Depth Charts Crypto

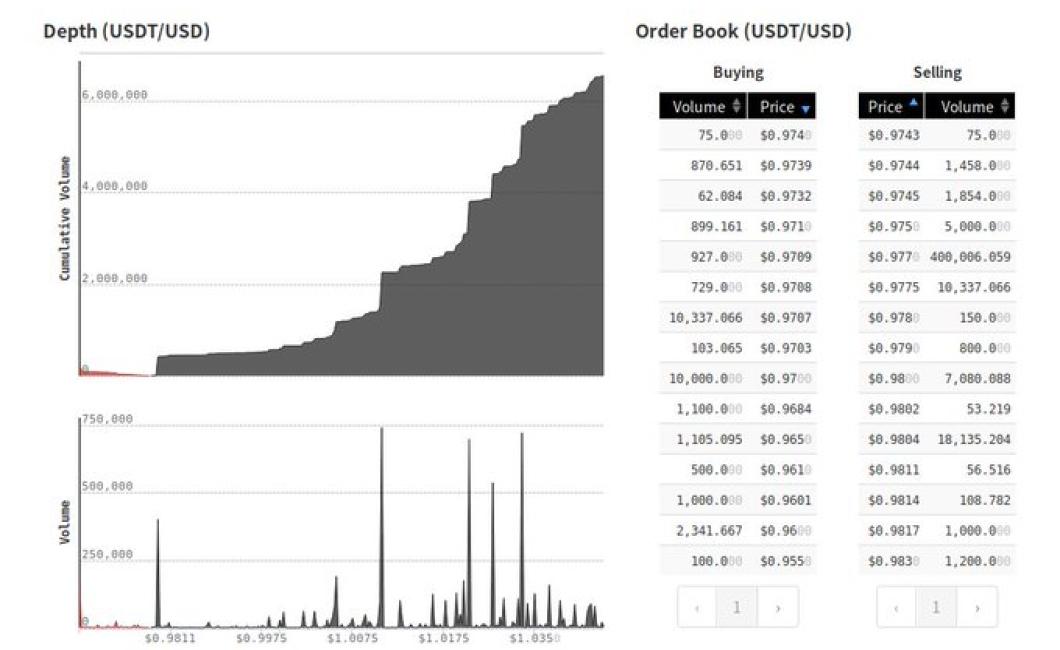

The article "Depth Charts Crypto" is a guide to understanding and using depth charts to trade cryptocurrencies. Depth charts are a graphical representation of the order book for a particular cryptocurrency exchange. They show the bid and ask prices for a given cryptocurrency as well as the order size at each price point. Depth charts can be used to identify trends in the market and to make trading decisions.

How to Read a Crypto Depth Chart

A crypto depth chart is a visual representation of the value of a cryptocurrency over time. The chart usually lists the price of a cryptocurrency at different points in time, and it can be used to track the value of a cryptocurrency over time.

To read a crypto depth chart, you first need to understand how to read a price chart. Once you have a basic understanding of how to read a price chart, you can then use that knowledge to read a crypto depth chart.

To read a crypto depth chart, you first need to understand how to read a price chart. Once you have a basic understanding of how to read a price chart, you can then use that knowledge to read a crypto depth chart.

When you are looking at a crypto depth chart, you are looking at a visual representation of the value of a cryptocurrency over time. The chart will list the price of a cryptocurrency at different points in time, and it will show how that price has changed over time.

The most important thing to remember when reading a crypto depth chart is to keep in mind the context of the data. For example, if you are looking at the data from December 2017, you should not just look at the prices listed on the chart. Instead, you should also consider what was happening in the world of cryptocurrency at that time.

If you are looking at the data from January 2018, you should also consider what was happening in the world of cryptocurrency at that time. Similarly, if you are looking at the data from February 2018, you should also consider what was happening in the world of cryptocurrency at that time.

Cryptocurrencies are constantly changing, and the data on a crypto depth chart may change over time as well. Therefore, it is important to always be aware of the context of the data when reading a crypto depth chart.

Understanding the Different Types of Depth Charts in Crypto Trading

There are a few different types of depth charts that traders use in order to analyze and trade cryptocurrencies.

The most common type is a candlestick chart, which displays the prices of a cryptocurrency over a specific time period as well as the volume of trading activity for that particular period. Other types of charts include bar charts and line charts.

Candlestick charts are the most popular type of cryptocurrency depth chart, and they allow traders to see how the price of a cryptocurrency has changed over a specific time period by displaying the price and volume data for each candlestick.

Bar charts are similar to candlestick charts in that they display the price and volume data for a cryptocurrency, but they also include indicators that show the direction of the market. Line charts are similar to bar charts in that they display the price and volume data, but they also include indicators that show the trend in the market.

What do the Colors on a Depth Chart Mean?

The colors on a depth chart indicate a job's level of complexity. Green indicates a level 1 job, while red indicates a level 5 job.

How to Use a Depth Chart to Place Trades

Depth charts are a great way to keep track of trades that you make. By using a depth chart, you can see at a glance how much money you are making or losing on each trade.

To create a depth chart, start by drawing a horizontal line across the page. Next, sketch out each trade that you make on the line. For each trade, mark the amount of money that you made or lost on the line below the trade.

Once you have created your depth chart, you can use it to keep track of your profits and losses. This will help you make more profitable trades and avoid losing money on trades that you don't think are worth investing in.

How to Analyze a Depth Chart for Trading Opportunities

When looking at a depth chart for trading opportunities, it is important to first identify the trend of the market. Once you have identified the trend, you can then look for opportunities that correspond with the trend.

Additionally, when analyzing a depth chart for trading opportunities, it is important to be aware of the current supply and demand conditions. This will help you determine which assets are in demand and which assets are in supply.

What is Order Book Trading and How to Use It

Order book trading is a technique that can be used by traders to get an edge in the market. It is a form of trading where the trader looks at the order book and tries to guess which way the market is going to move.

Order book trading is risky because it is based on guessing what the market will do. However, order book trading can be very profitable if the trader is able to correctly guess which direction the market is going in.