Understanding Candle Charts Crypto

Candle charts are one of the most popular types of charting used by cryptocurrency traders. They provide a clear and concise way to view price action, and can be used to spot trends and make trading decisions. In this article, we'll take a look at what candle charts are, how they're created, and how you can use them to your advantage.

How to Read a Candle Chart for Cryptocurrency Trading

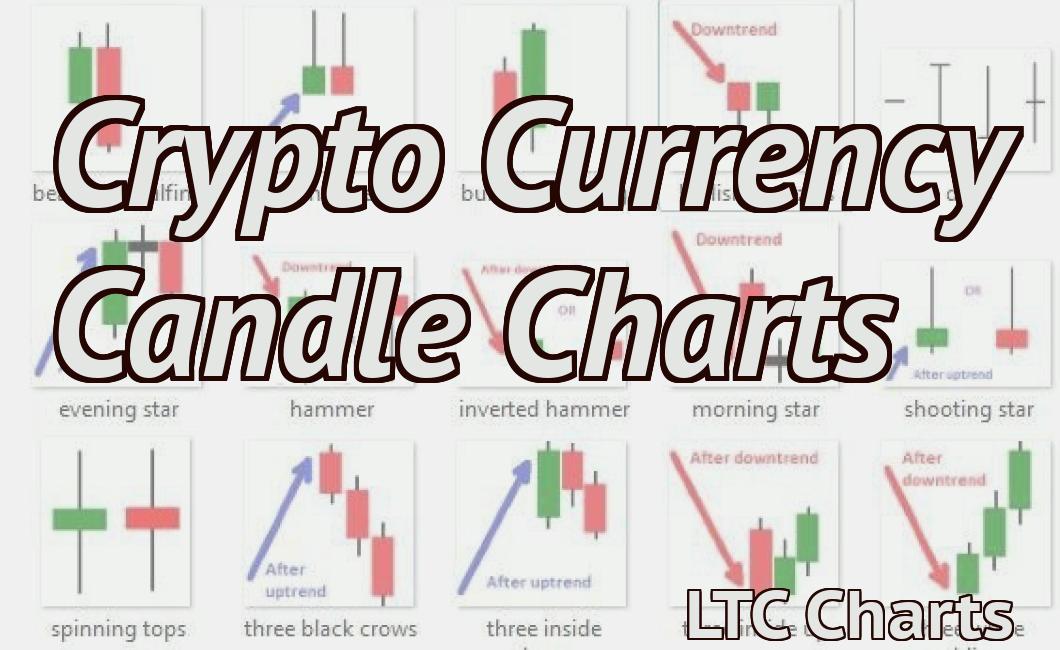

To read a candle chart for cryptocurrency trading, you will need to first understand what a candle is. A candle is simply a graphical representation of the open, high, low, and close prices for a given digital asset.

To read a candle chart, you will first need to identify the open, high, low, and close prices for the given digital asset. Next, you will need to identify the volume for the given digital asset at each of these prices. Finally, you will need to identify the trend for the given digital asset at each of these prices.

Using Candle Charts to Analyze Cryptocurrency Price Movement

candle chart is a graphical representation of price movement over time. Candle charts are often used to identify patterns in cryptocurrency prices and to help traders make informed investment decisions.

There are a few things to keep in mind when constructing a candle chart:

The height of the candles should be proportional to the value of the underlying asset.

The width of the candles should be proportional to the number of trading hours during which the candle was open.

Candles that are close together indicate that the price moved relatively close together during the corresponding period of time.

Candles that are far apart indicate that the price moved relatively far apart during the corresponding period of time.

When analyzing a cryptocurrency candle chart, it is important to consider the following factors:

