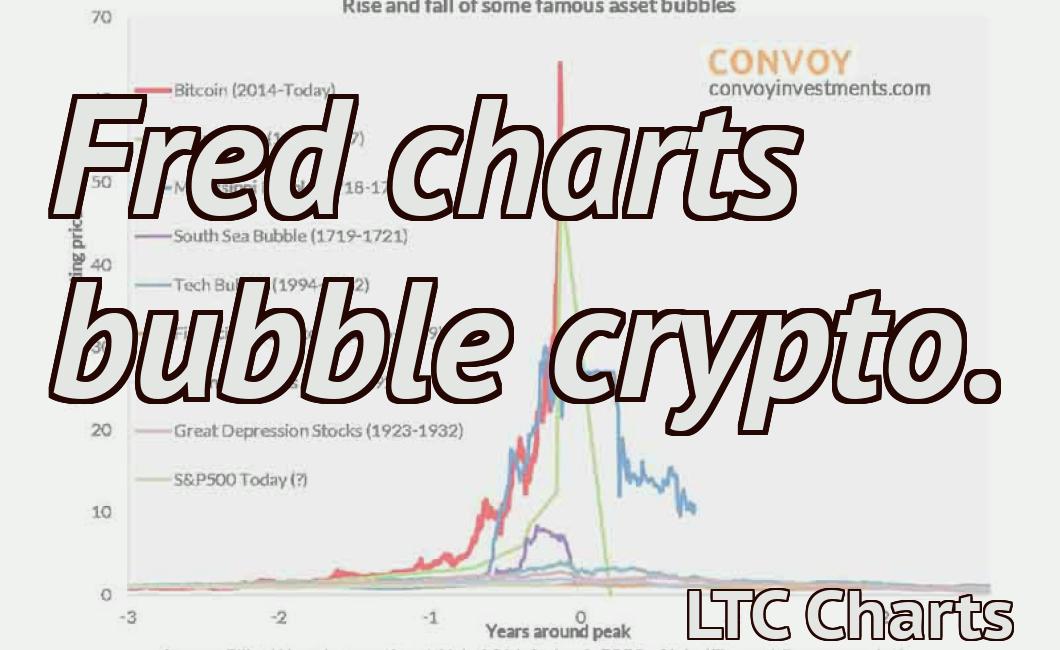

Crypto trading charts are similar to stock charts in that they show the price of a cryptocurrency over time. The main difference between crypto trading charts and stock charts is that crypto trading charts are designed to show the movement of cryptocurrencies rather than stocks.

Cryptocurrencies are traded on various exchanges around the world and the prices of these cryptocurrencies can be seen on crypto trading charts. Crypto trading charts usually show the price of a specific cryptocurrency over a period of time, such as a day, a week, or a month.

Cryptocurrencies are often traded on exchanges with very different prices, so it is important to pay attention to the trends on crypto trading charts. The trends on crypto trading charts can help you identify whether the price of a cryptocurrency is going up or down.

Another important thing to consider when looking at crypto trading charts is the volume of each cryptocurrency. Volume is a measure of how much money is being traded for a specific cryptocurrency. High volume cryptocurrencies are usually more valuable because they are likely being traded by more people.

How to Use Crypto Trading Charts to Make Better Trades

Crypto trading charts are a great way to help make better trades. They can help you identify patterns in the market and make informed decisions about your investments.

Crypto trading charts can also help you stay disciplined when trading. By tracking your losses and profits, you can avoid over-trading and ensure that you make profitable investments.

Here are some tips on how to use crypto trading charts to make better trades:

1. Look for Patterns

Crypto trading charts can help you identify patterns in the market. This can help you make informed decisions about your investments.

For example, you might find that the market is often volatile. This means that prices can change rapidly and unexpectedly.

When you see a pattern in the market, you can use this information to your advantage. You can try to predict when prices are going to change and buy or sell accordingly.

2. Stay Disciplined

Crypto trading can be risky. If you over-trade, you could lose all of your investment.

To stay disciplined, use crypto trading charts to track your losses and profits. This will help you identify when you are making a profitable investment and when you are not.

3. Make Sure You Are Comfortable with Risk

Crypto trading is a high-risk investment. Before you start investing, make sure you are comfortable with the risk involved.

Crypto trading charts can help you stay disciplined and make informed decisions about your investments, but they are not a guarantee of success. Always do your own research before investing in any cryptocurrency.

The Benefits of Reading Crypto Trading Charts

There are a number of reasons why reading crypto trading charts can be very beneficial.

1. It can help you to better understand the market dynamics.

2. It can help you to spot opportunities.

3. It can help you to make better investment decisions.

How to Read and Interpret Candlestick Charts for Crypto Trading

There are many ways to read and interpret candlestick charts for cryptocurrency trading. The most common way to read a candlestick chart is to identify the open, high, low, and close values for each day. You can also look at the volume and price action for each candle to get an idea of how the market is performing.

How to Analyze Cryptocurrency Market Charts for Trading

Cryptocurrency market charts are valuable tools for traders. By examining the charts, traders can identify patterns and trends in the market.

