Analyzing Crypto Charts

This article discusses the different ways to analyze crypto charts in order to make better investment decisions. It covers the basics of chart analysis and technical indicators, as well as more advanced concepts such as Fibonacci retracements and Elliot Wave theory.

How to read and analyze cryptocurrency charts for beginners

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrency charts are visual representations of the price of a cryptocurrency over time. They can be used to assess the health of a cryptocurrency by examining how its prices have fluctuated over time.

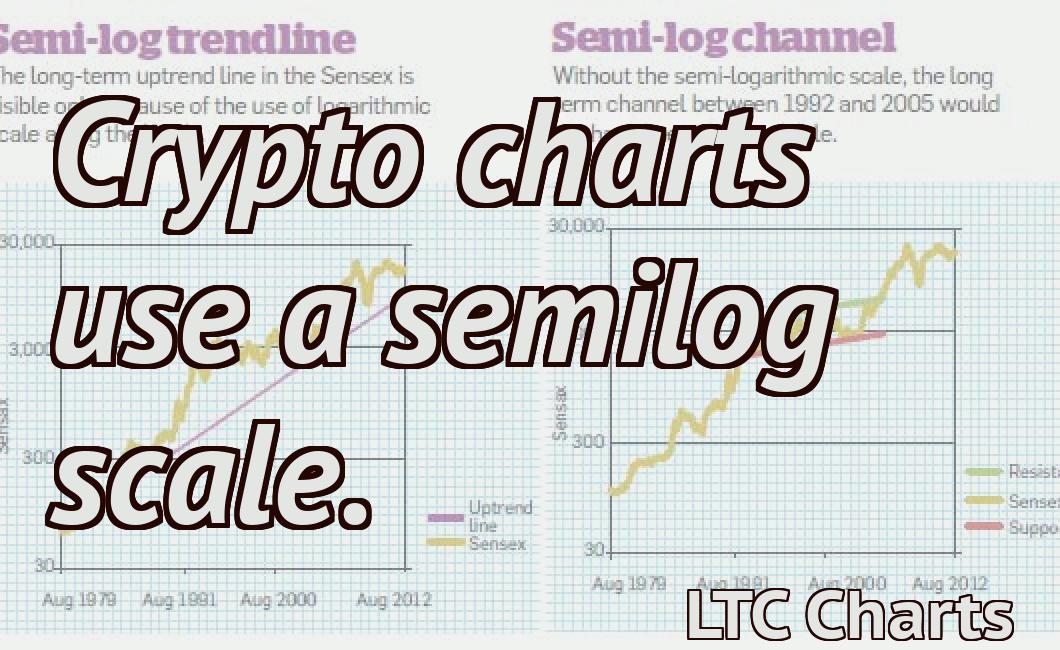

The first step in reading cryptocurrency charts is to understand the structure of the chart. Cryptocurrencies are listed on different exchanges in different currencies, so a chart may display the price of one cryptocurrency in a different currency than the one shown on the chart's axes. For example, the Bitcoin chart on CoinMarketCap may display the price in US dollars, but the Yobit exchange may display the price in British pounds.

Next, identify the vertical axis. This axis shows how much money has been spent on a given cryptocurrency over a given period of time. The X-axis usually starts at 0 and goes up to the value of the currency being displayed on the chart. The Y-axis usually starts at 0 and goes down to the value of the currency being displayed on the chart.

The next step is to identify the horizontal axis. This axis shows how much money is being spent on a given cryptocurrency over a given period of time. The X-axis usually starts at 0 and goes left to right across the chart, while the Y-axis usually starts at 0 and goes down to the value of the currency being displayed on the chart.

After understanding these two axes, you can begin to analyze the chart. For example, if you see that the price of a cryptocurrency is increasing, you can assume that there is more demand for that cryptocurrency than there is supply. This is good news for investors, as it means that there is likely more profit potential for those who invest in that cryptocurrency. Conversely, if the price of a cryptocurrency is decreasing, this may be indicative of a market correction or a problem with the underlying technology or business model of that cryptocurrency.

