Crypto Daytrading Charts

If you're serious about daytrading cryptocurrencies, then you need to check out these charts! These charts provide all of the information you need to make informed decisions about when to buy and sell.

How to read crypto daytrading charts

Crypto daytrading charts are used to analyze the price movement of cryptocurrencies. The main goal of crypto daytrading is to make profits by buying and selling cryptocurrencies at the best possible moment.

To read crypto daytrading charts, first you need to identify the basic trends. The most important trend to watch for is the price movement of the cryptocurrency over a certain period of time. Other important trends to look for are the volume and the moving averages.

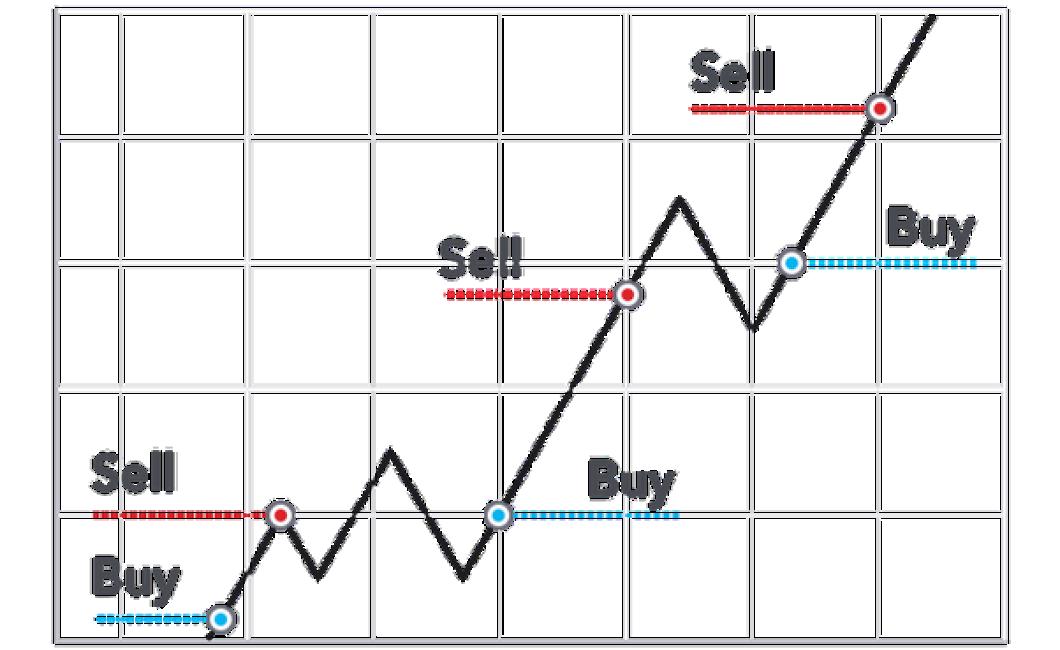

To analyze the price movement of a cryptocurrency, you need to find support and resistance levels. Support and resistance levels are determined by the price points where a lot of buyers and sellers are present. When the price reaches a support level, it tends to stay there for a while, while when it reaches a resistance level, it tends to break through and continue moving higher.

It is important to watch the market conditions and react accordingly. If the market is moving in a downward trend, it is usually best to sell your cryptocurrencies, while if the market is moving in an upward trend, it is usually best to buy cryptocurrencies.