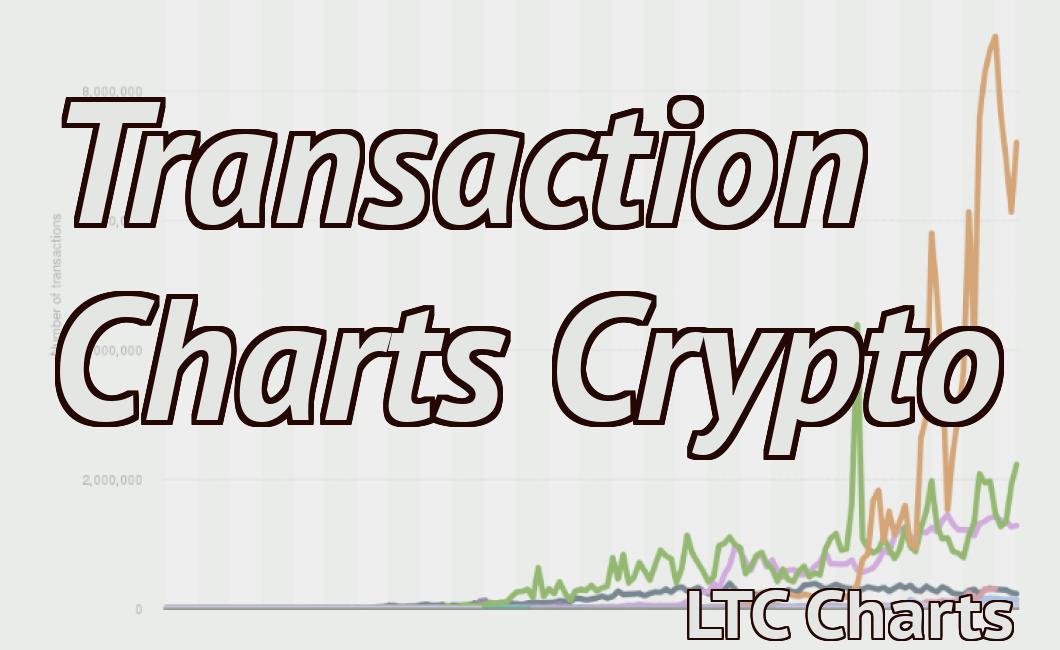

The Overall Trend – Looking at the overall trend can help you identify whether the current candle chart is indicative of a long-term trend or a short-term trend. If the candle chart appears to be in a long-term trend, then it may be worth holding onto your cryptocurrency investments. On the other hand, if the candle chart appears to be in a short-term trend, then it may be worth selling off your holdings to try and take advantage of the short-term trend.

– Looking at the overall trend can help you identify whether the current candle chart is indicative of a long-term trend or a short-term trend. If the candle chart appears to be in a long-term trend, then it may be worth holding onto your cryptocurrency investments. On the other hand, if the candle chart appears to be in a short-term trend, then it may be worth selling off your holdings to try and take advantage of the short-term trend. The Length of the Trend – The length of a cryptocurrency trend can also be indicative of whether or not it is going to continue. If the trend seems to be lasting for a relatively long period of time, then it may be worth holding onto your cryptocurrency investments. However, if the trend seems to be ending soon, then it may be worth selling off your holdings so that you can take advantage of the short-term trend.

– The length of a cryptocurrency trend can also be indicative of whether or not it is going to continue. If the trend seems to be lasting for a relatively long period of time, then it may be worth holding onto your cryptocurrency investments. However, if the trend seems to be ending soon, then it may be worth selling off your holdings so that you can take advantage of the short-term trend. The Direction of the Trend – It is also important to look at the direction of the trend. If the trend is up, then the candles will be taller than if the trend is down. This information can help you make informed investment decisions.

Here is an example of a candle chart for Bitcoin:

As you can see, Bitcoin has been trending upwards for the past several months. This makes it a good candidate for long-term investment. However, if you are looking to take advantage of the short-term trend, then it may be a good idea to sell off your holdings now.

What do Candlestick Charts Reveal about Cryptocurrency Prices?

