Traps In Crypto Charts

Many investors don't realize that there are traps in crypto charts that can lead to big losses. This article discusses some of the most common traps and how to avoid them.

The Five Most Common Charting Traps In Crypto Trading

1. Focusing on the Wrong Data

One of the most common mistakes traders make is focusing on the wrong data. Instead of looking at charts to decipher what’s happening with the market, they instead look at news articles or social media posts to try and determine what’s going on. This can often times lead them to make decisions based on emotion rather than reason.

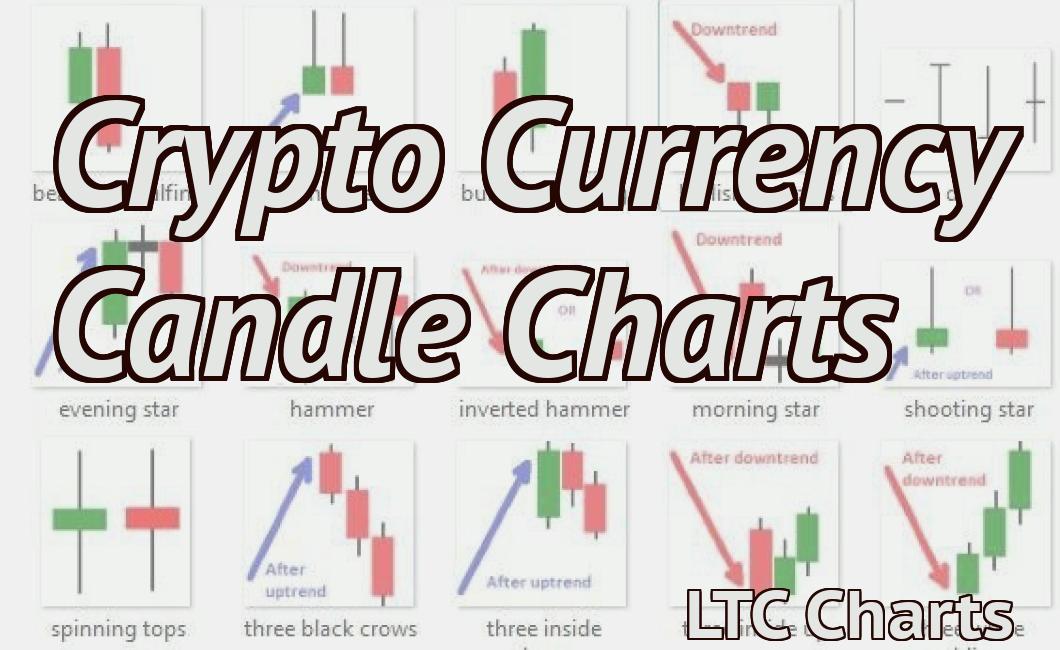

2. Misinterpreting Patterns

Another common mistake traders make is interpreting patterns incorrectly. For example, if a chart is showing a sudden spike in prices, they might assume that this is a sign that the market is about to go up in general. However, this may not actually be the case. There could be any number of reasons why prices are surging right now, and it may not indicate anything about the future direction of the market.

3. Focusing Too Much on Short-Term Trends

Another common mistake traders make is focusing too much on short-term trends. This means that they pay more attention to changes in prices than they do to the overall trend of the market. This can often lead them to make decisions based on emotion rather than reason.

4. Making Unwise Investment Choices

Another common mistake traders make is making unwise investment choices. This means that they invest money in stocks or cryptocurrencies that they don’t understand or that they believe are overvalued. This can often lead to them losing money in the long run.

5. Forgetting to Diversify Their Portfolio

Last but not least, another common mistake traders make is forgetting to diversify their portfolio. This means that they invest all of their money in just one or two types of investments. This can often lead to them losing money if the investments they make go down in value.

How to Avoid the Five Biggest Charting Traps in Crypto Trading

1. Focusing on the Wrong Data Points

Charting is a powerful tool for predicting future price movements, but it’s useless if you only look at data that supports your predetermined viewpoint. Instead, use charting to analyze all of the data points in order to gain a more complete understanding of how the market is functioning.

2. Not Adjusting Your Viewpoint Based on New Information

If you find new information that contradicts your existing beliefs or hypotheses, you need to adjust your perspective accordingly. Don’t try to cling to your original views in the face of new evidence; instead, use the information to improve your analysis and trading strategy.

3. Ignoring Trading Patterns

Every market has its own unique patterns, and it’s important to pay attention to them in order to make informed trading decisions. If you don’t understand the patterns that are occurring in the market, you’re likely to make mistakes in your trading strategy.

4. Not Taking into Account Other Factors

When you’re charting a digital asset, it’s important to take into account not only the price movement but also all of the other factors that are influencing the market. This includes things like news events, regulatory changes, and economic indicators.

