How to read and predict crypto charts?

This article will teach you how to read and predict crypto charts so that you can make better investment decisions. You will learn about the different types of charts and what information they can provide, as well as how to spot trends and make predictions. By the end of this article, you will have a better understanding of how to read and predict crypto charts.

How to read and predict crypto charts

Cryptocurrencies are traded on various exchanges and can be bought and sold with different currencies.

To read crypto charts, you will need to understand the different types of charts.

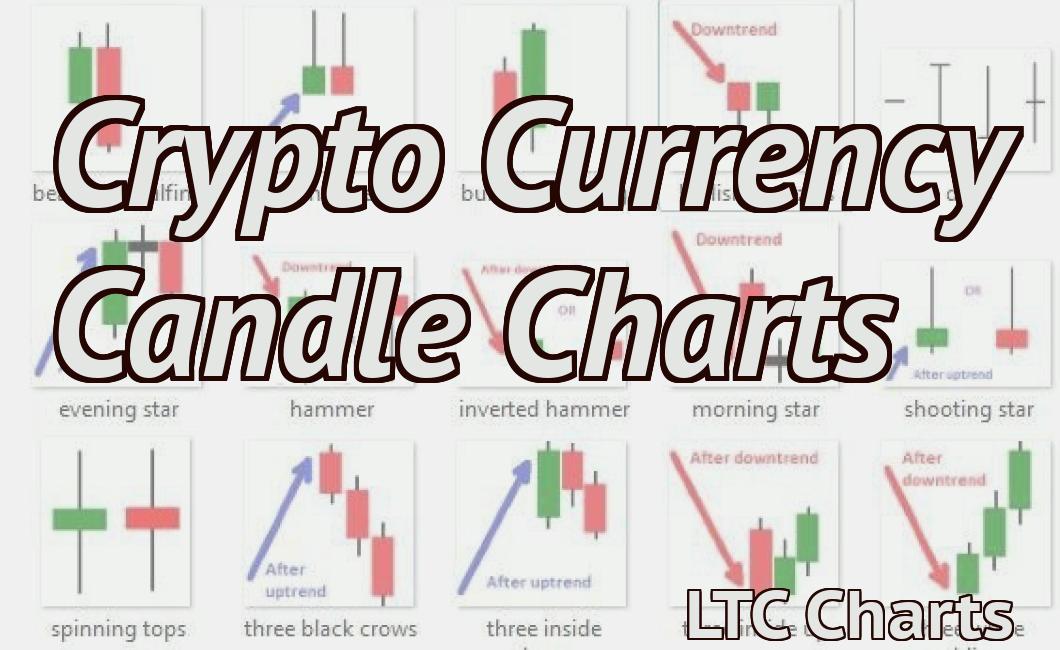

candlestick chart: This is a basic type of chart that shows the price of a cryptocurrency over a period of time. It is usually displayed as a series of candlesticks.

This is a basic type of chart that shows the price of a cryptocurrency over a period of time. It is usually displayed as a series of candlesticks. line chart: This type of chart shows the price of a cryptocurrency over a period of time and can be used to show trends.

This type of chart shows the price of a cryptocurrency over a period of time and can be used to show trends. volume chart: This chart shows the amount of cryptocurrency traded over a period of time.

How to make sense of crypto charts

Crypto charts are used to track the price of a cryptocurrency over time. The price of a cryptocurrency is determined by the supply and demand for that cryptocurrency. When the demand for a cryptocurrency exceeds the supply, the price of that cryptocurrency will rise. Conversely, when the supply exceeds the demand, the price of that cryptocurrency will fall.

How to decipher crypto charts

Crypto charts are often used to help investors and traders understand the price movement and trends of a cryptocurrency. The different types of crypto charts can help you make informed decisions about whether or not to buy or sell a cryptocurrency.

Here are four types of crypto charts you'll commonly see:

1. Line chart

A line chart is a type of chart that displays the price movement of a cryptocurrency over a period of time. The x-axis shows the price, while the y-axis shows the percentage change.

2. Candlestick chart

A candlestick chart is similar to a line chart, but it includes a series of candlesticks that show the price movement of a cryptocurrency over a period of time. The candlesticks are separated by white spaces and are color-coded based on the type of movement they represent.

3. Bar chart

A bar chart is similar to a candlestick chart, but it includes a series of bars that show the price movement of a cryptocurrency over a period of time. The bars are separated by black spaces and are color-coded based on the type of movement they represent.

4. OHLC (Open, High, Low, Close) chart

An OHLC (Open, High, Low, Close) chart is a type of chart that displays the price movement of a cryptocurrency over a period of time. The x-axis shows the price, while the y-axis shows the percentage change. The open, high, low, and close prices are shown in green, blue, yellow, and red, respectively.

How to identify patterns in crypto charts

Crypto charts are a great way to identify patterns in the price movement of digital assets. Patterns can include peaks and valleys, large moves up or down, and consistent trends.

To identify patterns, you first need to understand how crypto charts work. A cryptocurrency's price is displayed as a series of green, red, and yellow bars. The height of the bar indicates the price of the cryptocurrency at that particular point in time.

Crypto charts also include indicators, which are lines that indicate the overall trend of the asset. These indicators can include the moving average, the Bollinger Bands, and the SMA.

Once you understand how crypto charts work, you can start to look for patterns. To do this, you will need to pay attention to the following factors:

Peak and valley behavior: Peaks and valleys are common in crypto charts, and they indicate when a digital asset's price has increased or decreased significantly. When you see a digital asset move up or down dramatically, it is likely that there is a peak or valley present.

Large moves up or down: When a digital asset's price makes a large move up or down, it is often indicative of a trend. If the asset's price moves up significantly, it is likely that there is a bullish trend present. If the asset's price moves down significantly, it is likely that there is a bearish trend present.