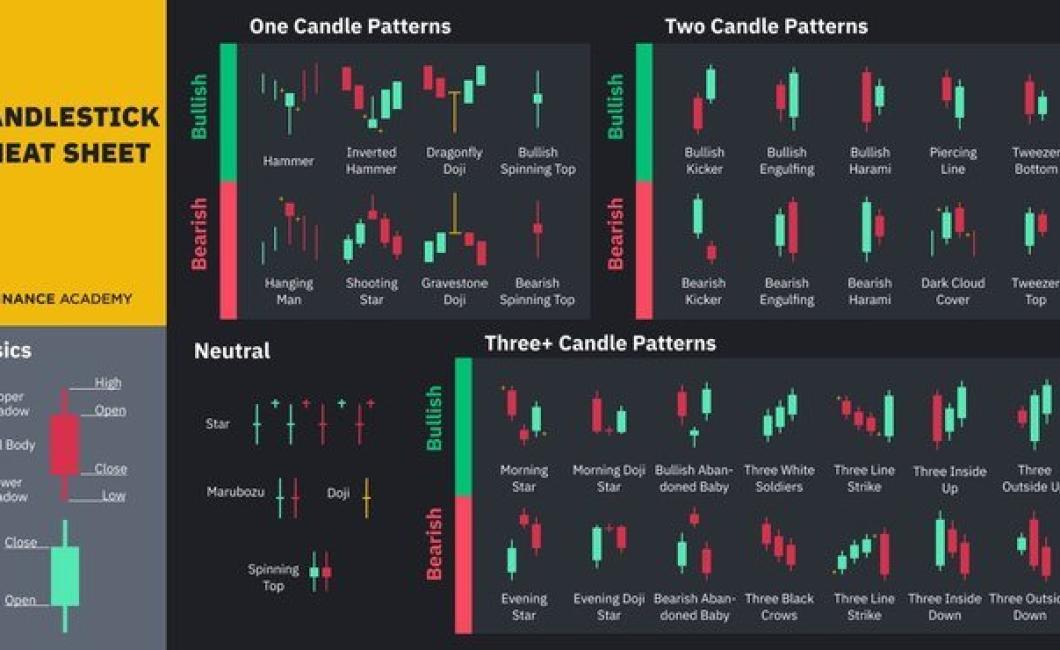

Candlestick charts are a type of chart that can be used to reveal information about the prices of cryptocurrencies. Candlestick charts essentially show the changes in price over a given period of time, and can be used to provide a more visual representation of how prices are moving.

One of the key things that candlestick charts can reveal about cryptocurrency prices is how volatile they are. Candlestick charts can help to show how quickly prices can move up or down, and can give a more accurate overall picture of how the market is performing.

How to Use Candlestick Charts to Trade Cryptocurrencies

Candlestick charts are a popular way to trade cryptocurrencies. They show the price of a cryptocurrency over time and can be used to identify trends.

To use candlestick charts, first find the currency you want to trade. Next, open a chart for that currency and find the appropriate time frame. You can either look at a weekly or daily chart.

Next, identify the open and close prices for the time frame you're looking at. The open price is the price at which buyers were able to purchase a cryptocurrency, and the close price is the price at which buyers were able to purchase a cryptocurrency.

Next, find the green and red lines on the candlestick chart. The green line is the indicator of a bullish trend, and the red line is the indicator of a bearish trend. If the green line is above the red line, then the trend is bullish, and if the red line is above the green line, then the trend is bearish.

Next, use the indicators on the candlestick chart to make your trading decisions. For example, if you see that the green line is moving higher while the red line is moving lower, you might decide to buy a cryptocurrency.

Candlestick Charting for Cryptocurrency Traders

Cryptocurrency traders use candlestick charts to track the performance of their assets. Candlestick charts are a simple way to visualize price movements over time.

To create a candlestick chart, open your trading platform and select the "Charts" tab. Then, select the "Candlestick" option.

Next, select the " timeframe " you want to use. You can choose "Daily", "Weekly", or "Monthly".

Finally, select the "types" of candles you want to include. You can choose "Open", "Close", "High", "Low", and "Volume".

Once you've selected your options, click "Create Candlestick Chart."

Your candlestick chart will now appear on the screen. To view it, click on the chart's title bar.

Candlestick charts are useful for cryptocurrency traders because they allow you to see how your assets are performing over time. You can use this information to make informed trading decisions.

analyzing cryptocurrency markets with candlestick charts

Candlestick charts are a popular way to analyze cryptocurrency markets. Candlestick charts show the high, low, open, and close prices for a given period of time. Candlestick charts can be used to identify patterns in price movement and to make predictions about future price movements.

Candlestick charts are useful for analyzing the following aspects of cryptocurrency markets:

1. The price movement of individual cryptocurrencies

2. The overall trend of cryptocurrency markets

3. The impact of specific events on cryptocurrency markets

4. The sentiment of cryptocurrency markets

Candlestick charts can be used to make the following predictions about cryptocurrency markets:

1. That the price of a cryptocurrency will rise or fall

2. That the price of a cryptocurrency will stay the same

3. That the trend of cryptocurrency markets will change direction

4. That specific events will have an impact on cryptocurrency markets

5. That the sentiment of cryptocurrency markets is positive or negative