Technical analysis 101: How to read crypto charts like a pro

Cryptocurrency charts are a great way to track the performance of digital assets.

There are a few things to keep in mind when analyzing crypto charts:

1. Look at the overall trend

The first thing to look at is the overall trend. Are prices rising or falling? Are they stable or moving around a lot?

2. Check the technical indicators

Next, check the various technical indicators to see how the currency is performing. These include the Bollinger Bands, MACD, and RSI.

3. Be patient

Don’t get too stressed out if the chart looks complicated. Take your time and learn how to read it. With practice, you’ll be able to understand what’s going on and make better investment decisions.

3 simple steps to start analyzing cryptocurrency charts

1. Look at the time frame of the chart. Some coins may have longer or shorter periods of activity. This can give you an idea of how volatile the currency is.

2. Compare the price of the coin to its historical price. This will give you an idea of how quickly the price has changed in the past.

3. Compare the volume of the coin to its historical volume. This will give you an idea of how active the market is for the currency.

The most important indicators for analyzing crypto charts

1. Price (horizontal axis)

2. Volume (vertical axis)

3. Market Cap (color coded)

1. Price (horizontal axis)

2. Volume (vertical axis)

3. Market Cap (color coded)

Beginner's guide to analyzing cryptocurrency charts

Cryptocurrency charts can be a confusing and daunting task for the uninitiated. In this guide, we will walk you through the basics of how to use cryptocurrency charts and help you understand what each indicator means.

First, you will need to find a cryptocurrency chart that you are interested in. There are many different types of cryptocurrency charts, so it is important to find one that is specific to your investment. For example, you might want to look at a cryptocurrency chart that tracks the price of Bitcoin.

Once you have found a cryptocurrency chart, you will need to understand the different indicators on the chart. The following are the most common indicators used on cryptocurrency charts:

1. Price: The price of a cryptocurrency is determined by the supply and demand on the market. The price on a cryptocurrency chart will fluctuate as buyers and sellers interact with each other.

2. Volume: The volume of a cryptocurrency is a measure of how many transactions have occurred on the market. This indicator can be helpful in determining how active the market is.

3. Supply: The supply of a cryptocurrency is determined by the number of coins that have been created. This indicator can be useful in determining how valuable a cryptocurrency is.

4. Change: The change in a cryptocurrency is a measure of how much the price has changed over a certain period of time. This indicator can be helpful in determining how volatile the market is.

5. RSI: The RSI indicator is a technical indicator that measures the strength of a currency’s rally or decline. The RSI indicator is usually located on the bottom of the chart. When the RSI indicator is high, the currency is increasing in value, and when the RSI indicator is low, the currency is decreasing in value.

How to use candlestick charts to analyze crypto prices

Cryptocurrencies are often traded on decentralized exchanges (DEXs). These exchanges allow for the buying and selling of cryptocurrencies with traditional fiat currency.

The candlestick chart is a technical analysis tool that is used to examine the behavior of prices over time. Candlestick charts are divided into four sections: the open, the high, the low, and the close. The open is the first time that the price of a security is visible on the chart. The high is the highest point reached by the price of the security during the session. The low is the lowest point reached by the price of the security during the session. The close is the last time that the price of a security is visible on the chart.

Candlestick charts can be used to analyze the following information:

Volume

The volume of a security is a good indicator of how well it is being traded. A higher volume indicates that there is more interest in the security.

Price

The price of a security is a good indicator of how well it is being traded. A higher price indicates that there is more demand for the security.

Relative Strength Index (RSI)

The RSI is a technical indicator that is used to measure the momentum of a security. A higher RSI indicates that the security is more bullish than bearish.

How to spot trends and make predictions using crypto charts

Cryptocurrencies are complex and ever-changing ecosystems, so it can be hard to spot trends and make predictions. However, there are some basic techniques you can use to help you make informed decisions.

