Where to draw crypto charts?

If you're looking for a place to draw crypto charts, look no further than CryptoCharts! Our user-friendly interface makes it easy to create and share your own custom charts. Plus, we've got all the data you need right at your fingertips - no more digging around for hours!

How to Read Crypto Charts

Cryptocurrencies are often traded on exchanges, and their prices are tracked on cryptocurrency charts.

Cryptocurrency charts are often represented in a variety of ways, including as candlesticks, bars, and histograms.

Cryptocurrency prices are often updated multiple times a day, so it is important to keep up with the latest prices.

Cryptocurrencies are volatile, so it is important to pay attention to how the prices are changing over time.

A Beginner's Guide to Crypto Charting

Cryptocurrencies are all the rage right now, and many people are curious about how to track them. Crypto charting is a great way to get started, and it can help you understand the dynamics of the market.

What is a crypto chart?

A crypto chart is a visual representation of the price movement of a cryptocurrency. It shows the price over time, and it can also show important indicators like Bollinger bands and MACD.

How to create a crypto chart

To create a crypto chart, first open a cryptocurrency exchange and find a cryptocurrency you want to track. Then, head to the exchange's website and sign in.

Next, click on the "Exchanges" tab and select the cryptocurrency you just tracked. On the exchange's main page, scroll down until you see the "Charts" section.

In the charts section, click on the "Cryptocurrency" tab and select the cryptocurrency you want to track. Then, click on the "Create Chart" button.

You will now be taken to a new page where you can customize your chart. On this page, you will need to provide some basic information like the timeframe you want to use (day, week, month, or year), the currency pair you are tracking, and the exchanges where you bought and sold the cryptocurrency.

After you have provided your information, click on the "Create Chart" button to create your chart.

How to use a crypto chart

Once you have created your crypto chart, you can start to use it to understand the dynamics of the market.

To start, zoom in on the chart and focus on specific points of interest. For example, if you are tracking the price of Bitcoin, you might focus on the $6,000 and $6,500 price points.

Next, use indicators like the Bollinger bands to try to understand how the market is behaving. The Bollinger bands show you the range of prices that the cryptocurrency has experienced over the past few days or weeks.

Finally, use the MACD indicator to see how the market is reacting to different events. The MACD indicator is typically used to identify whether the market is bullish or bearish.

The Most Important Crypto Charts for Beginners

Crypto Beginner’s Guide – How to Buy and Store Cryptocurrencies

Bitcoin Price Chart (BTC/USD)

Ethereum Price Chart (ETH/USD)

Bitcoin Cash Price Chart (BCH/USD)

Litecoin Price Chart (LTC/USD)

Dogecoin Price Chart (DOGE/USD)