The first step in analyzing cryptocurrency charts is to identify the asset you are trading. For example, if you are trading Bitcoin, you would look at the Bitcoin chart.

Once you have identified the asset you are trading, you need to understand the technical indicators used to measure the market. Technical indicators are used to predict future price movements.

Some common technical indicators used to measure the cryptocurrency market include the Bollinger Bands, the MACD, and the RSI.

To find out how these indicators are performing, you will need to use a cryptocurrency trading platform.

Once you have identified the indicators and understand their function, you can begin to trade based on these signals.

What do All Those Lines Mean? A Beginner’s Guide to Reading Crypto Trading Charts

Crypto trading charts are a great way to track the movements of digital assets.

When you look at a crypto trading chart, you are seeing a visual representation of the prices of a given digital asset over a period of time.

Crypto trading charts can be very useful for understanding market trends, predicting price movements, and making informed investment decisions.

Here is a brief guide on what each line on a crypto trading chart means:

1. The green line on a crypto trading chart is known as the “buy” signal line. When the green buy signal line is above the red sell signal line, this indicates that buyers are aggressively buying up the digital asset.

2. The red line on a crypto trading chart is known as the “sell” signal line. When the red sell signal line is above the green buy signal line, this indicates that sellers are aggressively selling up the digital asset.

3. The blue line on a crypto trading chart is known as the “sell-stop” line. When the blue sell-stop line is crossed by the green buy signal line, this indicates that sellers have reached a point where they are no longer willing to sell the digital asset at that price.

4. The yellow line on a crypto trading chart is known as the “buy-stop” line. When the yellow buy-stop line is crossed by the red sell signal line, this indicates that buyers have reached a point where they are no longer willing to buy the digital asset at that price.

5. The purple line on a crypto trading chart is known as the “high-low” channel line. When the purple high-low channel line is crossed by the green buy signal line, this indicates that the price of the digital asset has moved between two specific price points in a consistent manner.

6. The blue dotted line on a crypto trading chart is known as the “support” line. When the blue dotted support line is broken by the green buy signal line, this indicates that sellers have started to gain strength and buyers may start to lose interest in buying the digital asset.

7. The red dotted line on a crypto trading chart is known as the “resistance” line. When the red dotted resistance line is broken by the green buy signal line, this indicates that buyers have started to gain strength and sellers may start to lose interest in selling the digital asset.

How to Read charts like a Pro – A guide to Crypto trading charts

A crypto trading chart is a graphical representation of what’s happening in the crypto market at any given time. As you can see on most charts, prices are plotted against time. This means that you can see how prices have changed over the past few minutes, hours, or even days.

However, there’s more to a crypto trading chart than just a visual representation of prices. In fact, there are a few things you need to know in order to read a chart like a pro.

1. Chart Patterns

One of the first things you need to know about crypto trading charts is that there are a lot of different chart patterns that you’ll see. These patterns can help you identify trends in the market, and they can also help you make predictions about where prices are likely to go.

For example, you might see a pattern called a “head and shoulders” pattern. This pattern occurs when prices rise up until they reach a peak, and then they decline until they reach a lower point.

2. Trading Strategies

Another thing you need to know about crypto trading charts is that they can be used to help you develop trading strategies. For example, you might use a chart to figure out when it’s a good time to buy or sell shares in a cryptocurrency.

3. Technical indicators

Finally, you need to know about technical indicators if you want to be able to read a chart like a pro. These indicators are numbers that are used to measure various aspects of the market, and they can help you make better investment decisions.

For example, you might use a technical indicator called the “ Relative Strength Index ” to figure out whether the market is weak or strong.

How to make money by reading crypto trading charts

There are a few ways to make money by reading crypto trading charts. You can try to find trends in the prices of different digital currencies, and then make predictions about when those prices will change. You can also try to identify patterns in the prices of different digital currencies, and then buy or sell cryptocurrency based on those patterns. Finally, you can try to predict when a digital currency will become worth more or less than its current price.

What technical indicators should you look for in crypto trading charts?

Cryptocurrency charts can be analyzed for a variety of technical indicators, including:

1) Price action: Look for consistent and orderly price movements, with clear indications of support and resistance levels.

2) Volume: monitor how active the market is by tracking the amount of trading activity taking place.

3) RSI (Relative Strength Index): A RSI indicator is a technical tool that helps traders identify overbought or oversold conditions. When the RSI is nearing 70 levels, this usually indicates that the market is becoming too volatile and could potentially experience a sell-off. When the RSI is below 30 levels, this usually indicates that the market is becoming too stable and could potentially experience a buy-up.

How to read crypto trading charts: a step-by-step guide

If you want to read crypto trading charts, there is a step-by-step guide you can follow.

1. Choose the right crypto trading platform

The first step is to choose the right crypto trading platform. There are a number of options available, but some of the most popular ones include Coinbase, Binance, and Bitfinex.

2. Chart your portfolio

Once you have chosen a platform, the next step is to chart your portfolio. This will help you to understand how your investments are performing.

3. Analyse your charts

Once you have charted your portfolio, it is important to analyse the data. This will help you to make informed decisions about your investments.