1. Look at the overall trend

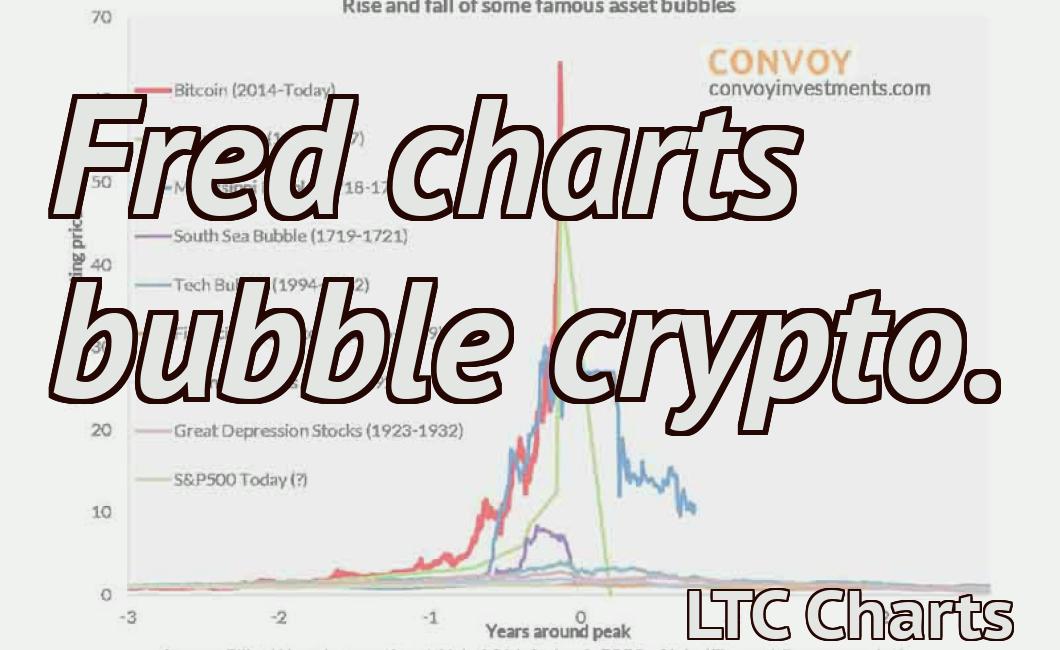

If you want to make a prediction about the future of a cryptocurrency, it's important to look at the overall trend. Over time, most cryptocurrencies will either rise or fall in value, so it's important to keep an eye on the overall trend.

2. Watch for changes in price

Another way to make predictions about the future of a cryptocurrency is to watch for changes in price. Whenever there is a change in price, it's often a sign that there is something happening in the market that you didn't expect. This can help you make informed predictions about the future of a cryptocurrency.

3. Keep an eye on the news

One way to make predictions about the future of a cryptocurrency is to keep an eye on the news. Whenever there is news about a new development in the market, it can often have an impact on prices. This is especially true for cryptocurrencies that are heavily correlated with the stock market.

4. Compare different cryptocurrencies

Another way to make predictions about the future of a cryptocurrency is to compare different cryptocurrencies. This can help you identify which ones are likely to perform well in the future.

The art of crypto chart analysis: What do the experts look for?

Crypto chart analysis is an important part of any crypto investment strategy. However, there is no one definitive way to analyze a digital currency’s chart. Instead, experts look for certain signals that can help them make informed decisions about whether or not to buy or sell a cryptocurrency.

Some of the most common signals that crypto chart analysts look for include:

1. Price trends

When analyzing a digital currency’s chart, experts often focus on price trends. This means that they pay attention to the cryptocurrency’s price movement over time, in order to determine whether or not there is evidence of an upward or downward trend.

2. Volume levels

Another common signal that crypto chart analysts look for is volume levels. This information is often used to determine whether or not there is overall investor interest in a digital currency. high volume levels could indicate that there is strong demand for the currency, while low volume levels could suggest that there is little interest in the currency.

3. Technical indicators

Technical indicators can also be helpful when analyzing a digital currency’s chart. These indicators are designed to help traders identify patterns and predict future movements in the market. Some of the most common technical indicators include:

-The Bollinger Bands

-The Relative Strength Index (RSI)

-The MACD

-The DMI

4. Social media reaction

Social media reaction can also be an important signal when it comes to analyzing a digital currency’s chart. For example, if a major news outlet covers a digital currency’s price movement, that could indicate increased investor interest. Conversely, if there is negative social media reaction to a digital currency’s price movement, that could be a sign of impending market volatility.