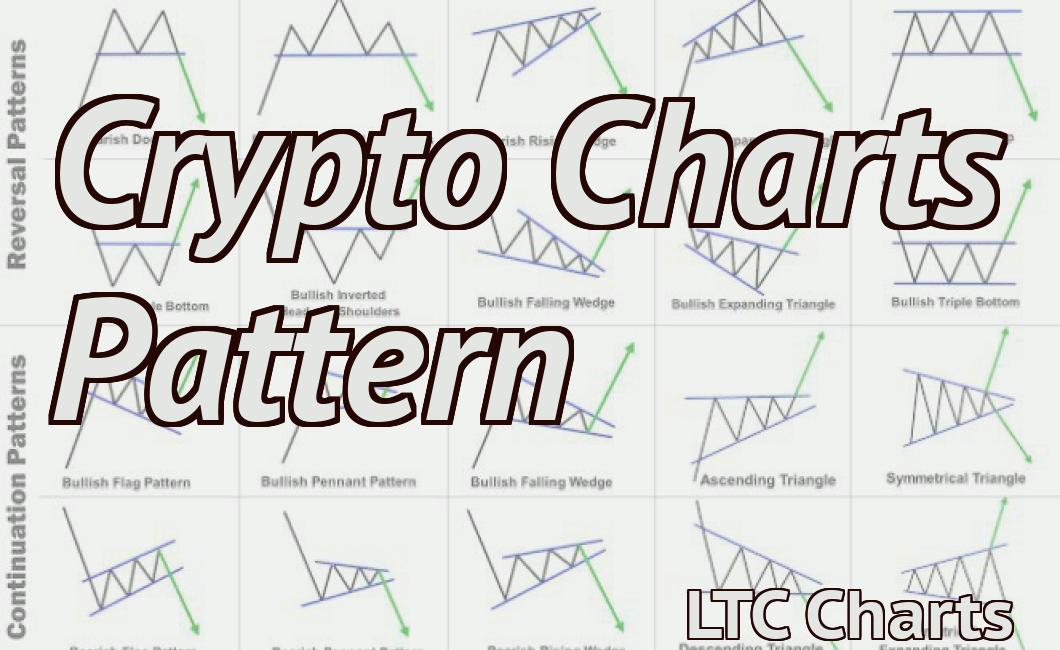

3 essential crypto daytrading chart patterns

1. The head and shoulders pattern

The head and shoulders pattern is a bullish chart pattern that consists of two consecutive peaks that are higher than the previous peak. The pattern is often followed by a downtrend, but can also signal an impending market top.

2. The double bottom pattern

The double bottom pattern is a bullish chart pattern that consists of two consecutive lows that are lower than the previous low. The pattern is often followed by a rally to the original high.

3. The triangle pattern

The triangle pattern is a bullish chart pattern that consists of three converging lines that form a triangle. The pattern is often followed by a rally to the original high.

A beginner's guide to crypto daytrading charts

Crypto daytrading charts are a great way to help you learn about the market and find opportunities to make money.

There are many different types of crypto daytrading charts, so it can be hard to know which one to choose.

Here’s a guide to help you choose the right chart for your trading strategy.

Types of crypto daytrading charts

1. Candlestick charts

Candlestick charts are probably the most common type of crypto daytrading chart. They show the price of a cryptocurrency over time, usually in bars.

They're easy to use and can be helpful when you want to see how the market is performing on a given day.

2. OHLC (open, high, low, close) charts

OHLC charts are similar to candlestick charts, but they also show the percentage changes in price over time.

This can be helpful if you're looking to make short-term profits.

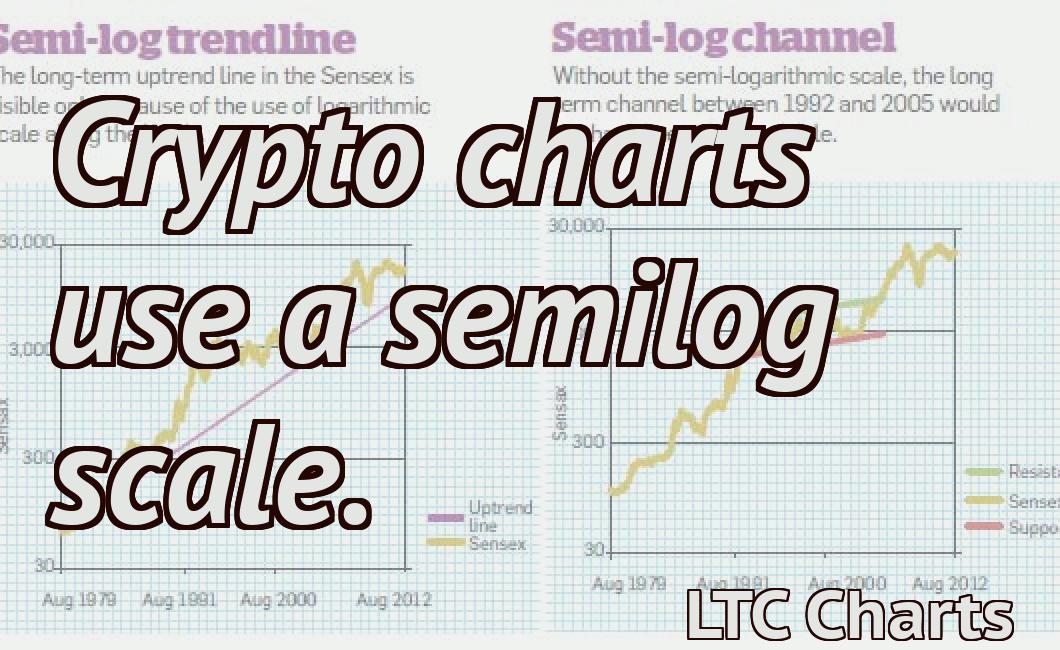

3. Time-based charts

Time-based charts show the price of a cryptocurrency over a certain period of time, like 24 hours or 1 day.