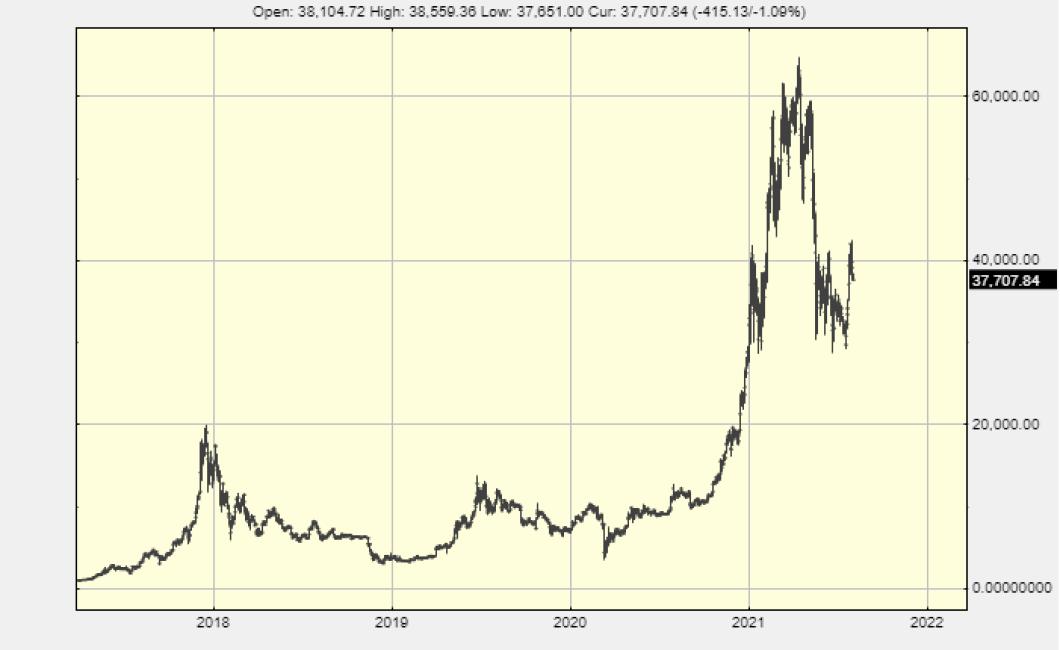

Bitcoin Price Chart (BTC/USD)

Bitcoin is the first and most well-known cryptocurrency. It was created in 2009 by an anonymous person or group of people under the name Satoshi Nakamoto. Bitcoin is a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin is open-source and decentralized, meaning that it is not subject to government or financial institution control.

Ethereum Price Chart (ETH/USD)

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third party interference. Ethereum is also a platform that allows for second layer scaling solutions to be built on top of it. This could allow for a vastly increased number of “dapps” (decentralized applications) to be created.

Bitcoin Cash Price Chart (BCH/USD)

Bitcoin Cash is a cryptocurrency that was created on August 1, 2017. Bitcoin Cash is different from Bitcoin in that it has a block size limit of 8MB, and it has an increased block time of 10 minutes. This makes it more efficient than Bitcoin.

Litecoin Price Chart (LTC/USD)

Litecoin is a cryptocurrency that was created on October 26, 2011. Litecoin is different from Bitcoin and Ethereum in that it has a faster block time of 2.5 minutes, and it has a total supply of 84 million coins. This makes it more valuable than Bitcoin and Ethereum.

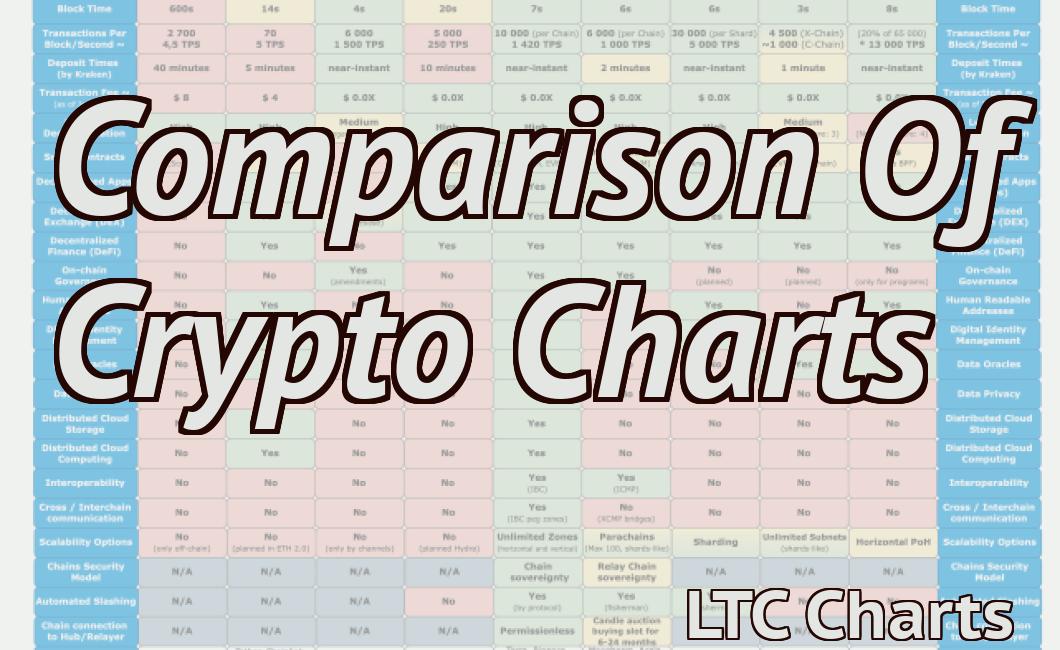

The Different Types of Crypto Charts

Crypto charts are a great way to track the performance of different cryptocurrencies and watch their prices change over time. You can find different types of crypto charts on different websites and apps.