How to become a master of crypto chart analysis

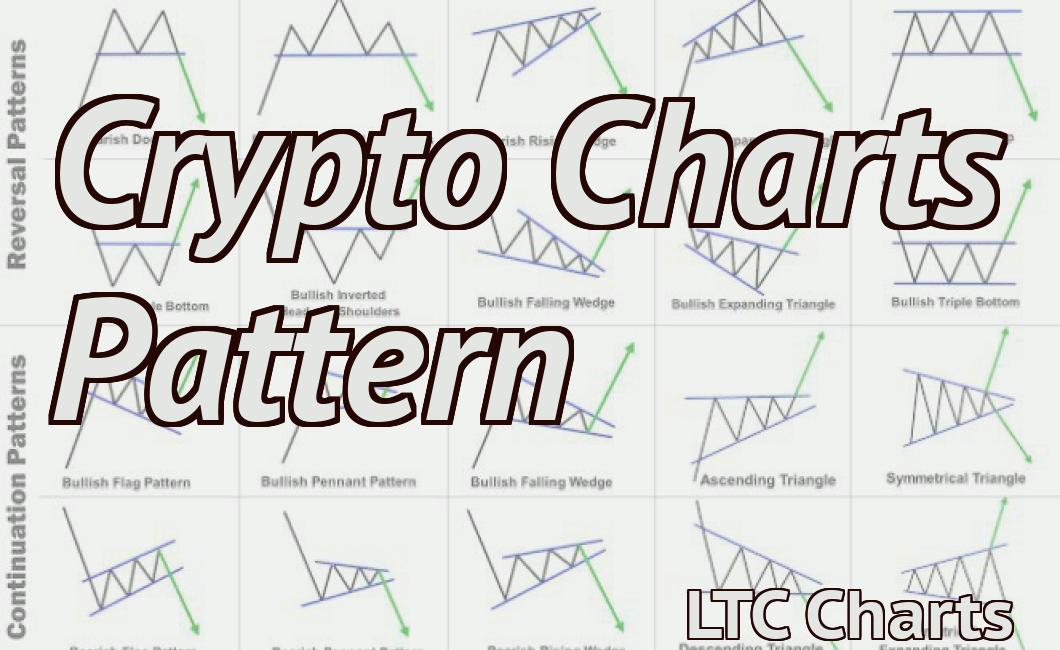

The first step is to become familiar with the different types of charts available and how they can be used to analysis crypto prices.

There are a number of different types of crypto charts available, including:

• Time-series charts

• Volume-weighted charts

• Accumulation/distribution charts

• Gaps and support/resistance charts

Once you have become familiar with these different types of charts, it is then important to understand how to read them and identify patterns.

Once you have a basic understanding of how to read crypto charts and identify patterns, the next step is to develop your own analysis techniques. This will allow you to identify potential opportunities and potential risks in the cryptocurrency market.

Tips and tricks for analyzing cryptocurrency charts

There is no one definitive way to analyze cryptocurrency charts, as the strategies that work for one person may not work for another. However, here are a few tips that may help you get started:

1. Look at the total value of a cryptocurrency's market cap.

This is the most basic measure of a cryptocurrency's overall value. The larger the market cap, the more valuable the cryptocurrency is.

2. Look at the value of a cryptocurrency over time.

Cryptocurrencies tend to rise and fall in value over time. It can be helpful to analyze a cryptocurrency's price over a period of several weeks, months, or even years to get an idea of how it has performed relative to other cryptocurrencies.

3. Look at the volume of a cryptocurrency's trading activity.

This can indicate how popular a cryptocurrency is and whether there is potential for it to grow in value. Volumes can also be indicators of market manipulation.

4. Look at the market capitalization of a cryptocurrency.

This is another measure of a cryptocurrency's overall value. Market capitalization is calculated by multiplying a cryptocurrency's price by the number of outstanding shares.