This type of chart can be helpful if you're looking to track long-term trends.

4. Volume-based charts

Volume-based charts show the amount of cryptocurrency that's been traded over a certain period of time.

This type of chart can be helpful if you're looking to track trends in the market.

5. technical indicators

Technical indicators are indicators that are used to predict the future movements of the markets.

They can help you identify opportunities in the market and make better trading decisions.

Choosing the right crypto daytrading chart

When choosing a crypto daytrading chart, you'll want to consider your trading strategy.

Candlestick charts are easy to use and can be helpful when you want to see how the market is performing on a given day. OHLC charts are useful if you're looking to make short-term profits. Time-based charts can be helpful if you're looking to track long-term trends. Volume-based charts can be helpful if you're looking to track trends in the market. And technical indicators can help you identify opportunities in the market and make better trading decisions.

The most important crypto daytrading chart indicators

Volume

This is the most important crypto daytrading chart indicator. Volume measures how much cryptocurrency is being traded on a given day. When volume is high, it indicates that there is a lot of interest in the cryptocurrency market.

Breadth

Breadth measures how wide the different price ranges are on a given day. When breadth is wide, it indicates that the market is volatile and there is a lot of movement in the prices.

Volatility

Volatility measures how much movement the prices have on a given day. When volatility is high, it indicates that the market is volatile and there is a lot of movement in the prices.

How to use candlestick charts for crypto daytrading

Candlestick charts are a great way to visualize price movements over time. You can use them to track the price of a cryptocurrency over a specific period of time, or to identify specific patterns in the price movement.

To use candlestick charts for crypto day trading, first find the appropriate time period for your analysis. Candlestick charts usually show prices for a specific period of time, such as 30, 60, or 120 minutes. Once you've chosen your time period, find the open and close prices for that period.

Next, plot the open and close prices on the chart. The x-axis shows the time period, and the y-axis plots the price of the cryptocurrency.

Next, find the candlestick that corresponds to the open price. The candlestick's color will indicate how much the price has changed since the previous candlestick.

Next, find the candlestick that corresponds to the close price. The candlestick's color will indicate how much the price has changed since the previous candlestick.

Finally, find the height of the corresponding candlestick on the graph. This will indicate how much value was traded during that particular period of time.

Top 5 crypto daytrading charting tools

1. CoinMarketCap

CoinMarketCap is arguably the most popular crypto day trading charting tool. It provides real-time market data for over 1,500 cryptocurrencies. CoinMarketCap also offers detailed historical data and live streaming prices.

2. TradingView

TradingView is another popular crypto day trading charting tool. It allows users to create and customize their own charts. TradingView also offers live streaming prices and historical data.

3. Cryptocompare

Cryptocompare is a popular crypto day trading resource. It provides real-time market data for over 1,500 cryptocurrencies. Cryptocompare also offers detailed historical data and live streaming prices.

4. Coinigy

Coinigy is a popular crypto day trading platform. It allows users to track cryptocurrency prices, perform technical analysis, and create custom alerts. Coinigy also offers live streaming prices and historical data.