Consistent trends: When you see a digital asset consistently moving in a particular direction, it is often indicative of a trend. If the asset's price moves up significantly over time, it is likely that there is a bullish trend present. If the asset's price moves down significantly over time, it is likely that there is a bearish trend present.

Once you have identified a pattern, you can begin to trade based on that pattern. For example, if you see a digital asset consistently moving up in price, you may want to buy the asset. Conversely, if you see a digital asset consistently moving down in price, you may want to sell the asset.

How to forecast price movements using crypto charts

Cryptocurrencies are complex and volatile instruments. It is important to do your own research and not rely on anyone else's opinion.

There are many ways to forecast price movements using crypto charts, but the most reliable approach is to use a moving average.

To find a moving average, you need to identify the closing prices of the last N coins/tokens. To find the closing price of a coin/token, you need to take the last N prices and divide them by the number of coins/tokens in circulation.

For example, if there are 100 coins in circulation, you would find the closing price for a day by taking the last N prices and dividing them by 100. If there are 10 coins in circulation, you would find the closing price for a day by taking the last N prices and dividing them by 10.

Once you have found the moving average, you can use it to forecast future prices. To do this, you need to identify the current price and the moving average. Then, you need to calculate the difference between the two values and use that number to predict future prices.

For example, if the current price is $10 and the moving average is $8, then the difference between the two values is $2. So, you would predict that prices will be $12 two days from now.

How to use crypto charts to your advantage

Crypto charts are an excellent way to track the performance of individual cryptocurrencies and altcoins. By monitoring the prices and trends of these assets, you can make informed investment decisions.

1. Compare prices and trends

When looking at crypto charts, it is important to compare prices and trends to determine the best way to invest in these assets. This will help you to identify any potential buying opportunities or sell-offs.

2. Identify oversold and overbought areas

When analysing crypto charts, it is important to identify oversold and overbought areas. Oversold areas indicate that the price of a cryptocurrency is below its equilibrium level, while an overbought area indicates that the price of a cryptocurrency is above its equilibrium level.

3. Identify key support and resistance levels

When analysing crypto charts, it is important to identify key support and resistance levels. These levels indicate where the price of a cryptocurrency is likely to bounce back or fall. When trading cryptocurrencies, it is important to take account of these levels in order to maximise profits.

The ins and outs of reading crypto charts

Cryptocurrencies are often traded on digital exchanges and can also be bought and sold through so-called “over-the-counter” transactions.

Most digital currencies are built on a blockchain, a public ledger of all transactions. Transactions are verified by network nodes through cryptography and recorded in a chronological order. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrency prices are highly volatile and can be affected by a wide range of factors, including political and economic events, technical analysis, and news events.

Getting the most out of crypto charts

Crypto charts are a great way to track the performance of cryptocurrencies.

When you first get started, it’s important to understand how to read crypto charts.

There are three main components to a crypto chart: the price, the volume, and the technical indicators.

1. The price is usually at the top of the chart.

2. The volume is displayed in number of transactions.

3. The technical indicators show the current trend.

There are many different types of crypto charts, so it is important to familiarize yourself with the different types before you start trading.

Some of the most popular types of crypto charts are:

1. Candlestick charts: Candlestick charts are used to display the changes in price over time. They are usually divided into two sections: the upper section shows the price over a period of 24 hours, and the lower section shows the change over the last eight hours.

2. Line charts: Line charts show the price over a certain period of time. They are usually divided into two sections: the upper section shows the trend, and the lower section shows the actual prices.

3. Volume charts: Volume charts show the amount of cryptocurrency that has been traded over a certain period of time. They are usually divided into two sections: the upper section shows the total volume, and the lower section shows the current volume.

Making the most of crypto charts

Cryptocurrency charts can be a useful tool for understanding the market. By looking at the charts, you can see how the price of a cryptocurrency is changing over time, and you can also see how many people are buying and selling that cryptocurrency.

Some tips for using cryptocurrency charts:

1. Look at the long-term charts. These charts show how the price of a cryptocurrency has been changing over an extended period of time. This can help you understand how the market is behaving overall, and it can also help you predict future prices.

2. Check out the 24-hour charts. These charts show how the price of a cryptocurrency has been changing in the past day or so. This can help you see how the market is reacting to specific events, or it can help you identify trends.

3. Look at the volume charts. This data shows how much money is being exchanged for a cryptocurrency. This information can help you understand how active the market is, and it can also help you predict future prices.

4. Watch for signals. Charts can sometimes signal changes in the market that you should watch for. For example, if the price of a cryptocurrency starts to rise rapidly, that might be a sign that there is about to be a major shift in the market.

Unlocking the power of crypto charts

Cryptocurrency charts are a valuable tool for investors and traders. By understanding how they work, you can unlock the power of these charts to help you make better investment decisions.

Cryptocurrency charts are made up of two main components: price and volume. Together, these two factors indicate how active the market is and how much money is being traded.

Price is the most important factor on a cryptocurrency chart. It shows you how much the currency is worth on the market. Volume is also important, but it’s not as crucial as price. Volume shows you how many units of a particular currency are being traded on the market.

Two things that can affect price on a cryptocurrency chart are supply and demand. Supply refers to the number of coins that are available to be traded. Demand is the number of people who are interested in buying the coins. When there’s a lot of supply and little demand, the price will be low. When there’s a lot of demand and little supply, the price will be high.

There are different ways to track price and volume on a cryptocurrency chart. You can use a moving average to smooth out volatility and make it easier to see trends. You can also use a candlestick chart to look for specific patterns in the price and volume data.

Cryptocurrency charts are an important tool for investors and traders. By understanding how they work, you can unlock the power of these charts to help you make better investment decisions.