5. Not Using a Proper Trading Strategy

Without a proper trading strategy, you’re likely to make mistakes in your trading activity. A good strategy will be designed based on your individual risk tolerance and goals for the trade.

The Five Biggest Charting Mistakes Traders Make in Crypto

1. Focusing on the wrong metrics

Traders who are only interested in making money will often focus on the wrong metrics, such as market cap or price. Instead, they should be focusing on indicators that will give them a better understanding of the crypto ecosystem, such as network activity and developer activity.

2. Not properly diversifying their portfolio

A trader who is focused on making money will often put all of their eggs in one basket. This can lead to them losing money if the market goes against them. A proper portfolio should include a mix of different cryptocurrencies and assets, so that a trader is able to weather any storm.

3. Not properly timing their trades

If a trader is not properly timing their trades, they could end up losing money. This is because there is a chance that the market will go against them. A good rule of thumb is to wait for at least two hours after a cryptocurrency has reached a certain price before making a trade.

4. Focusing on short-term gains instead of long-term growth

Many traders focus on making short-term gains instead of focusing on long-term growth. This can lead to them losing money in the long run because the market can go against them. A good rule of thumb is to focus on taking profits and holding onto your assets for the long term.

5. Not properly researching their chosen cryptocurrency

If a trader is not properly researching their chosen cryptocurrency, they could end up making mistakes. This is because not all cryptocurrencies are the same and some may be more volatile than others. A good rule of thumb is to do your research before investing in any cryptocurrency.

How to Trade Crypto Without Falling Into Charting Traps

Cryptocurrencies are a new and volatile investment, and it’s important to do your research before trading. There are many ways to trade cryptocurrencies, but some of the most common traps are charting and trading based on price movements, instead of analyzing the underlying fundamentals.

To avoid falling into these traps, follow these tips:

1. Don’t trade based on price movements.

Price movements can be misleading and can lead you to make bad investment decisions. Instead, focus on the underlying fundamentals of the cryptocurrency and how it is performing relative to others.

2. Don’t rely on charts to make your trading decisions.

Charts can be a helpful tool for visualizing market movements, but don’t rely on them exclusively to make your trading decisions. Use charts as a supplement to your analysis, and don’t let them drive your trading strategy.

3. Do your research.

Before trading any cryptocurrency, do your research and understand the underlying fundamentals. This will help you make informed trading decisions and avoid common traps.

The Seven Worst Charting Traps in Crypto Trading

There are a few common traps that novice traders fall into when trying to trade cryptocurrencies. Here are the seven worst ones:

1. Focusing on short-term price movements

This is one of the most common traps that new traders fall into. They focus on short-term price movements and forget about the long-term trends that are actually driving the prices.

2. Trading based on emotions

Another common trap that new traders fall into is trading based on their emotions. They get carried away with the market and make decisions based on their feelings rather than on facts.

3. Trading without proper research

Another common trap that new traders fall into is not doing enough research before they start trading. They just go with the first idea that comes to their mind and don’t bother trying to verify it.

4. trading without proper risk management

Another common trap that new traders fall into is not taking proper risk management measures. They don’t have a solid plan for how they will handle possible losses, which can lead to big problems down the road.

5. Not having a strategy

One of the most important things that new traders need is a strategy. Without a plan, they will likely just get lost in the sea of cryptocurrencies and never make any real progress.

6. Not being patient

Another common trap that new traders fall into is being too impatient. They want to make quick profits and end up making very poor decisions that lead to them losing money.

7. Not learning from their mistakes

Finally, another common trap that new traders fall into is not learning from their mistakes. They keep making the same mistakes over and over again, which eventually leads to them losing all of their money.

How to Recognize and Avoid Charting Traps in Crypto Trading

There are a few things to keep in mind when charting crypto trades.

1. Don't Overthink It

Crypto trading is a very complex and volatile market. It's easy to get wrapped up in the details and lose sight of the big picture.

2. Don't Get Focused on the Wrong Factors

It's important to focus on the factors that are most important to your success as a trader. Don't get caught up in the minutiae of the market.

3. Be Patient

Crypto trading is a highly volatile market. It can be difficult to make consistent profits over time. Be patient and stay disciplined, and you'll be able to weather the storm.

The Ten Most Dangerous Charting Traps in Crypto Trading

1. Focusing on the wrong metrics

2. Focusing on short-term gains

3. Trading impulsively

4. Trading without proper risk management

5. Not maintaining a proper trading schedule

6. Ignoring market conditions

7. Excessive speculation

8. Becoming emotionally attached to a trade

9. Failing to take profits when appropriate

10. Continuing to trade when the market has gone against you