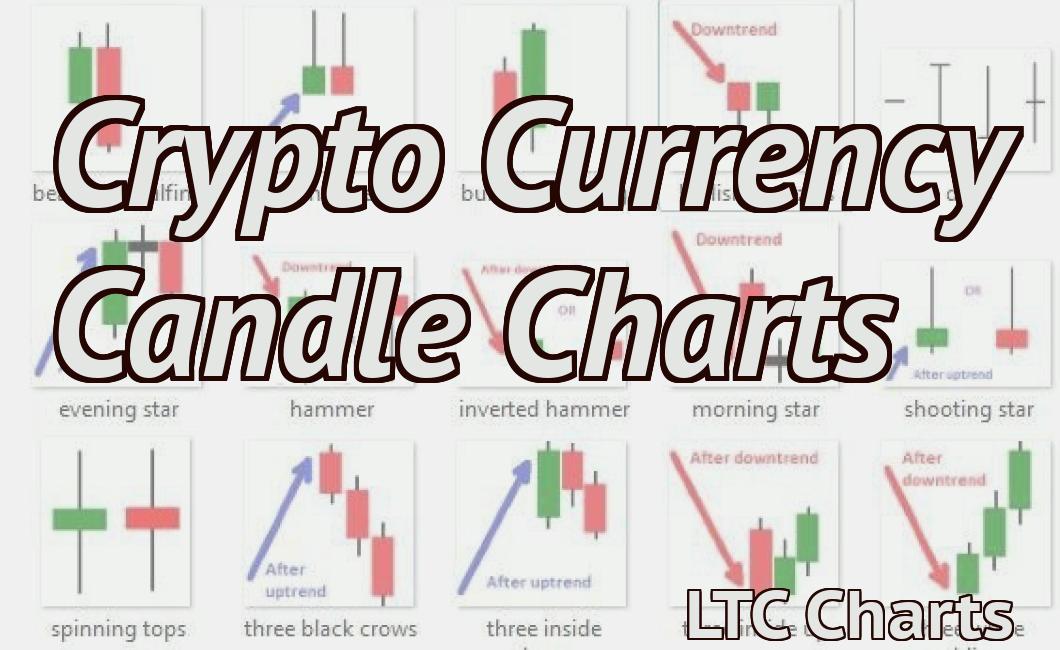

The most common type of crypto chart is a candle chart. This type of chart shows the price of a cryptocurrency over time, and it looks like a candle with a wick and flame. The height of the candle indicates the price of the cryptocurrency at that point in time, and the color of the candle indicates the percentage of change from the previous candle.

Another common type of crypto chart is a bar chart. This type of chart shows the price of a cryptocurrency over time, and it looks like a bar with a height and width. The height of the bar indicates the price of the cryptocurrency at that point in time, and the color of the bar indicates the percentage of change from the previous bar.

You can also find crypto charts that show the total value of a cryptocurrency over time, or the market cap of a cryptocurrency.

How to Use Crypto Charts to Make Better Trading Decisions

Crypto charts are a great way to get a broad overview of cryptocurrency prices and trends. By using charts, you can identify important price points, track volatility, and make better trading decisions.

1. Find the right crypto charting platform. There are a number of different crypto charting platforms available, and each has its own features and benefits. Some popular platforms include CoinMarketCap, TradingView, and CoinGape.