5. Kraken

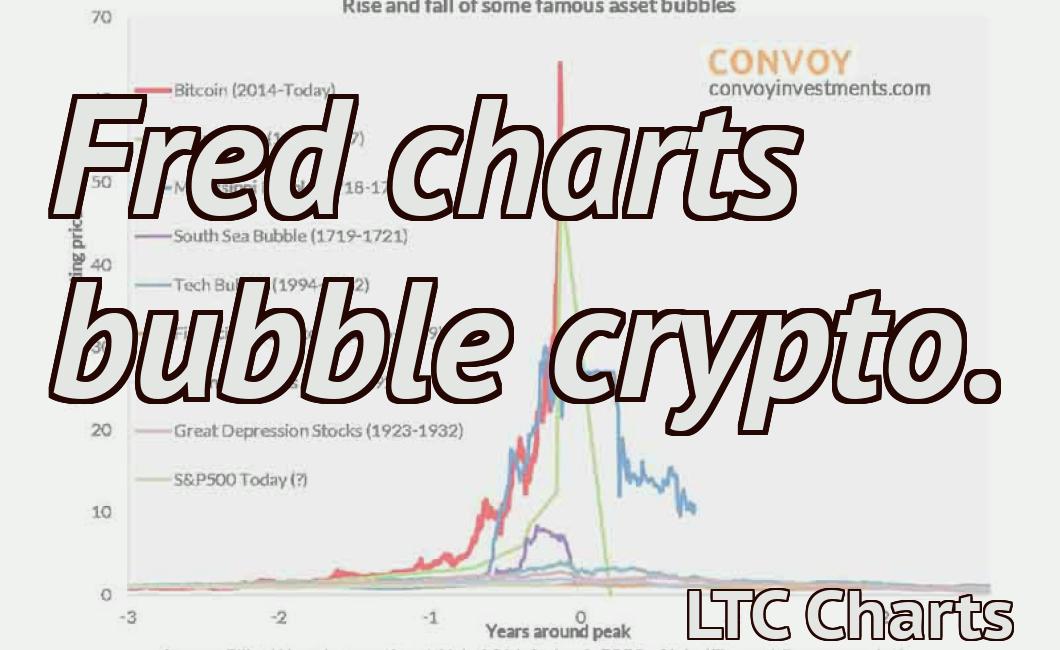

How to spot trends in crypto daytrading charts

There are a few things you can look for when analyzing crypto daytrading charts to spot trends.

1. Patterns of buy and sell orders

When analyzing crypto daytrading charts, be on the lookout for patterns of buy and sell orders. These patterns can give you clues about where the price of a cryptocurrency is likely to go in the near future.

2. Volume levels

Another thing to watch for on crypto daytrading charts is the volume levels. This information can help you to determine whether the price of a cryptocurrency is trending up or down.

3. Moving averages

Finally, keep an eye on moving averages to see if they are indicating that the price of a cryptocurrency is moving in a consistent direction.

How to set up your crypto daytrading charting software

There are a few different crypto day trading charting software options out there. Here are instructions on how to set them up:

1. Log into your account on the exchange you are using for day trading.

2. Click on the "Charts" tab.

3. Click on the " candle chart " link.

4. Click on the " Create new candle chart " button.

5. Fill out the required information and click on the " OK " button.

6. Your new candle chart will be displayed.

7. Click on the chart to zoom in or out.

8. To change the chart type, click on the " Type " dropdown menu and select the type of chart you want to use.

The benefits of using charts for crypto daytrading

There are many benefits to using charts for crypto daytrading.

One benefit is that charts can help you to quickly and easily identify trends in the market. By looking at charts, you can see how the price of a particular cryptocurrency has changed over time, and you can also see how prices are related to one another.

Another benefit of using charts is that they can help you to stay informed about the market conditions. By looking at charts, you can see how the price of a particular cryptocurrency is currently behaving, and you can also see how prices have been changing over time. This information can help you to make informed decisions about whether or not to buy or sell a cryptocurrency.

Finally, charts can also help you to identify opportunities in the market. By looking at charts, you can see where the price of a particular cryptocurrency is relatively low, and you can also see where the price of a particular cryptocurrency is relatively high. This information can help you to identify opportunities to buy a cryptocurrency at a low price and sell it at a high price later on.

Are you using the right crypto daytrading chart?

The right crypto daytrading chart can help you identify patterns in the prices of cryptocurrencies. It can also help you make informed decisions about when to buy and sell cryptocurrencies.

How to make money from crypto daytrading charts

Crypto daytrading charts allow you to make money by trading cryptocurrencies. By analyzing the market and making informed trades, you can earn profits.

Before you start day trading, you'll need to have a solid understanding of the technical indicators used in the market. These indicators can help you identify potential trends and buy or sell cryptocurrencies accordingly.

Once you have a good understanding of the market, you can start day trading. To do this, you'll need to establish an account with a cryptocurrency exchange and purchase a set amount of cryptocurrencies. You can then trade these cryptocurrencies for other cryptocurrencies or fiat currencies.

To make the most of your day trading strategy, keep a close eye on the price of cryptocurrencies and make informed trades. If you can correctly predict the direction of the market, you can make profits.