2. Begin by finding the cryptocurrency you want to track. You can find this information on CoinMarketCap or TradingView.

3. Once you have found the cryptocurrency you want to track, click on the chart to open it in the chosen platform.

4. You will now need to find the relevant price points. This can be done by hovering your mouse over the chart, and then clicking on the point you want to examine.

5. Next, you will need to track volatility. To do this, you will need to track the percentage change in prices for the selected currency over a specific period of time. This can be done by clicking on the “Volatility” link under the “Data” tab.

6. Finally, you will need to make trading decisions based on the information you have gathered. To do this, carefully consider the current market conditions, and then make your trading decisions accordingly.

What do all the Lines and Symbols Mean on a Crypto Chart?

The lines on a crypto chart represent price action, while the symbols represent different aspects of the market.

A green line signifies positive price movement, while a red line indicates negative price movement. The size of the line corresponds to the magnitude of the price movement.

A double bottom or "bullish flag" indicates that the price has dropped below the lower boundary of the flag and is expected to rise again. A triple bottom or "bearish flag" indicates that the price has dropped below the lower boundary of the flag and is expected to stay low.

A horizontal line drawn through the middle of the chart indicates the midpoint of the trading range.

An "oversold" condition indicates that the market is pricing in too much downside potential, while an "overbought" condition indicates that the market is pricing in too much upside potential.

How to Analyze Candlestick Charts

Candlestick charts are an easy way to analyze financial data. Candlestick charts show the price and volume of a security over time. This makes them useful for analyzing trends and predicting future prices.

To use candlestick charts, first identify the bars that make up the chart. There are two types of bars used in candlestick charts: close and open. The close bar is the last price of the security for the day and the open bar is the first price of the security for the day.

Next, identify the type of candlestick. The three types of candlesticks are the bull, bear, and doji. A bull candlestick shows that the security's price has gone up over the course of the bar. A bear candlestick shows that the security's price has gone down over the course of the bar. A doji candlestick shows that the security's price has remained unchanged over the course of the bar.

Finally, analyze the significance of each candlestick. The following are some analysis tips for candlestick charts:

If there are many bullish candlesticks, this may indicate that the security is going to go up in price.

If there are many bearish candlesticks, this may indicate that the security is going to go down in price.

If there are many doji candlesticks, this may indicate that there is no clear trend and that it is difficult to predict future prices.

How to Analyze Bar Charts

There are a few different ways to analyze bar charts. The most common way to analyze bar charts is to look at the height of the bars. This allows you to see how much the price has changed over time. You can also look at the location of the bars on the chart, and see how the price has moved around the chart.

How to Analyze Line Charts

To analyze a line chart, first identify the type of line chart. A line chart can be either a time series or a trend line chart.

Next, identify the data points plotted on the line chart. The data points can be the actual values or the values as of a specific point in time.

Finally, analyze the data points to determine whether the line chart is stable or trending.

Using Technical Indicators on Crypto Charts

Crypto charts are a great way to track the performance of specific digital assets. There are a number of technical indicators that can be used to measure the health of a cryptocurrency's market.

Some popular technical indicators include the Bollinger Bands, MACD, and RSI. Each of these indicators can provide valuable information about the health of a particular cryptocurrency's market.

Bollinger Bands

The Bollinger Bands are a popular technical indicator that measures the volatility of a cryptocurrency's market. The Bollinger Bands use two bands to indicate the volatility of a cryptocurrency's market: the upper band indicates the range of prices over which the average price is fluctuating, and the lower band indicates the range of prices at which the average sale is taking place.

MACD

The MACD is a popular technical indicator that measures the trend of a cryptocurrency's market. The MACD uses two lines to indicate the trend of a cryptocurrency's market: the green line indicates a bullish trend, and the red line indicates a bearish trend.

RSI

The RSI is a popular technical indicator that measures the strength of a cryptocurrency's market. The RSI uses a scale from 0 to 100 to indicate the strength of a cryptocurrency's market.

What are the most popular Crypto Charting Tools?

There are a variety of different crypto charting tools available, and it really depends on what you're looking for. Some popular tools include CoinMarketCap, TradingView, and Poloniex.